Author: Michael Nadeau, Source: The DeFi Report; Compilation: Deng Tong, Bitchain Vision

In today’s report, we focus on the crypto market with the goal of building confidence by combining two analytics.

Encrypted emotions

cryptocurrency investors were inspired after the election about a week before Trump’s inauguration.

But then the president gave up a memecoin — which absorbed the liquidity of nearly every other meme on the market.

Then:

-

Announcements/commitments regarding strategic Bitcoin reserves are considered to be vague.

-

“Monday Deepseek/AI Panic”.

-

The weekend “tariff panic” in early February – reportedly the largest sell-off in history (liquidation amounted to $2.2 billion, some estimates were much higher).

Bitcoin has performed quite well, with trading prices fluctuating between $90,000 and $108,000 in the past 3 months.

But market sentiment has become quite bad—revealing the impatient, inexperienced and emotional nature of the retail-driven cryptocurrency market.

We can observe this in the data below.

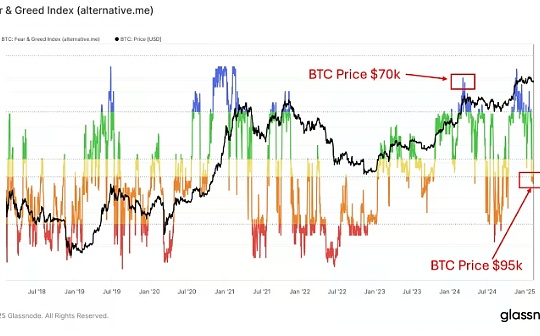

Less than a year ago, market sentiment was in a state of “extreme greed” – at that time, the price of BTC was $70,000.Today, the price is $95,000, but market sentiment has turned into “fear.”The last time that was reached was in early October last year, when BTC was priced at $62,000.

Fear and Greed Index

Here is the financing rate – a measure of the amount long pays to the shorts every 8 hours to keep their position open.It gives us an idea of traders’ preference for leverage – it’s an excellent emotional/momentum indicator.

Financing rate

We can see that the data supports the results we see on the fear/greed index.

So, why are investors so scared?

Probably because most of the market is altcoins and meme coins – they fell 50-75% as BTC dominance fell by more than 60%.

This makes investors question whether we will see a real “altcoin season”—it is precisely at the range lows.

Altcoin seasonal index

*The above data is viewed by market value and the top 200 assets with a 90-day return rate higher than BTC.

What is the key point?

When the market is volatile, you always want to keep it straight.

We think now is the right time to consider allocating again to select an altcoin (we will share some of our favorite altcoins later in the report).

Go to BTC on-chain data…

BTC chain data

If you are investing in altcoins, we think you need to understand where BTC is heading.This is why we focus on Bitcoin in on-chain data updates.

In this section, we will introduce some of our favorite ‘cycle awareness’ indicators and share our current position relative to past cycle peaks.

MVRV – Long-term Holder

MVRV (Raverage of Market Value to Actual Value) helps us understand the relationship between current market value and the Bitcoin “cost basis” (actual value) in circulation.

Glassnode calculates the cost basis for all Bitcoins on the network by getting the price of each UTXO last moved on the chain.

It does not take into account Bitcoin in exchanges or ETFs (about 18% of the supply).

In this analysis, we separate long-term holders (> wallets that did not move BTC in 155 days) from short-term holders (< wallets that moved BTC in 155 days).

Key points:

The MVRV for long-term holders is 3.96 today, and it was as high as 4.4 on 12/17.This tells usOn average, long-term holders earn 296%.When the market peaked, the group made 1,150% in the previous cycle, compared with 3,480% in the 2017 cycle.

MVRV – Short-term holders

remember.Short-term holders tend to chase the market.They enter the game later and tend to buy tokens from long-term holders.

Key points:

The MVRV for short-term holders is currently 1.06 (barely profitable), reaching a high of 1.45 in March last year.

In the last cycle, the market peaked when short-term holders held 74% of unrealized gains.

Currently 20% of the circulation supply is in the hands of short-term holders (16.4% in the same period last year).Again, this does not include exchanges or ETFs.In the last cycle, the market peaked at 24% of its supply held by short-term holders (at the time we had no ETF).This is an interesting data point because it tells us,There is more new money in the market today than a year ago—and we are approaching the peak percentage of the previous cycle.

Long-term holder supply

Key points:

When we start this cycle, 73.3% of the tokens in circulation are held by long-term holders.Now, the proportion of long-term holders has dropped to 66.1% (down 7.2%)

When we started the previous cycle, 67.2% of the supply was held by long-term holders.When the market peaked, that number dropped to 59.4% (down 7.8%)

If we follow the trend of the previous cycle, the number of short-term and long-term holders tells us that we are in the late stages.

BTC available on exchanges

Key points:

There are fewer BTC available on exchanges now than they were in late 2018, but the market is much larger today – most institutions can buy BTC now.

We usually see yellow lines rising at the end of the cycle as investors send their BTC back to the exchange to cash out.We haven’t seen any strong signs yet.ETFs may play a role here.

Pi-Cycle Top Metrics

Historically, Pi-Cycle top metrics have been the exact tool to identify the peaks in the BTC market.It consists of 2 times the 111-day moving average and 350-day moving average.

When the market is overheated, the shorter 111-day moving average crosses the longer 350-day moving average.

We can see from the above picture,There is still a healthy gap between the two moving averages – a sign that the market has not yet reached extreme levels.

Stable Coin

Key points:

Tether’s supply grew by more than $20 billion from Election Day to the end of the year.Since then, it has been stagnant (growth has been zero in the past two months).

USDC is now in the lead (mostly on Solana).Growing 22% in the past two months (over $7 billion)

We closely monitor the growth of stablecoins as on-chain liquidity is related to cryptocurrency prices.A new stablecoin bill (probably the first legislation we’ve seen) could fundamentally change the look of this chart.

ETFs

Key points:

The net flow of BTC has been actually negative over the past two weeks – a sign that investors are taking profits.Nevertheless, ETFs have increased their net traffic by more than $3.6 billion in the past month.For those curious, the ETH ETF has increased by $735 million in the past month and surpassed BTC in the past two weeks.

BTC ETFs have been trading for over a year and have accumulated nearly $38 billion in net traffic.Total holdings of more than $114 billion in AUM.

Bitwise’s ETF experts will tell you that we are more likely to see more money flowing into ETFs this year than last year.Why?ETFs often have a model where as liquidity generates more liquidity, flows will grow in the second and third years, etc.In addition, there are still some large institutions that have not yet received the green light to start configuring BTC.

New buyers in the market

In addition to on-chain data, we have to mention that several large new buyers have emerged in the market.

For example:

-

Mubadala, an Abu Dhabi sovereign wealth fund that manages more than $1 trillion, recently announced a $436 million investment in BTC.

-

According to VanEck’s Matthew Sigel, there are currently 20 national Bitcoin reserve bills.If enacted, they could bring in $23 billion in purchases.

-

The repeal of SAB121 means banks can now custody crypto assets.

-

FASB’s new rules for Bitcoin mean that businesses can now hold BTC on their books at fair value, marking the value they hold for the first time with unrealized gains.Previously, BTC was recorded as an intangible asset and was only written down.

We didn’t even mention strategic bitcoin reserves.A new committee has been formed and plans to make a decision by July.We think other central banks may have taken the lead in this plan.

What is the conclusion?

Bitcoin is very popular now.Historically, it was like a risky asset driven by retail FOMO.This is changing.

Investors should expect thatIf the central bank starts holding the asset, it may turn into a “help-haven” asset, which will reduce volatility over time.We believe we have seen this impact and ETF buyers have a more stable bid.

Final Thoughts and Portfolio Management

We shared our views on the macro setup yesterday.Today, we share a “cycle awareness” update related to BTC on-chain data.

When we combine the analysis, we concluded thatBitcoin (and the wide range of cryptocurrency markets) may have some room to run.

But that doesn’t mean there isn’t much risk.Some on-chain metrics indicate the need for caution.Not to mention, we’ve seen a lot of “top”-like antics in this cycle.

Meanwhile, from the perspective of macro and on-chain data, it is difficult for us to align with the bear market.Let’s not forget,The biggest fluctuations in cryptocurrencies often occur at the end of the cycle.

As for portfolio management?

We like the barbell method for this cycle phase.This means we keep our core assets positions, such as BTC, ETH, SOL + other projects with strong fundamentals (cash flow and buybacks).These include HYPE and Raydium.We also like TIA and SUI as alternative L1 investments.This is one side of the bar (we think it should be more biased towards BTC/ETH/SOL)

We then pair these core assets with smaller allocations of blue chip memecoin with high beta values and sufficient liquidity.The SPX6900, GIGA, PEPE and BONK are our favorites – they all fell more than 50% from their highs as of this writing.