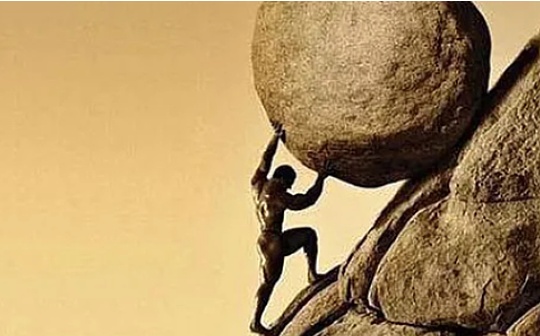

Original title: Is Crypto a Sisyphean Struggle?

Author: Zeke, researcher at YBB Capital

Preface

This article was written after watching a16z partner Chris Dixon’s speech titled “Is Web 3.0 dead?” As an idealistic tech investor, Dixon reviews the evolution of the Internet from the 1990s to today, andAsserting that the future of cryptocurrencies remains full of potential.However, from my point of view, the Web3 ecosystem is currently in a state of chaos.This article is a summary of my recent ideas and an extension of my ideas in previous articles.

1. The needs of gamblers and the vision of geeks

Chris Dixon highlighted two mainstream cultures in cryptocurrencies in his speech: the speculative “casino culture” and the more technology-oriented “computer culture”.I simplify these terms to “gambler culture” and “geek culture.”As Web3 develops, these two seemingly opposite cultures are combined by something called “Vision” that ultimately push cryptocurrencies to the mainstream.Since the birth of Bitcoin, the vision behind cryptocurrencies has been grand: from a decentralized peer-to-peer payment system that is not controlled by individuals, institutions or governments, to the world of Vitalik computers, decentralized permanent storage, and the reimagining of the Internet of Thingsetc.On a smaller scale, I personally like the 10k PFP – yes, the idea of an IP being pushed to the world by thousands of community members.Unfortunately, these grand visions are basically just visions.”Cash” has become “digital gold”, the concept of “world computers” is full of contradictions, and my favorite narrative has now become the joke stock of jokes in the community.The needs of gamblers and the vision of geeks will not intersect forever, and when the cracks begin to emerge, decentralization, vision and mission are no longer important.As Maslow’s theory of hierarchy of needs suggests, human needs are met in a specific order, from basic survival to self-fulfilment.The basic need for most mainstream cryptocurrency users is to make money.When the technical narrative no longer works, people go to the loudest places—PVP on MEME coins, click to make money on Ton, or, if everything fails, look for stocks like A-shares or the U.S. markets, etc.Liquidity.In fact, our attention has shifted from technological narratives to Powell, ETF, Trump, and even the MEME that the West can make up humor.Sometimes I think these blondes are the reincarnation of Satoshi Nakamoto.Having said that, it is very common to talk about your ideals after having a full meal.

The cryptocurrency field is forming a consensus, abandoning technical narratives, focusing on building consumer experiences, finding new users and developing high-performance heterogeneous chains.Essentially, this consensus is to find a way to make the “gamblers” and “geeks” intersect again.If successful, we will enter a new era of diversity, with both gamblers and geeks contributing to reshaping the Internet.If it fails, then we may return to the core of P2P’s vision and the financial system (although I don’t think that this alone can sustain future growth for blockchain).No matter where this path leads, I think the most important thing is to meet the value needs of ordinary users and have clear driving forces.The term “falsification” is often thrown out, such as the statement that the token price falls to zero or high threshold is evidence.But what if we think further?Where does the driving force come from?Last year, I wrote an article discussing the potential of decentralized AI computing power, and there was little information on this topic at the time.I am very confident in this direction and even wrote two chapters specifically to describe its future.With the continuous updates of GPT and the surge in NVIDIA’s stock price, AI has become a hot topic.Today, decentralized computing power projects are no longer new, but most of them lack the motivation for user-driven success.Without efficiency, they are difficult to achieve in terms of stability, affordability or low energy consumption.Compared to many simple Telegram games, they are not much different in real-life applications.Both are waiting on the exchange so offer exit liquidity, the only thing that can be said is still the vision.

In today’s world, generative AI penetrates every industry, and without a strong driving force, Web3 is difficult to inspire “gamblers”.Ponzi schemes are driven by human greed; consumer applications are driven by value, whether it is emotional or practical value—you have to provide something valuable.A decent application can meet users’ needs for trading, arbitrage and speculation like those enduring DeFi protocols.Beyond cryptocurrencies, there are many more examples, such as the early ChatGPT, which flocked to use it despite its cumbersome payment process, queues, IP blocking and account pauses.In the 2021 liquidity torrent, even 12-word mnemonics cannot stop older people from speculating on meme coins.The logic is the same; the only difference is the driving force.Although low thresholds and good user experience are important to ordinary users, dopamine and practicality are secondary.What drives non-Web3 users to participate after we solve all the abstraction problems and lower the barrier?For unspeculative Web2 users, Web3 is currently of little use except for transfers and payments.So, where will the growth we imagine come from?

2. Why don’t we talk about decentralization anymore?

I understand that short-term popularity does not mean that centralized heterogeneous chains are the future.But judging from the current excitement of the altcoin market, these chains seem to be ready to overshadow Ethereum.Criticism of Ethereum is so rampant that even Vitalik calls for a restructuring of the fragmented Ethereum ecosystem.From every perspective, Ethereum remains the “Apple” of Web3 – with the largest ecosystem, the highest TVL, and decentralization and security behind Bitcoin.But today, it’s more like the “Apple” that Tim Cook inherited from Steve Jobs – no longer cool, and no one cheers for its innovation.Decentralization does not seem to be the same as success for now, at least.

From the perspective of technological development, decentralization and security require time to mature. They should be scarce assets like gold and cannot be easily replicated, but the replication method has been conceived by Vitalik and Mustafa Albasan.In today’s world, decentralization is more like artificial diamonds, with dozens of vendors selling them from the highest quality Ethereum to the lower-priced Near DA.Will Ton or Solana be the Layer 2 solution in the future?I think the answer is yes, but they won’t be Layer 2 solutions on Ethereum due to faction reasons.But Ethereum is not the only place where decentralization and security are prevalent. Bitcoin’s security, decentralization, social recognition, and consensus mechanism are better than Ethereum, and Bitcoin is not a faction.Even with the concept of 1:1 fork, if a native DA solution can be implemented, wouldn’t Ethereum’s most proud advantage—decentralization and security—become a burden?How will Ethereum defenders criticize heterogeneous chains based on Bitcoin?

From a ZK technology perspective, if it is feasible to scale up using ZK Rollups, then it may also be feasible to scale down using coprocessors or ZKML.With off-chain computing technology for high-performance applications mature, achieving a balance between scalability, decentralization, and security on Layer 1 may not be as out of reach as it seems.So, from this perspective, maybe it’s OK to keep the ecosystem and user experience ahead of time without having to get stuck with the ancient triangle paradox.

3. Will Web3 take the path of Web2?

Token economics has always been an interesting topic.We have witnessed countless complex token economic designs, but ultimately, only service-oriented tokens can achieve long-term success.For example, CEX, Layer 1 and various DeFi projects – why?The easiest reason is demand.Blockchain has real demand and revenue mainly in these areas.From its inception to today’s mainstream era, tokens have played a vital mediating role in helping these projects and their communities grow into giants.The positive feedback loop deepens their moat.In contrast, think of many 10k PFP projects that try to save themselves through staking and destruction mechanisms when they are on the verge of collapse in 2022.However, without strong demand, reducing supply has no real meaning.

Another long-standing problem is the witch (Sybil) attack problem.Sybil attackers are a big problem in token incentives.Many projects aimed at bottom-up development through incentive models ended in failure.In the past, KYC was the only way to barely mitigate this problem, as centralized platforms and compliance projects could rely on KYC to avoid Sybil attacks.But for purely on-chain projects, the situation is much more complicated.While Vitalik has proposed solutions like SBT (Soul-Binding Tokens), reminiscent of Soul-Binding Items from World of Warcraft, these ideas contain many logical vulnerabilities.Using Worldcoin’s iris scanning method is even more impractical.Today, the most effective way to prevent Sybil attacks has shifted to points-based systems.Attackers can create many addresses and spam transactions, but they cannot forge currency.Just like the hash power of PoW, it doesn’t matter how many addresses they have; as long as the deposit accounts for most or all of its weight in the points system, it works.This method is beneficial to the project party. Points are just a soft commitment, and ultimately the control is in the hands of the team.But this leads Web3 in a worse direction.Only whales can benefit from this kind of activity, not real users, and of course they cannot attract Web2 users.After the token is on the exchange, what remains is a wasteland.

It is not uncommon to solve one problem and another come one after another.So why not just cancel the token?Earlier this year, I repeatedly praised the token-free project for outperforming many competitors in every way.These projects won’t fall victim to the Ponzi scheme, and there is no need to worry about the myriad challenges of witch attacks, token prices, or token utility.By focusing their energy and resources on marketing and ecosystem construction, they can accurately target value users and thus expand their ecosystem.

I think it is worth thinking about whether this represents a transition to Web2.Web3 giants like Base provide excellent services and continue to profit from users, but the community has not shared successfully.How is this different from Web2?From construction to online development, everything was monopolized by Coinbase, and its flagship protocol, Farcaster, is also internally controlled, and even led to the marginalization of Friend.tech.Is this a manifestation of decentralization?We must admit that our development path is becoming more and more like Web2. In the 1990s, the vision of the Internet was to return power and wealth to users.In the Web 1.0 era, television and radio stations held the dominance of the media; by the Web 2.0 era, control had been transferred to the hands of the seven major Nasdaq giants.Now, the oligarchs of Web3 are testing their limits.Is the bottom-up innovation legend over?I’m not sure, but I know we’re at a crossroads.

4. Scarcity: a double-edged sword

Before the collapse of the Bretton Woods system, gold was the role of the hub of the human monetary system. Its biggest advantage was its scarcity, and its biggest weakness was its scarcity.From shells to gold, decentralized currencies have been around throughout history.Before humans entered the steam era, scarcity ensured that dictators could not plunder the people’s wealth arbitrarily and that society could function normally.In an era of rapid development of science and technology, scarcity has hindered the rise of mankind.In 2002, former US President Bush Jr. said in a speech: “In the thousands of years of human history, the most valuable achievements are not dazzling technology, not classic works of masters, or eloquent political speeches, but ratherThe domestication of rulers – put them in a cage. I am standing in that cage now and speaking to you. “Putting power in a cage is the only compromise for mankind to accept fiat currency.Fiat currency without any precious metals is arguably the largest Ponzi scheme in human history, but it has made a huge contribution to the development of modern society.

Scarcity is one of the inherent characteristics and sources of value of blockchain, and we constantly emphasize its importance.However, I sometimes wonder if excessive scarcity is also hindering our progress.For example, if Bitcoin was born in a more isolated country – would its vision be realized faster?The case of 10k PFP provides a clearer metaphor.Bored Ape Yacht Club, Azuki and Pudgy Penguins are all very successful NFT projects – at least the first two have been like this in the past.At their respective intersections, they each chose different paths: games, animations and merchandise.The last method rooted in practicality allows Pudgy Penguins to make a comeback through difficulties.Meanwhile, it still makes me feel really cool to make games or animations – even building the entire IP universe.But scarcity is doomed to them.As I mentioned in GameFi’s discussion, the cost of creating an AAA game is unimaginable.Limited NFT supply isolates participants, while issuing additional NFTs dilutes the community.It’s like a microcosm of a dictator’s economy manipulation.The community has a much smaller influence than people think.Both Bored Ape Yacht Club and Azuki ended up going bankrupt due to the release of the sub-series, and in hindsight, all of this makes sense.

Of course, this double-edged sword also applies to Ethereum. I discussed it in the previous article, so I won’t talk about it here.Back to the topic, how should a decentralized project deal with deflation and inflation when it grows big enough to enter the mainstream?Is it relying on simple rules embedded in the code, or the decisions of small teams, or the influence of well-known figures?Oh, don’t forget to govern tokens.The only problem is that governance tokens is meaningless if the Sybil issue cannot be solved.Democratic votes can never be reflected in governance proposals—after all, a16z can veto a vote of favor from a large community with just a few wallets.So what is the meaning of voting?

5. Closed loop of business logic

When writing the Babylon report, I thought about a question: How many projects in Web3 can truly realize the commercial closed loop?I don’t think at least 95% can do it.In most cases, this closed loop only exists in the white paper.People always want to design a perfect reservoir, but they are too ideal about how water flows in.Ideally, Babylon and Eigenlayer can activate silent Bitcoin wallets and Ethereum staking tokens, eliminate the LST bubble, and bring security to various long-tail chains, protocols and new projects.At that time, I thought it was a very grand vision.But a doubt shattered my fantasy.How much interest does it take to pay every year to attract BTC whales and ensure the safety of trillions of assets?How many long-tail projects can be rented in a trillion-dollar cake?Ultimately, the gap left by the closed loop is likely to be filled with tokens.

This problem permeates every corner of Web3.For example, the current popular Ton ecosystem mini-game faces similar challenges.After the airdrop is over, leading projects like Catizen will soon prove whether they have real consumers.Most mini-games will disappear soon – this is inevitable.In many African, Latin America and Asian countries, cryptocurrencies are becoming increasingly popular in payments and remittances.A large portion of Ton’s user base comes from these regions.I hope that user needs in these countries will ultimately help a major player emerge in the applet ecosystem.

6. The story should not end on Wall Street

Nietzsche once said, “There is no fact, only explanation.” My point of view comes from the pragmatist point of view, which may contradict the idealist point of view.But I believe we are not wrong – after all, there is no absolute truth, and we must learn to look at new perspectives through different perspectives.Embracing opposition brings us closer to the truth than any single belief.Every project I support is a project I love.There is at least one thing in common between the two camps: the hope that Web3 will stand side by side with generative AI to play a role in promoting human progress.The story of cryptocurrency should not stop at Wall Street.

7. Sisyphus

When I was titled for this article, I was thinking of Sisyphus in Greek mythology.Sisyphus, known for his cunning in Homer’s Odyssey, has used his wisdom to accumulate huge wealth.Whenever he feels death is approaching, he tricks the god of death into handcuffs, so that no one on earth will enter the underworld.As a punishment for the gods, he was sentenced to push a large stone up to a steep peak.Just as he reaches the top of the mountain, the boulders will slide out of his hands, forcing him to start over—a endless, arduous task.In the Western world, “Sisyphus” is often used to describe an endless, futile task.However, in Camus’ philosophical essay “The Myth of Sisyphus”, Sisyphus’s continuous struggle to climb mountains has become a symbol of human optimism and resistance.How similar is this duality to the current situation of Web3.The night before dawn is always the darkest.