Source: Powell’s speech

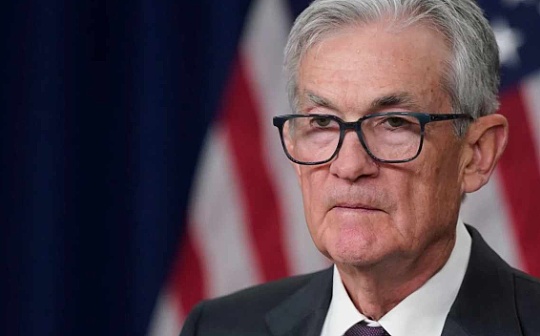

Jerome H. PowellChairman of the Federal Reserve Board of GovernorsIn the U.S. SenateBanking, Housing and Urban Affairs CommissionFebruary 11, 2025Chairman Scott, senior Warren members and other members of the committee, thank you for the opportunity to introduce the Federal Reserve’s semi-annual monetary policy report here.

The Fed has always focused on achieving its dual mission, namely, maximizing employment and stabilizing prices for Americans.Overall, the U.S. economy has performed strongly and has made significant progress towards our goals over the past two years.The labor market conditions have cooled down from the previous overheating state, but are still stable.Inflation has been significantly closer to our 2% long-term target, but is still slightly above that level.We closely monitor the risks faced by both the dual mission.

Before discussing monetary policy, I will first review the current economic situation.

Current economic situation and prospects

Recent data show that economic activities continue to expand steadily.Supported by consumer spending resilience, gross domestic product (GDP) grew by 2.5% in 2024.Although equipment and intangible asset investment declined in the fourth quarter, overall performance for the whole year was stable.Real estate market activity seems to have stabilized after experiencing a downturn in the middle of last year.

The labor market situation remains stable and stable.Over the past four months, the average monthly new jobs have been created at 189,000.Unemployment has remained stable since mid-last year after an earlier rise, at 4% in January, still at a low level.Nominal wage growth has slowed over the past year, and the gap between job openings and labor has also narrowed.Overall, a large number of indicators show that the labor market is roughly in equilibrium and that the labor market is not the source of significant inflationary pressure.Strong labor market conditions in recent years have helped to narrow the long-standing gap in employment and income for different groups.

Inflation has dropped significantly over the past two years, but remains slightly higher than the 2% long-term target.In the 12 months to December, the personal consumption expenditure (PCE) price index rose by 2.6% overall, and the core PCE price index rose by 2.8% after excluding the volatile food and energy categories.Judging from various surveys on households, businesses and forecasting institutions, as well as relevant indicators in the financial market, long-term inflation expectations seem to remain stable.

Monetary Policy

Our monetary policy actions are guided by a dual mission and aim to promote maximizing employment and stabilizing prices for the American people.Since September last year, the Federal Open Market Committee (FOMC) has lowered its policy rate by a full percentage point from its peak after 14 months of maintaining the target range of federal funds rate at 5.25% to 5.50%.Given the progress made in inflation and the cooling of the labor market, it is appropriate to adjust our policy stance.At the same time, we are continuing to reduce our holdings in securities assets.

Given that the current policy stance is obviously not as restrictive as before and the economy remains strong, we do not need to rush to adjust our policy stance.We are well aware that too fast or excessive easing of policy restrictions may hinder progress in controlling inflation; but at the same time, too slow or too small relaxation of policy restrictions may also over-shrink economic activity and employment.When considering further adjustments to the magnitude and timing of the target range of federal funds rate, the FAP will assess newly received data, changing economic prospects, and balanced risks.

As the economic situation changes, we will adjust our policy stance in a way that will most help achieve the goal of maximizing employment and stabilizing prices.If the economy remains strong and inflation fails to keep moving closer to the 2% target, we can maintain policy restrictions for a longer period of time.If the labor market unexpectedly weakens, or the inflation rate drops faster than expected, we will also relax policies accordingly.We closely monitor the two risks facing our dual missions, and the current policies are fully prepared to address the risks and uncertainties we face.

This year, we are conducting a second periodic assessment of monetary policy strategies, tools and communication methods, a framework used to achieve the goals of maximizing employment and stabilizing prices given to us by Congress.The evaluation focused on the Federal Open Market Commission’s Long-term Goals and Monetary Policy Strategy Statement (which articulates the Commission’s monetary policy approach) and the Commission’s policy communication tools.The committee’s 2% long-term inflation target will remain the same and is not the focus of this assessment.

Our assessment will include exchanges and open activities with all parties, including the Fed Listening event held across the country, and a research conference in May.We will learn from the lessons learned from the past five years and adjust our strategies when appropriate to better serve the American people because we are responsible for them.We plan to complete this assessment by the end of the summer.

Finally, I would like to emphasize that at the Federal Reserve, we will do our best to achieve the two major goals set by Congress for monetary policy – maximizing employment and stabilizing prices.We are committed to supporting maximizing employment, keeping inflation at the target level of 2%, and stabilizing long-term inflation expectations.The success we have achieved on these goals is in the vital interests of every American citizen.We know that our actions affect communities, families and businesses across the country, and that everything we do is to fulfill our public mission.

Thank you everyone, and look forward to your questions.