Article Author: Chase Article Translation: Blcok unicorn

One of the biggest opportunities in Web3

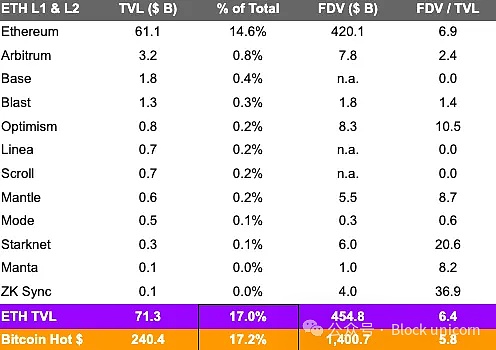

Bitcoin was born as a digital currency in 2008 and was originally used for payment purposes, and over time it evolved into a store of value tool.With the rise of retail-focused Layer-1 and Ethereum Layer-2, Bitcoin’s practicality is facing a time to disrupt.Currently, $240 billion of Bitcoin “hot money” (3.4 times the total locked position of the entire Ethereum ecosystem) is available for capture and build on this basis.

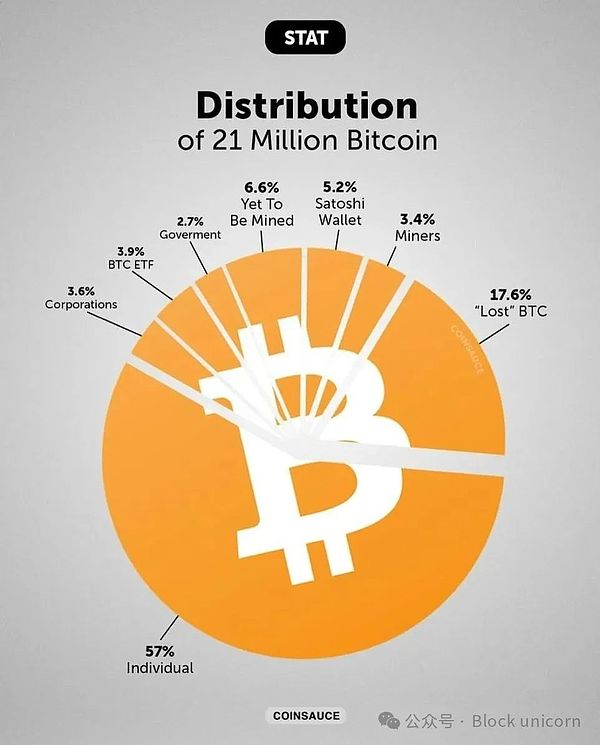

Bitcoin = Individual Investor

It is generally believed that Bitcoin is adopted more by institutions than Ethereum.However, this is not the case, with Bitcoin mainly driven by individual investors, with 57% of the supply held by individuals, while only 9.7% are held by institutions (including miners).My definition of “individual investors” is non-professional investors and individuals who are more likely to be converted into Bitcoin application users because of the speculative nature of the new market.

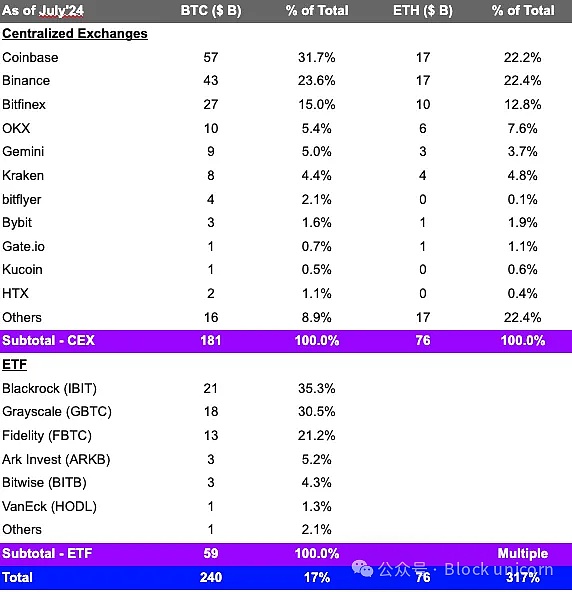

Currently, $240 billion of “hot money” exists in centralized exchanges (CEXs) and ETFs, representing a huge opportunity to capture value by building programmable layers on Bitcoin.In comparison, the total amount of Ethereum hot money on CEX is $76 billion.CEX capital is a good indicator of “hot money” because “cold money” is usually stored in cold wallets as long-term capital.ETFs can also be considered hot money, as both BlackRock and VanEck say more than 80% of ETF inflows come from non-professional investors using online brokerage accounts.In the assumption of a downside, even if it reduces by 50%, there is still $120 billion of Bitcoin hot money to be deployed.Therefore, a large number of individual investors’ capital can be deployed into the Bitcoin native Dapp.

Number of Bitcoins on CEX and ETFs

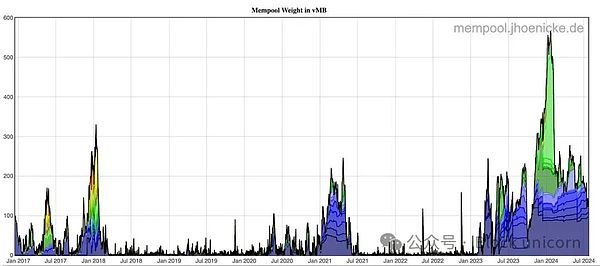

Bitcoin is the most widely distributed digital asset in the world, with more than 460 million independent wallets.Since the advent of Ordinals and inscriptions, demand for Bitcoin has increased significantly.On December 19, 2022, Bitcoin’s Dick Butt (pictured above) became the first inscription engraved on Bitcoin.Since then, Bitcoin’s mempool usage averaged over 50% (picture below), far higher than before, and even double the bull cycle in 2021.This shows that demand for Bitcoin block space is very strong, but it also causes transaction fees to rise to the point where ordinary users have difficulty using the chain.

Bitcoin memory pool usage

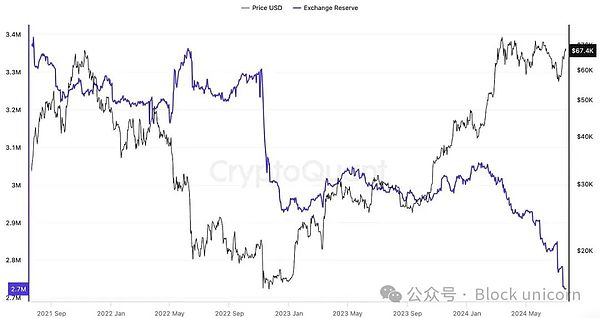

Bitcoin’s hot money grew 23% between January and July 2024, during which time the Bitcoin supply on CEX decreased from 2.9 million to 2.7 million, while the Bitcoin supply in ETFs grew to 890,000.This resulted in a net increase of 680,000 bitcoins.According to statistics on ETF holders and CEX hot money flows, this is mainly driven by individual investor capital.

Bitcoin in centralized exchanges

Embrace speculation by individual investors

Bitcoin may be at the beginning of a speculative cycle that was first triggered by Ordinals, with cumulative trading volume reaching $117 billion.Combining Bitcoin’s native Dapps and $240 billion in hot money, Bitcoin’s speculative cycle will inevitably be longer and larger than the cycles experienced by Ethereum LRTs and Solana DeFi in early 2024.In addition, the adoption of Bitcoin in practicality has just begun.According to the study, 57% of Bitcoin is held by individuals, and only 3.4% is held by miners who usually sell mining Bitcoins for profit.

Bitcoin distribution

Current scaling solutions

Most scaling solutions currently do not effectively serve Bitcoin’s large-scale individual investor community because they are either slow and costly or focus on institutions.For example, @Stacks is one of the earliest Bitcoin sidechains, and it still takes 30 minutes to complete the transaction after Nakamoto upgrades.@Lightspark is building enterprise-to-consumer payment solutions based on Lightning network, focusing more on merchants and institutions’ adoption rather than existing individual investor needs, which remain in the Bitcoin adoption cycleIn its early stages.In the future, we may even see high fidelity DeFi, such as Bitcoin Open Order Book Exchange, Perpetual Protocols and Forecast Markets.

A successful example of a Bitcoin hot money app is @Bounce_bit, a protocol focused on the earnings of CEX hot money, with its Bitcoin TVL reaching $1 billion in six months since its launch.This shows that CEX users have a strong demand for leveraging Bitcoin.

Network Effect: Rollup and Side Chain

Bitcoin is the largest and most widely distributed digital asset, so it has the strongest network effect in Web3.Bitcoin’s hot money is 3.4 times that of TVL, the Ethereum ecosystem.We may be witnessing the birth of a new global Internet computer.

Ethereum sidechains such as Wanchain, Neo and Ziliqa have been created as alternative solutions since 2019.At its peak, there were over 700 PoS and EVM sidechains.However, due to technical and economic constraints, these side chains fail to effectively utilize Ethereum’s network effects and cannot successfully attract and retain developers.

In contrast, @Optimism and @Arbitrum focus on the network effects of Ethereum and work closely with Ethereum to expand their underlying layers.Therefore, they are more successful than EVM sidechains and become the leading scaling solution.Similar trends are also emerging in the Bitcoin ecosystem, with multiple side chains being created.If history is referenced, the real winners in the Bitcoin ecosystem may be those scaling solutions that align with Bitcoin in terms of economics, security and incentives.This means taking Bitcoin native as gas (Bitcoin can be paid as a handling fee), any Bitcoin full node verification status, and the unilateral exit of assets to the Bitcoin basic layer.

Compared with Ethereum

Bitcoin’s hot money to total value is similar to Ethereum’s total TVL, and this part of the value can be released by achieving programmability on Bitcoin.The total TVL of Ethereum L1 and L2 is US$71 billion, accounting for 17% of Ethereum’s total value.Unlike Ethereum, most of the hot money in Bitcoin is underutilized and is mainly stored in CEX and ETFs.There is reason to believe that Bitcoin-native financial instruments can significantly improve their utilization.

Comparison of Bitcoin and Ethereum’s hot wallet

challenge

1. The positioning of Bitcoin as digital gold is difficult to change, resulting in a low utilization rate of scaling solutions.

-

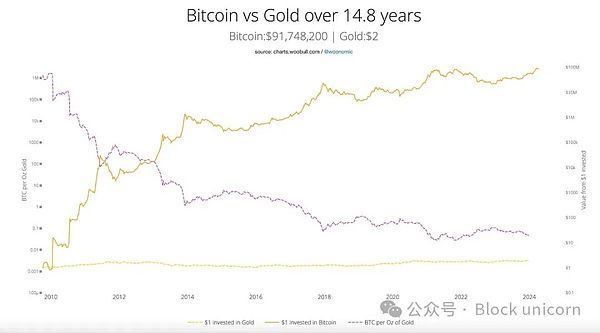

Mitigation measures: Narratives are driven by demand, and existing data indicate that individual investors in Bitcoin are overdemand.Bitcoin’s positioning as digital gold may be misleading.Historically, the price fluctuations of Bitcoin have nothing to do with the price of gold (picture below), but are highly correlated with technology stocks.This suggests that the market is more inclined to see Bitcoin as a technological innovation rather than a store of value tool.The roots of Bitcoin also herald future programmability, as it was originally created as a practical token for payments.

Price comparison between Bitcoin and gold

2. Bitcoin will be mainly aimed at institutions and serve as a decentralized payment settlement layer. It is difficult for Bitcoin native applications such as DeFi to emerge.

-

Mitigation measures: There are $240 billion in Bitcoin hot money on CEX and ETFs.Referring to the Ethereum ecosystem, the historical utilization of ETH increases with the increase in the number of applications.

3. Retail users are unwilling to spend Bitcoin.

-

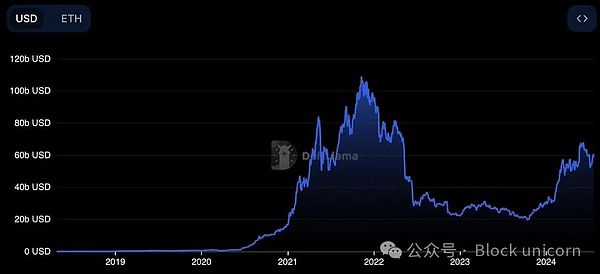

Mitigation measures: Smart contracts that expand solutions can unlock Bitcoin, making it a global digital currency, not just a digital asset.Before the DeFi summer in 2020, Ethereum was very practical, with TVL less than $1 billion.But with the rise of DeFi, TVL grew to $100 billion in November 2021.

Future trends

In the next 6-12 months, the following catalysts may allow us to recreate the “DeFi summer” phenomenon of Ethereum on Bitcoin:

1. OP_CAT (Technical): New opcodes in the Bitcoin programming language can enable zero-knowledge proof verification and trustless bridging, which is the missing component that creates a Bitcoin native scaling solution.In addition, covenants and vaults will also improve the practicality of Bitcoin.This upgrade only requires a soft fork, as the opcode already exists in Bitcoin’s code base.

2. BitVM (Technical): As an alternative to OP_CAT, BitVM can perform arbitrary calculations off-chain and realize the creation of trustless bridging.

3. US monetary policy (monetary): Due to the U.S. election and policy shifts in Trump and JD Vance, interest rates are expected to drop by up to 50 basis points in the next 6 months, which will drive funds into Bitcoin as the mostOne of the trusted cryptocurrencies.

4. Liquidity staking on Bitcoin: Liquidity staking driven by @babylonlabs_io can bring a new wave of liquidity to Bitcoin native applications.For reference, @Lombard_Finance launched in September, attracting over $260 million in Bitcoin TVL in less than a week.