Foreword

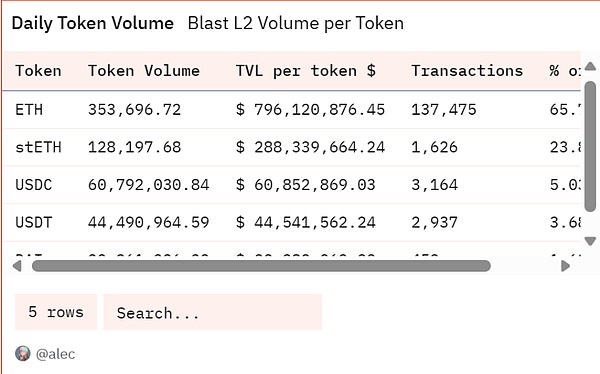

With BLAST’s announcement of testing online, after 50%of shorts are distributed to developers, ecology will inevitably face the problem of optimization of funds.Among the existing stablecoin CASE, at the typical 150% mortgage rate, users need a mortgage worth more than $ 150 to purchase a $ 100 stablecoin, and the remaining $ 50 is not fully utilized.This model represents serious inefficiency.

>

How to better attract and use the current liquidity of more than one billion US dollars on the Blast chain has become a question that all Crypto world has ambitious development teams that must be considered, and ZEST has given their answers.

Zest Introduction

Different from other chains, the sufficient liquidity on the BLAST is given to developers a new proposition- “how to maximize capital efficiency”, or simplify it, how to help users better leverage.

>

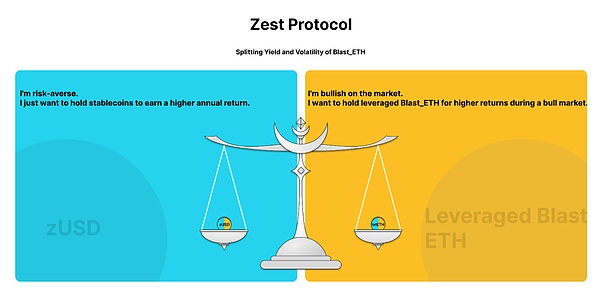

In response to this proposition, the answer given by Zest is to decompose the yield and volatility to achieve a stable currency of 100%capital utilization efficiency.

Project core mechanism

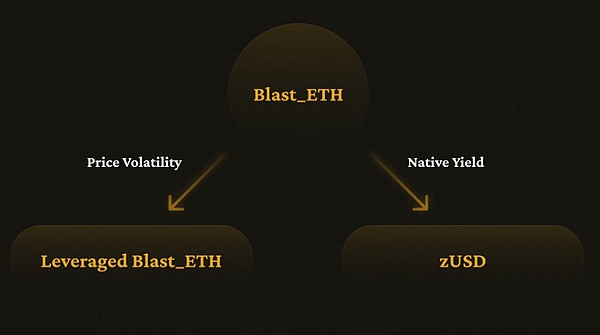

One of BLAST’s innovative design is that the ETH on all BLAST networks has native income. Above this, the protocol layer can perform various operations, such as LSDFI.

When users pledge Blast_eth worth $ 150 in ZEST, they can get ZUSD worth $ 100 and Leveraged Blast_, a $ 50.Blast_eth’s yield is inherited by ZUSD, and the volatility is inherited by Leverad Blast_eth.The specific process can be described by the following formula

$ $ 1 ∗ Blaster = K ∗ ZUSD+1 ∗ LBETHK $ $

In the upper formula, 1 BLAST_ETH can cast K a ZUSD and 1 lbeth_k.When the price of ETH fell to $ k, lbeth_k faced liquidation.After the launch, considering the risk preferences of different users, the agreement of the agreement introduces a diversified K value.

>

By decomposing volatility and yields, the ZEST protocol can meet the needs of two types of users at the same time

-

Risk disgust, pursuit of farming income users

-

leveruser

-

RISK-AVERSE or YIELD-LOVING Users Can Obtain Stablecoins withleverageyield.

-

DEGEN or Leverage-LOVING Users Can Access Long-Term on-Chain Leveraged Derivatives

Because all the fluctuations in Blast_eth are absorbed by the Leverad Blast_eth, ZUSD has risk -free leverage income.

>

Assuming K = 1000, ETH price has risen from 1800 to 3000, and the APR of Blast_eth is 4.5%, then there is Zusd Stake APR = (3000**4.5%)/(1000**0.5) =27%,,Six times to native APR(27%/4.5%)

It is also assumed that the price of ETH has risen from 1300 to 3000, and K = 1000, then the value of Ibeth will increase from (1300-1000) to (3000-1000) to achieve nearly 7 times the income.

The specific design has not been launched on the token side, and this part is left for follow -up discussions.

Summarize

Due to the particularity of Blast’s abundant liquidity, the above protocol can better focus on its own product mechanism and economic model design to achieve higher leverage and higher capital utilization efficiency.So we can see more excellent designs on it.

? AS Blast Intropus a Large Number of Yield-BEARING AsSETS, where should the ad?

Old, Uninspired Defi Projects May Lack Innovative Solutions, But Zest is Here to ProvideEntirely NewandOriginal AnswersThen, then