Source: Cycle Capital Research

The biggest volatile week since 2019

Although US stocks remained basically the same over the past week, the market is a real roller coaster.

The market for technical selling fell again on Monday, and the decline in the number of first-time unemployment claims for Thursday triggered the market’s impulse to buy at the bottom, although this data is not worth overexciting.Because the number of people who continue to apply for unemployment benefits is increasing.The market continued its rebound trend on Friday, but the amplitude slowed down.

In the past week, the stock market and the crypto market have been closely linked. In the media, the US recession and the yen arbitrage trading are the two core themes, but I personally think these are two “false propositions”, and in fact, the real panic is also very serious.Shortly after, there was no normal situation where everything including bonds and gold was sold when a crisis broke out.

U.S. stocks experienced peak and trough fluctuations of about 4.5% after Monday’s sell-off, the biggest volatility since the COVID-19 panic in 2019.Volatility means risks and also opportunities. I quickly recorded a video during the trading session on Monday, explaining why selling except the yen is overly panic. This is a gold pit for mainstream encryption and stock markets.For bonds, this is a short-term high.In summary, the main

-

Most of the current U.S. economic data are good and the trend is good, with only a few data supporting recession, and these data types have been proven to be unreliable in this recovery cycle.

-

The company’s profit growth is good, but the extent of exceeding expectations has not expanded.

-

Secondly, interest rate hikes in Japan cannot continue because huge debt cannot be digested through economic growth.

-

The short-term panic of unexpected interest rate hikes triggered the lifting of the previous overly high leverage trading. Such stampede was speculated to be digested on Monday based on data.

-

The fixed income dominated by big players and the trends in the US dollar foreign exchange market do not match the situation of panic trading or scarcity of liquidity

Therefore, it can be judged that Monday was an accidental missed killing.

However, further observation of data changes is needed. Now it can be said that everything is well. It is too early to return to what it used to be. After all, from the perspective of capital preferences, aggressive defense has not changed yet, and I am disappointed with big technology.The sentiment has escalated to the level of “killing narrative” (the three decline stages of killing performance, killing valuation, and killing narrative are becoming more and more serious), unless the financial report of NV can once again crush all doubts and mobilize industry sentiment, so US30 and US500 may outperform US100 in the coming months.However, from the trading level, Cyclical has lagged behind defensive a bit recently, and it is not ruled out that the short-term rebound is even greater.

Goldman Sachs customers bought technology stocks behind the back last week, the largest in five months:

On the other hand, bond prices rose and interest rates fell, providing a buffer for the decline in stock markets.In the past month, US10Y has dropped from 4.5% to 3.7%, and the 80bp change has greatly exceeded the decline caused by the change in interest rate cut expectations. Unless you really see a recession approaching, such pricing is obviously an opportunity, just like everyone is enthusiastic about interest rate cuts in the fourth quarter of last year.The market is the same when it is rising (5% fell to 3.8%). Personally, the market in recent years seems to be more animalistic than before, and the pricing is no longer so rational.

The recent pullback of the stock market started at a record high, with the maximum amplitude of 8%, and the current level is still 12% higher than the beginning of the year. Moreover, due to the rise in bonds, investors with higher degree of diversification will not be affected only by the overall decline of the stock index.The impact is that the chain sell-off situation is not worth worrying about in the US stock market.Over the past few decades, on average, we have experienced about 3 adjustments per year of 5% and 10% adjustments per year.

If the decline and adjustment of the stock market are not accompanied by an economic or corporate profit recession, they are often temporary and will subsequently show a good rise:

However, considering that the pessimistic sentiment of technology narratives is unlikely to reverse quickly, and the short-term violent fluctuations have brought great damage to many investment portfolios, such medium- and long-term funds still have a demand for adjustment of portfolios, and short-term fluctuations may occur.It has not been completely over yet, but the market will start a bigger and deeper decline.The strong rebound in the second half of last week was a positive signal.

According to JPM statistics, judging from the extent of adjustments between each asset relative to its own historical adjustment, since metals fell more, treasury bonds rose more, and stocks fell less, the recession expectations reflected by the treasury bonds and commodity markets are more than those reflected by the stock market and corporate bonds.market

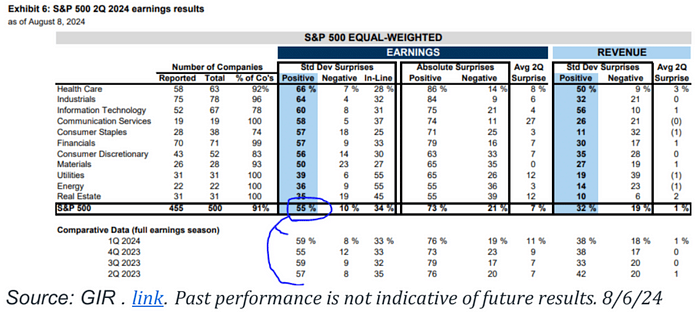

91% of S&P 500 companies have announced Q2 financial reports, of which 55% have exceeded expectations.This ratio, although lower than the average in the past four quarters, is still above 50%, indicating that most companies have performed well in terms of revenue.

As can be seen from the chart, there are big differences in performance in various industries.For example, the healthcare, industrials and information technology industries performed better, with a higher proportion of companies exceeding expectations, while the energy and real estate industries performed relativelyDifference.

NVIDIA’s valuation has been pulled back:

Its 24-month forward PE is currently 25 times, close to its lowest point in the past five years (about 20 times), and its premium endorsement for SPX will be from 1.8 times to 1.4 times, indicating that NVIDIA’s valuation is gradually becoming more reasonable.

The financial reports of large technology companies this quarter are solid, but in fact there is no situation in killing performance. The valuation is mainly caused by the increase in AI investment:

Palantir raised guidance, emphasizing that AI boosted performance, and the stock price rose by 37%, triggering some discussions on AI narratives on the street.

About the expectation of a rate cut in September

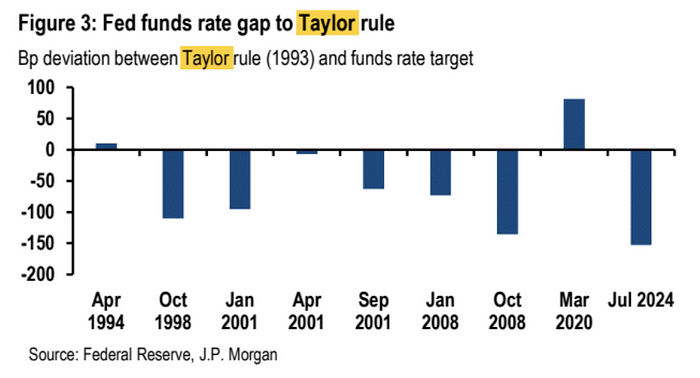

According to the Taylor Rule, the Federal Reserve’s federal funds rate target should be around 4%, 150 basis points lower than the current interest rate.The Fed has reason to quickly adjust its policies to make it more in line with the current economic situation.

In terms of market pricing, the normal rate cut in the FOMC meeting in September will be 25 basis points, but the market expects that it may exceed 25 basis points.During the session on Monday, the price was once priced at 63bp due to panic, and finally closed at 38bp this week. In addition, the current market has digested the expectation that the Federal Reserve will cut interest rates by 100 basis points this year, which is four times.

The expectation that exceeds 25bp for the first time and exceeds 3 times this year requires continued deterioration data, especially the data from the employment market to support it, otherwise this price may be excessive. If the data supports it, the market will gradually price a rate cut of 50bp in September or even a rate cut of 125bp in the year.possibility.

From the perspective of trading strategies, the US interest rate market will mainly use the pullback model when it rises in the short term. It will be in a buying and falling model for more than one month. Because the interest rate cut cycle is destined to start. Whether the market’s rise in unemployment indicates an economic slowdown.And potential recession will take time to raise consensus, during which there will be constant recurring emotions.

Fed officials’ speeches last week were slightly dovish, but generally unanimous, which is expected.

Crypto Market

After experiencing the sharpest correction since the FTX crisis, the price of big cakes has rebounded after falling by more than 15%.Because the trigger for this callback is not an internal event in the cryptocurrency market, but an external impact from the adjustment of traditional markets.The technical side is also seriously oversold, the degree is almost the same as at 816 last year. At that time, the big cake fell from 2w9 to 2w4, and then experienced two months of fluctuation and consolidation.

So it is understandable why the momentum of the crypto rebound is so fierce.

The following analysis is cited from JPM’s August 7 study:

Retail investors also played an important role in this adjustment.Bitcoin spot ETFs saw a significant increase in capital flows in August, reaching the highest monthly outflow since the inception of these ETFs.

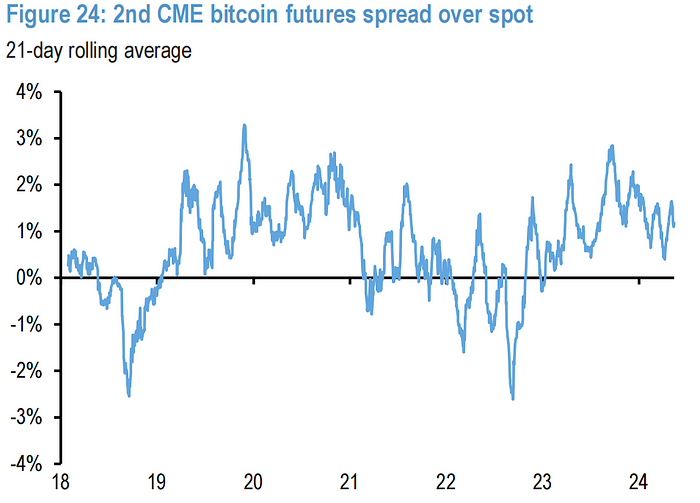

In contrast, the risk-removing behavior of players in the US futures market is limited.This can be seen from the changes in the position of the CME big cake futures contract that the positive price difference of the futures curve indicates that futures investors still maintain a certain degree of optimism.

The pancakes hit a low of around $49,000 last week.This price level is comparable to JPMorgan’s estimated cost of producing Bitcoin.If the Bitcoin price remains at this level or below for a long time, it will put pressure on miners, which may exert further downward pressure on the Bitcoin price.

Several factors may keep institutional investors optimistic:

-

Morgan Stanley recently allowed its wealth consultants to recommend Bitcoin spot ETFs to clients.

-

The liquidation pressure on cryptocurrency payments from Mt. Gox and Genesis bankruptcies may have passed.

-

More than $10 billion in cash payments after FTX’s bankruptcy may further stimulate demand in the crypto market by the end of the year.

-

Both sides in the U.S. election may support regulations that favor cryptocurrencies.

Funds and Positions

Although stock allocations have significantly decreased in recent weeks due to declines in stock prices and sharp increase in bond allocation, the current share allocation ratio (46.5%) is still significantly higher than the post-2015 average.According to J.P. Morgan’s calculations, if stock allocation is to return to the post-2015 average, the stock price needs to fall further 8% from the current level.

The current ratio of investors’ cash allocation is extremely low, which shows that investors’ funds are more concentrated on stocks and bonds. Low cash allocation may increase the market’s vulnerability when facing pressure, because investors may need to sell when the market falls.Export assets to obtain cash, which may exacerbate market volatility.

There has been a significant increase in bond allocation in recent days, as investors turn to bonds as safe-haven assets during the stock market pullback:

Retail investors have had relatively modest reactions in recent market volatility, and there has been no large-scale divestment:

Retail investigators’ sentiment survey is still positive:

Changes in Nikkei futures positions indicate that speculative investors have significantly lifted long positions:

The speculative net shorts of the yen (blue line below) basically returned to zero as of last Tuesday:

How big is the “Yen Arbitrage Trading”

There are three main parts for yen arbitrage trading:

-

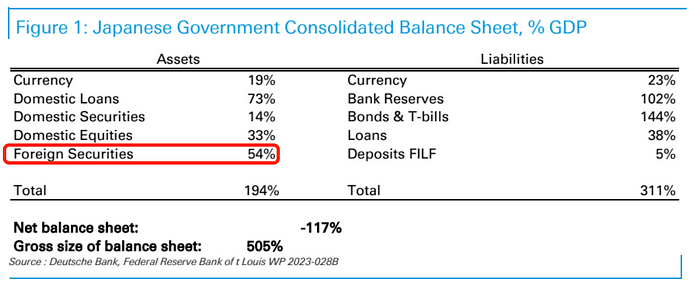

The first part is that foreign investors buy Japanese stocks. For the sake of insurance, they will make a derivative that shorts the equivalent size of the yen.Recently, due to the decline in Japanese stocks, the yen rose, these investors were both losing money and had to close the entire portfolio.According to the Japanese government’s statistics, the amount of foreigners invested in Japanese stocks is estimated to be about US$600 billion.

2. The second part is that foreign investors borrow yen to buy assets abroad, such as stocks and bonds.According to the statistics of the total credit amount of yen for non-bank borrowers outside Japan based on the Bank for International Settlements.At the end of the first quarter of 2014, this operation was about US$420 billion.However, the relevant data is only updated every quarter, and there is no data for the second quarter yet.

3. The third part is that domestic investors, that is, Japanese own investors, use the Japanese yen to buy foreign stocks and bonds.For example, in order to pay in the future, Japanese pension funds will use yen to buy foreign stocks and bonds.This transaction was about $3.5 trillion before the adjustment, with about 60% of which were foreign stocks.

If we add these three parts together, it is estimated that the total size of the yen arbitrage transaction is about US$4 trillion.If Japan’s inflation situation in the future forces Japan’s central bank to raise interest rates, then this kind of transaction will gradually decrease.So this is why short-term positions are completely lifted but long-term positions may have an impact.

In summary, different types of investors are adjusting their investment strategies according to market changes:

-

Trend followers or speculative investors (such as CTA): Recently, they have to sell large amounts of long and short yen they previously held.

-

Yen arbitrage trading: If the yen appreciates, this operation will lose money.Although the yen trading has changed from oversold to overbought, overall, this large $4 trillion deal has not been lifted on a large scale.

-

Risk parity funds: The market has been volatile recently, and they are also reducing their investments, but they are less than CTAs.But because of the rise in bond prices, they helped control their losses.

-

Ordinary retail investors: Compared with the previous stock market decline, they did not withdraw much this time

China’s theme funds inflows of US$3.1 billion have been continuously buying passive funds since the end of May:

Despite market turmoil, stock capital inflows remained positive for the 16th consecutive week, even increasing from the previous week.The inflow of bond funds has slowed down

The allocation of subjective investors fell from a higher level to slightly below average (36 percentile).The configuration of systemic strategies has also dropped from a higher level to slightly below average (38 percentile) for the first time since the major pullback last summer:

On Monday, the VIX index fluctuated more than 40 points in one day, setting a historical record, but considering that the market fluctuated less than 3% on Monday, historically, when VIX jumped 20 points a day, the spot fluctuation of the stock market could reach 5~10%.So Goldman Sachs Trading Station commented that this is “vol market shock, not a stock market shock”, there is a problem with liquidity in the VIX market, the panic in the derivatives market has been amplified, and the market may remain turbulent before the VIX expires on August 21:

Goldman Sachs brokerage department statistics clients sold product funds for the third consecutive week last week, while individual stocks recorded their biggest net buys in six months, especially in the information technology, consumer essentials, industry, communications services and finance sectors.It seems to foreshadow that if economic data is relatively optimistic, investors may turn their attention from the overall risk of the market (market beta) to individual stocks or industry-specific opportunities (alpha)

U.S. stock liquidity is at its lowest level since May last year:

Bank of America’s CTA strategy model shows that US stock CTA funds tend to increase their positions in the next week. Because the long-term trend of US stocks is still optimistic, CTAs are unlikely to quickly turn short, but instead may quickly rebuild stock long positions after the stock market finds support.

Japanese stocks tend to reduce their positions:

Key events coming

-

Consumer Price Index (CPI): CPI data is expected to have an impact on the market. If the CPI meets expectations or is lower than expectations, the market may not react much; if the CPI is higher than expectations, it will be a major issue.

-

Retail sales data: If the data is strong, the market may be optimistic about a soft landing.

-

Jackson Hole Conference: The Fed is expected to convey a message supporting the market and may also mention the tightening of financial conditions.

-

Nvidia’s financial report: It is expected to release its financial report at the end of the month, and the market may be positive about its performance.