author:Cody Poh, Pantera CapitalLiquid Token Fund Investment Analyst; Compiled by: 0xjs@Bitchain Vision

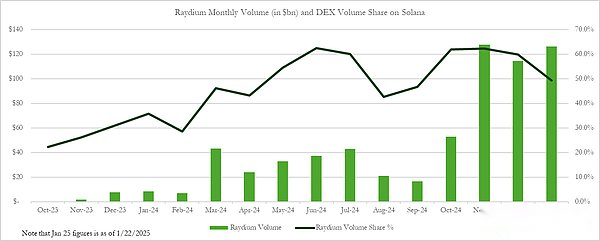

Raydium is the leading DEX on Solana, and it is now arguably the most attractive asset for investors in the entire market.

Raydium is a rare combination that has both strong market leadership in long-term growth areas and a clear value-added story, which is not common in DeFi protocols on any other chain.

Solana’s growth

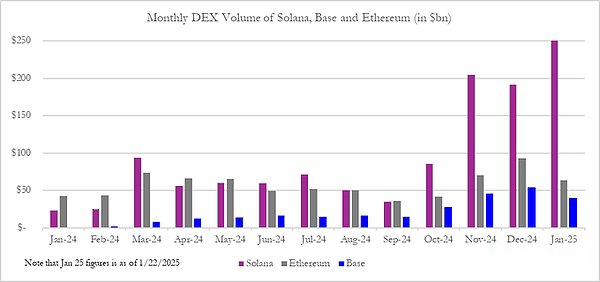

Thanks to the rise of memecoin transactions, Solana has become the most active ecosystem for DEX.Solana’s monthly transaction volume increased exponentially throughout the year, far exceeding Ethereum and Base.

Raydium’s trading volume has also increased significantly as a major beneficiary of the leading DEX on Solana and its strong growth.This protocol currently accounts for more than 50% of all DEX transactions in the Solana ecosystem.

As a result, Raydium has become one of the highest-paid applications on Solana, with an annual protocol revenue of $450 million, and this number is expected to grow as Solana continues to flourish.

The main beneficiaries of Memecoin transactions

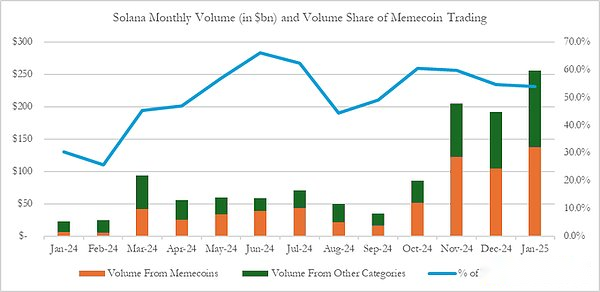

As mentioned above, the increase in Solana’s on-chain activity can be largely attributed to memecoin transactions.Raydium has unique advantages in capturing memecoin-driven growth on Solana with its integration with pump.fun.

The partnership with pump.fun provides an unfair opportunity for Raydium to build liquidity around newly graduated tokens with a market cap of $69,000 as they will be deployed directly on Raydium, not on Solanaon other DEXs.

This is a win-win for Raydium and pump.fun.Because listing on Raydium will bring higher trading volume and prices.Raydium is the first choice for this integration, as it has built a sniper ecosystem since the early days of Solana IDO.

These robot-operated fluids are programmed to snipe memecoin after graduating from Raydium.This has led to a flood of new capital into newly graduated memecoin, resulting in a sharp rise in prices, resulting in a CEX listing effect.Such infrastructure moats are hard to replicate by other competing DEXs on Solana.

Memecoin becomes long-lasting

A major source of controversy for Raydium is that most of its trading volume comes from memecoin transactions and should therefore be considered unsustainable.Many people even believe that memecoin will not exist in the long run.

However, empirically, memecoin transactions have gradually evolved into a more lasting, less cyclical social chain phenomenon.Memecoin trading is essentially a modern, digitally native form of gambling with a global market size of about $400 billion.

By the numbers, Memecoins always account for more than 50% of all Solana transaction volumes and mint about 50,000 new tokens on Pump.fun on average every day.thisIndicates that memecoins will continue to exist and will continue to grow.

Strong network effect

As Raydium consolidates its position as the preferred DEX for new token offerings on Solana, strong liquidity advantages will be established, thereby attracting more trading volume to the platform, as better liquidity leads to tighter spreadsand more competitive pricing.This helps Raydium win more transaction flows from consumer-facing front-end and DEX aggregators.

Profitable unit economy and value accumulation

Raydium’s profitable unit economy and clear value accumulation mechanisms also stand out among most other DEXs on the market with pure governance tokens.

This can be attributed to Raydium’s dominance in the primary issuance market, as traders of newly issued assets (or primarily memecoin) are often price-insensitive recipients.This allows Raydium to charge a 25bps fee in its AMM v4 pool and has the right not to compete on price with other DEXs in other subsets of transaction flows such as stablecoins swaps and utility tokens.

Raydium programmatically repurchases 12% of transaction revenue in the open market, giving back value directly to RAY token holders.Raydium has repurchased 56 million RAY tokens in total, equivalent to about 10% of its total token supply.

Our Buy (Underwriting)

Raydium has strong growth prospects, provided Solana’s continued growth and its birthplace of memecoin transactions.We believe that given Raydium’s dominance in the primary token issuance market, Raydium will be in a good position to continue to occupy most of Solana’s trading volumes while the rate rate remains unchanged.

Raydium’s current trading price is the lower limit of its historical price-to-earnings ratio range, with P/E of 10 times, which suggests that strong fundamentals combined with its strong growth prospects may be underestimated by the market.There is reason to believe that both Raydium’s P/E ratio and growth rate may double.

in conclusion

As changes in the U.S. regulatory environment brings speculation about SOL ETF approval, and a resurgence of AI agent activity on Solana, we may see Solana on-chain activity gaining support again.

Raydium may be the ideal candidate to capture trends.