Author: Thor Hartvigsen, On Chain Times Crypto Researcher; Translation: Bitchain Vision xiaozou

1, Introduction

Since the launch of HYPE, Hyperliquid has seen a huge increase in both transaction volume and revenue.HYPE was released on November 29 for $2, up more than 1,400% in less than a month.This article will dig into the fundamentals of Hyperliquid and HYPE, explore the reasons for bullishness of HYPE, and its potential valuation in the context of trading volume and revenue growth in 2025.

2, transaction volume

Before the release of HYPE, skeptics expected low trading volumes after airdrops, as past actions by perpetual decentralized exchanges demonstrated this… Greedy capital will move from the highest reward agreement to the nextA maximum reward agreement.It is worth noting that since the launch of HYPE, Hyperliquid’s trading volume has increased sharply, hitting a single-day high of more than $10 billion in just one day.In addition to the large amount of incentives given to traders before, Hyperliquid is a high-quality on-chain product that most traders using the platform will recognize.

It is also worth noting that while the first wave of airdrops accounts for 31% of HYPE supply, an estimated 42.81% of the total supply will be used for future token distribution and community rewards.While it is expected that a portion of these rewards are dedicated to staking incentives and potential rewards centered on the HyperEVM L1 ecosystem, the current transaction volume and/or the possibility of HYPE holders receiving some kind of reward without their knowledgeSex is not without it.

The 42.81% HYPE supply is approximately $11 billion (at a price of $25 per HYPE), which is a considerable return, making Hyperliquid trading more attractive to perpetual contract traders.However, it must be noted that this is purely speculation.

(1)Hyperliquid vs CEXs(Centralized Exchange)

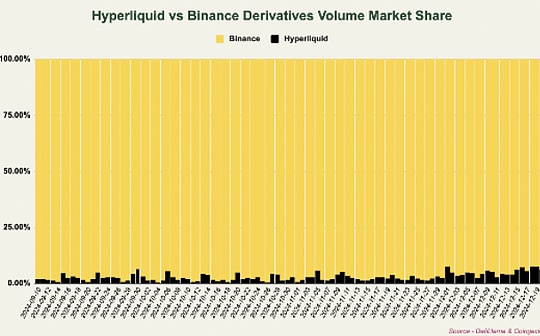

We have long been tracking Hyperliquid’s trading volume relative to centralized exchanges like Binance.Hyperliquid’s market share will continue to grow over time as more and more users and transaction volumes move to the chain.Comparing Hyperliquid with Binance, it is obvious that Hyperliquid has a long way to go.However, Hyperliquid market share showed a significant upward trend in December, as shown in the figure below.In the past two weeks, Hyperliquid’s relative market share has remained at around 5-8%.According to Coingecko, Binance’s recent daily derivative trading volume ranged between $60 billion and $150 billion.But because there is no way to actually verify these transaction volume data from centralized exchanges, it may be necessary to be reserved for these data.

(2) Spot trading volume

As you probably already know, Hyperliquid also has a spot token market.Hyperliquid also has a spot token market.Since the launch of HYPE, spot trading volume has increased significantly, with the largest trading tokens being HYPE, PURR, HFUN and PIP.

Tokens join the Hyperliquid spot market through auctions, and those with the highest bids in auctions can post their tickers.This happens every 31 hours and is currently selling for about $300,000, as shown in the figure below.The highest auction price was the GOD on December 16, with bidders paying nearly $1 million.

3, fees and benefits

(1)Perps(Sustainable Transaction)

Hyperliquid fees are paid by traders on the platform.Fees remain at a low level compared to other exchanges such as Binance to incentivize trading activity.For perpetual futures trading, for most people, the fee for market orders (takers) is 0.035%, and the fee for limit orders (makers) is 0.01%.The more you do, the lower your expenses will be.

In order to calculate the fees charged by the agreement, the average fee paid by the trader (taker and maker transaction volume and average fee rating).ASXN made a good analysis of this in its September report, as shown in the figure below.From this, the average fee paid is estimated to be 0.01276%, which is a conservative/worst case because there is a market maker kickback.

Considering this average fee value, if Hyperliquid’s perpetual futures daily trading volume averages $5 billion to $10 billion, it’s equivalent to an annual fee of $232,870,000 to $465,740,000 (actually, due to conservative assumptions about the average fee, the actual fee isProbably higher).

These fees are charged at HLP market maker vaults, insurance funds, aid funds and a number of other various addresses on Hyperliquid.The team did not disclose information about the exact allocation of revenue generated by transaction activity fees on the platform, so it is difficult to accurately estimate the HYPE repurchase.

(2)Spot(Spot trading)

The fees paid by traders in the spot market are used to purchase and burn traded tokens.Not surprisingly, HYPE accounts for the majority of spot trading volume on Hyperliquid.So far, over 100,000 HYPE has been burned from HYPE spot fees ($2.5 million at current prices).From a macro perspective, this has no substantial impact on HYPE supply compared to the repurchase of the aid fund (at least not yet).

(3) Spot Auction

Hyperliquid also earns considerable income from funds paid by the winning bidder of spot auctions.Hyperliquid’s annual revenue will increase by $84,774,000 per auction.Flo released a wonderful analysis article on X, covering Hyperliquid returns under different spot auction prices and daily trading volumes.Based on the $1 million per spot auction and the daily trading volume of $6 billion, Hyperliquid’s annual revenue is estimated to be $829.5 million.At 30x P/E (P/E ratio), this will bring HYPE to $74.52 per token.

4, aid funds andHYPERepurchase

While it is not yet certain how the revenue from spot auctions and perpetual transactions is distributed among the Aid Fund (AF), insurance funds, HLP and other addresses, we can measure the daily repurchase of HYPE through the Aid Fund.A few days ago, I posted an analysis article on X, analyzing the 48-hour HYPE repurchase of the aid fund.The situation at that time was that 151,000 HYPEs were repurchased within 48 hours, equivalent to an annualized purchase pressure of US$686 million.In the past two days, Hyperliquid’s average daily trading volume has reached US$8 billion.

Compared to many other encryption protocols, HYPE directly obtains value from the revenue generated by Hyperliquid.

5, future prospects

Entering 2025, bullish HYPE is a bet on the growing volume of Hyperliquid exchanges and the growing demand for spot auctions, which will lead to increased revenues that will lead to larger HYPE buybacks.One reason Hyperliquid will be used by more and more is that it also reserves billions of dollars in future bonuses, which makes Hyperliquid a very profitable place to trade.Hyperliquid has a very strong user-centric community that forms a lot of thought sharing and strong narrative around protocols and HYPE.

With the emergence of new features, such as staking, perpetual trading token margin, and the application ecosystem brought by HyperEVM, there will be many potential positive factors and many things to look forward to.