In recent weeks, discussions on improving blob throughput in Pectra have become increasingly fierce, and two major camps have emerged.One side supports increasing throughput, while the other side is more cautious and tends to wait for clearer data to support this change.

In my opinion, a sentiment in the community has become very clear: independent stakeholders are at the heart of Ethereum.

Although there is no consensus on the minimum requirements for validators (see sassal.eth tweet Article 12), the Ethereum community has shown one thing: we are reluctant to sacrifice independent/family pledgers for linear scaling.

In my opinion, this reflects the healthy development of Ethereum and emphasizes the community’s emphasis on the feasibility of independent staking.

However, this also raises an important question: “Where is the bottom line?”

Specifically, what is the role of low bandwidth and weak contribution stakeholders in decentralization at which point is no longer enough to offset their limitations on Ethereum’s scaling capabilities?

In this article, I want to provide more data points to help the community decide more wisely whether to pursue increased blob throughput in Pectra.

As Prysm core developer Potuz1 said, the real question is not “whether we want to scale, how to scale”, but “are we ready to scale now?”

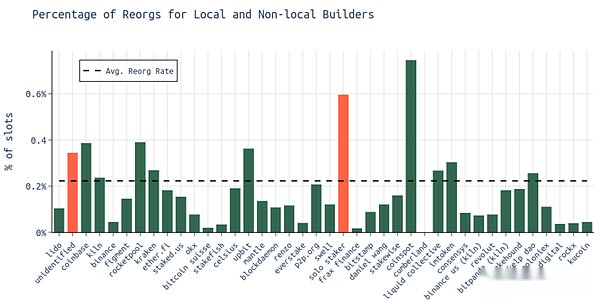

1. Who is undergoing reorganization?(October 2023 – October 2024)

On average, about 0.2% of blocks are reorganized (the reorganized block is part of the leaked block).Professional node operators (NOs) like Lido, Kiln, Figment, and EtherFi are reorganized below average.

Less professional node operators, such as independent stakers, Rocketpool operators, and unidentified categories (which may contain a large number of unidentified independent stakers), are more frequently experienced reorganization.

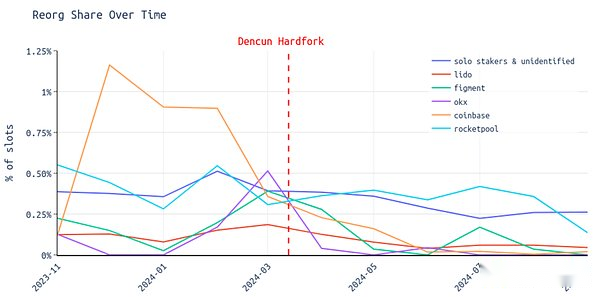

As shown in previous analysis 1, the restructuring rate has shown a downward trend since the Dencun hard fork.

In the figure below, we can see that this effect varies between different entities:

Since Dencun, the reorganization rate of independent stakers and unidentified nodes has declined.

The restructuring rate for Rocketpool operators, as well as large operators like Lido, Coinbase, Figment and OKX, is also reduced.

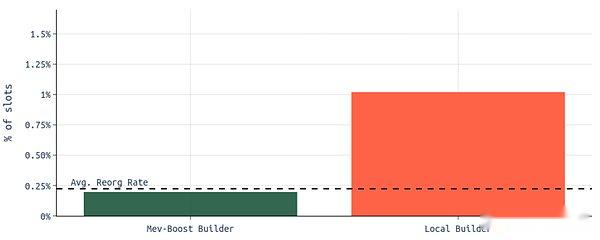

2. How is the block construction in this region?(October 2023 – October 2024)

The restructuring rate for local builders is about 1.02%.

The restructuring rate for MEV-Boost builders is about 0.20%.

Local builders are about 5 times more likely to experience reorganization than MEV-Boost builders.

The proportion of reorganizations for block builders in this region appears to remain unchanged after the Dencun hard fork, or even rise.

For MEV-Boost users, the restructuring rate has been on a downward trend since Dencun.

It is worth noting that previous analysis shows that local builders include more blobs in their blocks on average.In addition, we also observed that after the Dencun hard fork, blocks containing 6 blobs faced some challenges at one time, but eventually returned to stability.This may explain why the restructuring rate of local builders has not declined.

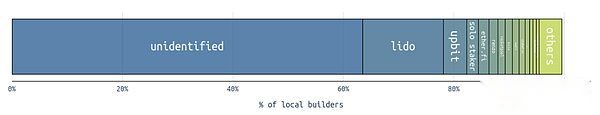

3. Who is the local builder?(October 2023 – October 2024)

Independent stakers (marked here as “independent stakers”, but many of them belong to unrecognized categories) are the largest entities in the “local builders” category.

In addition, there are some Lido node operators that do not use MEV-Boost at all, or use the lowest bid sign.

Key Insights

Independent stakers are more likely to miss slots than professional verifiers.

Independent stakeholders often choose to build blocks locally rather than using MEV-Boost.

Block builders in this region cannot enjoy the fast propagation benefits provided by MEV-Boost relays.

Relay adopts a time strategy (e.g., relay delay, leaving time to wait for more profitable blocks).

Era boundaries lead to an increase in reorganization.

A variety of factors can lead to reorganization, so it is difficult to accurately determine why some validators (such as independent stakeholders) experience reorganization more frequently than others.