Source: Kaiko Research; Compilation: Wuzhu, bitchain vision

After the North American tariff differences were quickly resolved, the market stabilized.The United States is exploring its own sovereign wealth fund, while regulator and cryptocurrency Tsar David Sachs envision digital assets ushering in a “golden age”.This week we will discuss:

Coinbase’s momentum before the financial report, USDC’s trading volume on Binance continues to grow, and altcoin liquidity.

How does cryptocurrency data affect earnings?

Coinbase announced its fourth-quarter earnings on February 13, and we analyze market data to understand its performance.While earnings guidance and analyst outlook will affect stock prices, cryptocurrency market data is a leading indicator of exchange health.

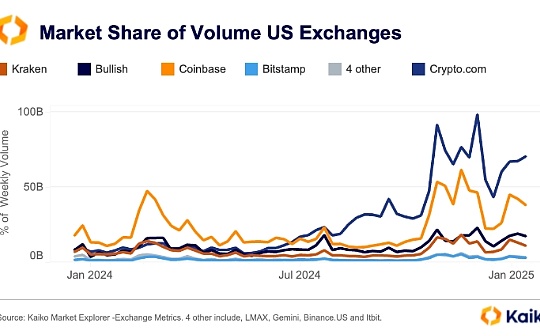

In the fourth quarter, Coinbase’s weekly trading volume soared to its highest level in two years, indicating it has benefited greatly from the post-election rebound.

Coinbase has diversified its business in the past few years to expand beyond transactions, with revenue from “subscriptions and services” (including blockchain rewards, custody fees and USDC interest) rising sharply as a percentage of its total revenue.

However, it remains at its core a trading platform, with transactions still accounting for more than 50% of revenue (except for a quarter of 2023).

Furthermore, subscriptions and services are essentially related to activities in the underlying crypto market and do not serve as a risk-diversifying role in preventing market declines and trading downturns.A quarter of poor transactions and price action will exacerbate the loss of subscription and service revenue.

For example, in the third quarter of 2024, the company’s blockchain reward revenue fell by 16% due to falling ETH and SOL prices.

Using Kaiko’s blockchain monitoring tool,We can see net traffic on the Ethereum beacon chain drop in the fourth quarter.Coinbase is currently the second largest ETH staking entity after Lido, and is one of the biggest factors leading to this decline.The exchange’s share of the pledge market has dropped by 3.8% over the past six months, with a net outflow of 1.29 million ETH during that period.

While ETH and SOL prices rose this quarter will offset some of the reduction in staking, the data still suggests that blockchain reward revenue may be affected in the fourth quarter.

at the same time,Coinbase’s USDC-related revenues associated with Circle’s commercial agreements may further provide buffering.Circle’s new partnership with Binance and record USDC transaction volumes may further help offset the decline in staking revenue.

Still, retail traders (the payers with the highest fees) did not return strongly, with their share of volume shrinking from 40% in 2021 to just 18%.Despite the increase in subscription volume, this still puts pressure on transaction revenue.

The so-called “acceptance rate” (an indicator of revenue generated by retail traders) has fallen to its lowest point since the first half of 2022 since peaking in mid-2023, when crypto markets were hit hard by the Terra Luna crash and credit market crash.

The decline in retail income occurred amid growing competition in the United States, with some platforms offering substantial fee discounts.

Although Coinbase remains one of the most liquid exchanges in the United States, its fee structure – like most other platforms – is beneficial to market makers rather than recipients and has remained relatively stable.

also,Although Coinbase has diversified its products and benefited more from cross-product synergies, Coinbase has slowed its launch activity due to the tough U.S. regulatory environment.

The chart below shows that the number of active trading pairs on Binance.US and Coinbase dropped sharply after the SEC filed a lawsuit against both platforms in June 2023.However, if the regulatory environment improves, this situation may change, which may increase the appeal of Coinbase to retail traders.

Binance’s USDC trading volume hits record high

Binance has become the largest USDC market, with weekly trading volumes reaching US$24 billion in January, accounting for 49% of global USDC trading volume, the highest share since September 2022.This surge comes after a strategic partnership with Circle in late 2024, aiming to expand USDC adoption.

By contrast, Bybit’s dominance has dropped from 38% in October to 8% today after deciding to reintroduce USDC-to-trade fees and phase out options and futures settled by USDC by the end of the month.

Bullish has become a strong competitor and is currently competing with Binance with a 32% USDC market share.

This shift coincides with a general decline in shareholding by newly listed USDT quotes, from 77% of total listings in 2023 to below 63% in 2024 and only 50% so far in 2025 – a sign of stabilityThe competition among coins is getting stronger.

Interestingly, euro-backed trading pairs are gaining attention, which may herald a recovery in the EU market following the implementation of MiCA last year.

Liquidity remains highly concentrated

Since the US election,The prospects and sentiment of altcoins have improved, driving a surge in new altcoin ETF application waves and trading activity.Since September, the daily liquidity of altcoins (measured by 1% of the market depth of the previous 50 tokens) has nearly doubled to $960 million.

However, liquidity remains highly concentrated, with the top 10 altcoins currently accounting for 64% of the total market depth.The share of medium tokens (top 20-30) has declined, while the share of small tokens (top 50) has risen unexpectedly, surpassing the share of high-market capital tokens (top 40) in terms of liquidity.