Article Author: HeartArticle translation: Block unicorn

This interview reveals many common practices that most people take for granted but never publicly acknowledged, and the scope of their spread.

But in my opinion, it also touches on some very interesting topics, involving the issuance of Meme coins and purely hype-based coins, which go beyond the criminal behavior described in the interview, and I think these topics deserve more in this areaExtensive discussion.

Or, it’s more like the “emperor’s new outfit” moment, with a layer of veil being uncovered and can no longer be concealed.

Here are some important highlights:

-

Most “large Meme coins” offerings are usually made after private transactions are concluded, with a portion or a majority of the supply being purchased or given to KOLs and other entities at a price lower than the market capitalization of the issue.

-

As it involves a large number of people with different goals and attributions, early information about these tokens/transactions is sometimes “broken” to other parties who are not involved in the transaction.

-

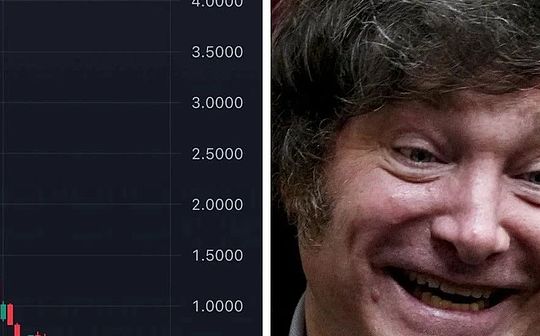

From Hayden Davis himself, “Then how do you make money?”, that is, all these entities firmly believe that the only way to make big money is to be an insider who manipulates the game, there is no fairness here, no exclusion for the peopleOpportunities offered.

-

Partly because of point 2 (information leak), but it is inevitable that once the token is deployed on the public blockchain and the CA address exists, there will be a large number of skilled, well-capitalized (millions of dollars) snipers, can seize a large amount of supply within seconds of the birth of the token, and these people have no connection with the “team”, they will only destroy the K-line by selling the tokens without hesitation.

-

So far, the “team”’s response to the point 4 issue is to snipe on its own (by commission, I believe) to “limit” the supply that other snipers can seize and sell.Surprisingly, they don’t think it’s immoral, or it’s “protecting” retail investors and K-lines.

-

Hayden mentioned a gray area, indicating that this supply/liquidity (also by partially “pulling” from liquidity pools such as Meteora) is considered a “treasury” to maintain medium- and long-term stability of the K-line, but it is alsoThe source of profits from the team.It seems that there is a large amount of funds mixed here, and the “retail investors” are kept in the dark and have no idea of the real use of these funds.

-

“Organic” Meme coins are mostly dead or are already dead and then sold (usually taken over by the same type of team).

-

These teams managing large hype issuances want to see the currency survive for a few months, “preferably 1 to 2 years”, but the reality is that the currency usually can’t last for a few days.They mainly blame point 4 (sniper).

-

There is a common cynicism among these insiders who believe that the entire cryptocurrency world, basically without any practicality or application scenarios, is a zero-sum game with the goal of finding a bigger fool to take over, andThis is just a game to maximize the value extraction.According to Hayden, this is “top to bottom, even Bitcoin.”

-

They have a distorted moral concept that since traditional capital markets (stocks, etc.) are seen as “manipulation and corruption”, despite all the regulation and laws, it is hypocritical to just pick out the “manipulation” of cryptocurrencies.The idea that cryptocurrency may be a new area for building a more fair game place is considered childish and naive.

As I said above, despite the widespread criminal act acknowledging in the interview, in my opinion, these views have mostly been unresponsive in public cryptocurrency discussions, and as for the “solutions”, it also seems very scarce, utopian, and also utopian., or these problems themselves are understateed as non-problems.

First of all, the open and transparent nature of blockchain makes it possible that once a token’s CA (contract address) is established, the act of rushing to buy the coin first becomes a “solving game”, and the participants have technical knowledge and almost unlimited capital.Basically, retail investors have almost zero chances to buy currency at low market value, unless it is a “dead” coin, and you are lucky enough to encounter someone who buys the market and then hypes it up (usually they will still be taken away by insiders first).

This is a mostly unresolved issue, any currency that wants to be fairly issued directly on the open market even in good faith (i.e., notAfter a private investment round) you will encounter similar problems (but even those, you may be sniped in TGE).

There are some possible remedies and workarounds that I personally haven’t seen verified, such as batch deployment of 50 tokens on Pumpfun and then publishing the real CA address after binding and reaching sufficient market capitalization.This will force snipers to disperse their capital or hope to choose the CA for luck, thereby reducing the damage to retail investors, but it does not fundamentally solve the problem.In addition, it may also be affected by insiders’ leaks of real CAs (possibly sold to snipers, etc.).

Another important factor is the general skepticism

This may be worth a separate article (or even more!) to explore, but basically the theme of this cycle is disillusionment.

In my opinion, most participants, especially new entrants, are not optimistic about cryptocurrencies’ commitment to achieving decentralized finance (DeFi).DeFi’s vision is to make people the real controllers of their own funds, operating without third-party intermediaries, without being bound by national boundaries and additional expenses.However, cryptocurrencies are now seen more as a wild Western casino, and no tokens are seen as innocent, all of them are seen as pure speculative assets with a lack of practical support or purpose.Everything is like a zero-sum game, I want to make a dollar, you have to lose a dollar, and we are all playing a “bigrill fool” game until the music stops.

I add that it’s hard to blame them because even if we see Ethereum as the first mature step towards “world computers” and “decentralized finance (DeFi)” and its smart contracts, this technology and this industryIt is now nearly 15 years old.While there are several respectable agreements that meet the demand for DeFi by thousands of users, 15 years has been a long time in the tech and finance.I think we can say that it “major fails to deliver on” its promise.

But I see too much attention and saliva is wasted on issues such as criminal behavior, loss of funds and lack of morality, and few people discuss the fact that we are now “mature enough” to ask ourselves, we are really buildingIs something meaningful?Are we really providing or building an alternative to get rid of traditional finance, banks and institutions?

Or is it that we really end up with only Bitcoin being a traditional financial asset to a large extent, while the rest of the cryptocurrency sector has become a wasteland full of attempts to squeeze money from clueless despair individualsThe robber?

Or do we really have only Bitcoin left to be a traditional financial asset to a large extent, and the rest of the space is a wasteland where bandits try to squeeze money from clueless desperate individuals?