Author: Trustless Labs Source: X,@TrustlessLabs

The popularity of the Bitcoin Layer 2 track is not reduced. Among the many L2 projects, CKB is unique. On the one hand, because the team’s origin is the well -known public chain NERVOS, it has been deeply cultivating the POW mechanism; on the other handLater, the team proposed a pioneering solution RGB ++, using CE on the CKB chain, and UTXO of the original Bitcoin chain “isomorphic binding”.The market’s response to CKB is also very enthusiastic.

On February 22, Trustless Labs invited RGB ++ authors and CKB Lianchuang CIPHER and ecological head Baiyu to share their understanding of Bitcoin L2, RGB ++ mechanism, RGB ++ assets and CKB ecological construction ideas.The following is the text of the Twitter Space content.

1.Nervos is a long POW public chain. Why does it always insist that POW has not transformed the POS chain?How is the idea of transforming BTCKB?

NERVOS chooses to insist on POW and not transform into a POS chain. This decision is rooted in our profound understanding of technology and market.We believe that the decentralization and security of the POW (workload certificate) mechanism are irreplaceable.In addition, our technical selection-including the UTXO model and the adoption of the RISC-V architecture, although it runs counter to the mainstream trend at the time, is based on consideration of long-term sustainability and technical advantages.

From 2018 projects to launch in 2019, we have experienced many fluctuations in the cryptocurrency market, but we have never changed our direction.At that time, smart contracts and POS mechanisms were considered to be the future direction, and POW was regarded as outdated technology.Nevertheless, our persistence in POW is not only for technology preferences, but also because we believe that the UTXO model and POW mechanism can provide unique security and decentralization characteristics, which is difficult to replace by other technical solutions.

The idea of transforming BTCKB is actually derived from our profound insight into market narrative.In the past few years, although our narrative seems to be suppressed by the narrative of POS and account models, since last year, with the expansion of Bitcoin on Layer1 and the emergence of emerging applications for UTXO models, we have seen an opportunity.These changes not only expand the scope of Bitcoin, but also enhance users’ understanding and acceptance of UTXO and POW.In addition, with the re -evaluation of the environmental impact of POW and the verification model on the out -of -chain computing chain, it is becoming more and more recognized. We believe that it is the best time to launch a new protocol based on the POW UTXO model, such as RGP+.

I believe that with Bitcoin’s Renaissance and market re -understanding of POW and UTXO models, Nervos and BTCKB will be at the forefront of cryptocurrency development.Our insistence on POW is not without reason, but is based on the understanding of the true value of technology and a deep insight into future trends.

2. What is the expansion of BTC and the understanding of BTC and the understanding of BTC L2, and why do you choose the RGB protocol?

Regarding the NERVOS team’s understanding of BTC and the understanding of BTC L2, and why choosing the RGB protocol, my view is based on the characteristics of our team and the accumulation of previous technology.We have discussed in depth whether to pursue TVL or choose EVM compatible Layer 2 path.After careful consideration, we believe that adhering to the line of technical faction, even if it means taking a road that is different from mainstream, is also our advantage.Our technical selection and strategy, especially the RGB protocol, is based on our conservative attitude towards the Bitcoin community and the pursuit of technological innovation.

We know that direct competition with Bitcoin and Ethereum is a difficult road.In the past, we tried to position CKB into a Layer1 public chain similar to Bitcoin and Ethereum, which aims to be a value storage platform.But such positioning has made us in an embarrassing situation-not fully meet the conservative standards of the Bitcoin community, but also conflict with the development direction of Ethereum.This unique positioning makes us look incompatible in both major communities.

Faced with such a challenge, we decided to embrace our characteristics and adhere to the original technical vision.This includes in -depth exploration and innovation of UTXO models, as well as research on Bitcoin No. 2 solutions.We believe that by focusing on our technical advantages and innovations, we can find a path that meets both the spirit of Bitcoin and bring value to the community.

In the process of transformation, we realized that the acceptance of the market for the UTXO model gradually increased, which provided a favorable timing for our transformation.We decided to clearly express the positioning of CKB, that is, as a second -layer solution for Bitcoin, this not only conforms to our technical concept, but also provides new growth opportunities for the Bitcoin ecosystem.In general, our decision -making is based on a deep understanding of the essence of technology and a keen insight into market trends.We believe that by focusing on our core advantages and adhering to technological innovation, we can find our unique position in the world of cryptocurrencies.

3. At the technical selection level, BTCKB chose the RGB protocol and proposed the RGB ++ protocol to briefly explain this solution (which layer DA is, client verification, open source index, what VM)?

Baiyu: I will first introduce our big background and decision -making process at the time.We believe that the key to the second layer of Bitcoin is the first layer of competition, and the core of the first layer of competition lies in the new agreement.We divide the new protocol into two categories: one is assets that use UTXO characteristics, and the other is not.On this basis, we have chosen protocols with UTXO characteristics, such as Atomical, RGB and Taproot Assets.

In particular, we decided to choose the RGB protocol, because CIPHER personally had a strong interest in RGB and conducted in -depth research with Teacher A Jian.We proposed a method of homogeneous binding to launch RGB ++.In the future, the core direction of CKB will be to promote RGB ++ technologies, but it is clear that RGB ++ and RGB are two different concepts.RGB is mainly proposed by the IMPBP Association, Dr. Maxim, and initially by Peter that they use the concept of one -time sealing to expand.The RGB ++ more introduces that other UTXO chains can be used as the possibility of RGB ++ client. The core contribution is the concept of homogeneous binding.Judging from the standpoint of CKB, we plan to be compatible with more agreements in the future.

CIPHER: When discussing the technical selection level, I first explained what the RGB protocol is.RGB is actually a one -time sealing and client verification technology that uses Bitcoin. Through the UTXO model of Bitcoin, the RGB transaction status is bound to the chain, thereby realizing an asset agreement on Bitcoin Layer1.This design allows to verify that when a transaction is verified, you only need to pay attention to the transaction path related to the UTXO, instead of checking all transactions to confirm the balance or status like other models.

For data usability (DA), we often discuss its storage position and its impact on security in Layer1 or Layer 2 in the Ethereum ecosystem.But in the Bitcoin ecosystem, this concept is different from Ethereum, especially for protocols that use UTXO characteristics like RGB.In the RGB protocol, you only need to verify the data related to the user, and these data do not need to be stored on a specific DA layer in theory, because both parties to the transaction can directly exchange the necessary information.

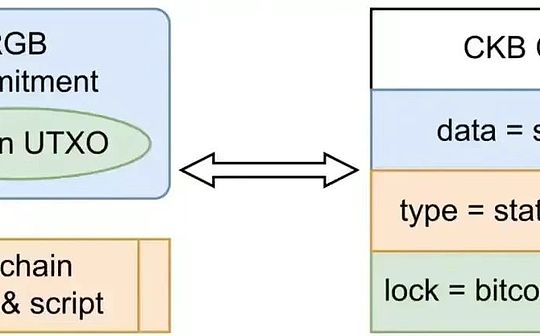

The RGB ++ protocol is an extension of RGB.RGB itself needs to exchange the history and data of transactions through P2P networks, including using new virtual machines and definition interactive logic, making the external logic complex and slow development.RGB ++ aims to use homogeneous binding or mapping to migrate all “smart” components in the RGB protocol, such as P2P networks, virtual machines, smart contracts, etc., to put these functions on CKB (NERVOS Network))superior.The state transfer of each UTXO on CKB is constrained by the CKB smart contract. In this way, it can verify and run the RGB ++ contract assets and logic on CKB, while solving problems such as interaction, smart contract operation and proof.CKB uses the virtual machine of RISC-V, which supports Turing’s complete smart contracts, so that users can directly check or verify the status of asset status on CKB without sacrificing security, or when there is a need, on the client, the client is on the client.Verify.

Technical implementation:Through the RGB ++ protocol, we first ensure the compatibility of all operations with RGB.We solve the problem of slow progress in the chain client, and replaced by using a UTXO chain strategy based on the workload proof (POW).In addition, we have implemented a mechanism that can seamlessly migrate transactions on Bitcoin to CKB (NERVOSNETWOR) to execute, use the high -performance execution environment provided by CKB, and then move the execution results back to the Bitcoin chain.

Performance optimization:An important feature of the RGB ++ protocol is that the transaction is allowed to “jump” to the second layer (Layer 2), such as jumping from the Bit currency chain to the CKB chain.This means that transactions can be performed many times on CKB (such as 100 times, 1,000 times), enjoy the benefits of low cost and high performance, and then “lower” back to the Bitcoin chain.This method significantly improves the efficiency and performance of transactions, while bypassed the performance restrictions of Bitcoin itself.

Safety consideration:In the process of realizing the jump, we pay special attention to safety issues.This process does not depend on any cross -chain bridge or multiple signing mechanisms, but is based on direct binding between two UTXO.Based on the security standards of the workload (POW), we believe that the transactions on the Bitcoin chain cannot be reversed after 6 blocks. On CKB, we need about 24 blocks through equivalent calculation formulas.To achieve the same security guarantee.This method ensures the security of assets jumping or migrating between two levels.

Innovation and optimization:Our method is different from the Layer 2 logic of Ethereum or other cross -chain bridge Layer 2 logic, which represents our innovation and optimization in blockchain technology.Through the RGB ++ protocol, we not only solve the problem and cost of performance, but also improve the security and reliability of the entire system.

In short, by introducing the RGB ++ protocol, while maintaining compatibility with the original RGB protocol, we have achieved significant improvement in performance and strict security for security.These optimizations and innovations show our in -depth understanding of the development of blockchain technology and the exploration of future directions

4. The development of smart contracts for theRGB protocol is difficult. This is one of the main reasons for RGB’s slow progress. Will RGB ++ use the same smart contracts as RGB?What technical stacks and support do I have for developers?

First of all, about the compatibility of the RGB ++ and the original RGB protocol, our development process will be divided into two steps.In the first step, we will not be completely compatible with the original RGB’s original protocol, mainly because the RGB protocol itself is still changing and not fully improved.In the second step, we use homogeneous binding technology to allow each RGB or RGB ++ transaction to bind it with CKB’s UTXO (we call it Cell).This means that the smart contracts and status of the RGB ++ protocol layer will be equivalent to the smart contracts and status on the CKB.Our tool chain and support based on the accumulation of CKB in the past five years, although the development is relatively complicated.

Secondly, comparing Ethereum’s account model and the UTXO model of CKB, the intuition differences and difficulty in the development of smart contract development.Ethereum’s account model is more in line with programmer’s intuition, and simply calling functions can get results.However, it is extremely difficult to implement UTXO -based business logic (such as RGB or RGB ++) based on UTXO. The reason is that the transaction results under the account model are uncertain, which affects the feasibility of homogeneous binding.

Although it is difficult to programming under the UTXO model, we think this is the only solution for the logic of the Bitcoin protocol.The development tools and product awareness accumulated in the past four or five years, including the use of Rust, C, LUA, and JavaScript tool chain and basic design to write smart contracts, providing developers with rich support.We tried to achieve AMM similar to UNISWAP under the UTXO model, but encountered major challenges, and the final project failed, showing the difficulty of innovation under the UTXO architecture.

Regarding the user experience, we plan to launch RGB ++ alternatives and irreplaceable token and corresponding DEX at the end of March, which will be based on CKB.User experience design aims to simplify, and users can easily transfer assets without the need for tedious inscriptions.The processing of homogeneous transactions through the entire process is transparent for users and aims to provide a seamless cross -chain interactive experience.

In terms of technology selection, we first guaranteed the compatibility with the RGB protocol, and at the same time introduced a mechanism to allow transactions to be migrated from seamlessly from the Bitcoin chain to CKB to perform, enjoy higher -speed execution efficiency, and then move back to Bitcoin.chain.We call it “IUMP” in this process, which allows assets to jump safely between the two chains without relying on any trust cross -chain bridge or multiple signing mechanisms, rely only on the binding between UTXO.This design is based on the differences in the confirmation time of Bitcoin and CKB blocks, and confirmation of blocks with appropriate length to ensure the security of asset migration.

For the challenge of the RGB protocol intelligent contract development, we respond through providing richer exchange experience and development support on CKB.We will launch a dex solution for Layer 2 to optimize the user experience so that they do not need to care about whether the asset is in Layer1 or Layer 2.This DEX allows users’ assets to set up from the Bitcoin chain to DEX. During the process, the ownership of the assets was transferred from the UTXO of Bitcoin to the CKB address to ensure the security and transparency of the transfer.The smart contract code we use is open source, which reduces users’ concerns about security.In addition, we ensure that the double payment protection in the process of asset jump (JUMP), and the smooth trading experience on Layer2, so that users do not need to worry about the specific location of the assets, thereby providing an almost seamless trading experience.

5. Since a similar transaction will occur on CKB after the Bitcoin is transferred, how can users calculate when using two chains, including the two chains, including these transfers of assets?

First of all, when trading on Bitcoin and CKB, it will indeed perform a transaction once on the two chains.CKB’s transactions require not only network fees (GAS fees), but also status costs for storing transaction status (such as the number of CKB held).This status fee usually requires more than 100 CKB, which leads to the question of who will bear these costs, and how to ensure that it does not affect the user experience.

The solution is that when performing Bitcoin transactions, you can add an additional output to Bitcoin transactions. This Output is a small part of Bitcoin (the cost is about a few dollars), pointing to a paid -by -person referred to as Paymaster.This agent uses these Bitcoin to construct and initiate a corresponding transaction on CKB to replace the cost of paying the CKB chain instead of the user.

In this process, there is a key point that CKB uses a feature that allows the transaction to prove that the transaction does occur on CKB through Bitcoin transactions without the need for users to sign again on the CKB chain.This means that anyone (such as Relayer or Paymaster) can replace users to initiate transactions and pay relevant fees on the CKB chain.

In the end, through this mechanism, users do not need to directly worry about the calculation and payment of GAS costs when they transfer the assets between the two chains, because these are indirectly processed by the additional Output in Bitcoin transactions.Payment, thereby providing a seamless experience to user -friendly experience.

6. The BTC L2 on the market has shown an explosion. For example, BoundceBit, Merlin Chain, B^2 already have very objective TVL; RGB ++ will consider how to cut into the market?Will there be native asset issuance agreements on RGB ++?

When responding to the explosion of the second floor (L2) solution on the market, and the question of how RGB ++ cut into this market, I will explain from two main aspects: First, the functions and functions of RGB ++ as a issuance protocol andFeatures, the second is our strategies and plans on the second -layer chain of the CKB.

First of all, the core function of RGB ++ is a issuance agreement for NFT and FT (intangible homogenization tokens and homogeneous tokens).This means that RGB ++ can support NFT and FT issuance, and its experience is similar to trading on the Bitcoin main network, but may face higher GAS costs and slow trading speed.However, when the transactions involving these assets are involved, the CKB’s DEX can be used directly. In this regard, the assets on RGB ++ and CKB follow the same standard, such as our FT standard XUDT, similar to ERC20.We also have the standard of NFT, that is, Sport NFT, these standards have been applied on the main network.

Secondly, the strategy on the second-layer chain of the CKB, we focus on providing a smooth user experience, including the issuance of native assets and the support of cross-chain assets.Bitcoin and Ethereum assets can be transferred to CKB through bridge technology. We are working with large institutions to ensure the security and reliability of this process.In addition, we emphasize the importance of smart contract platforms. Once RGB ++’s assets are issued, we can immediately use this platform for various decentralized applications (DAPP) development, such as definition, pledge and mining activities.

Three types of assets on CKB: FT, NFT and CKB native inscriptions assets.Each type of assets have their specific applications and trading mechanisms, and we provide corresponding technology and market solutions to support them.For example, we support the circulation of NF assets through unified standards and trading markets, and we are developing specific platforms, such as the Omega trading market to support the issuance and transaction of CKB native inscriptions assets.

In summary, the market entry strategy of RGB ++ includes both the ability to use its power as a powerful NFT and FT distribution protocol, as well as plans to launch innovation and native assets on the CKB two -layer chain.We are committed to providing a complete smart contract platform, supporting the transfers of assets cross -chain, and cooperating with industry partners to ensure the safety and practicality of technology.

7. What is the difference between RGB ++ assets and RGB20 and RGB721?Compatible with BRC20 and ARC20 assets with a relatively high market share on the original Bitcoin chain?

Assets on Bitcoin can be roughly distinguished into two categories and three categories.First of all, Bitcoin itself is an independent asset.Secondly, all assets that need to be verified under the chain, or the so -called “dye assets”, constitute the second largest category.In this second largest category, I further subdivided into two categories: one is assets that can use UTXO characteristics and can be reused on the Lightning Network. Such assets are similar to RGB solutions, through homogeneous reflections and binding.Definitely, it can be migrated to CKB for use.This means that assets such as Atomical and Taproot Assets, although they are still issued on the Bitcoin chain, they can be used on CKB through the RGB ++ solution, and there is no need to modify this layer of agreement assets.

The second type of assets such as BRC20 uses assets with less UTXO characteristics, and it is difficult for them to migrate to CKB through homogeneous binding.For such assets, our processing methods are similar to other chains on the market, that is, through the creation of cross -chain bridges.This bridge locks BRC20 assets on the Bitcoin chain, and then releases a equivalent FT (Fungible Token) or NFT (NON-FUNGINGIBLETOKEN) on CKB to allow users to trade on CKB.This method is suitable for those protocol assets that cannot directly use UTXO characteristics, BRC20 assets such as ORDI.In short, RGB ++ aims to use a flexible homogeneous binding mechanism to compatible and optimize the use and migration of different types of assets between Bitcoin and CKB.

8. ERGB ++ What support will the assets of some of these existing, more users and communities in the future?

We are planning to support the existing and widely used assets, and we mainly consider two ways:

1. Inscription Bridge Support:We intend to support the support of BRC 20 or other assets through the inscription bridge, as long as there is a suitable INDEXER and the operating party of the bridge.We are looking for partners to build these inscriptions cross -chain bridges.We can solve the problem of the BTC Bridge soon, and we are working hard for the inscription bridge.This requires support for wallets in the ecology, including plug -in wallets, which is currently lacking in the CKB ecosystem.We look forward to the support of more hardware wallets and plug -in wallets in the future. These wallets will be compatible with the main protocols to support the development of the entire ecology.

2. Non -inscription bridge path:The first thing we pay attention to is the implementation of RGB ++.After completing RGB ++, we may consider supporting UTXO protocols such as the Room protocol to see which method is faster and more effective.Our goal is to implement RGB ++ first.In addition, we are considering cooperation with the Lightning Network team, although they are mainly focused on payment and limited script functions. We believe that it is the most appropriate way to bring these functions to CKB and provide them with a smart contract level.

Overall, our strategy is flexible and radical. It aims to gradually promote to support extensive users and community assets through various technical channels and partnerships.We are confident that these tasks are feasible, and the ultimate power of implementation is in our own hands.