Author: David Feliba, CoinTelegraph; Compilation: Baishui, Bitchain Vision

While the Trump administration has laid the initial foundation for crypto industry regulation in the U.S. (The new White House crypto czar is expected to set the direction in the coming months), these digital assets are already booming in emerging markets.

Stablecoins are pegged to fiat currencies and are becoming an important financial tool in many developing countries, promoting remittances and cross-border trade, bridging the financial inclusion gap, and in countries where traditional banking is often insufficient and millions of people are almost unable to access financial services.Provides inflation hedging.

Stablecoins (mainly pegged to the US dollar) have seen explosive growth in recent years, with their actual use cases rapidly expanding to Africa, Latin America and some Asian developing countries.While the United States is still looking at how the technology can be applied outside the crypto field, emerging markets have proven the importance of stablecoins.

In these regions, they are not just a financial experiment, but a solution.

Stablecoins as South American inflation hedge

In inflation-ridden economies such as Argentina and Venezuela, stablecoins provide a safe haven for the dollar to avoid depreciation of their currency, especially when foreign exchange channels are strictly controlled.Throughout Africa and Central America, they are a cost-effective remittance and cross-border payment tool, while in places like Indonesia, they can provide an alternative that is easier to obtain than traditional dollar banking, which may be a good deal.Complex requirements involved.

Eswar Prasad, professor of trade policy at Cornell University, saidAlthough stablecoins are primarily used in decentralized finance in wealthier and more developed economies and serve as a bridge between traditional banking and DeFi, they are more useful in emerging markets with limited financial infrastructure.Fundamental, but essential.

“In low- and middle-income economies with underdeveloped financial systems, they can play a beneficial role in providing citizens and businesses with convenient, extensive, low-cost digital payment systems.”

The US dollar is widely regarded as a global storage of value, and access to the US dollar is a key driver of the adoption of stablecoins in emerging markets.Stablecoins are designed to provide stability compared to the volatility of early cryptocurrencies such as Bitcoin, with most stablecoins pegged to the US dollar, with USDT Tether accounting for nearly 60% of the global market, followed by another US dollarSupported assets USDC.

Stablecoin provided by the issuer.Source: Castle Island Ventures.

“There are some problems in the world that need to be solved with a cryptocurrency whose prices don’t fluctuate,” Julián Colombo, senior director of Mexican cryptocurrency exchange Bitso, said in an interview that Bitso has official offices in Argentina, Brazil and Colombia..

“Stablecoins offer a way to bring all the benefits of cryptocurrencies into real-world use cases – not just leveraging the potential of Bitcoin to get rich.”

Stablecoins are Trump’s top priority

The U.S. momentum surrounding stablecoins is growing as senators from both parties introduced legislation on February 4 to establish a regulatory framework.Speaking to the industry for the first time, the White House AI and cryptocurrency Tsar David Sacks stressed that stablecoin regulation is the government’s top priority, and the former venture capitalist-led task force will be held in the next six monthsDraft key policies within.

In any case, the growth of stablecoins is amazing.According to DelfiLlama, their market cap has reached an astonishing $100 billion in the past year alone, with total market cap soaring to $225 billion as of February 2025.USDT still dominates with over 60% of the market share, but challengers — including those backed by financial giants like PayPal — are rapidly rising.

“Stablecoins – tokenized representations of fiat currencies circulating on blockchains – are undoubtedly the ‘killer application’ of cryptocurrencies,” a report written by Castle Island Ventures and sponsored by VISA mentioned.

“We believe that stablecoins represent a payment innovation that has the potential to give more people in more places access to safe, reliable and convenient payment services,” said Cuy Sheffield, global head of cryptocurrency at the US payment giant.

“While they initially emerged as crypto-native collateral types and settlement media for traders and exchanges, they have crossed the gap and are widely adopted in the general global economy,” the report noted.

“Based on the differences between stablecoin activity and crypto market cycles, it is clear that stablecoin adoption has gone beyond the scope of serving crypto users and transaction use cases only.”

Spot cryptocurrency trading volume and stablecoin monthly send address.Source: Castle Island Ventures.

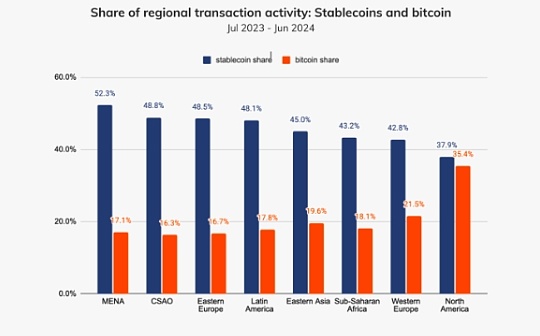

Stablecoins are regarded as a store of value, a tool for hedging inflation and a tool for cross-border transactions, gaining significant appeal in emerging markets.A recent report by Chainalysis found that stablecoins adoption rates far exceed Bitcoin in regions such as Africa, Eastern Europe, Latin America and Asia, and in some cases account for nearly half of all cryptocurrency transactions.

By contrast, the U.S. and North America have the lowest adoption rate, although it still accounts for a considerable share.

Regional trading activity share: stablecoins and Bitcoin.Source: Chainalysis.

Brazil’s central bank governor Gabriel Galipodo said that in places such as Brazil, the use of stablecoins has increased significantly in recent years.Brazil is a powerful country in Latin America with a population of 216 million and a GDP of 2.2 trillion US dollars.The economist said at a Feb. 6 Bank of International Settlements event in Mexico City that up to 90% of the entire circulation of cryptocurrencies is related to stablecoins.

“Most of it is buying things and shopping from abroad,” Galipolo said, highlighting the new trend posed a serious regulatory challenge in taxes.

But Julián Colombo, who leads the local business of Bitso, a regional exchange, said that in Latin America, no stablecoin is more popular than Argentina.They provide citizens with important financial shelter amid long-term inflation and economic instability.

Colombo said:“In Argentina, just like in other high inflation countries, stablecoins have become the solution to a very realistic and pressing problem.

“Argentines do not trust local currencies and prefer savings with the US dollar, but foreign exchange controls and restrictions imposed by the government make it difficult to obtain the US dollar. Stablecoins fill this gap and provide a way to hold and trade the US dollar.”

In Argentina, about two-thirds of cryptocurrencies purchased through exchanges are made on assets pegged to the US dollar, he said.Despite improvements in financial indicators in Argentina under the market-driven government of President Javier Milei, who supports cryptocurrency, inflation remains as high as 84.5%.

Despite recent monthly data showing a downward trend, rebuilding trust in local currencies takes time to ensure sustained demand for stablecoins pegged to the dollar in a country that has been long plagued by triple-digit inflation and severe currency depreciation.

Similarly, Venezuela has a great significance for the adoption of such digital assets, which is suffering from long-term inflation and a lot of regulation, making it very complicated to obtain foreign currencies such as the US dollar.In emerging markets with relatively stable currencies such as Brazil or Mexico, they can play a different but equally important role: to achieve fast, low-cost remittances without volatility like traditional cryptocurrencies.

Businesses use them to pay for international service fees, hire remote employees, send dividends and facilitate remittances, making cross-border transactions more efficient and convenient.

“Stablecoins have a commitment to stability compared to other crypto assets,” the Bank for International Settlements said in a report on stablecoins.“Due to this potential, they are increasingly entering mainstream finance, and many jurisdictions have already developed regulatory approaches for stablecoin issuers pegged to a single fiat currency.”

Stablecoins drive remittances in Central America and Africa

One of the most powerful use cases for stablecoins is cross-border transfers and remittances, especially in Central America and Africa, where these digital assets provide cheaper and faster alternatives to cross-border capital flows.Immigrants working in the United States often find stablecoins to be a tool that is more convenient to send money to their families in the country.

“Stablecoins have gained some attention both domestically and cross-border payments,” Prasad, who teaches trade policy at Cornell University in the United States, told Cointelegraph.“They have played a particularly useful role in overcoming the inefficiency, high cost and slow processing time of cross-border transactions conducted through traditional payment channels.”

Speaking of the popularity of stablecoins in remittances, Colombo said, “Before cryptocurrencies emerge, the remittance service could charge up to 10% fees, just to transfer money from one country to another. With cryptocurrencies, you mightThere are some extra money to transfer to Mexico, and the transfer may only take a cent – it can be reached in minutes, not hours or days.”

More cases of stablecoins for non-cryptocurrency use

In a Visa-sponsored report, researchers surveyed about 500 cryptocurrency users in Nigeria, Indonesia, Turkey, Brazil and India, totaling 2,541 adults.While obtaining cryptocurrencies is still the most popular motivation to use them, non-cryptocurrencies such as acquisition of US dollars, generating revenue or trading purposes are also very popular.

Stablecoin questionnaire results.Source: Castle Island Ventures.

The survey shows that Nigerian users have the strongest affinity for stablecoins compared to other countries surveyed.Nigerians trade the most frequently, have the largest share of stablecoins in their portfolios, use them for the widest range of non-crypto uses, and have the highest level of knowledge about stablecoins.Saving dollars is their top priority.

Zekarias Dubale, co-founder of the African FinTech Summit, said that throughout Africa, stablecoins have become the “holy grail” of cross-border trade, international remittances and value transfer across the continent.He believes that these digital assets can provide the financial infrastructure needed to facilitate global trade.

However, stablecoins are not without risks.While the most widely used stablecoins have basically maintained a peg to the strong fiat currencies they are designed to reflect, the market is expanding rapidly, with hundreds of digital assets currently in circulation.However, many of these assets lack transparency to support their reserves, and stablecoin decoupling occurs from time to time and in some cases even collapse.

Still, stablecoins are in strong momentum in the U.S. and emerging markets under the Trump administration, and they prove to be a powerful tool to help citizens overcome challenges related to financial inclusion and underdeveloped infrastructure.