Author: David Canellis Source: blockworks Translation: Shan Oppa, Bitchain Vision

Ethereum is currently in its longest inflation period ever, and “blobs” (data blocks) may be the culprit.

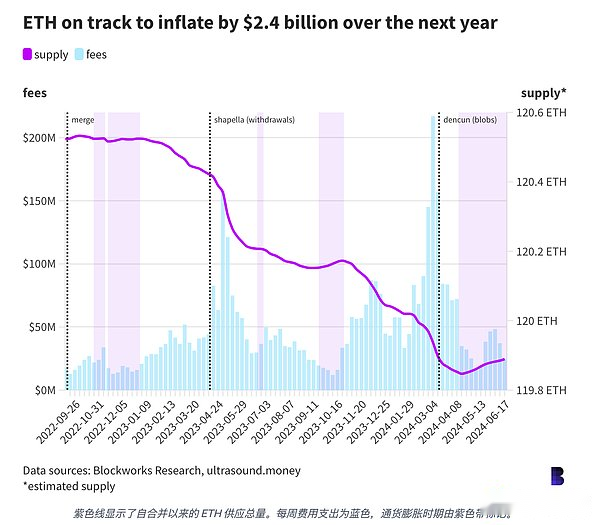

Ethereum’s circulation supply has risen steadily for nearly 72 consecutive days since mid-April, adding nearly 50,000 ETH (approximately $168.7 million).ETH holders will benefit from the increased scarcity caused by the decrease in supply.However, the situation is just the opposite now – ETH is becoming less scarce – as Ethereum’s underlying fees are at its lowest point in the past two years.Meanwhile, the number of transactions on the Ethereum main network has increased, and activity in the second-tier network has increased explosively.

Since the merger in September 2022, ETH has been in inflation for only a few cases, with the longest being 40 days shortly after the merger and 30 days at the end of last year.(Ethereum is in an inflationary period without a uniform standard. For this article, the inflationary period is defined as a total ETH supply increase for three consecutive days, and vice versa.)

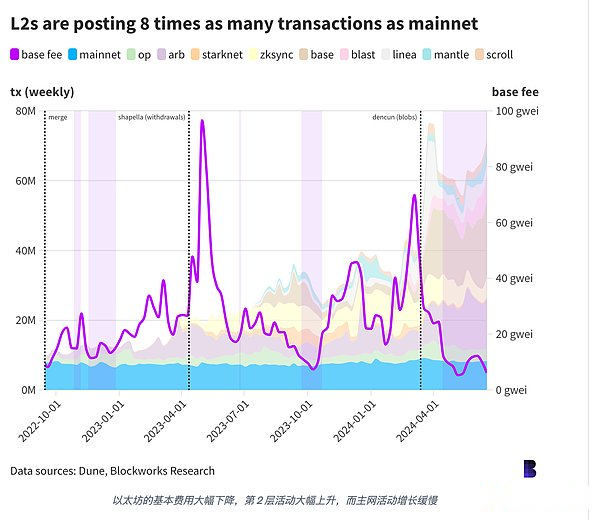

The reason why ETH is in an inflationary state is because the underlying expenses used for destruction have been greatly reduced.The Dencun update in March this year specifically reserved space for each block so that the Layer 2 network can settle “blobs” transactions without competing with the main network users.

This combined with increasing data availability through proto-danksharding, resulting in a significant reduction in competition for block space.

Since everyone has enough block space, including Tier 2 users through blobs, Ethereum’s underlying fees have plummeted 90% since Dencun, making each block issue more ETH than it has been destroyed.

In addition to abandoning the Proof of Work (PoW) and turning to Proof of Stake (PoS), the merger also allows Ethereum to become deflationary on a per-block basis.The Ethereum basic fee paid by users was once part of the reward for miners to discover blocks by consuming power.

But in the absence of any power costs after the merger, the total block reward will far exceed the overhead.This could distort the money supply distribution in the long run, and validators will eventually accumulate too much ETH with almost pure profits.

In order to make the experience of ordinary users more fair, developers choose to burn the basic expenses.Verifiers receive priority fees, reduced block rewards, and if activated, additional MEV benefits.

Currently, the reward for each Ethereum block is only 2 ETH (about $6,800), and the fee contributes less than 2.5%.Proof of Work Bitcoin pays nearly 3.3 BTC ($200,000) per block, although the cost is significantly higher.

It should be clear that Ethereum has burned a lot of supply since the merger, although most of it was before the advent of blobs.Overall, 171 million ETH ($5.8 billion) has been burned down and 136 million ETH ($4.46 billion) has been issued, resulting in a decrease in supply by 346,000 ETH ($1.17 billion).

This makes ETH deflation at 0.161% per year.

If Ethereum is still running Proof of Work, supply will increase by 6.76 million ETH ($22.87 billion) – an annual inflation rate of more than 3%.So even with recent inflation tendencies, holders are still much better, albeit slowly and slightly diluted.