Original title:Ethereum VCs have EBOLA for Infra

Author: Yash Agarwal, researcher at Superteam.fun; compiled by: 0xjs@Bitchain Vision

“Let your opponents talk and they will weave a net that keeps them safe.”

Two weeks ago, Haseeb and Tom from Dragonfly made a series of arguments in the Ethereum and Solana link on the show “The Chopping Block”.They outlined the following:

-

Solana’s VC ecosystem is incomplete.

-

The amount of funds on Solana is much lower than Ethereum, and there are few winners in the Solana ecosystem except memecoins.

-

Solana is regarded as a memecoin chain, and perhaps a DePIN chain.Solana’s TVL is only $5 billion, limiting its TAM.

-

Starting a business on Ethereum is like “starting a business” in the United States, because its expectations are more positive.

-

Solana has a high Gini coefficient (inequality is more serious).

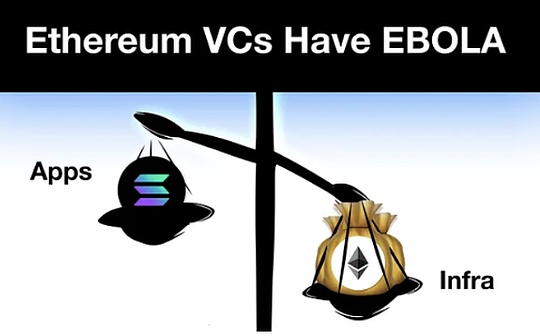

We will review these arguments-Emphasize the structural problems of large VC funds and how these issues drive them to invest in infrastructure – and worse, putting founders in bad advice.Finally, we will share tactical suggestions on how to avoid EBOLA infection (EVM Bags Over Logic Affliction).

Ethereum VC is highly contagious EBOLA

As Solana Foundation Lily Liu said, EBOLA (EVM Bags Over Logic Affliction) is a disease that affects Ethereum venture capital firms—a structural problem, especially for large “tier one” venture capital firms.

Take a large fund like Dragonfly, which raised $650 million in 2022 from top LPs such as Tiger Global, KKR and Sequoia, likely putting forward the theme of infrastructure-heavy investment.Large funds like Dragonfly are structurally incentivized and deploy funds within a prescribed period (such as two years).This means they will gradually be willing to fund larger rounds and give higher valuations.If they don’t fund a larger round of financing, they will not be able to deploy capital and must return the capital to their LP.

Think about the economic incentives of GP:They receive management fees (2% of the funds raised) annually and success fees (20% of the returns) upon exit.Therefore, on the basis of risk adjustment, the fund has the motivation to raise more funds to “accumulate expenses.”

Given that infrastructure projects such as Rollup/Interoperability/Restaking) can successfully achieve FDV of over $1 billion, considering the multi-billion dollar infrastructure exit in 21-22, investing in infrastructure projects is a positive expectation.But it’s a narrative they created themselves, driven by Silicon Valley’s capital and legitimacy engines.

Here is the content of the infrastructure narrative:

1. The currency network will succeed in the information network.That’s why it’s called Web3.

2. If you could “invest” TCP/IP or HTTP in the 1990s, you would do that.Now you can invest through online tokens.

3. These blockchain infrastructure bets are the bets of this generation on the currency protocols equivalent to TCP/IP and HTTP protocols.

This is a pretty compelling narrative, and this narrative does have some substance.The question is, in 2024, when we look at the next EVM L2 dedicated to scaling TPS to support the ultra-high TAM potential of the NFT community, we have deviated from the original story of TCP/IP becoming a global currency.or,Whether this reason is driven by fund economics of large crypto funds such as Paradigm/Polychain/a16z crypto.

EBOLA makes founders and LP sick

Given the assumption that basic branding can drive high valuations, we see many major EVM applications announce or launch L2 in the hope of obtaining these high valuations.The pursuit of EVM infrastructure is so crazy that even top consumer founders like Pudgy Penguins feel the need to launch the L2.

Take EigenLayer as an example – a project on Ethereum has raised $171 million, but it hasn’t had any significant impact, let alone generate revenue.It will make some venture capitalists and insiders (holding 55% of the tokens) rich.People’s criticism of low circulation, high FDV projects is reasonable; so what about criticism of low impact, high FDV projects?

The infrastructure bubble has begun to burst, and the token FDV issued by many top infrastructure projects in this cycle has been lower than the private equity valuation.With major unlocks in 6-12 months, venture capital firms will be in a slump in a race to lower prices for who sells first, affecting returns.

There is a reason for retail investors to experience a new round of anti-VC sentiment; they feel that the more VC funds = higher FDV, the lower circulation infrastructure.

VCBad advice to take you to the grave

EBOLA also claims promising apps/protocols among its victims, and venture capitalists influence founders to build apps/protocols on chains that cannot achieve their product vision.Many social applications, consumer-facing applications, or high-frequency DeFi applications can never be achieved on the Ethereum mainnet because it performs comparable to a modem and has an absurdly high gas fee.However, despite other options,These applications are still built on Ethereum, resulting in a large number of applications that are conceptually promising, but cannot go beyond the “proof of concept” because the infrastructure they rely on has come to an end.In my opinion, there are many examples, from Enzyme Finance (2017) to recent SocialFi applications such as Friend Tech, Fantasy Top and Quail Finance (2024).

Take Lens Protocol, the largest DeFi protocol Aave, for example, which raised $15 million and launched on Polygon for a large grant (now again due to another grant), while maintaining its L3.The fragmentation caused by infrastructure chaos has led to the downfall of Lens Protocol, which could otherwise become a basic social graph.In contrast, Farcaster adopts a light infrastructure approach—i.e., Web2 heavy approach.

Recently, Story Protocol received a $140 million financing led by a16z to build an “IP blockchain”.Despite being forced into a desperate situation, frontline VCs are still doubling their bets on infrastructure narratives.therefore,A keen observer may notice the exit path: This narrative evolves from “infrastructure” to “application-specific infrastructure”——But usually focuses on unproven EVM stacks (such as OP) rather than the proven Cosmos SDK.

Structural collapse of VC market

The current venture capital market has not effectively allocated capital.Crypto Ventures manage billions of dollars in assets that generally need to be deployed to specific tasks over the next 24 months: from private seed turn to round A projects.

On the other hand, liquid capital allocators are highly sensitive to global opportunity costs, from “risk-free” Treasury bonds to holding crypto assets.This means that liquid investors will be more efficient in pricing than venture investors.

Current market structure:

Open market – insufficient capital supply, excessive supply of high-quality projects

Private market – excess capital supply and insufficient supply of high-quality projects

The insufficient supply of capital in the open market has led to poor price discovery, and this year’s token listing is proof of this year.High FDV issuance is a major issue in the first half of 2024.For example, the total FDV of all tokens issued in the first six months of 2024 was close to $100 billion, accounting for half of the total market capitalization of all tokens in the top 10 to the top 100.This is a reliable way to ensure price discovery drops until real buyers are found.

The private venture capital market has shrunk.Haseeb also acknowledges this – all of these funds are smaller than previous funds, for a reason – Paradigm would raise 100% of the previous funds if possible.

The structurally collapsed VC market is more than just a cryptocurrency issue.

The structurally collapsed VC market is more than just a cryptocurrency issue.

Cryptocurrency markets obviously need more liquidity funds to act as structural buyers in the open market, to solve the problem of the collapse of the VC market.

Vaccination to prevent EBOLA

Enough gossip, let’s talk about potential solutions and what needs to be done as an industry – both for founders and investors.

For investors – tend toward liquidity strategies and scale up by embracing the open market rather than confronting it.

Liquidity funds are essentially investing in or holding publicly traded liquidity tokens.As DeFiance founder Arthur pointed out, an efficient liquid cryptocurrency market requires the existence of active fundamental investors – meaning that cryptocurrency liquidity funds have enough room to grow.It should be clear that we are specifically discussing “spot” liquidity funds; leveraged liquidity funds (or hedge funds) performed poorly in the previous cycle.

Multicoin’s Tushar and Kyle seized on this concept when they founded Multicoin Capital 7 years ago.They believe liquidity funds can achieve the best of both worlds: venture capital economics (invest early tokens for excess returns) combined with open market liquidity.

This method has several advantages, such as:

1. Open market liquidity allows them to exit at any time according to changes in their theme or investment strategy.

2. The ability to invest in competition agreements to reduce risks.Generally, it is easier to find trends than picking specific winners among these trends, so liquid funds can invest in multiple tokens in a particular trend.

While a typical venture capital fund provides more than just capital, liquidity funds can still provide various forms of support.For example, liquidity support can help solve the cold start problem of DeFi protocols, which can also play a practical role in protocol development by actively participating in governance and providing advice on the strategic direction of the protocol or product.

Contrary to Ethereum, Solana’s financing scale in 2023-24, except for DePIN, is on average quite small; there are rumors that almost all first-round major financings are below $5 million.Major investors include Frictionless Capital, 6MV, Multicoin, Anagram, Reciprocal, Foundation Capital, Asymmetric and Big Brain Holdings, as well as Colosseum, which hosts Solana Hackathons, which launched a $60 million fund to support founders in SolanaConstruction is carried out on.

Time for Solana liquidity funds:

It’s time to rely on liquidity strategies and make money through VC’s incompetence, stupidity, or both.Contrary to 2023, Solana now has a large number of liquid tokens in the ecosystem, and people can easily launch liquidity funds to bid for these tokens as early as possible.For example, on Solana, there are many FDV tokens worth less than $20 million, each with unique themes such as MetaDAO, ORE, SEND, UpRock, and more.Solana DEX has now been tested in practice and even surpassed Ethereum in trading volume, with vibrant token launchpads and tools such as Jupiter LFG, Meteora Alpha Vault, Streamflow, Armada, etc.

As the liquidity market continues to grow on Solana, liquidity funds can be a reverse bet for both individuals (those seeking angel investments) and small institutions.Large institutions should start targeting increasingly large liquidity funds.

For the founders – choose an ecosystem with lower startup costs before finding PMF

As Naval Ravikant said, keep it small until you find a way to do it.He said that entrepreneurship is about finding scalable and repeatable business models.So what you are really doing is looking for, you should keep a very, very small scale and a very, very cheap scale before finding a business model that can be repeated and scalable.

Solana’s low startup costs

As Tarun Chitra points out, Ethereum’s startup costs are much higher than Solana.He noted that in order to get enough novelty and ensure a good valuation, it often requires a lot of infrastructure development (for example, the entire application becomes a rollapp fanatic).Infrastructure development essentially requires more resources because they are largely research-driven, requiring the hiring of a research and development team, as well as numerous ecosystem/BD experts to convince a few Ethereum applications to integrate.

on the other hand,Applications on Solana do not need to focus too much on infrastructure, infrastructure is handled by select Solana infrastructure startups such as Helius/Jito/Triton or protocol integration.Generally speaking, an application does not require enough funds to start; take Uniswap, Pump/fun, and Polymarket as examples.

Pump.fun is a perfect example of Solana’s low transaction fee unlocking “fat application theory”; single application Pump.fun has surpassed Solana in revenue in the past 30 days, and even surpassed Ethereum in 24 hours in a few days.Pump.fun initially started with Blast and Base, but soon realized that Solana’s capital speed was unparalleled.As Pump.fun’s Alon admits, both Solana and Pump.fun focus on lowering costs and barriers to entry.

As Mert said, Solana is the best choice for startups because it has community/ecosystem support, scalable infrastructure, and philosophy around delivery.Due to the rise of successful consumer applications such as Pump.fun, we have seen early trends in which new entrepreneurs (particularly consumer founders) prefer Solana.

Solana is not only suitable for Memecoin

“Solana is only suitable for memecoins” is the biggest controversy among the ETH biggestists in the past few months, and yes, memecoins dominate Solana’s activities, and Pump.fun is at the heart of it.Many people may say that DeFi on Solana is dead, and Solana blue chip stocks such as Orca and Solend are not doing well, but the statistics are not:

1. Solana’s DEX trading volume is comparable to Ethereum, while most of the trading pairs in the top 5 trading volumes of Jupiter 7D are not memecoin.In fact, memecoin activity accounts for only about 25% of DEX trading volume on Solana (as of August 12), while Pump.fun accounts for 3.5% of daily trading volume on Solana – this one considers the platform’s rapid adoption.The proportion is very small.

2. Solana’s TVL ($4.8 billion) is 10 times smaller than Ethereum ($48 billion), because Ethereum still enjoys higher capital leverage with its 5x market capitalization, deeper penetration of DeFi and proven agreementsRate.However, this does not limit the TAM of new projects.Two best examples are:

-

Kamino Lend grew to $1.4 billion in just 4 months.

-

PayPal USD reached $450 million in just 3 months, surpassing PYUSD’s $360 million supply on Ethereum, although PYUSD has been on Ethereum for a year.

With many EVM blue chip stocks deployed on Solana, it’s only a matter of time before TVL is.

Although one might say the price of Solana DeFi tokens has dropped sharply, so does Ethereum’s DeFi blue chip stocks, highlighting the structural problem of governance token value accumulation.

Solana is undoubtedly a leader in the DePIN field, with more than 80% of the major DePIN projects being built on Solana.We can also conclude that all emerging fields (DePIN, Memecoins, consumers) are developed on Solana, and Ethereum is still the leader in the field of (money markets, income agriculture) in 2020-21.

Suggestions for application creators

The larger the fund size, the less you should listen to them.They will inspire you to finance your product before you achieve a product market fit.Uber’s Travis explains very well why you shouldn’t be trusting big venture capitalists.While it is certainly profitable to pursue first-class venture capital and high credibility valuations, you don’t necessarily need large venture capital to get started.Especially before you are in PMF, this approach can lead to a valuation burden, putting you in a cycle that needs to constantly raise funds and start with higher FDV.Discovering poorly at startup makes it even more difficult to build a truly distributed community around the project.

1. Financing-small scale.More community-oriented.

-

Raise funds from the angel investor consortium through platforms such as Echo.It’s undervalued: You trade valuation for distribution and then play to your strength.Find relevant founders and KOLs and work together to get them on board.This way, you can build an early evangelist community/network composed of high-quality builders and influencers who can fully support you.Prioritize community over 2/3 stream VC.Pay tribute to some Solana angels like Santiago, Nom, Tarun, Joe McCann, Ansem, R89Capital, Mert and Chad Dev.

-

Choose accelerators like AllianceDAO (Best for Consumer Projects) or Colosseum (Solana Native Fund). They are not predatory and more in line with your vision.Use Superteam to meet all your startup needs; this is a tip.

2. Consumer-Embroidered speculation.Attract attention.

-

Attention Theory: Jupiter received $8 billion in FDV in the open market, a strong demonstration that the market has begun to value front-end and aggregators.What is the best part?They are not funded by any venture capital firms and are still the largest application in the entire cryptocurrency space.

-

Rise of app-focused VCs: Yes, when VCs see billions of dollars exits, they will likely follow the same infrastructure strategy to develop consumer applications.We have seen many applications with annualized revenue of $100 million.

Summary (too long to read the version):

-

Don’t listen to VC’s infrastructure narrative anymore.

-

The time has come for liquidity funds to flourish.

-

Built for consumers.Embrace speculation.Chase profits.

-

Solana is the best place to experiment due to its low startup cost.