Author: TANAY VED, COINMETRICS analyst; Matías Andrade, Coinmetrics researcher; Translation: Bit Chain Vision Xiaozou

Points in this article:

-

Bitcoin is expected to usher in the fourth decrease of the fourth time on April 20 (block height of 840,000). At that time, block rewards will be reduced from 6.25 BTC to 3.125 BTC.

-

Due to the decrease of issuance revenue, the profitability of miners will face pressure, which will promote more efficient mining business. At the same time, the transaction fee income source will become more and more important.

-

The demand for the continuous increase in Bitcoin may offset the pressure and decrease the circulation, and promote the price trend.

1. Foreword

Under the current macroeconomic uncertain environment -continuous inflation and the decline of federal capital interest rates, the upcoming election related chain reactions, geopolitical tensions, and debt levels — one thing is to determine the constant change.That’s the fourth halved of Bitcoin.With the first block (creation block) in 2009, Bitcoin was born as a scarce, decentralized digital currency. It has a pre -determined monetary policy, predictable inflation rateAnd a fixed supply of 21 million BTC.This week, the Bitcoin network will usher in the fourth halves of its 15 years of birth -this is a vital event for its economic policy and global value proposition.

In this article, we will learn about the importance of Bitcoin halving. The impact of Bitcoin halving on the key interests in the ecosystem, and as the fourth bitcoin is approaching, the BTC price will receive.

2. The importance of “minus”

Each reduction of each incident is a critical moment in the life cycle of Bitcoin, because it directly affects the issuance and inflation rate of Bitcoin, reducing block rewards (the newly issued Bitcoin that inspires miners to produce blocks and maintains network security),And it may have impact on the market value of BTC due to greater scarcity.

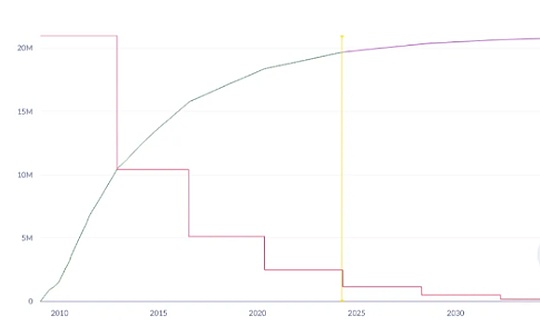

As its name indicates, “halving” means that the amount of Bitcoin is reduced by half, which effectively reduces the Bitcoin inflation rate (the speed of new Bitcoin into the market).With half of this time, the circulation of Bitcoin will decrease from 900 Bitcoin (1.8%circulation rate) to 450 bitcoin (0.9%issuance rate) per day.Therefore, the rewards obtained by miners for verifying new blocks and protecting network security (excluding expenses) will also be reduced by half, which will affect their incentive level and profitability.Half of the decrease was set to occur every 210,000 blocks, that is, about once every 4 years, and it is inseparable -the rules of the process of managing this process are written into the bottom code of the Bitcoin network.

Bitcoin’s monetary policy is shown above.Since its birth in 2009, the network has experienced three halves of the incident, and each time the miners’ block rewards have been reduced by half.The first decrease in November 2012 will reduce the reward from 50 BTC to 25 BTC, and then the second decrease in July 2016. The reward will be reduced from 25 BTC to 12.5 BTC.In May 2020, rewarded rewards from 12.5 BTC to 6.25 BTC.The upcoming halve is expected to be carried out on April 20 (the block height of 840,000), and the block award will be further reduced to 3.125 BTC.

Bitcoin’s monetary policy is shown above.Since its birth in 2009, the network has experienced three halves of the incident, and each time the miners’ block rewards have been reduced by half.The first decrease in November 2012 will reduce the reward from 50 BTC to 25 BTC, and then the second decrease in July 2016. The reward will be reduced from 25 BTC to 12.5 BTC.In May 2020, rewarded rewards from 12.5 BTC to 6.25 BTC.The upcoming halve is expected to be carried out on April 20 (the block height of 840,000), and the block award will be further reduced to 3.125 BTC.

However, Bitcoin continues to develop according to this timetable. With the decline in the circulation rate and 19.7 million among the 21 million supply limit, the impact of each newly reduced half of the overall supply will become smaller and smaller.Therefore, as Bitcoin is close to its limited limit, the importance of halving in the future will gradually weaken.

3. Miners’ economy and incentives

Miners are an indispensable role in the Bitcoin ecosystem and are pillars of the safety and integrity of blockchain.They use professional hardware computing capabilities to have hash trading data, and seek a solution of a Nonce -hash function. When they find Nonce, they verify a new block and add it to the Bitcoin blockchain.

As a return on computing work, the miners will receive block rewards (block subsidies), including new cast Bitcoin with a scheduled number and transaction fees contained in the block.

Block subsidies are the main economic incentives of miners.However, with the reduction of this reward from 6.25 BTC to 3.125 BTC, miners will face pressure because a large number of sources of income have decreased.The transaction fee is expected to be increasingly important for the revenue of the miners, and the value of Bitcoin will be appreciated when the demand is large.

Block subsidies are the main economic incentives of miners.However, with the reduction of this reward from 6.25 BTC to 3.125 BTC, miners will face pressure because a large number of sources of income have decreased.The transaction fee is expected to be increasingly important for the revenue of the miners, and the value of Bitcoin will be appreciated when the demand is large.

Since the third decrease, Bitcoin revenue from block subsidies has climbed to $ 43 billion, which is 180%higher than the first time in 2016.Although transaction fees are currently small in the total revenue of the miners, as each time it decreases, the importance of the transaction fee is getting greater and the total income brought by the transaction fee has doubled compared with the previous time.It reaches $ 2.5 billion.

The total revenue of mining continues to hit the high, and the block reward of the day on March 11 will exceed 76 million US dollars, a record high.Despite the calculation of BTC, block subsidies will decrease, but the rise in the market value of the Bitcoin offsets this decline, thereby bringing more revenue of US dollars to the dollar.As Bitcoin performed strongly at the beginning of this year, miners hope that this trend will continue after halving.

The total revenue of mining continues to hit the high, and the block reward of the day on March 11 will exceed 76 million US dollars, a record high.Despite the calculation of BTC, block subsidies will decrease, but the rise in the market value of the Bitcoin offsets this decline, thereby bringing more revenue of US dollars to the dollar.As Bitcoin performed strongly at the beginning of this year, miners hope that this trend will continue after halving.

In addition, Ordinals can engrave data such as images, videos, and text into NFT, which also improves the trading costs of miners.In the first quarter of 2024, the average of $ 3 million a day for miners was much higher than historical standards.In fact, in May and December 2023, transaction fees revenue soared to US $ 17 million and $ 24 million, respectively, accounting for nearly 40%of the total cost of miners at that time.As the “Runes” (alternative tokens on the Bitcoin network) is about to be launched with a halving incident, the miners are expected to see the income of transaction fees further increased, thereby offset the impact of the decline in the subsidy of the block.

4. mining profitability and efficiency

The profitability of mining has a complex connection with the efficiency of mining hardware used and the power cost required for its power supply.The following ASIC profit and loss balance power consumption map depicts this relationship. The chart reflects the maximum power costs (units: kilowatt -hour) that can maintain profitability in Bitcoin mining.

The newer ASIC models, such as Antminer S19 and S19 XP, are profitable than old models such as S9 and S17 in the case of power costs lower than 0.13 US dollars/kWh and $ 0.20/kWh/kWh.This is because the technological progress of ASIC design brings more energy -saving miners, allowing mining operations with favorable charts when the electricity cost is higher.However, this indicator will be reduced by half, even if the mining machines of these models have no money to earn even if they are $ 0.08/kWh (the average industrial electricity rate in the United States).As the fourth Bitcoin halve is approaching, miners with the most efficient hardware and cheapest electricity will be more capable of being able to withstand the reduction of block rewards.

Therefore, mining companies have always adopted various strategies, such as cooperating with renewable energy suppliers to carry out business near cheaper sustainable energy, implement advanced cooling technology, and use idle energy to improve sustainability and profitability.Those with old hardware and low efficiency will find that maintaining profitable operations is becoming more and more difficult, which may lead to the integration of mining capabilities between operators with the highest efficiency and gradually eliminate inefficient ASICs from the Internet.

This may affect the hash rate -a computing resource indicator assigned to mining.Before halved, the hash rate of Bitcoin has increased to 605 EH/s.However, after halving, the hash rate is usually temporarily reduced due to the low -efficiency hardware departure.In order to maintain the target block time of 10 minutes, the decline in the hash rate may lead to the downgrade of Bitcoin, thereby alleviating the hash process in the change environment.

5. The impact of demand driving factors

Although the reduction is the supply -side incident, the weakening of the impact of issuance shows that demand plays a vital role in promoting the market value of non -elastic supply assets such as Bitcoin.The spot Bitcoin ETF launched in January gave birth to a large number of new demand. Compared with the previous half -cycle, it changed the Bitcoin market.The funds of continuously inflowing into the US and recently approved Hong Kong BTC Exchange trading products, as well as other sources of demand sources such as the balance sheet and smart contracts from funds to listed companies, will help more effectively absorb from being forced to sell and issue new issuance.Supply pressure.

6. Price dynamics

The same as halving each time, everyone has an important issue in their hearts: how will the half -haller affect the price of Bitcoin?Although we can infer some opinions from the performance of the past half -cycle, we may not be able to directly indicate what will happen in the future.Considering that under different market conditions and different investors, we have only experienced three halves before (although this is a well -known event), predicting whether the reduction of half will affect the price may be misleading.

The price of Bitcoin is often one cycle in four years.If we look back at half a half, we will find that the price of Bitcoin will rise sharply in a year after a half of the incident.Before the first halving in 2012, Bitcoin’s return rate exceeded 14,000%.After the first and second halves, the price of Bitcoin rose 5100%and 1200%, respectively, and finally reached a record high after about 500 days.Today, before the fourth halves, as of April 15, we have witnessed 664%of the appreciation. For the first time, BTC reached a record high of $ 73,000 before halving.

The demand caused by ETF and the subsequent attention have led to a slightly different dynamic pattern, and it is expected to play a greater role in the future.Other factors may also promote the growth of demand side, such as a wider macroeconomic and liquidity changes, regulatory changes, growth in global digital assets, and speculative behaviors. These factors may affect the price trend of Bitcoin.

The above historical decline shows the elasticity of the price trajectory of Bitcoin.Although the price continues to be adjusted by more than 70%from the historical high, the price will rebound and innovate the high at the beginning of each cycle.As the fourth halving approaches -although the BTC has reached a record high even before halving -important is to consider the price that may be due to external conditions or the increase in the increase of the depression and the increase in speculation.fluctuation.

7. Conclusion

The decrease of Bitcoin reflects a predictable currency rhythm in an uncertain financial environment.The scarcity and contraction of Bitcoin make it a unique asset in each economic cycle.Although the reduction of block rewards will put pressure on miners, it will also promote them to be more efficient and sustainable.The integration of this supply -side incident and strong demand -driven factors shows that Bitcoin is ready to enter the next stage of growth.Bitcoin does not lack innovation. For example, the upcoming Runes and Bitcoin L2S have improved transaction fees and scalability. Bitcoin has prepared to welcome the next era.