As the start of the pledge sector, Symbiotic has soared more than $ 1 billion in a month, and quickly got market attention.Supported by Lido and led by Paradigm and Cyber Fund, Symbiotic is definitely Eigenlayer’s competitors that cannot be underestimated.The following content will be from the twoSupport the type of assets, design concepts and design methods of pledged pledgeThree angles discuss the similarities and differences between Symbiotic and Eigenlayer.

introduction

Symbiotic and Eigenlayer are two platforms that provide shared security through pledge.Both aims to reduce the starting cost of distributed trust networks by allowing “operator” that allows user pledge funds to assume distributed trust networks in multiple “networks” to reduce the starting cost of distributed trust networks and improve their security.Although both of them realize their functions, these two projects have obvious differences:

-

Types of RESTAKING assets:Symbiotic shows in the official document that they support almost all ERC-20 token and position themselves as DEFI services.In contrast, Eigenlayer only focuses on the pledge related to ETH, and emphasizes that he is an infrastructure of the blockchain ecosystem.

-

Design concept:Symbiotic uses a broader RESTAKING to create a flexible open Defi market.In contrast, Eigenlayer focuses on the use of the existing trust in the Ethereum POS system to maintain the foundation of stability and credibility, which is narrower.

-

Design method:Symbiotic’s design is more modular and decentralized, supports wider assets, and allows deeper customization.EIGENLAYER is relatively centralized, and the overall design is more preferred to consider the security of the Ethereum POS system.

-

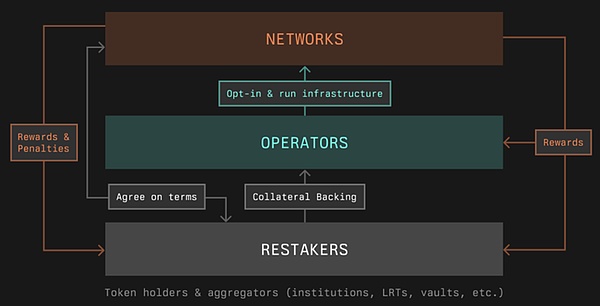

RESTAKERS: Restakers to pledge their assets again.

-

Operators: RESTAKER’s assets are entrusted to an Operators that bear calculation.

-

Networks: Operators choose to join the selected networks, accepting the cooperation clauses as a distributed trust network to provide node services.

-

Eigenlayer:It aims to use Restaking to attract users and build a better blockchain ecosystem based on Ethereum.It emphasizes the re -pledge of Ethereum POS trust, and only allows pledge related to ETH, and protects the POS POS from the problem of trust division.Eigenlayer positions itself as a basic service to enhance the Ethereum ecosystem.

-

Symbiotic:Seeking the leverage of RestAKing to attract as many users as possible. The goal is to create a flexible and open Defi market, and everyone can make money.It supports the re-investment of various ERC-20 tokens and regards itself as a DEFI service to maximize the opportunity to improve income and capital efficiency.Symbiotic did not give priority to the problem of trust, and even stood on the opposite side of this problem.Their growing TVL (total value lock) may pose a threat to Ethereum POS.

-

Open: Support multi-asset RESTAKING, and increase the utilization rate of assets by allowing various ERC-20 token to mortgage.

-

Modification: The system has a clear role division. By separating the responsibilities between different participants, it makes them more friendly to developers.

-

Flexible: Allows extensive customization so that top networks can fully control its underlying services.

-

No license is required: Symbiotic’s core implementation of the contract is quite lightweight, and the roles involved are not required, and the developers can be deployed by themselves.

-

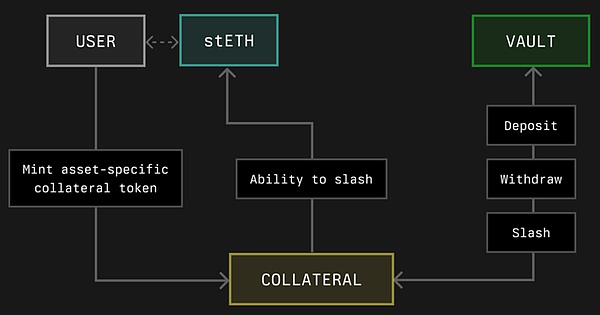

Collateral: The assets that represent mortgaged assets are the abstraction of mortgage assets. They support various types of assets and create corresponding extension of the mortgage ERC-20s to the mortgage.The mortgage tokens separate the assets from the ability to access, apply or punish the access, apply or punish.This separation of assets is abstracting assets into the mortgage tokens, and can even further support various assets outside the Ethereum main network.

-

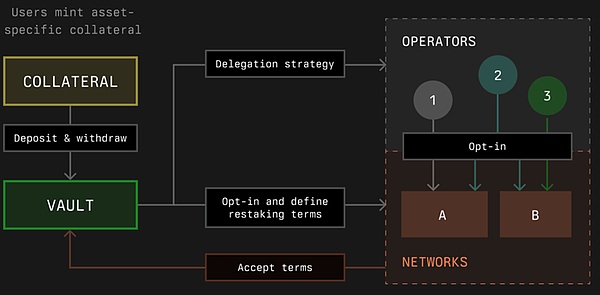

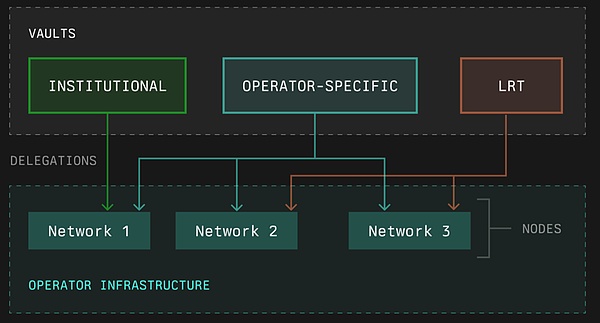

Vaults: Manage the mortgage tokens stored.They are responsible for entrusting the tokens to the operator and implement a reward and punishment mechanism in accordance with the predefined agreement.Vault is usually created by the operator based on the terms they accept from the Internet.

-

Operators: Provide nodes for computing services.They follow the assets in various insurance libraries as the assets, accept the terms prescribed by the network and choose to join.The operator is vital to the ecosystem of the decentralized network.

-

Resolvers: Customized decision -making arbitrators.They can be a centralized address, reduced committee or decentralized entity to provide the flexibility of arbitration.

-

Networks: The distributed trust network needs to be used as the basic service.Similar to AVS in Eigenlayer.

-

Re-pledge based on ERC-20 tokens

-

Trust division problem

-

Hug

-

Resolver assignment risk

-

Risks similar to Eigenlayer

-

Two -way free choice of malicious AVS related security risks in the market;

-

Security risks of the malicious funding caused by pledge;

-

The safety risk of the core contract implemented by the platform itself;

-

Allow the platform to use and reward and punish the potential security risks of the Ethereum POS pledged pool assets;

Their differences reflect the design concepts and design methods of Symbiotic and Eigenlayer, which will be discussed further in the following sections.

>

Figure 1: Symbiotic and eigenlayer similarities and similarities; Source: Blocksec

Functional similarity

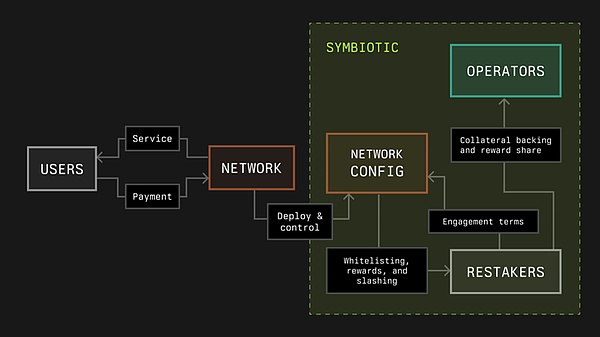

Both Symbiotic and Eigenlayer pledge the shared pool security through RestAKing, which helps reduce the starting cost of distributed trust networks and liberate innovation in the blockchain.Their re -pledge mechanism allows Operators to be used by assets from Restakers, use these assets in multiple Networks, perform multiple tasks, and obtain multiple returns while undertaking multiple risks.Symbiotic’s re -pledge involves the following process:

>

Figure 2: Symbiotic’s re -pledge procedure; Source: Symbiotic Docs

In contrast, the re -pledge function provided by Eigenlayer is actually very similar. It refers to the distributed “network” as “active verification service” (AVS).In addition, in the core narrative of Eigenlayer, it has not clearly separated the concepts of Operators and Restakers.The difference between the two will be discussed in detail later.

Conceptual difference

At the abstract level, Eigenlayer and Symbiotic have a different attitude towards the “trust division” problem in the POS field of Ethereum.Based on this difference, they show different methods of pledge:

In addition, Symbiotic separates Staker’s role with Operator, probably because they have Lido as their strong support, and Lido has the best resource for Operators.Therefore, users only need to focus on pledge instead of commission.This separation also encourages users to invest as much as possible.

Design and service differences

Symbiotic’s design is characterized by emphasis on openness, modularity and flexible DEFI markets, with a clear difference between role.The main functions include:

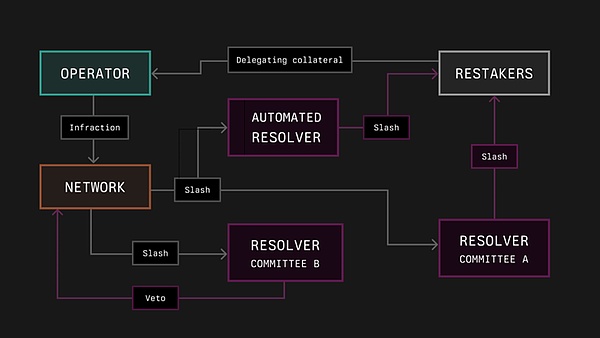

In contrast, Eigenlayer retains some centralized elements.A typical example is the supervision of rewards and punishments.Symbiotic uses Ryolver’s role to make customized arbitration decisions, with potential decentralization conditions.Compared with the centralized reward and punishment supervision committee of Eigenlayer, it provides a more flexible and decentralized solution.Let’s study the flexibility and modular design of Symbiotic.

The key component of Symbiotic

>

Figure 3: The key component of Symbiotic; Source: Symbiotic Docs

Symbiotic’s modular design involves 5 main characters: collateral, insurance libraries, operators, resolvers, and networks.We will briefly introduce these roles.

>

Figure 4: Collateral; Source: Symbiotic Docs

>

Figure 5: Vaults; Source: Symbiotic Docs

>

Figure 6: Operators; Source: Symbiotic Docs

>

Figure 7: Resolvers; Source: Symbiotic Docs

>

Figure 8: Networks; Source: Symbiotic Docs

Current project status

As of now, Symbiotic has only opened its RESTAKING function, and it is unavailable to entrust the custody assets to distributed services that require sharing security.Similarly, Eigenlayer has not fully implemented its expectations, and its key functions such as Slashing and rewards are still waiting to be released.In terms of TVL, as of July 8, 2024, Eigenlayer still occupies market dominance. TVL reached US $ 13.981 billion, while Symbiotic also reached a $ 1.037 billion TVL in one month.

Risk

Symbiotic’s most direct security risk is brought to almost all ERC-20s to the re-pledge field.The pledge pool is usually more inclined to use more stable assets, such as native ETH, which minimize risks and bring stable returns.Unlike Eigenlayer’s main support for native ETH, Symbiotic allows a wider range of ERC-20s to participate in pledge.However, the stability of the ERC-20s tokens is uneven and differently, which may weaken the security of the pledged pool and may lead to financial instability.Allowing almost all ERC-20s as a mortgage increases the platform’s volatility, thereby weakening the overall stability of the ecosystem.

In order to alleviate this security risk, we should consider establishing a systematic monitoring framework for a systematic tokens to rely on the monitoring system (token interDepependency Monitoring System) to evaluate whether a token price collapse will trigger the chain reaction and affect other generations in the ecosystem in the ecosystem.Coin or the entire pool.This helps to allow the related Collateral managers in Symbiotic to discover problems in time and make necessary adjustments in time.Of course, network (Networks) should also think twice when choosing supporting re -pledged assets, try to avoid choosing unstable pledged assets.

The problem of trust division was proposed by the founder of Eigenlayer. In the previous Blog, we explained this problem in detail.EIGENLAYER believes that the blockchain ecosystem has invested a lot of efforts in starting a distributed trust network.At present, many of these networks are the infrastructure of the Ethereum main network DAPP and have attracted a lot of assets.However, the security of everything on the Ethereum online is guaranteed by the pledged assets in the POS pledge pool of Ethereum.These DAPP infrastructure “divert” many pledged assets into their own pledge pools, but still serves the main network of Ethereum at the same time, which seems to have formed a paradox.

To solve this problem, Eigenlayer proposed the RestAKing Pravian Collection, which aims to redirect POS pledged assets to distributed trust network infrastructure.This method of reusing the Ethereum POS pledged assets can guide the assets in the third -party pledge pool to return to the Ethereum POS pledged pool to effectively alleviate the problem of trust rupture.

In contrast, Symbiotic stood on the opposite side of this problem.By allowing non -ETH to pledge in their own “Collateral”, the rapid growth of these assets may pose a threat to trust splitting the security of Ethereum POS consensus.

Eigenlayer only allows ETH -related assets to pledge, and then pledge enables a single asset to pledge in multiple AVS services.This has introduced some leverage risks to the ecosystem.Symbiotic is further, completely embrace leverage, allowing any ERC-20s to pledge.As mentioned earlier, ERC-20 tokens naturally have higher risks and greater volatility.The re-pledged ERC-20 token in different networks will further enlarge this risk.

Symbiotic’s unpredictable and modular design brings more open and free to the DEFI market, but also hides greater risks.Each role in the framework can be deployed without permission, which increases the risk of exposure of potential security issues.For example, the role of Resolver, as a significant distinction with Eigenlayer, Symbiotic allows the network to specify a specific Resolver to monitor the rewards and punishments of its subordinate operators.This design enhances the decentralization and customization of the system, but it also opened the door for the potential malicious Resolver.

To prevent such malicious RESOLVER, security audits can be performed to ensure the basic reliability of specified Resolver.

Eigenlayer bear the following risks. In the previous tweets, we have a detailed explanation:

Since Symbiotic has a similar reconstruction function, these risks also exist in it.

in conclusion

Although Symbiotic and Eigenlayer are similar in function, there are significant differences in asset support and system design.Symbiotic supports wider assets and uses modular and decentralized design to cater to more flexible and open Defi markets.In contrast, Eigenlayer focuses on the use of the existing trust in the Ethereum POS system to maintain a more concentrated but secure platform.These differences highlight the unique value claims of each platform and meet the needs of different parts in the decentralized ecosystem.