Author: NingNing, Independent Researcher Source: X, @0xNing0x

The cornerstone of Restaking is EigenLayer’s AVS.From the perspective of block space economics, Rollup L2 is an abstract block space resale that abstracts Ethereum, and AVS is an abstract economic security sale that abstracts Ethereum.

There is a theoretical assumption in the market that although Restaking increases the consensus load of Ethereum, LRT projects with higher staking yields can help improve Ethereum’s staking rate and price and thus enhance the economic security of the main network.

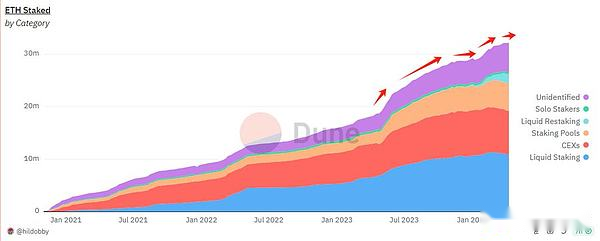

By observing Dune’s on-chain data board, we will find that the above assumptions have some conflicts with facts:

The net inflow growth trend of ETH staking brought about by the Restaking Fomo boom has been very short-lived.The time range is only from January 19 to February 13 this year, less than one month.Currently, although net inflow remains above the 0 axis, it is in the historical bottom range.

The positive impact on ETH staking is far inferior to that of Shanghai’s upgrade overall.

Over the past 24 years, the total number of Ethereum staking has increased to 3212.14, with a growth rate of 10%.But the slope of this growth trend is almost consistent with the sideways bear market period in 2023 Q3.January 24 is exactly the market adjustment period after the Bitcoin ETF is passed.

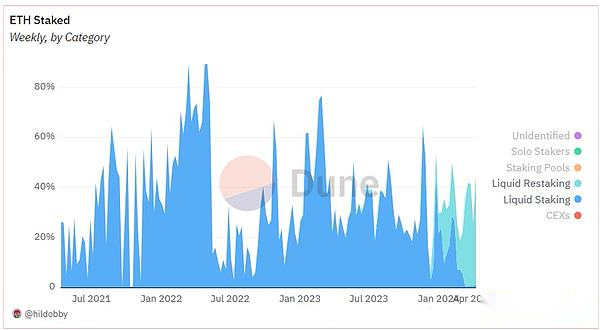

It can be seen here that the PMF of the Restaking project is a period of high ETH standard passive returns + market adjustment.The correlation with EigenLayer’s AVS narrative is relatively weak.

Restaking projects such as Etherfi and Renzo are devouring the share of new staking in LSTs such as Lido and Rocket Pool.Currently, the Restaking project accounts for 40% of the new Staking market share.

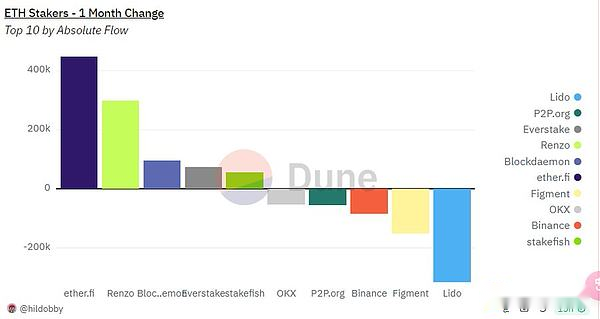

Judging from the monthly changes, traditional staking protocols and platforms such as Lido, Figment, Binance, and http://P2P.org are leaking, while Restaking protocols such as Etherfi and Renzo are having a significant net inflow.

But it is worth noting that Figment and Binance are constantly investing in the primary market to incubate the Restaking protocol, while Lido is negatively responsible because it is bound to reach the 1/3 Staking market share threshold.

Therefore, Restaking can actually be regarded as a siege initiated by the Restaking project and Lido competition.

In this process, Lido lost its market share and gained ethical security within the Ethereum ecosystem.Figment and Binance are just left hand and right hand, and are doing asset issuance in the bull market at the cost of losing some passive income.Etherfi is the first successful case.