Author: YBB Capital Researcher AC-Core, Compilation: 0xjs@作 作 作 作 作

TLDR

-

The essence of modular lending is not only cross -chain and aggregation, but cross -chain and aggregation play an important role in modular lending.

-

The modular borrowing uses the security, consensus and data availability provided by the basic layer, and focuses on the functional modularization of the execution layer and the application layer.

-

Modular lending decompose processes into several independent modules, such as mortgage management, interest rate calculation, risk assessment and liquidation mechanism. Each module communicates through standardized interfaces.

-

At present, the characteristics of the modular DEFI protocol are similar to the logic of the one -click deployment of OP Stack. The deployment needs to establish a module portfolio above the agreement itself, thereby creating new financial products and services.

1. The origin of modularization

The concept of modular blockchain comes from two white papers. In 2018, Mustafa Albasan and Vitalik Buterin wrote the papers of “Data usability sampling and fraud” thesis, and proposed a system that allows light client receiving and verification of full node fraud certification.And designed a data availability sampling protocol to reduce the balance between the capacity and security on the chain, and solve the problem of scalability of the blockchain without harming security and decentralization.

Subsequently, in 2019, Mustafa Albasan introduced a new architecture in detail in the white paper “Lazy Ledger”.This architecture uses the blockchain to sort and ensure the availability of transaction data without processing and verification of transaction.This new architecture aims to solve the scalability problem in the existing blockchain system, which was originally called the “smart contract client”.The execution of the smart contract is performed by another execution layer on the client, forming the prototype of Celestia, the first modular data availability layer project.

With the emergence of RollUP technology, this concept has become more specific. Following the logic of implementing smart contracts under the chain and uploading results as proofs to the “client” execution layer.Under the reflection of the blockchain architecture and new expansion technology, Celestia came into being, defining the new paradigm of “modular blockchain”.

2. The emergence of modular blockchain

Modern blockchain aims to solve the “impossible triangle” dilemma in the blockchain field through decoupling and reconstruction.In simple terms, it decompose the main function of the single chain into multiple layers, focusing on specific functions on each layer, thereby achieving scalability.Generally speaking, the basic functions of the single chain can be divided into the following four layers:

-

Data availability layer: ensure that data in the network can access and verify, including data storage, transmission and verification functions, and maintain the transparency and trust of the blockchain network.Representative DA projects include Celestia, Avail, EIGENDA, etc.The overall single chain such as Ethereum and Solana can also meet DA demand (Bitcoin lacks good verification solutions for traditional RollUps due to non -Turin, but its capacity expansion capabilities are rapidly improving).

-

Consensus layer: processing the protocol between nodes to realize the consistency of data and transactions in the network.Through the consensus algorithm (such as POW or POS), it verifies the transaction and creates a new block.Most DA projects also need their consensus layer, which are usually designed for low hardware requirements and simple verification light nodes.

-

Execution layer: deal with transactions and execute smart contracts, including transaction verification, execution and status update.Layer2 projects (such as Arbitrum, Optimism, ZKSYNC) act as the execution layer of the modular blockchain, verify the correctness of the transaction through the main chain and inherit the security of the main chain.

-

Settlement layer: Complete transactions to ensure permanent records on asset transfer and blockchain.The main function of the modular settlement layer is to verify the validity proof and status data of the Rollup. The famous projects include Dymension and CEVMOS.

Solutions such as lightning networks and side chains that were proposed around Bitcoin in the early days can be described as “modular pioneers”. However, due to the non -Turing completeness of Bitcoin, these expansion schemes have progressed slowly and various defects have been widely used.Traditional blockchain attempts to solve the dilemma by reconstructing the underlying framework, but the effect is very small.To solve this problem, Vitalik Buterin proposed a improvement around Rollups.With the maturity of errors and zero -knowledge proof, it becomes realistic to build an execution layer on Ethereum in Ethereum in a similar way.Ethereum has set its ultimate goal as a layered expansion road centered on Rollups. This upgrade method centered on RollUps is expected to surpass the previous capacity expansion scheme and become the ultimate solution for blockchain to expand.

Third, the evolution of modular loans

Image source: legendary quant

The modular DEFI lending uses the security, consensus and data availability provided by the basic layer, focuses on the functional modularization of the execution layer and application layer, and runs these modules on the blockchain.The key modular parts include:

-

Mortgage management module: Responsible for storage, management and processing users’ mortgages to ensure their safety and compliance.

-

Interest rate calculation module: Dynamically adjust borrowing interest rates according to factors such as market supply and demand, user credit scores.

-

Risk assessment module: Evaluate the credit risk of the borrower to determine whether to approve the loan application and determine the required mortgage amount.

-

Clear mechanism module: When the borrower fails to repay on time, start the liquidation program to protect the interests of the platform and other users.

The modular lending system needs to obtain all the necessary transactions and contract data from the data available layer to achieve interaction and verification between modules.The operation results of each module need to be confirmed and recorded by the consensus layer to ensure the security and consistency of all module state changes.Most of the logic of modular lending runs on the execution layer, and the functions of each module are implemented through smart contracts.The final settlement and liquidation of borrowing transactions depend on the settlement layer to ensure the ultimate nature of borrowing and liquidation transactions.

3.1 Core concept

-

Modular design: The lending process is decomposed into multiple independent modules, such as mortgage management, interest rate calculation, risk assessment, clearing mechanism, etc., each module can be independently developed, tested and deployed.

-

Mutuality: The standardized interface allows communication between modules to easily combine different modules, and even use certain modules across platforms.

-

Upgrade: Since each module is independent, it can be upgraded alone without affecting the entire system.This function enables the system to quickly respond to market changes and technological progress.

-

Security: Modular design can isolate risk.For example, if a module appears safely, it only needs to repair the module without affecting the entire system.

3.2 Key components

-

Mortgage management module: handle the deposit, extraction and management of mortgage to ensure the safety and compliance of the user’s mortgage.

-

Interest rate calculation module: Dynamically adjust the loan interest rate according to factors such as market supply and demand, borrower credit scores.

-

Risk assessment module: assess the borrower’s risk, decide whether to approve the loan request and determine the required mortgage amount.

-

Clear mechanism module: When the borrower fails to repay on time, start the liquidation program to ensure the security of the borrowing platform.

3.3 advantages

-

Flexibility: Different modules can be combined as needed to meet different loan needs.

-

Efficiency: Optimize the performance of each module and improve the efficiency of the entire system.

-

Innovation: Developers can enhance their functions by introducing new modules to innovate specific problems.

-

Transparency: The modular system provides higher transparency, allowing independent review and verification of the operating logic and status of each module.

3.4 The role of cross -chain and aggregation in modular lending

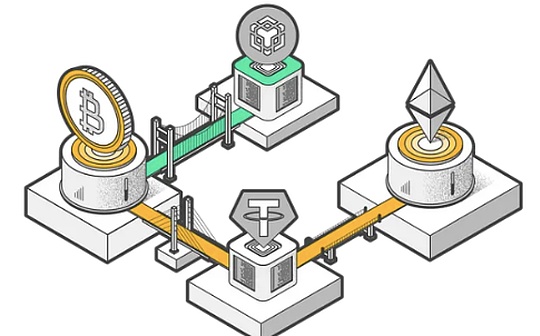

Photo source: cross -chain bridge detailed explanation

The essence of modular lending is not just cross -chain and aggregation, although cross -chain and aggregation both play an important role.The core idea of modular lending is to enhance the flexibility, scalability, security and innovation of the system through various functions of the modular lending process.Cross -chain and aggregation are part of this core idea, but not all.

Cross -chain (interoperability):

-

Cross -chain technology: enable the assets and functional modules on different blockchain to operate.This is very important for modular borrowing because it allows users to transfer assets across the blockchain and use various decentralized applications (DAPP).

-

Multi -chain support: By supporting multiple blockchain, the lending platform can enhance its availability and flexibility and attract more users and assets.

polymerization:

-

Plastic agreement: A variety of borrowing agreements and liquidity pools, providing a unified interface and a better user experience.For example, users can access multiple borrowing markets through a aggregation platform to obtain the best borrowing interest rate.

-

Liquidity aggregation: By aggregating a variety of liquidity sources, the efficiency of capital use and market liquidity are improved.

3.5 Other key aspects of modular borrowing

Modular design:

-

Functional modularity: Decompteling the lending process into an independent functional module (such as mortgage management, interest rate calculation, risk assessment, liquidation mechanism, etc.), each module can be developed, deployed, and upgraded independently.

-

Standardized interface: The module communicates through the standardized interface to ensure compatibility and interoperability between modules.

Security and risk management:

-

Risk isolation: Modular design can isolate risk in a specific module. If a module occurs, it will not affect the entire system.

-

Security audit: Each module can be audited independently to enhance the security of the entire system.

Flexibility and scalability:

-

Flexible combination: Users and developers can flexibly combine different modules to meet diverse borrowing needs.

-

Scalability: You can expand the functions and performance of the system by adding or replacing the module without reconstruction of the entire system.

Some mature DEFI platforms, such as AAAAO, Compound, and MakerDao, also adopt a modular design concept.For example, MakerDao is turning to a more decentralized SubDao model, and the AAVE protocol is composed of multiple smart contracts to handle loans, mortgage management, liquidation, etc.Developers and users can combine these contracts as needed, and even develop new contracts to expand the functions of the platform.

Fourth, modular loan project

4.1 Morpho laboratory

Morpho Labs aims to improve the efficiency and user experience of the decentralized lending market through technological innovation and optimization, and promote the growth of the DEFI ecosystem.Morpho Labs seek to attract more users and funds to enter the decentralized financial field with its modular design and friction -free transaction mechanism.Key innovations include Morpho Blue and Meta Morpho, which can improve the efficiency and interoperability of DEFI borrowing.

Image source: Morpho Labs official

Morpho blue

Morpho Blue is a high -end version of the lending agreement provided by Morpho Labs.It aims to minimize the deployment of crypto assets (ERC20 and ERC4626 tokens) on the Ethereum virtual machine and create an independent lending market.Morpho Blue provides a basic layer of the loan, borrower, and applications that does not need to be trusted, running under double licenses (Busl-1.1 and GPLV2).Once deployed, it will be permanently run on the Ethereum blockchain.(1) Main functions and components include:

-

Mortgage: Users must provide protocol support for mortgages to borrow assets.

-

Lleing loan value ratio (LLTV): The agreement sets the minimum value requirements for the mortgage compared to borrowing assets.For example, if the ratio is 90%, the value of borrowing assets must not exceed 90%of the mortgage value, otherwise the position will be liquidated.

-

Borrowing: Users start the lending process by interacting with the agreement.They designate the amount of assets they want to borrow and provide necessary mortgage.

-

Interest rate: The borrower pays the interest of the borrowing amount based on the interest rate model of the agreement.Interests accumulate over time and pay when repaying loans.

-

Repayment: The borrower can repay the borrowed assets and pay interest at any time to settle the loan.Once the repayment is confirmed on the chain, the borrower can retrieve its mortgage from the smart contract.

-

Clearing mechanism: In order to reduce the risk of breach of contract, the agreement includes the liquidation mechanism.If the value of borrowing assets exceeds LLTV due to market fluctuations or interest calculating interest, it can be partial or all of the liquidation position to repay the loan and any uncomfortable interest.

-

Borrowing: Users can start the loan process by interacting with the agreement, designated the number of assets they want to borrow, and transferring these assets to smart contracts.

-

Extraction: As long as the market is sufficient, the lender can withdraw the assets and interest that they borrows at any time.

One of the remarkable features of Morpho Blue is that it can create a trading market that does not need to be licensed, allowing users to establish an independent market consisting of loan assets, mortgage assets, LLTV, prophet and interest rate model (IRM).Each parameter is chosen during the marketing period, and it is immutable. LLTV and interest rate models are selected from a set of options approved by Morpho governance.

Meta Morpho

Meta Morpho is an independent meta -protocol, which aims to create Metamorpho Vault based on Morpho Blue to achieve seamless integration and interoperability between different DEFI platforms and protocols.The main functions include:

-

Cross -platform integration: allow users to seamlessly transfer assets and strategies across different DEFI protocols.

-

Enhanced interoperability: Provide better interoperability through standardized interfaces and protocols to promote smoother collaboration between different DEFI protocols.

-

Automation Management: Use smart contracts and automation tools to improve the efficiency and reliability of asset management and strategy execution.

-

Liquidity aggregation: The liquidity of aggregation comes from different platforms to improve the liquidity and efficiency of the overall market.

4.2 Euler Finance

Image source: EULER Finance Office

On February 22, 2024, Euler Finance, the lending agreement, announced that it is about to restart and release its V2 version.This modular lending platform mainly includes two main components: Euler Vault Kit (EVK) and Ethereum Vault Connector (EVC), which aims to enhance the flexibility and functionality of the protocol.

EULER VAULT kit (EVK)

EVK is a toolkit that allows users to create and manage customized “insurance library” systems.EVK allows users to deposit assets into the insurance library and set different strategies and rules as needed.It is integrated with EVC, allowing developers to freely build an ERC-4626 insurance library.The main functions of EVK include:

-

Custom strategy: Users can set different strategies according to their own needs and risk preferences, such as specific borrowing interest rates and liquidation rules.

-

Multi -asset support: EVK supports various assets, allowing different types of crypto assets to deposit into the insurance library.

-

Flexible management: Users can flexibly manage and adjust insurance library settings to meet market changes and personal needs.

-

Security: EVK provides high security through smart contracts and decentralized technologies to ensure the security of user assets.

Ethereum insurance library connector (EVC)

EVC is a tool for connecting EVK on Ethereum.It allows users to seamlessly transfer assets and strategies between different DEFI protocols, giving vault super powers as mortgages of other vaults to promote seamless communication between ERC-4626 vault and other smart contracts.The main functions of EVC include:

-

Unified interoperability: EVC allows users to transfer assets from one insurance library to another, whether they belong to the same protocol.This greatly improves the liquidity and flexibility of assets.

-

Strategy sharing: Users can share the same strategies between different insurance libraries and apply the same strategy to simplify the management process.

-

Automation Management: EVC realizes the automation transfer of assets and the application of strategies through intelligent contracts, which reduces the complexity of manual operations.

-

Enhanced liquidity: By connecting different vaults, EVC has improved the liquidity of the overall DEFI ecosystem, and users can use their assets more effectively.

Euler Vault Kit (EVK) and Ethereum Vault Connector (EVC) are important functions launched by Euler Finance, which aims to provide greater flexibility and management efficiency.Through EVK, users can create and manage custom vault; through EVC, they can seamlessly transfer assets and strategies between different vaults.These tools enhance users’ ability to control and manage assets and help improve the liquidity and efficiency of the DEFI ecosystem.

5. The view of current modular borrowing

The DEFI protocol refers to a series of decentralized applications (DAPP) built by blockchain networks (DAPP). These applications can provide traditional financial services such as borrowing, transactions and insurance without relying on traditional financial institutions.The modular DEFI protocol has decomposed these services into independent modules, thereby improving flexibility and innovation, so that users and developers can mix and match different functions.

At present, DEFI is mainly composed of income aggregates, lending agreements, derivatives and options, insurance protocols, etc. These modules can be freely combined to create new financial products and services.But their essence is similar to the logic of OP STACK’s “one -click chain”. The modular DEFI protocol needs to establish a module combination within its own framework to create new financial products and services.

While modular DEFI brings flexibility, it is also accompanied by potential risks.UNISWAP ignited the DEFI boom and became the “blueprint” of various DEFI protocols today.Since its establishment, Uniswap has never been attacked by hackers. This is mainly because it relies on a simple core unattended (tokenbalanceX * tokenbalancey = K) and integrates with unchanged smart contracts.

However, the flexibility of modularity also brings relative complexity.The high degree of interconnection between different DEFI protocols means that if an upgraded contract in a protocol fails, it may cause a chain response that affects other protocols, which may cause the systemic risk of the entire ecosystem.This is an important aspect that needs to be considered.