Original title: Bitcoin Halving.

Author: Jasper de Maere, the person in charge

After four months of Bitcoin, we have witnessed the worst price performance after half of the decrease.In this article, we will explain why the reduction is no longer a fundamental impact on the prices of BTC and other digital assets. The fundamental impact of the last minus halving is traced back to 2016.With the maturity of the digital asset market, the founders and investors are time to get rid of the concept of the four -year cycle.

Points in this article:

-

Half in 2024, the fifth period for Bitcoin to halve,,BThe TC price performed the worst within 125 days after halving.The price fell by-8% compared to half compared to the dayThe average increase in the previous period was+22%.

-

We believe,In 2016, production reduction is the last time that the decrease of halving on the price of BTC has a significant fundamental impact on the price trend of BTC.EssenceSince then, in the context of increasingly mature and diversified encryption markets, the scale of BTC block rewards of miners has become insignificant.

-

After the halving in 2020, the strong performance of the BTC and the cryptocurrency market is purely coincidental, becauseHalf of 2020 occurred in the world’s unprecedented capital injection period after the new crown epidemic.The currency supply (M2) of the United States alone (M2) in that year increased by 25.3%.

-

Some people think4 yearsThe cycle is still established in 2024, but in January 2024As a result, BTC rose strongly before halving.This statementIt’s wrong.BTC ETF approval is a catalyst for demand -driven, and halving is the catalyst for supply -driven, so they do not exclude each other.

Bitcoin prices have a significant impact on a wider market, so it also affects the founder’s through equity,SAFTAnd the ability to raise funds for private placement or token sales.In view of the liquidity brought by cryptocurrencies for venture capital, the founder must understand the top -down market -driven factors in order to better predict financing opportunities and predict its development trajectory.In this article, we will disassemble the concept of the four -year market cycle and lay the foundation for the real driving factor for exploring future work.The truth to expose the four -year cycle does not mean that we have a confused view of the overall market.

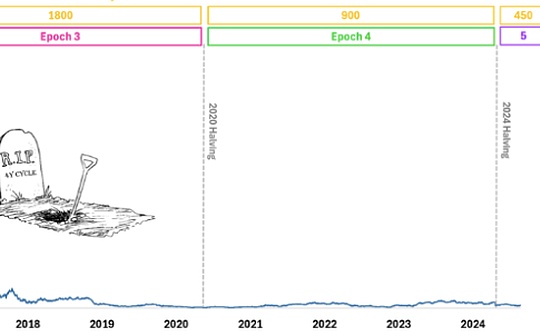

Let’s first look at the price performance of BTC before halving the past few cycles.Obviously,In the 125 days after halving, the 5thThis cycle (2024) is the worst period since halving, and it is also the only cycle of BTC price decline compared to half the day.

picture1: Different cycles are halved aroundBTCPrice performance

source:Outlier Ventures

So what effect does the reduction in the price?In short, there are two main reasons.

-

Fundamentals:Bitcoin is half reduced to new supply, resulting in scarcity. When demand exceeds limited supply, prices may increase.This new dynamics also changed the economic situation of the miners.

-

Psychological level:The decrease of Bitcoin has enhanced people’s awareness of scarcity, strengthened the expected price of prices based on historical models, and attracted the attention of the media, which can increase demand and push the price.

In this article, we thinkThe fundamental driving factor behind the price trend of BTC has been exaggerated, and it has been unrelated in the past two cyclesEssenceWe will combine these numbers to proveThe net effect of halving is not enough to have a significant impact on the price of BTC or a broader digital assets.

Preliminary Observation -Daily BTC Block Inspiration

If you learn one thing from this article, it is:

The most powerful argument for the halves on the market is that in addition to reducing BTC inflation, it also affects the economic conditions of the miners and leads to changes in their financial management.

So,Let’s consider extreme situations, that is, all mining block rewards will be sold immediately in the market.How much will it be of selling pressure?Below, the daily total block rewards (in the US dollar) obtained by all miners will be evaluated in addition to the total transaction volume in the market (in the US dollar) to evaluate the impact.

Until mid -2017, the impact of miners on the market exceeded 1%.Today, if the miners sell all its BTC block rewards, it only accounts for 0.17%of the market transaction volume.Although this does not include the BTC accumulated by the miners before, it shows thatWith the decrease in block rewards and the market maturity, the impact of BTC block rewards has become insignificant compared with the entire market.

picture2: If all miners sell their dailyBTCBlock rewards may have the impact on the market

source:Outlier Ventures

Review -Half the impact

Before we continue, look back quickly.Bitcoin is halvedIn the event of about every four years, the block rewards of the miners are reduced by halfEssenceThis reduces the generation of new BTCs, thereby reducing new supply in the market.BTC’s generalThe upper limit of the supply is 21 millionThe speed of this upper limit will become slower at half time.The period between each halving is called a cycleFrom a historical point of view, a halving at a time will affect the price of Bitcoin, because the supply decreases and the scarcity increases.All content is explained in Figure 3.

picture3: Bitcoin minus dynamic, block rewards, total supply and cycle

source:Outlier Ventures

Bitcoin halve performance

Starting from the most important thing for many of us, the impact on price performance, we findThe performance after 2024 is the worst since the birth of BTCEssenceAs of today (September 2, 2024), the price of BTC transactions was about 8%lower than the price of 63,800 US dollars on April 20, 2024.

picture4: After halving each timeBTCPrice performance

source:Outlier Ventures

“What is the situation before 2024 halved?“Indeed, we experienced an unusually strong trend before halving.Looking back at the performance before 2024, we found that BTC increased almost 2.5 times.This is almost the same as the second cycle,,At that time, 99%of BTC accounted for 99%of the total market value of digital assets, which was still meaningful.

picture5: Before halving each time200HeavenlyBTCPrice performance

source:Outlier Ventures

Having said that, it is also important to remember what happened during that time.2024At the beginning of the year, we received the approval of BTC ETF. Since January 11, 2024, the net inflow of BTC ETF has reached 299,000 BTCs.Greatly promoted the rise in prices.So to be honest.The rise is not from the expectation of the halvedEssence

Figure 6 shows the BTC performance between BTC ETF approval and halving.In January 2024, the approval of BTC ETF increased the demand for BTC, resulting in the 100 -day increase in the 5th cycle increased by the average cycle +17%.

picture6: Before halving each time200HeavenlyBTCPrice performance

Source:Outlier Ventures, Google

Figure 7 shows the performance of BTC ETF’s approval and BTC half after half a day.Obviously, the role of ETF’s approval on the price trend is more significant than halvedIt can be seen from the about 29% gap between 100 days of performance.

picture7: After half100skyBTCPerformance andETFcatalyst

source:Outlier Ventures

“therefore,BTC ETFPromote the needs and price trends we usually see in advance!”

This is a weak argument for the 4 -year cycle.The fact is,Both catalysts are independent and independent of each other.ETFIt is a catalyst with demand -driven, and halving is considered a catalyst for supply -driven.They do not exclude each other. If it is still very important, we should see a significant price trend with the support of this dual catalyst.

2016 is the last time

I think the 2016 and third cycles are the last time the decrease of halves on the market.As discussed in Figure 2, the following figure shows that if all miners are sold on the day of block rewards, the impact on the market.As you can see, around the mid -2017, this proportion fell to less than 1%, and today there are almost no more than 0.20%, which indicates that the impact of halving is minimal.

picture8: If all miners are sold dailyBTCBlock rewards, which may have the impact on the market

source:Outlier Ventures

In order to understand the decline in the importance of the financial decision -making of miners, let’s take a closer look at different variables that work.

variable:

-

Daily BTC block reward total amount– Every cycle will decrease (↓)

-

Daily transaction volume BTC– As the market matures, it rises (↑)

→ Over time, block awards will decline, and the market will gradually mature, thereby reducing the correlation of the influence of miners.

Figure 9 shows the BTC transaction volume and the cumulative BTC block rewards of the miners.The sharp rise in transaction volume is the real reason for the relevance of miners’ block rewards.

picture9:dailyBTCMiner rewards and daily transactions

source:Outlier Ventures

For those who were present at the time, it was obvious that it promoted the growth of transaction volume during that period.Looking back: After the launch of Ethereum and unlocking the smart contract function in 2015, the ICO boom followed, resulting in many new token on the Ethereum platform.The surge in the issuance of new token has led to a decline in BTC’s dominant position.ExcitingThe influx of excitement of new assets (i) promoted the trading volume in various fields of the digital asset market, including BTC; (ii) incentive exchanges to mature faster, making them easier to attract users and handle a larger transaction volumeEssence

picture10: First3New cycleEthToken issuanceBTCDominant position

source:Outlier Ventures

So … What about 2020?

Many things happened in the third cycle. Logically, this reduced the impact of mining fund management, thereby reducing the impact of halving as the BTC catalyst.What about 2020?That BTC rose about 6.6 times within one year after half.This is not because of halving, but because of the issuance of unprecedented currencies for cope with COVID-19.

Although the halving is not a fundamental factor, it may affect the price trend of BTC from a psychological perspective.As BTC becomes headlines before halving, it provides a goal for people to invest in excess capital when there are almost no other consumer choices.

Figure 11 shows the real reason for the rebound.At onceA few months ago in May 2020, US currency supply (M2) soared at unprecedented speeds in modern Western historyIt triggered the speculation and inflation including various asset categories including real estate, stocks, private equity and digital assets.

picture11The2020U.S. currency supply is half -year -old US currency supply(M2)andBTCprice

Source:Outlier Ventures, Federal Reserve Bank

In addition to flowing into BTC, it is important to realize that the money printing activity occurred after Defi Spring, and then developed into a summer summer.Many investors are attracted to the seductive income opportunities on the chain and put capital into cryptocurrencies and practical tokens to obtain this value.Because all digital assets have a strong correlation, BTC naturally benefits from it.

picture12TheUS currency supply (M2)andDEFI TVL

Source:Outlier VenturesAs well asDefalama

When halved just happened,A variety of factors promoted by global helicopters have triggered the largest cryptocurrency rebound so far, making the change in block rewardsseemIt has a fundamental impact on the price trend.

Supply of remaining miners

“So the remaining surplus held in the vaultBTCWhat about the supply?These supply volume was accumulated in the previous few periods. At that time, the computing power was low, and the block rewards were high.“

Figure 13 studies the supply rate of miners, that is, the total amount of BTC held by the miners is except for the total BTC supply, which effectively shows how much supply of the miners controlled.The impact of miners’ vault decisions on the price of BTC is largely the result of their block rewards accumulated in the early days.

As shown in the figure,The supply ratio of miners has been steadily declining, currently about 9.2%.Recently, miners’ sales of BTCs have increased, which may be to avoid much impact on market prices.This trend may be due to low block rewards, high hardware and energy input costs, and the price of BTC have not risen sharply -forcing miners to sell their BTCs faster to maintain profit.

We understand the impact of halving the profitability of mining industry, and they need to adjust the management of funds to maintain profitability.However, the long -term development direction is clear.The impact of the price of Bitcoin will only decrease only over time.

picture13: The proportion of miners and the turnover rate of month -on -month changes

source:Outlier VenturesAs well asCryptoquant

in conclusion

Although the decrease may have some psychological effects, reminding the holders to pay attention to their dusty BTC wallets, but it is obvious that its fundamental impact has become irrelevant.

The last meaningful decrease was in 2016.In 2020, it was not halved, but the response to COVID-19 and the subsequent printing for COVID-19.

For the founders and investors trying to grasp the market timing,It’s time to pay attention to the more important macroeconomic driving factors, rather than rely on the four -year cycleEssence

Considering this, we will explore the true macro -drives behind the market cycle in the future tokens.