Author: Jack Inabinet, Bankless; Compilation: White Water, Bit Chain Vision Realm

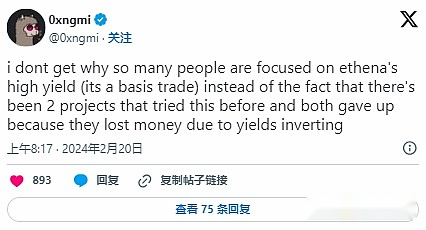

Ethena occupied the dominant position of Defi in 2024. Although its synthetic dollar received a lot of criticism and attention at the time of launch, as traders poured to the agreement, the team’s efforts have become the most noticeable success of Defi this year’s attention this year.One of the stories.

A signal shows that as other DEFI participants want to seize Ethena’s growth prospects, the basis trading tokens have just begun.

In recent months, the market bubble has greatly increased Ethena’s revenue and transformed ENA into the best cryptocurrency company.

Today, we discuss Ethena’s successful story in 2024.

Explosive growth

Ethena accepted the first public fundraising on February 19th. During the month of the main network, the circulation supply of USDE has exceeded all stable currency competitors except five stablecoin competitors.

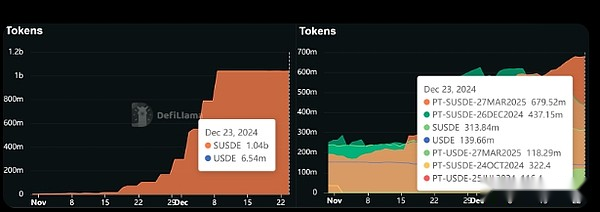

Due to its considerable airdrop incentives and the hottest financing interest rate environment throughout the year, the USDE supply will not be expanded to US $ 2.39 billion before mid -April, and then due to the weakened excitement of ENA airdrops and the cooling of the cryptocurrency market,Fall in stagnation.

Although Ethena subsequently decided to reduce insurance funds on May 16, temporarily revive the USDE and cause a monthly supply to expand by 50%, the continuous compression of the funding rate of the entire third quarter caused losses.By September, the rise in USDE supply has been completely reversed, and ENA prices have fallen by 86%compared with the issue.

Although Ethena’s funded interest rate arbitrage strategy is already possible for any traders who are familiar with futures, the problem is that the funds that mortgage these transactions must be locked on the exchange (whether in CEFI or DEFI), which makes them unable to be caught.locking.

Through the Ethena method, this basic transaction position itself becomes “tokenization” and is expressed in USDE to allow traders to make additional benefits or borrowed assets they hold in DEFI.

Although third -party applications were initially hesitated to quickly incorporate USDE mortgages, due to simple income economics, Ethena’s synthetic US dollar now dominates the crypto credit market.

The income provider cannot face the risk of reducing deposit or excessive borrowing demand with the leading competition with the Ethena market.This dangerous dynamics may set the borrowing interest rate to much higher than the market value through algorithms. When the financing interest rate soared again in November, many DEFI borrowing markets crazy to buy billions of dollars in US dollar derivatives mortgage.

In just a few weeks, the upper limit of the deposit of Aave Susde soared to $ 1 billion (in early November, the Ethena mortgage held by the loan market was only $ 20 million).At the same time, other loan parties on MakerDao and Morpho are absorbing 1.2 billion US dollars in PENDLE SUSDE main tokens (PT), which are extremely high with a maximum of 91.5% of the maximum leverage.

Unparalleled assets?

Ethena’s assets are now intertwined with the blue -chip DEFI. ENA is very interested in this. From the low point in September, it has rebounded more than 500%, which is impressive and eventually stable at a high point after the release.

Although the negative fund interest rate environment is a known risk that may cause USDE Mono to suffer losses,However, many cryptocurrency observers optimistically believe that Ethena’s recently deployed U.S. Treasury products (USDTB) may become a suitable basic transaction alternative, establishing a lower limit for Ethena reserves.

Having said that, the capital interest rate is essentially unstable, andHow Ethena appropriately responds to long -term negative funds interest rates, there are great uncertainty.If the loss must be achieved to convert the existing synthetic US dollar to the mortgage of government bonds, USDE investors may start selling tokens to avoid additional losses, which will lead to further redemption, which may cause USDE to be forced to clear upOr trigger the crisis of trust in the entire market.The liquidation occurs in a light market with high hedging demand (that is, in the market downturn).

Ethena’s core is an unsupervised token -based hedge fund.Although its basis trading has achieved great success in the fourth quarter of 2024, investors should still consider the various unknown factors of the agreement, and these unknown factors may have problems when the financing interest rate changes.