Author: Onkar Singh, Cointelegraph; Compiled by: Tao Zhu, Bitchain Vision

1. In-depth interpretation of market in cryptocurrency trading

In cryptocurrency trading, the market describes the market’s ability to withstand large quantities of orders without a significant impact on prices.

It is a liquidity indicator that shows the number of buy and sell orders for a given cryptocurrency at different price points.So, how is the market depth displayed?Depth maps are often used to illustrate these data.It draws the buy order (bid) on one side and the sell order (quest price) on the other side to reflect the price level.

For example, consider Bitcoin (BTC) order book on exchanges such as Binance.The order book shows all pending buys and sells, as well as their respective quantities and prices.If the buyer of the order book is significantly larger than the seller, it indicates that the buying interest is strong and the buyer’s market depth is high.On the contrary, a larger number of sellers indicates greater selling pressure.

In-depth markets can absorb large-scale transactions and have little impact on prices, thereby providing stability and reducing volatility.For example, if an investor wants to sell 100 BTC in a deeper market, the price may only drop slightly, as there are multiple buy orders at different price points.

On the other hand, because there are fewer buy orders offsetting sells in a shallower market, the same order may lead to a sharp drop in prices.Traders must have a thorough understanding of the depth of the market in order to assess market liquidity, predict price volatility, and execute transactions profitably.Traders can use tools such as in-depth charts and market depth indicators to view and evaluate these data to make informed decisions.

2. Factors that affect market depth

Various factors jointly affect the market’s ability to adapt to large-scale transactions, thereby affecting overall transaction efficiency and price stability.

These factors include:

Liquidity

The market with a large number of buyers and sellers tends to be more liquid and has a deeper market structure.On the other hand, large orders may have a big impact on prices due to fewer market participants with poor liquidity.

Purchase and offer spread

The price difference between the highest bid price and the lowest sell price is small, indicating strong trading activity and more stable markets.Smaller bid-ask spreads usually indicate a deeper market depth.

Exchange popularity and trading volume

The market depths of different exchanges vary greatly.With more active users and greater trading volume, major exchanges such as Binance, Coinbase, and Kraken often offer greater depth.Smaller exchanges may not have this depth, resulting in prices being more susceptible to large orders.

Distribution and scale of orders

Large numbers of small orders indicate a deeper market depth compared to fewer large orders.Small orders ensure more continuous transactions and price stability.

Market Maker Activities

Market makers provide liquidity by regularly reporting the trading prices of crypto assets.Their presence deepens the market by ensuring that both sides of the market always have orders available.

Economic indicators

News and macroeconomic factors may affect market depth.Positive economic news can increase market depth and confidence, but as participants become more cautious, uncertainty can also reduce market depth and confidence.

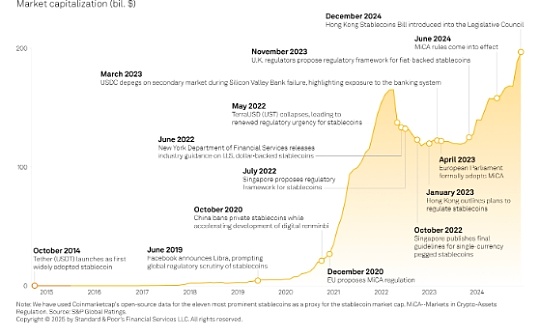

Regulatory environment

Regulations that support fair trading practices and transparency help deepen the market by encouraging investor participation and trust.

Transaction pair

The depth of different trading pairs may also vary.Less popular pairs may have less market depth and trading activity, and are usually shallower than those of major trading pairs such as BTC/USDT or ETH/USDT.

3. How can cryptocurrency traders use market depth to conduct technical analysis?

Market depth is a useful tool for technical analysis.Cryptocurrency traders use it to assess market liquidity, identify possible resistance and support levels, and make informed trading decisions.

Market depth enables traders to predict market changes and adjust strategies by showing them all open buy and sell orders at different price points in the order book.

For example, consider a trader analyzing the market depth of Bitcoin on exchanges such as Kraken.Traders may notice that a large number of buy orders gather at specific price levels, indicating strong support.This suggests that if the price drops to this level, it is likely to find buying interest and may rebound.Conversely, large sell orders at higher price levels may indicate resistance and selling pressure may prevent further price increases.

In addition, traders use market depth to evaluate the possible impact of large-value transactions.In a market with great depth, huge buy or sell orders have little impact on prices, indicating market stability and liquidity.On the other hand, the same trading may lead to large price fluctuations in markets with less depth, indicating high volatility and potentially risky.

Depth charts are a common tool that can visually display cumulative buy and sell orders at different price points.By looking at these charts, traders can see order “walls” – large buy or sell orders – which can seriously hinder price movements.For example, a trader may decide to place a sell order slightly below the large sell wall.

4. Cryptocurrency trading strategies affected by market depth

Crypto trading strategies affected by the market depth include swing trading, arbitrage, position trading, hat grab trading and algorithmic trading.

Swift trading

Swave traders usually hold positions for several days to weeks in order to profit from short- to medium-term market volatility.Market depth helps ensure that traders can enter and exit positions at favorable prices, although it is not as important as a hat-grabbing trade.

Swave traders can execute trades more easily in deep markets without slippage.Slips are caused by insufficient liquidity, which can cause the execution price to be different from the expected price.

arbitrage

Arbitrage traders use the price difference between the same asset on the exchange or market.Since market depth can affect the simplicity and expense of trading in multiple venues, it is crucial to the arbitrage approach.In-depth markets make it easier to exploit the arbitrage possibilities and reduce the risk of slippage before the price difference is fixed.

Position Trading

Position traders focus more on long-term trends than short-term volatility and hold assets for a long time – from months to years.Market depth can affect their ability to enter or exit large positions without significantly changing prices, even if this is not that important for their instant trading.When the market is deep, position traders can rest assured that they can eventually sell their shares without being affected by a significant market.

Hat robbing deal

A high-frequency trading technology called hat-grabbing trading requires the use of slight price fluctuations to generate multiple small profits.Deep markets are great for hat-grabbing trading as they provide enough liquidity to allow traders to quickly establish and exit positions without significantly changing prices.Since hat-grabbing traders rely on fast trade execution and tight bid-ask spreads, market depth is crucial to their success.

Algorithm Trading

Using a computer program to trade according to preset standards is called algorithmic transactions.These algorithms often optimize transaction execution by considering market depth.By checking the order book, the algorithm can determine the best time to buy or sell to minimize expenses and market impact.Deep markets are particularly important for the effective operation of high-frequency trading algorithms.

5. Risks of using market depth for cryptocurrency transactions

Using market depth to trade cryptocurrency in cryptocurrency involves a variety of risks, including market manipulation, fraud, wash trading, lack of transparency in over-the-counter trading, and the rapid operation of high-frequency trading algorithms, all of which can mislead traders and lead to potential losses.

A major risk is the possibility of market manipulation.In cryptocurrency markets, especially in low liquidity markets, large traders or “whales” can place large buy or sell orders to create false impressions of market sentiment.For example, whales may place large buy orders to simulate strong demand, encourage others to buy, and then cancel orders and sell at a higher price.

The possibility of washing trading and deception is another concern.In order to deceive other traders’ supply and demand situations in the market, deception requires placing a large number of orders without intention to fulfill orders in order to deceive other traders’ judgment on supply and demand in the market.Washing trading refers to a trader buying and selling the same asset to increase trading volume.These methods can distort market depth data, misleading traders and causing them to behave instable.

also,OTC tradingNot included in the depth of the market, these transactions may have a significant impact on the market, but will not be reflected in the order book.This ambiguity may lead to misunderstanding of the true market conditions.

High-frequency traders can also use market-depth data to execute trades at an astonishing speed, often surpassing retail traders.Computer algorithms respond quickly to market changes, making it difficult for individual traders to compete, and if the market is not good for them, it may lead to losses.Therefore, due to the above risks, traders must act cautiously when using market depth to trade cryptocurrencies.