Author: Arjun CHAND, BANKLESS; Compilation: White Water, Bit Chain Vision Realm

Is the assets of real -world be the next cutting -edge of cryptocurrencies?

Real World Assets (RWA) is a topic that people talk about.Large companies like Blackrolk are getting involved in RWA, Tether is launching its own platform, and these numbers are also impressive -RWA tokens reached a record of $ 2.7 billion in market value in February.

There are so many main promotion factors,RWA’s narrative is expected to become the focus in the second half of 2024.

This article summarizes RWA, focusing on different types of assets in the real world and outstanding projects that need attention.

What is the next step of RWA?

RWA is one of the fastest growing areas in cryptocurrencies.Many people see it as a way to use global trillion assets to promote the growth of the entire industry.

Larry Fink, chief executive officer of BlackRock, referred to RWA as “the next generation of the market.”Boston Consulting Group predicts that by 2030, the transition of these assets into tokens may release a $ 16 trillion opportunity.

However,So far, only one kind of asset has been successfully traveled and fully integrated into the encrypted ecosystem, which is the legal currency in the form of stabilizing currency.

Stable currency is the first, largest, and most mature RWA.They discovered the product market suitable for cryptocurrencies, and saw a strong demand for different services, and was the basic component of each cryptocurrency ecosystem.

But what else is in addition to stable coins in the RWA field?

In recent years, we have seen the trend of various real -world assets that have been trained and chain.Let’s take a look at some of the most popular types.

Commodities, stocks and funds

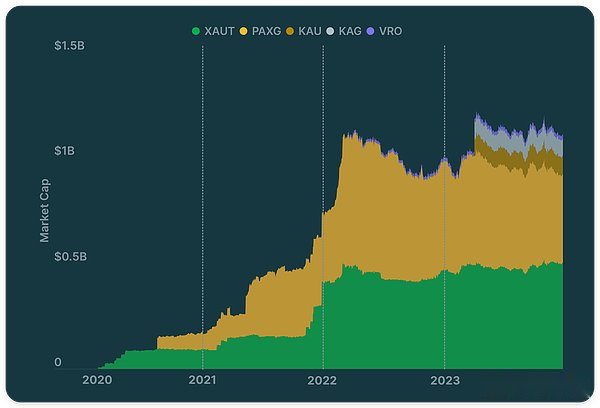

Gold, silver, and crude oil commodities are usually traded on various exchanges around the world.These natural resources can be held by the tokenization as the shares representing the actual commodity, just as stable currency do.

So far, precious metals, especially gold, have received the greatest attention as RWA in the field of cryptocurrencies.According to Coingecko, tokens such as PAX GOLD (Paxg) and Tether Gold (XAUT) are leading positions, of which gold -supported RWA accounts for 83%of the market value of the commodity token.

The dominant position of gold shows how new the RWA industry is.However, several projects are experimenting with different products.For example, the Uranium308 project launched a tokens linked to the price of a pound of U3O8 uranium compounds.

With the maturity of the RWA tokenization field, we may see tokens of crops such as crude oil such as crude oil and even corn.The argument is that more global transactions will be transferred to the blockchain in the future.

Similar to goods, stocks and common funds can also be available.These assets are the pillars of the traditional financial market, but their adoption in the field of cryptocurrencies is slow, which is largely due to regulatory obstacles.

It is very difficult to obey the laws of cross -judicial jurisdiction. Many projects need permits and face restrictions, such as excluding users from some countries/regions or meet strict KYC and AML standards.

Despite these challenges, some projects (such as Swarm and Backed) have gone out of the regulatory maze, allowing global stocks and funds to transactions, such as Coin and NVDAs in the US market, and index funds such as the core Standard Purcera 500 index.

National debt

Treasury bonds refer to government debt instruments.Traditionally, these tools are assets that are safely issued by the government and can generate income.

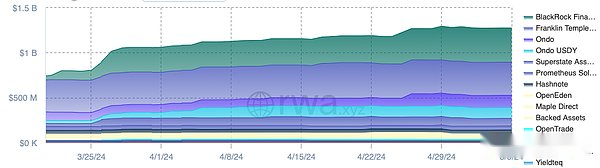

After the great popularity, as the Fed adjusted its monetary policy based on economic changes, the historic bond interest rates increased.By October 2023, short -term national bond yields have risen from nearly zero to about 5.4%.

The rise in interest rates has stimulated the start of the U.S. Treasury tokenization project. Some of the examples worth noting are:

-

Franklin Dunpon—From the Franklin Chain in 2021, the US Government Monetary Fund (FOBXX), the first public blockchain fund registered in the United States.Its yield is 5.11%, with a market value of US $ 365 million, ranking among the largest chain capital products.

-

BLACKROCK– In March 2024, the BLACKROCK Institution Digital Llerance Fund ($ Buidl) was launched on Ethereum.At present, it manages more than $ 375 million in assets, leading the chain to the Treasury Fund Market.

-

ONDO—The short -term US government bond (OUSG), which is launched, provides short -term U.S. Treasury bonds with a yield of 4.68%and a market value of about 140 million US dollars.A large part of OUSG is invested in BUIDL of BLACKROCK.ONDO also provides a USDY income stablecoin, with a market value of more than 120 million US dollars.

As interest rates rise, the yield of government bonds has become more attractive, and this category has increased significantly.Other well -known projects in this field include SUEERSTATATE, MAPLE, BACKED, Openeden, etc.

Private credit on the chain

Private credit involves financial institutions with loans to enterprises through debt instruments (essentially loans).

In the context of cryptocurrency RWA, these loans are available for tokenization through credit protocols, allowing loan directions to provide capital in exchange for income.

In traditional finance, private credit is a huge market worth $ 1.6 trillion, and it is slowly opening up an important niche market in the cryptocurrency field.

The encrypted credit agreement has gone more than 4.4 billion US dollars of loan token, of which more than $ 600 million is loan to the real world, bringing a return on the chain.

For investors on the chain, private credit has attracted attractive claim due to its high yield potential.For example, the average annual interest rate of borrowing stable coins like CENTRIFUGE can reach 8.7%, exceeding 4-5% of the annual interest rates that usually occur on platforms such as AAVE, but risks have also increased.

The main participants in the field of private credit include:

real estate

The real estate category in RWA focuses on tokenization of physical property such as residential, land, commercial buildings, and infrastructure projects.

Real estate is the world’s largest asset category.But traditionally, due to the high cost of real estate, real estate investment requires a lot of money.Through the tokenization, real estate can be traded on the chain, introducing a novel investment paradigm, enhancing accessability, realizing part ownership, and possible to increase liquidity.

Nevertheless, the lack of liquidity of real estate has limited the pace of its chain.The long -lasting nature and smaller buyer group of real estate transactions make coordinating sellers and buyers on the chain to be challenging, especially considering that the industry has traditionally operated on the retention system.

Projects like Realt Token are trying to inject liquidity into the market by simplifying property segmentation, so that sellers can easily divide their assets and enable buyers to obtain token stocks.

In addition, Parcl and other platforms allow the real estate value of different locations (such as different cities in the United States) through its chain transaction mechanism.

In the long run, all these measures will make the real estate market more liquid.

Conclusion

The concept of RWA is expected to bring new global access and liquidity levels for traditional assets such as real estate, commodities and debt.If the bold prediction of RWA becomes a reality, the tokenization of these assets is likely to redefine the world how to trade these assets, thereby allowing more people to enter the chain.