The US Securities and Exchange Commission (SEC) warned UNISWAP LABS on Wednesday, saying that the company may file law enforcement lawsuits.Uniswap Labs is the initiator of the decentralized trading protocol UNISWAP Protocol, and UNISWAP is the head protocol in the DEFI field. Since its launch before five and a half years ago, its transaction volume has exceeded $ 2 trillion, occupying the total transaction of the decentralized trading market.55.5%of the amount.

The warning is issued in the form of Wells notification. On behalf of the SEC, the informal reminder issued to the enterprises involved before the formal lawsuit will provide the company with the last opportunity to refute the allegations.Of course, receiving Wells notification does not mean that the SEC will definitely file a lawsuit.In short, this is the last opportunity for defense. The recipient can provide evidence and arguments to the SEC to try to persuade the SEC to not take action.If the SEC decides to continue, a formal lawsuit will be filed to issue a “complaint”.However, under normal circumstances, the process of Wells is just a goal, and the gossip said that the agency has not had a short time to investigate UNISWAP, and SEC is seeking a comprehensive blow to the cryptocurrency industry.

A spokesman for the agency said in an interview: “The US Securities and Exchange Commission does not comment on whether there is a possible investigation.”

At present, I have not yet understood the specific nature of SEC’s allegations of UNISWAP LABS-although the company has built the same-name agreement Uniswap Protocol, it is not the core controller of the agreement.Judging from the previous SEC’s litigation of high -profile cryptocurrency companies such as Coinbase, illegally providing the public with unregistered securities, or unregistered litigations such as agents or compliance exchanges.

The facts have also been confirmed. At a press conference on Wednesday afternoon, UNISWAP chief operating officer Marie Catherine Reed and chief legal officer Marvin Amiri told reporters that the contents of Wells notified are concentrated in Uniswap as unregisteredSecurities brokers and unregistered securities exchanges, but it is unclear whether UNISWAP’s native currency UNI is implicated as the potential security in the SEC notification.

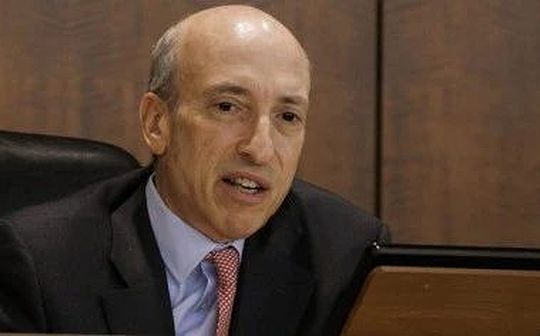

Uniswap’s litigation time is quite subtle, when the cryptocurrency industry complains to SEC.The industry generally believes that the problems of the SEC processing encryption are too arbitrary, and law enforcement operations are adopted on the basis of no clear rules. The cryptocurrency is not considered the uniqueness of the blockchain and decentralization.SEC Chairman Gary Gensler refutes this that the current securities law is clear. The cryptocurrency industry sought special treatment, but did not comply with the law-the White House, especially Gensler’s powerful allies, the Democratic Senator Elizabeth Warren also agreed with this.Views.

Of course, from a historical point of view, the conflict between the US Securities and Exchange Commission and the cryptocurrency industry is very high. Previously, there have been many attractive lawsuits. Coinbase and RIPPLE are typical cases.And rights, as well as how the Supreme Court defined in 1946 tests should be applied to cryptocurrencies.

These lawsuits are underway, and the results are half -giving off, and both parties have occupied the upper hand. However, the ruling in recent years shows that the SEC as a regulatory agency has legal advantage in law.However, in this lawsuit, in view of the uniqueness of Defi technology and the legal victory of the Uniswap Labs in the collective lawsuit last year, the results of the UNISWAP case are still unpredictable.

From a sense, since the 20 -year DEFI outbreak, DEFI has become a crucial segment of the encryption market, and the most headed Uniswap protocol has completed more than $ 2 trillion in transactions.The attention of underlying technology is also increasing, so the results of litigation between the US SEC and Uniswap Labs have a profound impact.

Unlike traditional brokers or cryptocurrency exchanges, the DEFI platform does not have a central organization as a transaction opponent, and there is no institution to match the trading and sellers for transactions.In contrast, they depend on automated protocols that are purely supervised by code, and the agreement sets basic requirements such as trading rules and collaterals.

In the case of Uniswap Labs, the founder Hayden Adams wrote the original underlying code that provides the foundation for the agreement, which provides users with interfaces that trades certain cryptocurrencies.The agreement itself is open source and is cited by many other projects in the field of DEFI, and the open source -based UniSWAP code, users can directly participate in market transactions without any intermediate merchants on the premise of self -custody property.

This particularity is particularly important for Uniswap Labs.In fact, UNISWAP has a relatively abundant lawsuit.As early as April 9, 2022, American law firms Kim & amp; Serrotella and Barton announced a collective securities lawsuit, accusing UNISWAP Labs, Paradigm, A16Z and other defendants violated the Securities Law on the UniSWAP platform in the form of digital token.Sell unregistered securities, including UNISWAP’s governance token UNI.

The lawsuit believes that Uniswap should be responsible for victims.In the case, the plaintiff used a car to be metaphorical, thinking that the ADAMS mechanism actually created an out of control of a dangerous autonomous vehicle.

UNISWAP Labs also responded to this, arguing that the technology developed was neutral-other third parties used the operation of this technology, and the enterprise did not control.

The judge clearly recognizes this view.On August 29, 2023, the case ended.The document of the court of the South District Court of New York in the United States shows that the UniSWAP platform is capable and in many cases; there is no transaction between the plaintiff and the Uniswap platform and the agreement;Responsibility.

The judge believes that the plaintiff was injured by the fraud tokens. They used Uniswap’s core contract to grab the funds. Uniswap created this platform.It means that UNISWAP is responsible for fraud and harm.

In the lawsuit of Coinbase last month, although the judge refused to reject the charges of illegal securities provided by the company, the decentralized wallet provided by Coinbase could not be regarded as a broker within the jurisdiction of the securities trading committee.This ruling also provides a powerful example of UNISWAP, because it also mainly operates through wallets with DAPP.However, it is worth noting that the ruling did not include the company’s authority -controlled display interface, and the interface had prominently displayed tokens that were identified by the US SEC as securities in the past.

On the whole, quoting the web3 rhythm view, SEC still has many challenges to the company’s lawsuits.The first is that transactions based on the Uniswap protocol are difficult to apply to the securities law. In the case of Risley and Uniswap Labs, the trial judge has made it clearThe determination of whether it is best to be judged by Congress. “” “” “” “” “”

Secondly, compared to many cryptocurrencies that can be traded directly, Uniswap is based on the open source protocol, and the application and wallet involved in accordance with the original rules do not comply with the legal definition of the stock exchanges or agents.

Finally, Uniswap’s own token UNI is a governance tokens, which is only a single function tokens. It does not meet the legal definition of any type of securities, including the definition of “investment contracts”.

In addition, since the developer in the Tornadocash incident, Uniswap itself was as thin as ice.According to BlockBeats, Uniswap has adopted a complete compliant route in team operations: Qingyi American executives, employee recruitment and welfare policies that fully comply with US law, and the legal route of open source agreement and development entity.

Perhaps because of this, UNISWAP is full of confidence in its own compliance.The founder of Uniswap clearly stated that he believes that the corporate provides the legality of the product, and believes that the company is on the right side of history, and also does not expressed dissatisfaction with the SEC rules. Taking FTX as an exampleEven in the faith, the final indicator will not give up the lawsuit, and may always appeal to the Supreme Court, and the determination to fight for the fight is evident.

UNISWAP LABS insider said that the company is going to carry out a “valuable struggle” in court and say that the company chooses to take root in New York City instead of overseas operations, which directly reflects the company’s legitimacyEssence

Although it seems to be reasonable, UNI is still seriously under pressure under the influence of litigation.According to the market data, under the influence of the news, the price of UNI has fallen from $ 14 to the current $ 9.38, and has plummeted by more than 16.88%in 24 hours.Coincidentally, the day before the SEC warned, the UniSWAP team/early investor affiliated wallet sold 15,000 UNIs on the average price of $ 11.18.Even though this value of Jiu Niu is for the market value, it has caused some concern to the anxiety of some concerns.

From the perspective of the SEC, without sufficient grasp, why the lawsuit is required to make people doubt.In this regard, some people believe that this is just a confrontation attitude. After all, the conflict between the SEC and the industry has erupted. Near the general election, the SEC party may have been suffered from more political pressure.Opponents are criticized, so they ca n’t wait to prove their professional positions in a targeted event. They extend their tentacles to decentralized fields when the head centralized trading platform has been locked.

But on the other hand, according to industry analysts, the two new rules passed by SEC on February 6 this year seem to make the lawsuit confusing.

The rules indicate that the market participants of some dealers’ characters, especially those market participants who provide important liquidity in the market, must register in SEC, become members of the self -discipline organization (SRO), and abide by the Federal Securities LawAnd regulatory obligation.According to the final rules, “Anyone who engaged in the rules is” dealers “or” government securities dealers “, and there is no exception or exemption, according to Article 15 (a) or 15th, 15th(A) Register 15C to the committee, if applicable; become a member of SRO;

According to this content, the automatic city merchants in DEFI and the largest liquidity provider of a transaction are still worth exploring whether it contains the largest liquidity provider, and this means that Uniswap and even DEFI will face new challenges.But the active side is that if the uniSWAP successfully won this time, it will clearly clear the key obstacles for DEFI, thus becoming a foundation stone for large -scale applications.

Perhaps success or failure is here.

References:

Fortune: SEC MOVES to Sue Uniswap in Bid to Hobble Fast-GROWING Defi Sector;

Web3 Law: SEC plans to file a lawsuit impossible to win to Uniswaplabs?

>