Author: James Ho, Source: Author Twitter @jamesjho_; Translated by: Tao Zhu, Bitchain Vision

Layer 2 on Ethereum has made significant progress over the past few years.

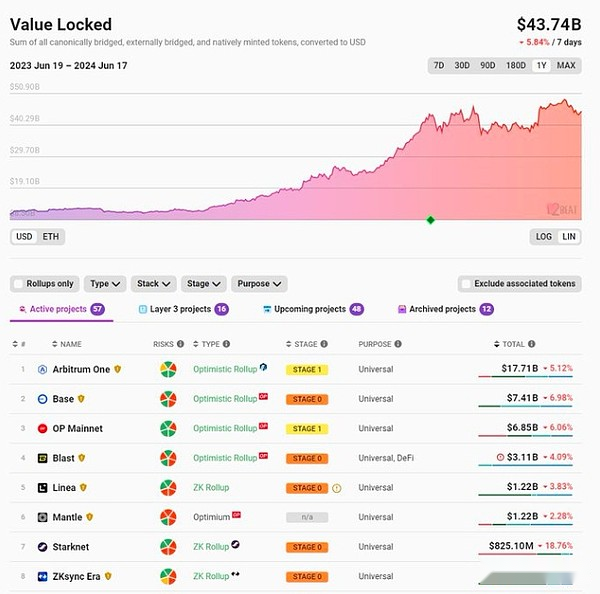

Today, ETH L2 has more than $40 billion in TVL, up from $10 billion a year ago.

On @l2beat, you’ll find a list of over 50 L2s, although the top 5-10 L2s make up over 90% of TVL.

After EIP-4844, Txns costs are very cheap, with Base, Arbitrum and more costs less than $0.01.

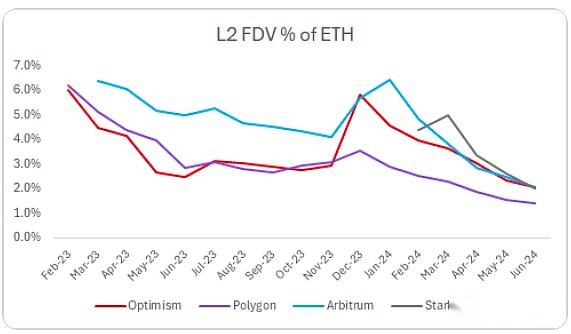

despite this,Compared to ETH, L2 tokens perform quite poorly as liquidity investments overall (they are obviously excellent venture capital).

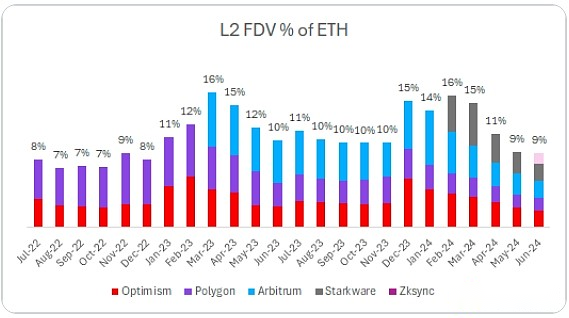

We go back and plot the valuation of the main L2 vs. ETH.A noteworthy observation:

Even if the number of listed L2s increases, their percentage of total FDV in ETH remains the same.

Two years ago, the only L2 listed were Optimism and Polygon.They make up 8% of ETH.

Today, we have Arbitrum, Starkware, and zkSync all joining the L2 ranks.Now they make up 9% of ETH.

Every new L2 token enters the market, actually diluting the valuation of the previously listed tokens.

Compared with ETH, the return on investing in L2 tokens is quite significantly lower than ETH.

Returns over the past 12 months (as of today):

ETH +105%;

OP +77%;

MATIC -3%;

ARB -12%.

The leading L2 token has long had a FDV of about $10 billion.In a sense, this is quite arbitrary, and I don’t think there is a good reason for market participants to explain why the valuation is $10 billion vs $20 billion vs $3 billion.Ultimately, there is huge supply pressure in the form of belonging, unlocking, etc. – from people who need liquidity and/or a big rise.

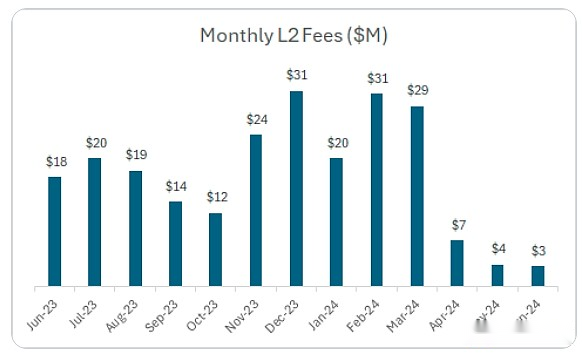

Why don’t there be more liquidity to buy these L2s?The above L2 incurs a monthly fee of US$20 million.Since eip-4844, expenses have fallen and now total $3-4 million per month.This is equivalent to a $40-50 million annual fee.

Blobs are very cheap now.Most of the income flows to the bottom line.

(Including optimism, arbitrum, polygon, starkware, zksync)

These leading L2s are currently worth approximately $40 billion FDV and have an annualized fee of $40 million.That’s about 1000 times.

This is in stark contrast to large DeFi protocols that are valued much lower than DeFi protocols (below is based on the annualized expenses of the last 1 month).Usually in the range of 15-60 times.

DYDX – 60x;

SNX – 50x;

PENDLE – 50x;

LDO – 40x;

AAVE – 20x;

MKR – 15x;

GMX – 15x.

There are more L2s in preparation.As these products enter the market, it may continue to put pressure and dilute the FDV category of L2.The supply is too large and the liquidity market is difficult to easily support.

Last thoughts:

-

L2 can generate considerable expense income in the long run.L2 incurs $150 million in annual fees (including Base, Blast, Scroll).This can grow meaningfully with L2 activity.

-

The comments above are not targeting any particular L2, which is more about the category.It seems difficult to buy a basket of L2s worth about $40 million worth of FDV for about $40 billion and expect to outperform ETH in the long term.

-

It is obvious that high-throughput chains such as L2, Solana, Sui, and Aptos do not lack block space.Limitations are primarily used on applications.I want to see people pay more and more attention to applications and in the coming years the mobile market will reward the application layer rather than the infrastructure stack.

-

In the previous cycle, it was more common for projects to go public earlier.MATIC’s FDV in the liquid market is less than $50 million, and now it’s over 100 times higher, reaching over $5 billion.This appreciation is achieved through the liquid market.However, this has not been the case with $OP $ARB $STRK $ZK and most other L2 tokens that may end up on the market.