Author: Matt Hougan, Chief Investment Officer of Bitwise; Translated by: 0xxz@Bitchain Vision

Building a cryptocurrency portfolio has been difficult for traditional investors over the past 15 years.You have to use unfamiliar applications, private equity funds, or inefficient products to piece together investment opportunities, and the costs are often high.

Those days have passed.

With the spot Ethereum ETP launched on July 23, investors can now use only three low-cost, liquid ETPs for the first time to seize the biggest opportunity in the cryptocurrency space.

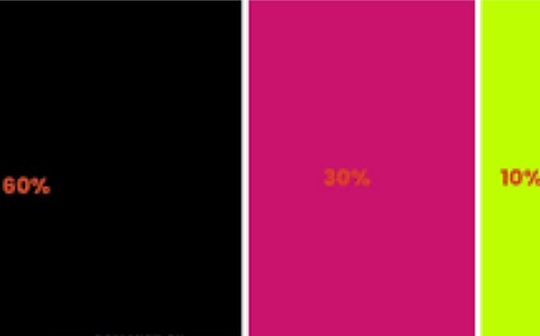

Here is the portfolio I think investors should use as a starting point:

-

Bitcoin ETP: Distribution ratio is 60%

-

Ethereum ETP: Distribution 30%

-

Crypto Stock ETP: 10% Distribution

Below I will explain why I think this is the “basic portfolio” for most investors.I will also cover how to increase or decrease investment in these three areas to build a customized portfolio that suits your needs, and how to supplement it with other strategic investments.

Why diversify in the cryptocurrency field

First, let’s start with “why”.Why build crypto packages instead of investing directly in Bitcoin?

In short: cryptocurrencies are not the same thing.It is a breakthrough technology that can be used for a variety of purposes.You can use cryptocurrencies to create new monetary assets (i.e. digital gold); build more efficient financial industries (i.e. DeFi); transfer more efficiently dollar-backed assets (i.e. stablecoins); and speed up stocks and bonds settlements (i.e. agents) (i.e. agents).monetization); and more (decentralized infrastructure, NFT, forecast market, decentralized social media, etc.).

These are trillions of dollars worth of markets.As an investor, I want to get involved in all these markets.Unfortunately, no cryptocurrency ETP is capable of doing this job.

Take Bitcoin as an example, it is the largest and most well-known asset in the cryptocurrency field.It is a leading monetary asset in the cryptocurrency field and is occupying a huge market.But Bitcoin accounts for only a little over half of the entire cryptocurrency market.Importantly, it is not a leading platform for DeFi, tokenization, or other smart contract applications.Ethereum is the second largest asset in the cryptocurrency field and dominates the smart contract field.

Both Bitcoin and Ethereum are exciting and are leaders in their respective fields.But if you buy only one of these, you’ll miss a large portion of the market.

Similarly, some applications of cryptocurrencies are best implemented through companies rather than crypto assets.For example, stablecoins are one of the most exciting applications of cryptocurrencies – digital dollars on blockchain, available worldwide!——But most of the value of creating stablecoins is attributed to the companies that created them, not the blockchain in which they trade.

If you want to fully understand the features cryptocurrencies offer, you need these three: Bitcoin, Ethereum, and cryptocurrency companies.

Build and customize cryptocurrency portfolios

As mentioned above,I think the correct starting point for combining these three assets is as follows:

-

Bitcoin ETP: Distribution ratio is 60%

-

Ethereum ETP: Distribution 30%

-

Crypto Stock ETP: 10% Distribution

I chose these weights because 60-30-10 roughly reflects the market value of each asset.Why not start with the relative importance of each asset that the market tells you?

However, I suspect that many investors may want to customize their investments by increasing or decreasing the weight of certain parts.For example:

-

Increased Bitcoin: Bitcoin’s main purpose is currently used as a store of value and emerging currency assets.If you are worried about hedging your portfolio to resist inflation, or worrying about global currencies depreciating, you need to increase your holdings of Bitcoin.

-

Increase stake in Ethereum: Ethereum’s main purpose is to serve as a smart contract platform that supports applications such as DeFi and tokenization.If you want to bet on the growth of these applications (such as Wall Street accepts tokenization), then you should overtake Ethereum.

-

Overweight cryptocurrency companies: cryptocurrency companies have performed poorly over crypto assets over the past year: The Bitwise Crypto Innovators 30 index has risen “only” 68% over the past 12 months, while Bitcoin has risen 128%.After growth adjustments, cryptocurrency companies have been valued quite attractive.Opportunist investors may want to increase their holdings of these stocks.

Apart from that, some experienced investors may want to enhance their core cryptocurrency portfolio by holding affiliate positions in other cryptocurrency investments.For example, cryptocurrency index funds offer a wider range of investments in cryptocurrency assets.(Full disclosure: Bitwise manages the world’s first and largest cryptocurrency index fund.) Or, investors may be interested in active and hedging investments, which have a very different risk profile than long investments.Others may want to look at venture capital focusing on private companies and next generation tokens.

But the above 60-30-10 three ETP portfolio is a great starting point.It provides investment opportunities for the vast majority of markets and major applications of cryptocurrencies.And it also has the comfort, familiarity and cost-effectiveness of traditional ETP.

A few years ago, it was difficult for even the world’s largest institutions to form such a comprehensive cryptocurrency portfolio at such a low cost.Nowadays, every investor can do it.

This sounds like progress.