Author: Kevin He, co -founder of Bitlayer; Compilation: 0xjs@作 作 作 作 作

background

Recently, Bitgo’s community discussion and attention on the transfer of WBTC project control is very extensive.

The author has rich experience in building blockchain infrastructure. He personally developed a centralized packaging token system and a MPC -based custody platform. He is currently committed to building a Bitcoin native verification capabilities.

In this article, the author will review the incident, covering multi -party actions and feedback to present facts.Based on the practical experience developed by the system, the author abstracted a simple structure and security model for packaging BTC products.Subsequently, the author classified different technical solutions based on the degree of dentalization, and pointed out that the technical solution based on Bitcoin’s native verification ability represents the future direction.

Incident review

Participant

WBTC: WBTC has more than 150,000 BTCs (worth more than $ 9 billion), and shows the reserve certificate on its website.

Bitgo (WBTC controller):It is announced that the control of the WBTC project will be transferred from Bitgo to the Bit Global related institutions related to Justin Sun within 60 days.

Related parties

MakerDao (DAI) risk management team Block Analitica:He expressed concerns about the transfer of control and pointed out that WBTC constituted risks, causing them to reduce risk exposure in related agreements.

Sun Yuchen (WBTC’s new controller):Promise not to move Bitgo reserves.

Third party:

Weidai (VC):It is recommended that the verification bridge will be a better solution.

Liu Feng (media):Questions about Bit Global’s qualifications.

Wrapped BTC’s business model

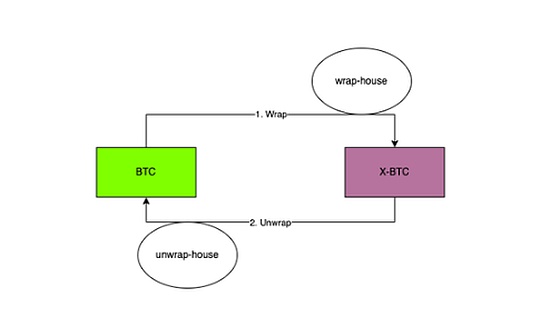

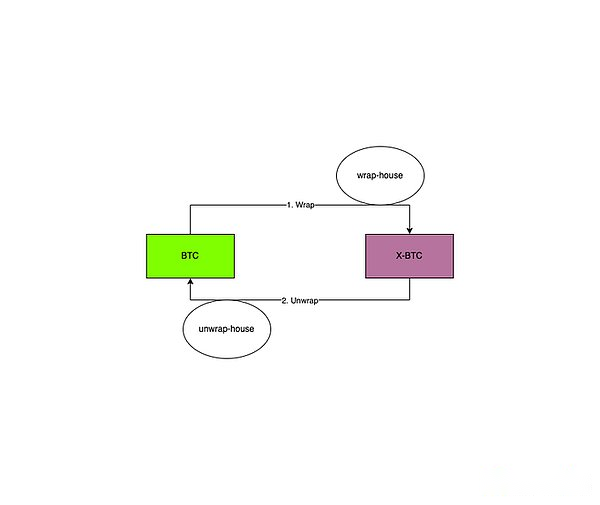

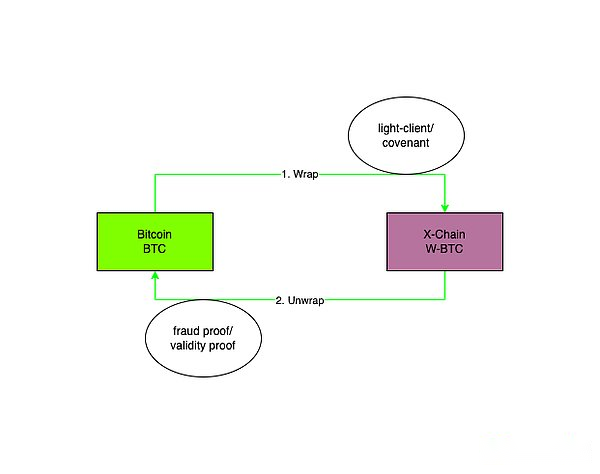

The business model of Wrapped BTC is relatively simple, as shown in the figure below:

Wrap:

Represents the conversion from BTC to W-BTC.

Wrap-house:

The operating mechanism of the package ensures that the BTC stored in the account (usually other blockchain, such as ETH) is cast and caused the corresponding W-BTC.

Unwrap: Represents the conversion from W-BTC to BTC.

Unwrap-house:

Represents the operating mechanism of the packaging packaging to ensure that after the user destroys the W-BTC, the mechanism can allow it to get BTC on the Bitcoin network, not many and many.

Trust the degree of trust

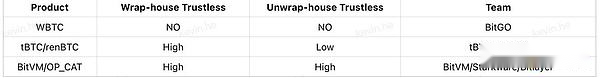

The comparison of the commercial and technical model mentioned above can be performed from multiple dimensions. The following author will compare the degree of comparison from the perspective of packaging and reconciliation packaging.

No need to trust

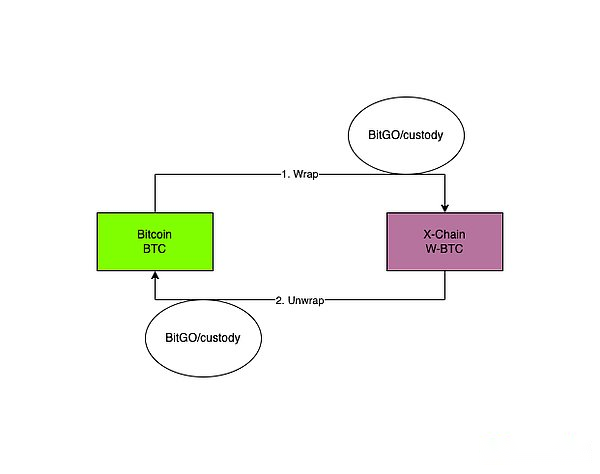

A typical example is the current BITGO’s WBTC, and the operation of packaging and packaging packaging is controlled by Bitgo Custody.

Obviously, users need to trust the Bitgo custody service provider to run correctly.

No need to trust

Next, let’s take a look at the two representative items that appeared around 2020: TBTC/Renbtc.

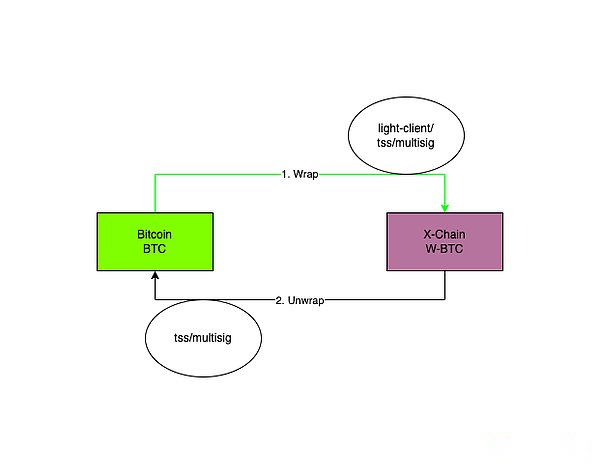

We can see that on the X chain (for example, with complete verification capabilities, such as EVM), Wrap-House can be easier to achieve high levels without trust, but due to technical restrictions at that time, Unwrap-House can only be enhanced through the thumballed signature to enhanceSafety has nothing to do with the degree of signing.

No need to trust in both direction

Express into 2024, thanks to the pioneering attempts of Bitvm/Starkware and other teams in Bitcoin’s native verification capabilities (including fraud and validity proof), and the actual landing of community teams such as Bitlayerlabs, Unwrap-House is expected to achieve it.No need to trust.

Among them, fraudulent proof is represented by BITVM and its derivative projects, and it has achieved optimistic verification without OP_CAT, and mainstream implementation is the process and challenge process of using zero -knowledge verification.

The validity proof assumes that the existence of the OP_CAT operating code will directly realize zero -knowledge verification. With OP_CAT, the locking BTC will be controlled by the so -called contract (the structure of similar contracts).

Comparison of schemes

It can be found that the above -mentioned various technical solutions can be found that solutions based on Bitcoin verification capabilities (Validation) performed better in both direction without trust.

in conclusion

The emergence of WBTC in 2018 marks the beginning of bringing BTC liquidity into the Defi world.The TBTC project in 2020 has been optimized and improved.

Verifying technical solutions represented by Bitcoin native verification capabilities (fraud proof and validity proof) will perform better in both direction without trust.

WBTC, it’s time to upgrade the technical solution!