Author: Carl Cervone,Gitcoin team member Source: Mirror Translation: Shan Ouba, Bitchain Vision Realm

Each financing ecosystem has core areas and important but secondary areas

Gitcoin showed the concept of nested scope in a blog post in 2021.The original article describes a series of influencing funding mechanisms, which were originally concentrated in the inner circle (“encryption”), overflowing to the next circle (“open source”), and eventually spreading all over the world.

>

This is a good saying: starting from solving the problem at the door, and then expanding outward.

Optimism also uses a similar visualization to explain its vision of funding for traceability public products.

>

Optimism belongs to Ethereum, Ethereum belongs to “all Internet public products”, and “all Internet public products” belong to “global public products”.Each external domain is a super set of its internal domain.

The following is a summary version of my four -layer concentric circular model.

>

Even if I personally have never spent time thinking about the diversity of deep -sea biological diversity or noise pollution in Kolkata, there must be many people who care about these issues.Just aware of something, it often moves it from “everything” to “what I want others to care about” circle.

Most of us cannot evaluate important things other than our “intimate circle layer”

-

We can usually be able to reasonably assess the close contact in our daily life.This is our core circle and something we absolutely cares about.

-

In a organization, the core circle may include your teammates, the projects you close to cooperate, and the tools you often use.

-

We can also evaluate some (but may not be all) from the upstream or downstream things from our daily circle.These are things we sometimes care about.

-

Taking software packages as an example, the upstream may be your dependency item, and the downstream may be a project that depends on your bag.Taking an education course as an example, the upstream may include valuable courses or resources that affect the course, and the downstream may include students who recommend courses to friends.

-

Software developers and educators can pay more attention to upstream research, as well as institutions that manage these research, and so on.Now we have entered the field of “care for everything”.

However, most rational people will not have deep concern about anything at this point.Once the single -layer correlation is exceeded, the situation will become blurred.These are things we want others to care about.

We use the distance as an excuse for not funding these things and the risk of continuing to take a car.

Although everything in our core circle depends on the good funding support of the peripheral circle, it is difficult to defend the funds that exceed our “fair share” (calculated anyway) for things that are beyond the single -layer association.There are several reasons that lead to this:

-

First of all, it is difficult to classify sorting on a large scale.Categories like “all Internet public products” are very broad. As long as it is a little bit solved, almost anything can be considered to be this category and worthy of funding.

-

Secondly, it is difficult to inspire stakeholders to care about funding to fund them outside the close circle, because the impact is too scattered.I would rather fund the entire individual in the team I knew, and I didn’t want to help a small part of the unknown person in the team that I didn’t know.

-

Finally, if these things are not funded, there will be no direct consequences -of course, this assumes that others will continue to fund them without giving up.

Therefore, we encountered the classic “ride” problem.

In addition to the government that can print money, taxation and issuance bonds to pay long -term public product projects, we are funded as a mechanism that lacks a good society to fund us.Most funds have flowed to a shorter return cycle and more direct things.

One way to solve this problem is to allow people to focus on things that they are familiar with (that is, they can personally evaluate), and establish a mechanism to continue to push some funds to the periphery.

By the way, the flow of private capital operates.We should try some characteristics of private capital.

Risk investment model is suitable for the reason for funding the short -term/mid -term without return project: combined and easy to divide

Investment with venture capital to fund the return period for 5-10 years or more long -lasting hard technology projects, this model has been verified -it is called venture capital (VC).It is true that the amount of capital flowing to the long -term project is more affected by interest rates rather than the ultimate value.However, from the past few decades, venture capital can attract and deploy trillions of dollars, which proves the effectiveness of the model.

The reason why the venture capital model works is to a large extent because the risk investment (and other sources of investment funds) has the characteristics of combined and easy to divide.

-

Combined: It means that you can obtain venture capital at the same time, you can conduct IPOs, obtain bank loans, issue bonds, raise funds through more alternative mechanisms, etc.In fact, this is even expected.All these financing mechanisms can be operated.

-

The reason why these mechanisms are combined well is because it clearly stipulates which ownership of which ownership, and how cash is allocated in different circumstances.In fact, most companies use a variety of financing tools during their life cycle.

Investment capital is also easy to divide.Many people pay the same pension fund.Many pension funds (and other investors) will become limited partners (LP) of the same venture capital fund.Many venture capital funds invest in the same company.All these divisions occur on the company and their daily operations.

These characteristics enable private capital to move efficiently in complex network diagrams.If a company supports a liquidity event (IPO, acquisition, etc.) supported by venture capital, the income will be between the company and its venture capitalists, venture capitalists and their limited partners, the pension fund and their retirees, and even retirement from retirement.Personnel to be efficiently distributed between their children.

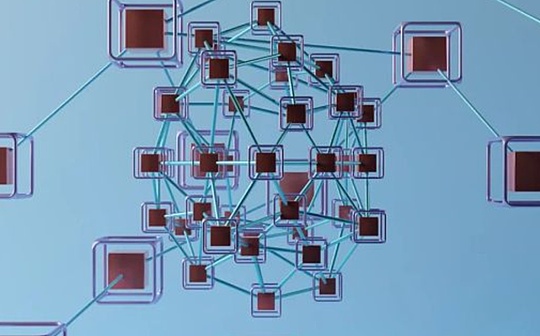

However, the capital flow of public product networks is different.The public product network does not like a large number of intricate irrigation channels, but more like a few large water storage towers (governments, major foundations, high net worth individuals, etc.).

>

What needs to be clear is that I am not advocating to provide venture capital funds for public products itself.I just point out the two important features of private capital, which is not available for public capital.

How to make public products get more funds from our intimate circle

Optimism has recently announced a new plan for traceability in its ecosystem.

In the last round of Optimism, the scope of funding is very wide.However, it is foreseeable that the scope of future funding will be more narrow and will be closer to the upstream and downstream links that are closer to its value chain.

>

Optimism how to consider the impact of upstream and downstream currently

It is understood that the feedback is mixed for these changes.Many projects in the scope of funding are now excluded.

The newly announced first round of funding will reserve 10 million tokens for the “developer on the chain”.In the third round of financing, the funds of the developers on the chain are extremely low, accounting for only about 30 million pieces of about 1.5 million pieces.So how will these projects use 2-5 times the previous traceable funds?

One thing they can do is to use some tokens for their own traceability or gift rounds.

Specifically, if OPTIMISM funded the DEFI application that promoted the use of the network, these applications can fund the front -end and investment portfolio tracker to realize the impact of these applications.

If Optimism funded the core dependencies of the OP stack, these teams can fund their own dependencies and research contributions.

If the project takes away the traceable funds they deserve, what will happen to the remaining funds?

This has occurred in various forms.Ethereum proves that there is now a scholarship plan that is used to fund the team that is built above its agreement.POKT has just announced its own traceable funding to invest all tokens from Optimism (and Arbitrum) to this round.Even the third round of beneficiaries Kiwi News, which ranked lower than the median, also implemented its own version for the traceability of community contributions.

At the same time, Degen Chain has created a more crazy concept, that is, to allocate tokens for community members, they must presented to other community members in the form of “tip”.

All these experiments have expanded the scope of influence from the central pool (such as OP or DEGEN Treasury Ministry of Finance) to the edge.

The next step is to start making these promises clear and verified.

These attempts are happening in various forms.Ethereum proves that there is now a scholarship plan that is used to fund the team that is built above its agreement.POKT has just announced its own traceable funding to invest all tokens from Optimism (and Arbitrum) to this round.Even the third round of beneficiaries Kiwi News, which ranked lower than the median, also implemented its own version for the traceability of community contributions.

At the same time, Degen Chain has created a more crazy concept, that is, to allocate tokens for community members, they must presented to other community members in the form of “tip”.

All these experiments have expanded the scope of influence from the central pool (such as OP or DEGEN Treasury Ministry of Finance) to the edge.

The next step is to make these commitments clear and verified.

One way is to make the project determine oneFloor ValueOnePercentage than the minimum value (Percentage Above the Floor)They are willing to put them into their own funds pools.For example, perhaps my minimum value is 50 tokes, and I am higher than the minimum value of 20%.If I receive a total of 100 tokens, then I will allocate 10 tokes (I am more than 20%higher than the minimum value of 20%) to fund the edge of my network.If I only receive 40 tokens, then I keep all 40.

(By the way, my project also did a similar thing in the last Optimism funding activity.)

>

In addition to pushing more funds to the edge, this also helps to establish the cost basis of public product projects and play a key role.In the long run, for those projects that continue to receive less than expected funds, information is their mistakenly priced their work, or their funding ecology has estimated its value.

The projects with surplus will not only evaluate their own influence in the subsequent rounds, but also evaluate a broader impact on the widespread impact of their good funds.It is not necessary to bear the project that the burden of operating its own donation plan should choose to store surplus in other effective places, such as the Gitcoin matching pool, agreement trade union, and even destroy!

In my opinion, the two values determined by the project before receiving the funds should be kept confidential.If a project receives 100 tokens and gives away 10, then anyone else should not know whether their value is (50, 20%) or (90, 100%).

The last step is to connect these systems.

The examples of EAS, POKT and Kiwi News are encouraged, but they all need to start a new plan, and then ask for/exchange/transfer/transfer to the new wallet to the new group of new receivers.

A protocols such as DRIPS, Allo, Superflum, and Hypercerts provide infrastructure for more synthetic gifts -now we need to connect the pipeline, just like this pilot of Geo Web.

The work of this round is to create a truly effective public product funding system.Then we started to promote them.

At present, the stage of the encryption field is still in the stage of experimenting with a large amount of funds allocation and determining the mechanism of funding.The complexity of public product funds channels, combined avitilliveness and extent that after actual combat inspection are far less than DEFI.

In order to allow any technology to expand outside the experimental stage, we need to solve the following two problems:

-

It is not only effective to measure these methods, but also more effective than the traditional public product funding model (see this post, explaining why this is an important issue that people need to work hard, and this post contains some vertical analysis on the influence of Gitcoin).

-

Clearly promise how to make “profits” or remaining funds flowing to the peripheral circle.

In venture capital, there will always be investors behind investors -eventually your grandmother (or more precisely, the grandmother of everyone).Each investor has an incentive mechanism that prompts them to effectively allocate capital so that they will be commissioned to distribute more capital capital in the future.

For public products, you always have a group of closely related participants in upstream and downstream, and your job depends on them.At presentno promisesShare the surplus back to these entities.Unless this commitment becomes the norm, it is difficult to expand public product funds outside our intimate circle.

>

I think it is not enough to promise that “when we reach a certain scale, we will fund those things”.It’s too easy to change the goal.Instead, these commitments need to be established as soon as possible and integrate into the funding mechanism and gift plan as the original language.

I don’t think it is reasonable to expect that a few giant whale foundations will fund everything.This is exactly the “water storage tower” model we currently see in the traditional government and foundation.

However, the earlier we clearly promise to fund our dependencies when the scale is smaller, the more we can show that the public product does exist in the market, the more we can expand the target market (TAM) and change the incentive pattern.

Only in this way can we have a real thing that is worth promoting. It will gather our own momentum and create the “diversified, civilized public product fund infrastructure” in our dreams.