Recently, the closure Hong Kong Exchange Atom ASSET (AAX) has begun to transfer funds from its wallet to various decentralized exchanges and centralized platforms, which is said to be to avoid anti -money laundering (AML) control.

Before being discovered, the last known transactions involved in AAX exchanges wallets occurred in October 2023 and November 2022.Before closure, AAX was one of the largest cryptocurrency exchanges in Hong Kong and had more than 2 million users.

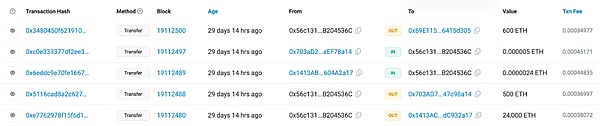

According to the analysis of the Beosin team, it was found that since January 29, 2024, the AAX Exchange began to transfer 2,5100 ETH out of its exchanges. Among them600ETH, a 24000 ETH.The transfer funds converted more than 74 million US dollars according to the current price.What is going on, what other unspeakable chains are strange on this exchange, please continue to watch with us.

AAX exchange incident

On November 13, 2022, two days after the cryptocurrency exchange FTX applied for bankruptcy, AAX also stopped withdrawing withdrawal due to the exposure of the risk of the transaction and cleared all social channels.Initially, AAX will be frozen due to security measures against malicious attacks.

>

On November 15, 2022, the AAX Exchange issued a statement saying that its platform needs to be maintained. In addition to the suspension of withdrawal, the derivatives will be automatically liquidated.Since then, AAX has stopped platform operation and social media updates.

>

The strange thing is:After 426 days of silence, the AAX Exchange wallet began to move, and a large amount of funds began to transfer to other addresses. Try to avoid the recognition and monitoring of AML tools!

>

link: https://etherscan.io/address/0x56c1319b316a327bd889d58633b204536c

Analysis of funds on the AAX exchange event chain

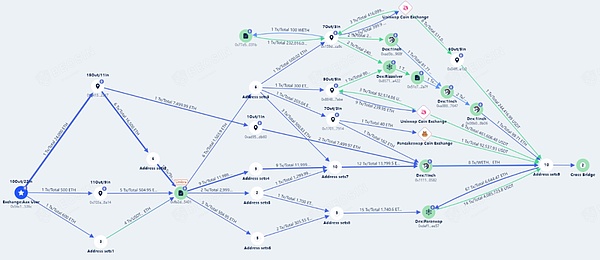

The Beosin Kyt Anti -Money Laundering Analysis Platform conducted in -depth research on the recent chain activities of the AAX Exchange’s wallet, and discovered a series of risk activities.First of all, all 25,100 ETH has been transferred. The operator has adopted various means to convert some ETH to USDT, and then the funds are transferred to different blockchains through the Cross Bridge cross -chain bridge to clean the funds.

>

Beosin Kyt Anti -Money Laundering Platform

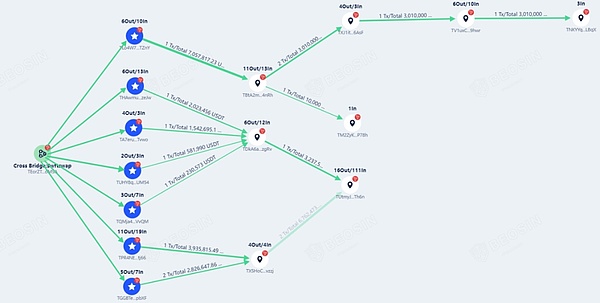

Among them, most of the funds were transferred to the TRON blockchain, and some addresses were transferred, and then it was deposited in certain addresses without transferring.This behavior shows the obvious attempt to escape AML, trying to cover up the real source and whereabouts of the funds.

>

Beosin Kyt Anti -Money Laundering Platform

The Hong Kong police quickly took action against fraud and arrested two people related to AAX. At present, they are working hard to draw the path of transfer funds and find the assets of the affected users.

The AAX exchange uses technical means such as decentralized exchanges, cryptocurrency exchange and cross -chain bridges to try to blur the path and source of the flow of funds.This has brought huge challenges to regulatory agencies and AML analysis platforms.

How to solve the problem of cryptocurrency money laundering?

Due to the anonymity, convenience and decentralization of encrypted assets, criminals will choose to use crypto assets to transfer their illegal profit funds.Regulatory agencies and virtual asset service providers (such as cryptocurrency exchanges, crypto wallet providers, crypto asset payment processors, etc.) are facing challenges such as anti -money laundering and anti -terrorist financingEssence

For regulatory agencies, relevant departments should improve and implement regulatory policies to ensure that virtual asset service providers abide by AML and KYC regulations, and at the same time strengthen cooperation with regulatory agencies with various countries and regions to jointly crack down on cross -border money laundering activities.

For virtual asset service providers, the following is an effective measure to prevent illegal funds:

1. Implement strict KYC and AML regulations

Exchange should require users to conduct comprehensive authentication and ensure that they meet the requirements of KYC and AML.This includes collecting users’ identity information, address verification and other necessary materials.

2. Monitor trading activities

Virtual asset service providers should implement real -time monitoring systems in order to detect and analyze suspicious trading activities.This includes information such as monitoring transactions, frequencies, sources and destinations.The exchange can use Beosin Kyt to locate each transaction, portraits users, rated the transaction, and identify criminal behavior on the chain, thereby reducing the risk of criminals using virtual asset money to launder.

3. Establish a report mechanism

Virtual asset service providers should establish a report mechanism to report any suspicious transactions or activities through risk control systems.Virtual asset service providers should handle these reports in a timely manner and cooperate with regulatory agencies to investigate.Beosin Kyt can issue suspicious transaction reports (STR) for virtual asset service providers to help regulatory agencies and law enforcement agencies conduct evidence collection surveys.

4. Strengthen cooperation and exchange

Virtual asset service providers should actively cooperate with security companies, regulators and law enforcement agencies to jointly combat money laundering activities.It is foreseeable that criminals will continue to adjust and improve their money laundering strategies to adapt to regulatory measures and changes in AML tools.They may adopt decentralized transactions, use concealed trading paths, or use technical vulnerabilities to hide illegal funds.Virtual asset service providers should cooperate and exchange with security companies on a regular basis to identify and cope with these changes in a timely manner.

Beosin focuses on the continuous update and optimization of KYT’s anti -money laundering tools. We continuously monitor the industry’s dynamics and new security threats, and apply the latest analysis results and data to the improvement of the Beosin KYT tools.This continuous update and optimization ensures that Beosin Kyt can maintain high sensitivity and accuracy when facing changing malicious money laundering behaviors.