Author: haseeb, Dragonfly managed partner; translation: 0xjs@特 chain vision world

Is the market structure broken?Is VC too greedy?Is this a game of being manipulated for retail investors?

Almost all theories I have seen about this problem seem to be wrong.Let me speak with data below.

This is a widespread form made by the X user tradetheflow, showing that a group of tokens that have recently launched by Binance are declining.Most of them are ridiculed as “high FDV, low circulation” tokens, which means that they have high and completely diluted valuation, but the amount of circulation on the first day is very small.

I drew all these into charts and deleted the label.I excluded any clear MEME coins and tokens that had been TGE before the currency of Binance, such as Ron and Axl.

As follows, the BTC (beta) is yellow:

The “low -circulation, high FDV” Binance listed tokens fell almost all.What can be explained?For the destruction of the market structure, everyone has a set of their favorite theories.

The three most popular theories are:

1. Venture Capital/KOL is dumping from retail investors

2. Give retail investors angrily giving up VC coins and only buy Meme currency

3. The supply is too small, and it cannot be found in meaningful price

It is a sense of reason!Let’s see if they are true.But in order to maintain science, we need a null hypothesis to refute.Our zero fake should be: these assets are re -priced, but there are no deeper market structure problems.(Classic “There are more sellers than buyers, end.”)

We will discuss each theory one by one.

1. Venture Capital/KOL is dumping from retail investors

If so, what should it look like?

We should see that the shorter tokens are selling faster than other tokens, and projects with longer lock -up periods or no KOL should perform well.(Motivation perpetual contract may also be another carrier of this dumping.)

So what do we see in the data?

Therefore, from the upper currency to the beginning of April, the tokens actually performed well -some were higher than the price on the day of SCO, and some were lower than the price of Supreme Currency, but most of them were concentrated at about 0.Before that, there seemed to be no VC or KOL sold.

Then in mid -April, everything fell.All these projectsAlthough it is listed on many different dates and has many different VC investors and KOL,Are they unlocked in mid -April and began to sell to retail investors?

I will disclose myself here.I am a VC.There are absolutely VC dumping towards retail investors. Yes, there are VCs that are not locked, hedge outside the field, or even break the locking period.But these are low -level VCMost teams that cooperate with these VCs are not listed on the first -level exchange.Every top VC company you think of has at least one year’s lock -up period and years of release period before obtaining tokens.In fact, according to 144A rules,For anyone who is supervised by the SEC, the one -year lock -up period is compulsoryEssenceIn addition, for large VCs like us, our position is too large to hedge outside the exchange, and according to the contract, we usually have obligations not to do so.

soThis is why this theory is meaninglessTheEach of these tokens is less than a year from TGE, which means that VC, which has a one -year lock -up period, is still locked!

Maybe some of these low -level VC projects sold tokens have been sold early, but all projects have fallen, even those top VC projects that are still locked.

Therefore, for some tokens, investors/KOL’s dumping may be true -there are always bad behaviors in some projects.But if all tokens fall at the same time, this theory cannot explain this.

The next theory.

2. Give retail investors angrily abandon these tokens and only buy Meme currency

If this is true, then what we should see is that the price of these new token issues fell, and retail investors turned to MEME coins.

On the contrary, what we see is:

I have drawn charts based on the so -called low -circulating high -FDV tokens compared to the MEME currency transaction volume.Time is not right. By March, Memecoin’s fanaticism had reached the level of crazy, but in April of April one and a half months, the entire basket tokens were sold.

This is the trading volume of DEX on Solana, telling the same story- ——MEME currency broke out in early March before mid -April.

So this is also inconsistent with data.After the above -mentioned so -called low -circulating high FDV’s basket tokens fell, the MEME currency transaction did not have a wide range of rotation.People are trading MEME coins, but they are also trading Singaporean currencyAnd the transaction volume does not support this reason that retail investors abandon VC coins to the narrative of Meme coins.

The problem is not the amount of transaction, but as the price of assets.

In other words, many people try to sell such stories: retail investors’ fantasies of real projects have been shattered, and now they are mainly interested in Meme currency.I visited the Coingecko page of Binance and checked the tokens of the first 50 trading volume,About 14.3%of the Binance transactions today came from MEME currency transactions.MEME currency transactions are only a small part of the cryptocurrency field.Yes, financial nihilism is a phenomenon, and it is very prominent in encrypted Twitter, but most people in the world are still buying tokens because they believe in certain technical stories, whether correct or wrong.

So, okay, maybe literally retail investors have not shifted from VC coins to MEME coins, but there is a sub -theory here:VC has too many projects, which is why retail investors quit anger.They (in mid-April?) Aware that these VC coins are scams, and the project team + VC has about 30-50% of tokens.This must be the last straw that crushes the camelEssence

This is a satisfactory story.But I have been an encrypted VC for some time.The following is a snapshot of the distribution of currencies from the 2017-2020s:

Take a look at the red shadow -this is the share of the insiders (team+investors).SOL 48%, Avax 42%, BNB 50%, STX 41%, NEAR 38%etc.Today’s situation is also very similar.Therefore, if the reason is that “the tokens were not VC in the past, but now”, this is also inconsistent with data.Regardless of the cycle, capital -intensive projects always have teams and investors when they start.Even after the tokens were completely unlocked, these “VC coins” were successful.

Generally speaking, if what you mean also happens in the previous cycle, it cannot explain the unique phenomenon that happens now.

Therefore, the story of this “retail investor is anger exiting and trading meme coins” sounds real, and it is a good irony, but it does not explain the data.

The next theory.

3) Too little tokens are not enough to discover the price

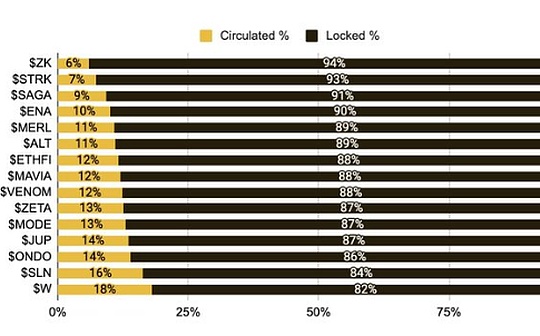

This is the most common reason I have ever seen.sounds good!It is not so sensational that this is its advantage.The Binance Research Institute even released a good report to illustrate this problem:

The average value is about 13%.This is very low, obviously much lower than the past tokens?

Is it correct?

Thanks to these data extracted from 0xdoug.You guess right,The average circulation of these tokens in the previous cycle was 13%.

Supplementary information: There is also a picture in the same article by Binance Research. It is also widely circulated, claiming that the average circulation of tokens launched in 2022 was 41%.

Sorry -what?My brother, I was in the industry in 2022, and the circulation supply of circulation was not 41% during the start of the project.

I have withdrawn the situation of Binance in 2022: OSMO, Magic, APT, GMX, STG, OP, LDO, MOB, NEXO, GAL, BSW, APE, KDA, GMT, ALPIO, ANC, ACA, ACA, ACA, ACAAPI3, LOKA, GLMR, ACH, IMX.

Some of the spot checks, because these tokens do not have all data in TokenunLocks: IMX, OP, and APE are similar to the latest batch of tokens we are comparing, of which the circulation rate of IMX on the first day of the currency is 10%.The circulation of APE on the first day of the dollar is 27% (but 10% of which are the APE vault, so I put it four to 17% of the circulation), and the circulation of OP on the first day of the summary is 5%.

On the other hand, there are LDO (55% unlocking) and OSMO (46% unlocked), but they have been launched more than a year before the Binance coin, so these currencies are compared with the latest first day currency.Stupid.If I have to guess, these non -currencies and random corporate tokens such as NEXO or Alpine are the reason why they get such crazy high numbers.I don’t think they are the real trend of TGE -they represent the tokens listed by Binance each year.

Well, maybe you will admit that 13%of the cycle supply is similar to the past cycle.But this is still too small to discover the price, right?This problem does not exist in the stock market.

After all, just look at the median circulation of the first day of the IPO in 2023.Check the stock data.12.8%.(H t@0xdoug)

But seriously, extremely low supply volume is definitely a problem.WLD is a particularly shocking example with a circulation of only 2%.The circulation of FIL and ICP was also very low when launching, which caused the price chart to be very ugly.However, most of the tokens in the Binance Tuqure group on the first day of the circulation were in the historic normal.

In addition, if this theory is correct, you should see that tokens with the lowest circulation are punished, and tokens with higher circulation should perform well.But we did not see a strong correlation.They all fell.

Therefore, this story that lacks price discovery sounds eye -catching, but after looking at the data, I don’t believe it.

Solution, solution

Everyone is complaining, but there are also a few people who have proposed a practical solution!Before discussing the zero -fake, let’s review them first.

Many people recommend restoration of ICO.Sorry -Do we remember that the ICO was tragically sold and the retail investors were buried after the listing?And ICO is illegal almost anywhere, so I don’t think this is a serious suggestion.

Multicoin management partner Kyle Samani believes that VC and team should immediately unlock 100%—— According to the 144A rules, this is impossible for American investors (it will also oil on the “VC dumping” theory).In addition, I think we learned why team belonging was a good idea in 2017.

ARCA believes that tokens should have a book manager like a traditional IPO (Note: When a company entrusted banks to issue securities, a main underwriter needs to be called the book manager).What I mean, maybe?Token issuance is more similar to direct listing, that is, it is just that.I think this is good, but I am preferred to simple market structure and less intermediary agencies.

Lattice Fund’s Reganbozman suggested that the project tokens should be served at a lower price, so that retail investors can buy and win some room for increaseEssenceI got my spirit, but I think this is incomparable.Artificially reduced the price below the market liquidation price, which means that no matter who traded in the first minute of the Binance transaction, the wrong pricing will be captured.We have seen this many times on NFT casting and IDOs.The price of artificially lowering the currency will only benefit a few traders who have full orders in the first 10 minutes.If the market thinks that your value is X, in the free market, your value will be X at the end of the day.

Some people recommend returning to fair launch.Fair launching in theory sounds good, but the effect is not good in practice, because the team will rebound.Believe me, everyone has tried this in Defi Summer.There are not many successful stories here-In addition to Yearn, what other non -MeME coins have been successful in the past few years?

Many people suggest that the team conducts a large -scale airdrop.I think this statement makes sense!We usually encourage teams to try more supply on the first day to improve decentralization and price discovery.In other words, I don’t think that the large -scale airdrops that are ridiculous for flowing are wise -a agreement must be successful after the first day, and a lot of things need to be done to deal with its tokens.Your burden becomes heavy just to succeed.When you want to compete for tokens in the future, huge circulation is not wise.You don’t want to be one of the tokens that must be re -increased in a few years later, because the vault is empty.

So as VC investors, what do we want to see here?Regardless of whether you believe it, the price of tokens in the first year reflects reality.We do not get paid through profits, but through DPI (Note: Distributed to Paid in Capital abbreviation, which means that LP’s investment in the fund, how much dividends are divided), which means that we must eventually convert tokens into cash.We cannot eat paper profits, nor will we mark the unwavering tokens as market valuations (in my opinion, anyone who does this is a lunatic).For VC, the valuation reaches an astronomical figure, and then it is in trouble after we unlock, which is actually a bad performance.This makes LP think that this kind of asset category is false -the paper looks good, but it is actually bad.We don’t want this.We hope that asset prices will gradually rise steadily over time, which is also what most people want.

So,Are these high FDV sustainable?I have no idea.Compared with ETH, SOL, NEAR, Avax and other projects, these numbers are obviously dazzling.However, the current scale of cryptocurrencies is indeed larger, and the market potential of a successful encryption agreement is significantly larger than in the past.

The important point that 0xdoug discovered is that if you standardize last year’s Congzhai FDV with today’s ETH price, you will get the number that is very close to the FDV we currently see.Cobie echoed this in his recent posts.We will not return to the $ 40 million FDV L1 public chain tokens, because everyone sees how big the market is now.But when SOL and Avax are launched, the price paid by retail investors can be comparable to that of ETH.

This sense of frustration can be largely attributed to: cryptocurrencies have risen sharply in the past 5 years.The startup is based on the comparison company, so FDV and other numbers will be greater.That’s it.

Well, so I can easily criticize others’ solutions.But what is my clever solution?

Honest answer?

No.

The free market will solve this problem by itself.If the tokens fall, then other tokens will be re -priced at a lower price.Give the founder.Due to the public market comparison, the price of Series B will be reduced, which will punish round A investors and ultimately affect seed investors.The price signal will always spread.

When a real market fails, you may need some clever market intervention.But the free market knows how to solve the pricing error -just change the price.Those who lose money, whether they are VC or retail, do not need to think about people like me or debate on Twitter.They have internalized this lesson and are willing to pay less for these tokens.This is why all these tokens are traded with lower FDVs, and future tokens transactions will be priced accordingly.

Such things have happened many times before.It only takes one minute.

4) zero assumption

Now let’s reveal the mysterious veil.What happened in April that caused all tokens to fall?

The culprit: Middle East.

In the first few months, the trading of these tokens was mostly flat since listing, until mid -April.Iran and Israel suddenly threatened the Third World War and the market plummeted.Bitcoin later recovered, but these tokens did not.

So,What are the best explanations of these tokens?My explanation is that these new projects are psychologically classified as “risky new coins.”Interest for “high -risk one basket of token” declined in April and did not recover.Market players decide not to buy them back.

Why?I have no idea.The market is sometimes fickle.But if this basket of “new tokens” rose 50%during this period, rather than falling 50%, would you still argue how the token market structure was broken?This will also be a mistake, but the opposite direction.

The wrong pricing is the wrong pricing, and the market will eventually repair it.If you want to help -sell things at a crazy price and buy things at a better price.If the market is wrong, it will repair it by itself.No need to do anything else.

do what?

When people lose money, everyone wants to know who should be blamed.Is it the founder?VC?KOL?Exchange?As a city merchant?Traders?

I think the best answer is no one.(I also accept the answer is everyone.) But thinking about market pricing errors from accusations is not a effective framework.Therefore, I will explain this based on people’s better aspects in this new market structure.

Vc:Listen to the voice of the market and slow down.Display price discipline.Encourage the founders to hold a real attitude towards valuation.Do not mark your lock tokens as market prices (almost all the top VCs I know hold the price of lock tokens at the price of large discounts on market prices).If you find that you are thinking “I can’t lose money in this transaction”, then you may regret the transaction.

Exchange:List tokens at a lower price.But you already know.Consider using public auctions to pricing the first day of the tokens, rather than pricing based on the last round of VC functions.Unless all investors/teams have the obligation to hedge, unless everyone (including KOL) has market standards locked, or token.To show retail investors better, we all know and love the FDV schedule, and educate them more about unlocking knowledge.

team:Try to provide more algender on the first day!The supply of tokens below 10% is too low.

Of course, there must be a healthy airdrop, and don’t be too afraid of the low FDV that listed on the first day.The best price chart to establish a healthy community is gradually grinding up.

If your team’s tokens have fallen, don’t worry.remember:

The price of Avax’s listing 2 months fell by about 24%.

SOL listed on the price of 2 months to fall by about 35%.

The price of NEAR listed 2 months fell by about 47%.

You will get better.Focus on building something worthy of proud and continue to deliver.The market will eventually figure it out.

For you, be careful of a single cause and effect explanation.The market is complicated, and sometimes the market is falling.Those who are suspected of knowing the reason confidently.

Dyor, don’t invest in anything you are not ready to lose.