Source: Glassnode; Compilation: Baishui, bitchain vision

summary

-

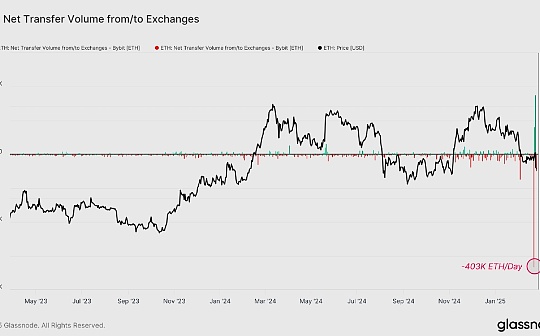

Bybit suffered one of the biggest hacks in cryptocurrency history, losing 403,996 ETH (approximately $1.13 billion) in its cold wallet due to a smart contract vulnerability.The vulnerability led to panic withdrawals, with total exchange outflows of Bitcoin and stablecoins reaching approximately $4.3 billion.

-

Market sentiment deteriorated rapidly, triggering widespread selling.Bitcoin’s monthly performance fell to -13.6%, while Ethereum (-22.9%), Solana (-40%) and Meme Coins (-36.9%) erased months of gains and reset the market momentum to its April 2024 level.

-

The price drop pushes Bitcoin back to the actual supply “space” between $70,000 and $88,000, a low-cost base density area.The weakness was initially driven by long-term holders’ sell-offs, which Bybit hackers exacerbated and increased the downward momentum.

-

As prices fall below the short-term holder cost base, new demand investors face huge pressure and begin to suffer significant losses.Historically, this marked a period of exhaustion from sellers, however, the ongoing lack of demand may continue the current downtrend.

Historic hacker attacks shock the market

On February 21, 2025, one of the largest exchange hacks in cryptocurrency history rocked the market, and Bybit suffered a serious security breach.The attacker stole 403,996 ETH (approximately $1.13 billion) from the platform’s Ethereum cold wallet, using smart contract permissions to rerout funds to an unidentified address.

Bybit CEO Ben Zhou explained that the attack was implemented through a “Musked UI” where a fraudulent interface tricks signatures into approving malicious transactions.Although the intrusion is very serious, Bybit assured users that other cold wallets are still safe and withdrawals can still be carried out normally.

Hacker transactions show that stolen assets are not limited to Ethereum, and a variety of assets suffer significant losses:

-

Ethereum (ETH): 403,996 ETH hacked

-

Staking Ethereum (stETH): 91,076 stETH hacked

-

mETH: 8,000 mETH hacked

-

cmETH: 15,000 cmETH hacked

The hacking has resulted in the theft of nearly $1.48 billion in funds, and market tensions have sparked concerns about exchange security, fund security, and potential market-wide selling pressure.

Market impact and exchange capital outflow

After the hacking attack, market volatility intensified, with panic withdrawals, and users flocking to protect assets, resulting in a sharp decline in Bybit reserves.

By February 24, 2025, Bybit’s BTC, USDT and USDE reserves experienced substantial outflows:

-

Bitcoin (BTC): 21,248 BTC Net Outflow (70,604 BTC → 49,356 BTC)

-

Tether (USDT): USD1.76 billion USDT net outflow (USD3.25 billion → USD1.5 billion USDT)

-

USDE: USD 217.47 million USDE net outflow (USD 578.37 million → USD 360.9 million USDE)

These figures illustrate Bybit’s liquidity loss and heightens concerns about the security of centralized exchanges.

Outflow peak

By February 24, 2025, Bybit’s major asset reserves, including Bitcoin and stablecoins, fell from $10.8 billion at the time of the hacking attack to $6.5 billion, with a cumulative outflow of $4.3 billion.Although the initial wave of panic withdrawals was severe, the outflow rate has since eased, indicating that it is gradually stabilizing.

Meanwhile, Ethereum reserves (including native ETH and pledged ETH) rebounded to $1.19 billion with Bybit’s efforts to supplement their stake.ETH price movement remained weak, falling to $2,490, while an subsequent outflow of about $117 million after the buyback suggests that investor confidence remains fragile.

Ethereum reserve recovery

As of February 26, 2025, Bybit received a total of US$1.58 billion inflows of Ethereum, of which US$802 million (50.7%) came from only 8 large transactions.

These inflows indicate intention to supplement reserves, possibly through intra-exchange transfers, strategic acquisitions, or external deposits from institutional liquidity providers.

While Bybit is working hard to supplement its Ethereum reserves, the exchange’s Bitcoin outflow is also considerable.Since the hacking, the total outflow of Bitcoin has reached US$2.47 billion, of which 47.2% (US$1.16 billion) have been outflowed through five large transactions.

There has also been a similar outflow of capital in Tether (USDT).During the same period, capital outflows reached USD 2.25 billion, of which 38.1% (USD 854 million) came from eight large transactions.

By analyzing Bybit’s Ethereum supplement efforts and a large amount of Bitcoin and Tether outflows, we have a deep dive into how the exchange (and larger entities) deal with one of the biggest hacks in cryptocurrency history.

Market turmoil after hacker attacks

As the impact of Bybit hacking gradually emerged, the market’s response was an intensified volatility and a sharp decline.As liquidity across the market declines and spot demand cools down, selling pressure has intensified, triggering wider adjustments.

Intensified weakness across the market caused Bitcoin price to plummet -13.6% monthly momentum, while Ethereum and Solana fell even more, at -22.9% and -40% respectively.Meme Coin Index also plummeted -36.9%, highlighting a strong risk aversion sentiment.

The decline reversed months of positive price uptrends, bringing momentum back to April 2024 levels.The huge decline highlights the general vulnerability of market confidence after a record high in December 2024.

Bitcoin re-enters the low liquidity zone

The Cost Base Distribution (CBD) heatmap illustrates how Bitcoin’s December 2024 ATH creates a gap in actual supply between $70,000 and $88,000.During strong trends, price increases tend to outweigh capital inflows, resulting in a decrease in actual supply concentration in these ranges.

As the market rebounded to new highs, long-term holders began to allocate supply, weakening the price momentum.Bybit hackers further exacerbate this downward trend, pushing Bitcoin back to the low liquidity gap shown in the chart below.As prices now retest the region, the market is seeking demand as further declines may trigger increased volatility and additional selling pressure.

Short-term holders face pressure

As Bitcoin plunges to $87,000, currently 20% below its $109,000 high, investors are under severe psychological pressure in the recent past as the price is about 5% lower than its cost base (STH-MVRV = 0.95).

Adjusting for STH-MVRV, we observed a decrease in profitability of new investors by -15.8% from their quarterly median, below a standard deviation threshold (-11%).This indicates significant unrealized losses, which historically resulted in sell-off events or forced sell-offs during market downtrends.

Short-term holders begin to realize the loss

To further analyze the new investor response, we use STH-SOPR (Expension Output Profit Margin) to measure whether short-term holders sell when they are profitable or loss-making.

-

STH-SOPR has fallen -0.04, below its quarterly median and significantly below a standard deviation threshold (-0.01).

-

This indicates a significant increase in loss realization, as many buyers are losing money to exit positions in recent years.

Historically, with the weaker side withdrawing, the deep contraction of SOPR will at least lead to temporary stability in the market.However,Under the current macroeconomic conditions, the risk of price declines may still be further expanded without strong demand catalysts.

Summarize

After the Bybit hack, the market experienced a large-scale pullback, causing Bitcoin’s monthly performance to fall to -13.6%, while Ethereum, Solana and Meme Coins fell more, and the market momentum reset to its April 2024 level.

As Bitcoin retreats to the realized supply “range”, short-term holders face increasing unrealized losses.Therefore, STH-MVRV and STH-SOPR fell below statistical lows, indicating significant losses for new investors due to lower profit margins.

If demand fails to recover, further downside risks remain, so the coming weeks are crucial to determine whether Bitcoin is stable or intensifying its sell-off.