Source: Grayscale; Compilation: Wuzhu, bitchain vision

Nasdaq 100 stocks and Bitcoin are very different but complementary investment portfolios.The Nasdaq 100 includes the largest non-financial stocks listed on the Nasdaq Exchange, a concentrated tech stock.Bitcoin is the first public blockchain and is now the largest crypto asset with market value.[1]Both the Nasdaq 100 index and Bitcoin can be seen as high-growth investments at the forefront of the digital transformation of the economy.In the portfolio, replacing some of the Nasdaq 100 stock investments with Bitcoin allows investors to reduce the risk of U.S. stock concentration and may help optimize risk-adjusted returns.

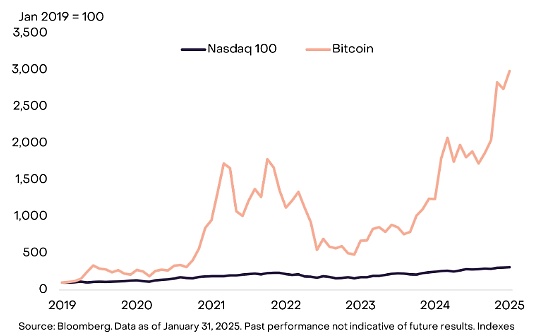

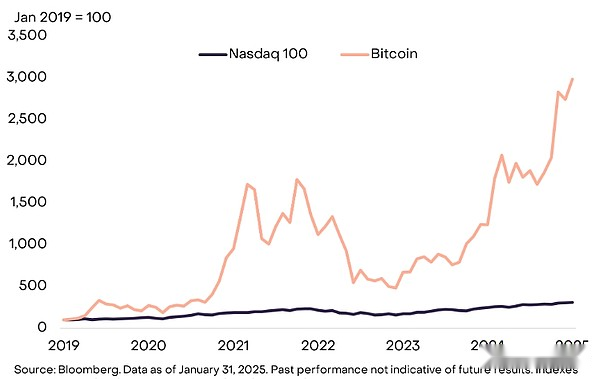

The Nasdaq 100 index returns and Bitcoin returns have moderate correlations, with significant differences in volatility.Since 2019, Bitcoin’s monthly returns have been correlated with the Nasdaq 100 return by about 40% (Figure 1).Meanwhile, the annualized volatility of Bitcoin’s return is 71.5%, while the annualized volatility of the Nasdaq 100 is 20.5%.However, investors who have held for many years will often compensate for the high risk of Bitcoin with higher returns.During this period, Bitcoin’s cumulative return rate was almost 10 times higher: the Nasdaq 100 index rose about 3 times, while the price of Bitcoin rose about 30 times higher.Both Bitcoin and Nasdaq 100 have Sharpe ratios of 1.0.[2]

Figure 1: Since 2019, Bitcoin has been correlated with the Nasdaq index by about 40%, with a return of about 10 times higher

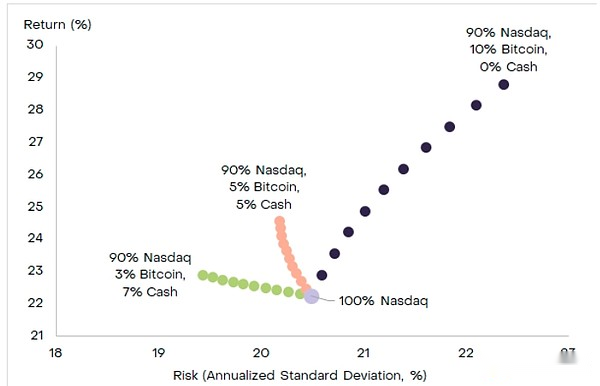

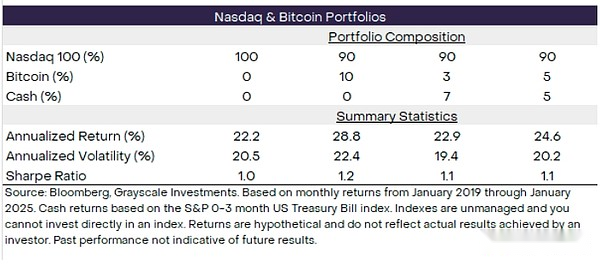

Given these characteristics, in portfolios with NASDAQ 100 positions, the allocation of Bitcoin and cash may be used to increase expected returns, reduce risks without sacrificing expected returns, or to go beyond the “effective frontier”—That is, achieve higher expected returns without increasing volatility.As a hypothetical example, we are here considering the potential impact of transferring 10% of the allocation from the Nasdaq 100 to the Bitcoin and cash combination on the portfolio.[3]

-

Bitcoin may increase expected returns.Since 2019, the Nasdaq 100 has an annualized return of 22.2%, an annualized volatility of 20.5%, and a Sharpe ratio of 1.0.Assuming that 90% of a portfolio is allocated to the Nasdaq 100 and 10% is allocated to Bitcoin, the annualized return is 28.8%, the annualized volatility is 22.4%, and the Sharpe ratio is 1.2 (Figure 2).in other words,Bitcoin allocation will shift the portfolio to a higher risk and return portfolio with certain diversification advantages and a slightly higher Sharpe ratio.

-

Bitcoin reduces risk without sacrificing expected returns.Alternatively, we can consider portfolios allocated to both Bitcoin and cash to reflect higher volatility in Bitcoin.For example, since 2019, assuming that 90% of a portfolio is allocated to the Nasdaq 100 index, 3% to Bitcoin, and 7% to cash, then annualized returns are available at 19.4% volatilityThe rate will reach 22.9%, and the Sharpe ratio is 1.1 – that is, the return rate is slightly higher, and the portfolio volatility will be significantly reduced.This result reflectsBitcoin offers both higher risks and higher expected returns, thus improving the capital efficiency of the portfolio (similar to the strategic use of leverage).

-

Bitcoin is used to go out of the effective frontier.Different combinations of Bitcoin and cash (or relatively low volatility stocks) may put investors in the Nasdaq 100 out of the effective frontier — i.e., achieve higher expected returns without increasing volatility.For example, since 2019, assuming 90% of the portfolio is invested in the Nasdaq 100 index and 5% are invested in Bitcoin and cash respectively, the annualized return will reach 24.6% and the annualized volatility is 20.2%.in other words,Assuming the addition of a balanced combination of Bitcoin and cash, the annualized rate of return will be about 2% higher than investing in the Nasdaq 100 alone, with comparable volatility.

Investors should consider their situation and financial goals before investing in cryptocurrencies.This asset class should be considered high risk and may not be suitable for investors with short-term capital needs and/or high-risk aversion.However,For investors seeking investment in high-growth innovative technologies, Bitcoin may supplement existing allocations such as the Nasdaq 100 stock and may help investors reduce the risk of centralization of U.S. stocks.

Chart 2: Assumption Impact of Adding Bitcoin to the Nasdaq 100 Index Configuration

Comments

[1] Source: Artemis.Data as of January 31, 2025.

[2] Source: Bloomberg, Grayscale Investments.Based on monthly returns data ended January 31, 2025.Past performance does not represent future results.

[3] All results are based on monthly returns between January 2019 and January 2025.