1. 1.Project introduction

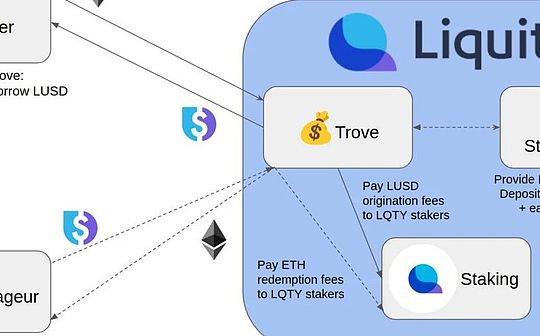

Liquity is a decentralized lending agreement that allows users to borrow with stablecoin (linked to the US dollar) with stable currency named LUSD and use Ethereum as mortgage.At the same time, it also introduced a completely redemption stable currency LQty.The protocol is designed by Robert Lauko, which aims to provide an alternative with higher capital efficiency and lower risk for existing systems such as MakerDao.

This agreement and traditional systems require a large amount of excess mortgage to issue stable currency. The difference is that liquity can instantly liquidate risk loans and adopt a unique redemption mechanism to minimize management needs, thereby reducing mortgage requirements.

For a borrower who seek effective ways to use Ethereum assets, this makes it an attractive choice.This protocol allows the use of ETH as a mortgage borrowing LUSD (a stable currency that is always linked to USD), and through the 3-clear calculation mechanism of the stable pool-debt redistribution-recovery model, Liquity only requires the minimum mortgage rate of 110%, which is greatThe capital utilization rate is improved, and the stability of the protocol can be well maintained at the same time.

The main cases of liquity are as follows: as follows:

-

Open TROVE: LUSD was borrowed with ETH as mortgage, and the minimum mortgage rate was 110%.

-

LUSD is exchanged for liquicity to clear income and LIQUITY’s native incentive token Lqty by providing LUSD to the Stability Pool (SP).

-

Pick up Lqty to earn the cost paid by other users to borrow or redeem LUSD.

-

Use LUSD to redeem ETH.

>

2.Core mechanism

The liquity protocol provides an innovative stablecoin solution in the field of decentralized finance (DEFI) through its unique design.The three key mechanisms -price stability mechanism, settlement mechanism and supply control mechanism -joint work to maintain the stability and efficiency of the system.

Price stability mechanism

The price stabilization mechanism of liquity aims to maintain the value of its stable currency LUSD and the US dollar (USD) 1: 1.The core of this mechanism is to allow users to cast LUSD at a price of 1 USD at any time, or redeem ETH at the price of 1 USD at a USD.This mechanism creates a hard price anchor, that is, when the price of LUSD is higher than 1 USD, the user is motivated to cast and sells LUSD to make a profit; when the price of LUSD is lower than 1 USD, the user has motivated to buy LUSD and use it with it.Repay the debt or redeem it to obtain ETH.This two -way price adjustment mechanism forms a strong price and stable feedback cycle.

>

In fact, this set of stability mechanisms are very effective. The figure below is based on CURVE’s LUSD/USDC price calculated based on CURVE’s LUSD/3pool (CURVE’s LUSD/3pool is currently the most lusd -liquidity exchange).

>

The price fluctuations of LUSD have remained at 0.97 ~ 1.03, and most of the time is between 0.99 ~ 1.02, which shows the stability of LUSD.

Liquidation mechanism

LIquity’s clearing mechanism design to protect the system from threats to excessive debt and ensure the repayment of debt.When the borrower’s mortgage rate is lower than the minimum value (110%), its position will be regarded as excessive debt and trigger a liquidation.Liquity uses a unique instant cleaning process without traditional auction.First of all, if there is sufficient funds in the stable pool (the user provided by the user), these funds will be used to settle debts, and related ETH collaterals will be distributed to participants in the stable pond in proportion.If the funds stabilized by stabilizing the pool are not enough to cover the debt, the system will allocate unpaid debts to other borrowers through the debt redistribution mechanism.This mechanism ensures the stability of the system, while reducing the needs of the auction on the chain, and reducing the complexity and uncertainty of the liquidation process.

The stabilization pool is the core factor that is a LIquity 110 % mortgage and can ensure stability.As the project’s white paper states: “Because the acquirer agrees in advance, when the mortgage position is insufficient, there is no need to find the buyer to acquire the mortgage on the spot. This advantage greatly reduces the mortgage ratio and maintains high stability.”

Supply control mechanism

The supply control mechanism of liquity is designed to adjust the total supply of LUSD to maintain its stable price.This is mainly achieved by adjusting the coinage costs and redemption costs. Both of these costs are dynamically adjusted, and the frequency of market conditions and redemption activities is determined.When the redemption activity increases, the redemption cost will increase, making the redemption LUSD less attractive, and vice versa.The coinage cost is also adjusted according to the redemption activity, which aims to motivate or suppress new LUSD castings to regulate market supply.In this way, Liquity tries to balance the supply and demand of LUSD through cost adjustment without conventional interest mechanisms.

>

3. LQty

Lqty is a stable currency of the liquity protocol. It is cast when the borrower deposits into the mortgage. The number of mortgagers may be much lower than the amount required by other systems.This efficiency is attributed to the liquidation process and redemption mechanism of liquity innovation to ensure the lower limit of LQty, so it can promote stability without governance intervention.The system aims to automatically handle the clearing by a stable pool, where the LQty tokens can be destroyed to remove the debt and automatically distribute the mortgaged loan by automatically distributed the loan with insufficient mortgage between the borrowers.This process is not only aimed at maintaining the stability of the system, but also sets a lower mortgage threshold compared with competitors.

>

The following are the main features of LQty and its impact on users and the entire Liquity system:

Allocation and reward

The total supply of LQty is 100 million pieces, and these tokens are mainly distributed to users participating in the liquity protocol in various ways.One of the most prominent distribution is to reward through stable pool.The user stores the LUSD into the stable pool to help the agreement to manage the liquidation process. In return, they will get the LQty tokens.In addition, users who provide ETH/LUSD liquidity for Liquity can also get LQty rewards.

Value acquisition mechanism

The value of LQty comes from part of its income that can capture the liquity protocol.When the user opens a borrowing position or performs the Ramd redemption operation, a certain fee is required, and some of these costs will be assigned to Lqty holders.This means that LQty tokens can benefit directly from the operation of the agreement.

Risk and income

One of the main risks faced by LQty holders is market value fluctuations.The market price of LQty will be affected by various factors such as protocol usage rate, ETH price, and overall trend of the DEFI market.However, by participating in the governance, stability pool and liquidity of the agreement, users can actively affect the value of LQty.

Governance function

Although LQty itself does not have a direct governance right, it is a key component in the LIquity protocol ecosystem, representing the recognition of the agreement.The holding and allocation of LQty reflects the degree of contribution of users to the stability and liquidity of the agreement.

4. Business

Circuit:

Liquity is a stablecoin -decentralized stable currency track.

Stabilizing currency is the most network -effect track in the field of DEFI, and in the previous round of cycles, it also achieved a significant development of the industry’s average growth rate.

Due to the convenience of settlement and more in line with the common popular habits, stable currency has replaced BTC/ETH as the basic settlement currency of spot trading currency.Settlement currency of financing activities.It is reflected in the data, that is, the increase in the market value of the stable currency exceeds the average increase in the crypto market, and the adjustment range is less than the market average.

The positioning of stablecoin as the basic settlement of cryptocurrencies has been very stable in the hearts of the entire market participants. The market size will be at least with the simultaneous development of cryptocurrencies, and it still has huge room for development.

Business product:

The following is an important deeds since the establishment of the Liquity project, as of March 2023.

>

Chicken bonds

The Chicken Bonds launched by liquity is a set of solutions that can inspire Pol (the liquidity of Protocol Owned Liquidity). The first product module is the Chicken Bonds of LUSD.Chicken Bonds goal is to help the protocol use as low as possible to guide liquidity while giving users a more stable principal protection.

Chicken Bonds’s mechanism is quite complicated and delicate. To put it simply, it is to divide the LUSD of Chicken Bonds into three pools (PENDING, Reserve, Parnament), but only one of the LUSDs of one pool can enjoy all the revenue of the three pools (Reserve), $ Blusd is used to characterize users’ share in this exclusive income pool.

>

Core concept

BLUSD (Boosted LUSD): By participating in the Chicken Bonds mechanism, a enhanced version of LUSD that users can get, its value and income potential exceeds the ordinary LUSD.BLUSD can represent the share of users in the Chicken Bonds mechanism, and can be redeemed into LUSD at any time.

LUSD Bond NFT: The non -homogenized token (NFT) obtained by the user after purchasing bonds through LUSD represents the user’s debt in Chicken Bonds.The NFT can be exchanged for BLUSD according to the preset time-income curve.

Mechanism workflow

Investment and income: After the user uses LUSD to buy bonds, these funds first entered the “PENDING BUCKET” and stored the stability pool through B.Protocol to obtain the LQty reward and ETH liquidation income.Converted to LUSD to achieve compounding effects.

Optional: users holding Lusd Bond NFT can choose to receive BlusD (Chicken in) or cancel bonds.The number of BLUSDs increases over time, but the increase will gradually slow down.Users can receive BLUSD in advance by paying a certain percentage of handling fees, but this will cause some LUSD to enter the “PerManent Bucket”, which is owned by the agreement.

Llericality and income distribution: The value and income of BLUSD mainly comes from the benefits generated by all LUSDs in three pools (to be determined pools, reserve pools, and permanent pools). These income will be assigned to BLUSD holders in the reserve pool.Therefore, BLUSD’s yield is higher than that of simply saving LUSD into a stable pool.

Competitive advantage and disadvantage

Advantages: Chicken Bonds provides an effective mechanism that inspires POL. At the same time, it provides users with the income potential that exceeds ordinary LUSD and increases the attractiveness of the Liquity protocol.

Disadvantages: Since the returns of Chicken Bonds mainly depend on the participation of new users, there is a certain degree of “Ponzi structure” characteristics, and its continuity and stability may be challenged.In addition, most participants are at a loss after participating in Chicken Bonds, which may affect their long -term willingness to participate in the healthy development of their willingness and the healthy development of the agreement.

In general, Chicken Bonds is an innovative mechanism designed by the liquity protocol to motivates the liquidity and improve user participation.By providing the revenue potential that exceeds the traditional LUSD, attracts users to participate and lock the funds, and increases the stability and attractiveness of the liquity protocol.However, its sustainability and the impact on early participants need to be observed and evaluated over time.

5.Team/cooperation/financing

team

Robert Lauko, founder and CEO, graduated from the University of Zurich and obtained a doctorate degree in law. He has many years of legal affairs and lawyers’ experience. Before he founded Liquity, he was a assistant researcher at DFINITY.

Rick Pardoe, co -founder and core development, Bachelor of Physics and Bachelor of Physics and Master of Economics. In 17 years, he began to contact the development of the blockchain field and created the website ethDevs.com.

Kolten Bergeron, the person in charge of growth, was once the Stellar Development Foundation Ecosystem and Community Development Manager.LinkedIn shows that there are currently 10 members of the team, most of which are developers.

consultant

Ashleigh Schap, she is currently the head of the growth of UNISWAP, and previously worked at MakerDao.

Yulin Liu, a doctor of economics from the University of Zurich, was previously a dfinity economist, and is currently an associate professor of economics from Huazhong University of Science and Technology.Dr. Liu cooperated with others to publish a large number of academic papers about cryptocurrencies.The initial macroeconomic model simulation is made for Liquity, which provides a basis for LUSD’s maintenance stability of ETH fluctuations.

Cedric WaldBurger, he was the first investor of Liquity.

Investor

The front wheels of the seeds are invested by Tomahawk.VC, where CEDRIC WALDBURGER is located, and has not disclosed the specific financing amount and financing time.

In September 2020, it completed a $ 2.4 million seed wheel financing led by Polychain Capital. Participants include A.Capital, Lemniscap, 1kx, DFINITY ECOSYSTEM FUND, Robot Ventures, Robert Leshner (founder of compound), and And Alex PackEssence

In March 2021, the 6 million US dollars in Series A financing led by Pantera Capital was completed. Participants include Nima Capital, Alameda Research, Greenfield One, iOSG Ventures, Angeldao, and angel investors Bo Shen, Meltem DEMIRORS, and DAV. ID HOFFMAN,Calvin Liu and George Lambeth.Previous investors such as Tomahawk.VC, 1kx, and Lemniscap also added investment.

6.Project advantage/disadvantage

Liquity is currently a leading decentralized stable coin, but in fact LUSD’s competitors are not just decentralized stablecoins, including “partial decentralization” stablecoins such as DAI and FRAX, and centralized stablecoin currencyUSDT, USDC, etc.Of course, the competitive relationship with LUSD is still decentralized stablecoin.

The competitive advantage of liquity in the stable currency market can be summarized as the following points:

1. Complete decentralization: Liquity, as a completely decentralized stable currency protocol, its decentralization characteristics are one of its most significant competitive advantages.This allows LUSD to avoid the impact of single -point failure or regulatory risk, providing higher security and resistance to review.Especially in the context of stable coins facing the increase in regulatory pressure, the complete decentralization characteristics of liquity are more precious.

2. Excellent mechanism design: LIquity’s stable pool, debt re -distribution, and recovery model design is considered to be very advanced and efficient.These designs not only achieve the fast and safe liquidation process, but also provide natural utilization scenarios by stabilizing the pool, so that LUSD can maintain price stability without a centralized guarantor, while maintaining high capital efficiency.

3. No governance, reducing artificial intervention: liquity’s non -governance mode means that its protocol parameters and updates are completely controlled by the preset algorithm, reducing the risk of errors or manipulation that may occur during the governance process.While improving the transparency and predictability of protocols, this design also ensures long -term stability and security.

4. Low -cost borrowing service: liquity provides interest -free borrowing services. Borrowers only need to pay a one -time coinage and redemption fee.This low -cost design has attracted many users who seek efficient capital, especially when the cryptocurrency market volatility is high, users can flexibly manage their assets.

5. The proof of extensive fork: The number of FORKs of the liquity protocol exceeds any other stablecoin protocol, which proves the popularity of its mechanism design and the industry’s recognition of its innovation in the industry.

6. Go through the market test: liquity has successfully experienced the severe fluctuations of the encryption market since its launch, which proves the toughness and effectiveness of its core mechanism.Especially during the market decline, the liquity clearance mechanism and price stability were fully verified.

Of course, compared to other stablecoin projects, the Liquity itself has a lot of innovation, and some characteristics have also been controversial, which also brings a certain competitive disadvantage to the agreement.The competitive disadvantages of liquity in the stabilized currency market mainly include:

1. No governance mechanism restricts use case expansion: Although the governance characteristics of liquity provides advantages in terms of security and decentralization, it also limits the flexibility of the agreement and the adaptability to the new change.No governance means that liquity is difficult to deal with market changes through governance adjustment protocol parameters or introduce new functions, which may limit LIquity’s ability to expand and quickly adapt to market demand.

2. Charging structure: liquity adopts a model that charges one -time fee when casting and redeeming, not a model based on borrowing interest.This charging model may lead to unstable agreement income, and as LUSD’s circulation increases, it cannot continue to profit from the increased stable currency scale, resulting in inconsistent risk returns.

3. Insufficient incentives in the future: The main incentives of LQty tokens are used for stable pools, but over time, the number of LQTYs with stabilized tank incentives will be reduced.In the future, Liquity is facing insufficient challenges, which may affect its ability to attract and maintain users.

4. Competitors’ governance and product innovation capabilities: Compared to other stablecoin items, such as MakerDao and Frax Finance, the governance model of liquity may be in an unfavorable position in governance and product innovation.These competitors can more flexibly adjust protocol parameters and launch new products through governance models to cope with market changes and user needs.

5. Adaptability to external changes: Because of no governance mode, liquity may be difficult to quickly adapt to changes in the external environment, such as changes in the pledge mechanism of ETH, which may limit its long -term competitiveness and market share growth.

7.Summarize

As a decentralized stable currency distribution platform, the liquity project shows its unique innovation and market potential.By providing Ethereum’s interest -free borrowing services, and introducing a series of innovative mechanisms, such as stable pools, debt re -distribution and recovery models, Liquity not only optimizes capital efficiency, but also enhances the stability and security of the system.

Nevertheless, Liquity is facing problems such as challenges brought by governance models, specific charging structures, and might insufficient future incentives. These are important aspects that the project needs to continue to pay attention and resolve.In order to maintain competitive advantages and achieve long -term development, Liquity needs to further optimize its products and mechanisms, strengthen cooperation with inside and outside the industry, and continuously explore and cope with market changes.

In summary, Liquity has established a strong competitive position in the stabilized currency market with its decentralized characteristics and innovation mechanism.Facing the future, Liquity is expected to use its team’s professional capabilities, continuous technological innovation and market strategies to continuously expand its business scope and market influence, and bring more value and possibilities to cryptocurrencies and decentralized financial fieldsEssence