Source: Jinshi Data

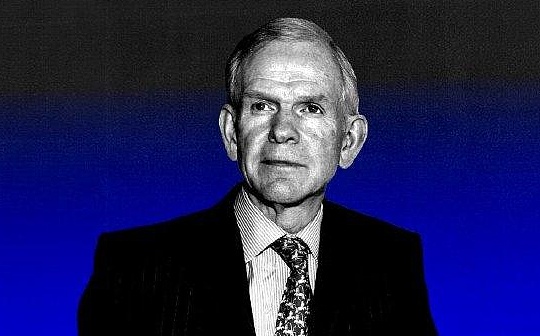

In a conversation, the host interviewed Jeremy Grantham, co-founder of GMO and an investment strategist known for accurately predicting market bubbles.

Based on more than 50 years of investment experience, Grantham analyzed the current market’s “super bubble”, green transformation dilemma, population crisis and other issues, and issued a harsh warning to US stocks.The following are selected excerpts of the conversation.

US stocks: an unprecedented super bubble

Q: You predicted that the US stock market will usher in a major adjustment, but the market has been firm yet.The AI craze has even intensified the bubble.Has your opinion changed?

Grantham: The bigger the bubble, the higher the risk.Currently, US stocks have entered the marketThe third largest super bubble in history, second only to the Japanese stock market and real estate bubble in 1989, but far surpassed the Great Depression in 1929 and the previous peak in 2021.As measured by Shiller PE, the valuation of US stocks has reached a historical high, and the ratio of total market value to economic added value is a record.If you return to normal according to the behavioral model,US stocks need to plummet by 50% – this is just a return to the “normal psychological endurance of human beings.”

Q: Supporters believe that AI will reshape the economy and that high valuations will be digested by future growth.How do you refute?

Grantham:Major technological revolutions will inevitably be accompanied by bubbles!This is true for railways in the 19th century and the Internet in the late 20th century.People invested wildly in the vision of “changing the world”, and in the end, most people lost all their money, while survivors (such as Amazon) took all the market.AI also cannot escape this rule: it will indeed subvert society, but when the bubble bursts, 99% of concept stocks will disappear, and only a few winners will reap dividends.

The paradox of AI: productivity improvement and social division

Q: If AI completely replaces manpower, how can the economic system be maintained?

Grantham: Assuming that the future is all about robot work, who will consume it?The answer can only be the strong redistribution of the government.History has proved that when productivity increases and benefits the public inclusively (such as the “Golden Age” of the United States from 1935 to 1975), social stability is the strongest; and if wealth is concentrated at the top (such as the United States after 1975), dissatisfaction will trigger political turmoil.The general dislike of European and American people towards the establishment is a manifestation of this imbalance.

Q: Is the AI era necessary for a “big government”?

Grantham: Must!The government does not need a huge bureaucracy, but it needs to ensure that wealth flows to the bottom through taxes and welfare.Otherwise, we will face famine or revolution.

Investment Haven: Green Transformation and Impact Resistance Assets

Q: Is there still a safe corner in the US stock market?

Grantham: Green economy-related stocks are seriously undervalued.The urgency of the climate crisis cannot be avoided – fires and floods have become normalized, the global decarbonization process will inevitably accelerate, and related fields will usher in long-term investment opportunities.In addition, high-profit, low-debt high-quality companies (such as Coca-Cola’s performance in the 1929 crisis) are more resistant to falling than cheap stocks.

Q: Are the European and Chinese markets worth paying attention to?

Grantham:The valuation of non-US markets is relatively reasonable and may outperform US stocks in the long run.Taking emerging markets as an example, S&P fell 22% in 2022, but they were almost flat.This differentiation will continue to take place in the future.

Population Crisis: Neglected Time Bomb

Q: Why is the population decline so dangerous?

Grantham: The shrinking labor force directly drags down GDP, and what is even more terrifying is the crackdown on the “animal spirit”.When companies no longer expand and promotion opportunities decrease, society will fall into conservatism and pessimism.Japan’s “lost twenty years” is a lesson learned from the past.Immigration can only relieve stress in the short term, but the global fertility decline is irreversible——Fertility rate in Africa has dropped sharply from 6.5 to 4.2, and many European countries rely on immigration to maintain their population, but this is not a long-term solution.

Q: What is the solution?

Grantham:Social incentives must be reconstructed!The government needs to reshape fertility into “public goods” through policies such as housing subsidies, high childcare allowances, and free education.Culturally, families need to be re-granted to have a high status of value rather than treating childbirth as a personal burden.

Gold and Cryptocurrency: Hedge or a trap?

Q: How do you view gold and Bitcoin?

Grantham:Although gold has no actual output, it has gone through ten thousand years of tests and is much more reliable than cryptocurrencies.Bitcoin is a pure speculative tool, and the surge in power demand caused by AI has made cryptocurrency mining an environmental disaster.

The ultimate warning: the physical boundaries of economics

Grantham: Traditional economics ignores the fact that pursuing infinite growth on a finite planet will inevitably hit the wall of physical laws.When resources are exhausted and the environment collapses, any model will fail – this is the biggest bubble of human beings.