Original title: Abstracting Chains

Author: Shlok Khemani, Decentralised.co; Compilation: 0xjs & 0xxz@Bitchain Vision

Before the text begins…

Chain abstraction has become one of the most discussed topics in the crypto space over the past few months, and there is good reason.No industry expert would think the status quo of hundreds of fragmented blockchains is ideal.

However, when people try to understand this topic, they face a whole host of professional terms—intention, solver network, clearing layers, and order streaming auctions.Even for writers like us who think they are proficient in cryptocurrencies, this becomes a bit difficult to understand.We need help.

Vaibhav Chellani is the founder of Socket, the first chain abstraction protocol.Vaibhav has been thinking about blockchain expansion for nearly a decade.As a member of the Ethereum Foundation, he participated in the construction of the first ZK rollup.He also serves as the head of the agreement for Polygon, which is Ethereum’s promotion of its expansion when it needs it most.There, he led the development of the Ethereum to Polygon bridge, which is currently worth more than $5 billion.

Vaibhav witnessed first-hand the development of Rollup, expansion and bridges.He foresees the multi-chain, multi-bridge future we are now in and the user experience challenges it will bring to users and developers.He founded Socket in 2022 to solve these problems.

To gain a deeper understanding of chain abstraction, we worked with Vaibhav and Socket teams.This article is the result of this cooperation.

While it may be dangerous to reason with analogy, today’s crypto landscape is surprisingly similar to the internet in the early 1990s.

At that time, American Online (AOL) was often called the “training wheel of the Internet.”Users spend hours sending emails on the platform, shaping real and imaginary characters, discussing niche topics, sharing pictures and playing games.By 1995, AOL had more than 3 million users and its stock price soared nearly 2,000% in three years, and its brand had become an iconic brand in pop culture.Although it can’t meet the growing demand, it still achieves all of it.

A version of the AOL homepage, the first “super app” of the internet.

However, although AOL achieved early success, it was not open.It is a closed computer network that requires users to install separate software and subscribe to AOL’s Internet Service Provider (ISP).And AOL is far from exclusive.CompuServe, IBM’s Prodigy, Microsoft’s MSN, AT&T’s Interchange Online Network and Apple’s eWorld all use similar proprietary software, networking and ISP models to compete for the same award.

This situation can be a nightmare for the user.If you use AOL and want to chat with friends on CompuServe, one of you must subscribe for an extra fee.Additionally, each network is competing for exclusive media content to its subscribers.The New York Times teamed up with AOL and the Wall Street Journal teamed up with CompuServe, and access to both companies requires separate subscriptions and connections.

Fortunately, this situation is fleeting.When the companies plotted to take over the network and dominate, a team of Swiss researchers led by Tim Berners-Lee and a team of college students at the University of Illinois led by Marc AndreessenThe miscellaneous team is developing different visions.They envision a community-driven network managed by common standards, open to everyone for access or development.What is the portal for this network?Web browser.

Today, we simply call it the Internet.

The Internet is open, flexible (HTML format allows users to create freely) and standardized, so it thrives on network effects and user-generated content.Once the Netscape Navigator browser was released, the Internet quickly became the first choice for users and developers.Slow at first, but suddenly, the global AOL realized that its walled garden could not compete with this behemoth and had to forcefully adapt to the internet.

The Internet unified the fragmented situation and triggered the greatest technological movement in history.

Today, in the cryptocurrency space, we have hundreds of different blockchains and Rollups, each with its own wallet, application, liquidity, users, standards and culture, all running in silos.Despite trying to bridge these silos, the experience is still clumsy.This fragmentation leads to poor user experience and limits the appeal of cryptocurrencies to a wider audience.

This ideological, implementation, and methodological difference is characteristic of early technology, as developers are still working on which approach is most effective.However, as technology matures and scales, the need for standardization and integration also follows.Cryptotech is now at a critical moment, moving from an early adopter and geek field to a tool for the masses.

The industry recognizes this need and a movement called “chain abstraction” emerges to solve this problem.While the vision of chain abstraction (making the user experience in Web3 as seamless as Web2) is simple, achieving this is not easy.

In today’s article, we will explore the current state of the multi-chain world, the problems it creates, the efforts made to solve these problems so far, and the role of chain abstraction and Socket’s solutions in all of these aspects.Finally, we discuss in the future, chain abstraction will lead to a major change in the way cryptocurrency values accumulate, thereby completely changing the face of the industry.

Let’s get started!

Statement: This article discusses the user experience issues of cryptocurrencies in detail and analyzes them from the perspective of absolute novices – such users constitute the “popular” we want to join cryptocurrencies.If you are an Aboriginal cryptocurrency, you may not resonate too strongly with these issues.

1000 blockchains

At the beginning, Bitcoin was a revolutionary technology that introduced the world to blockchain and its unprecedented features: decentralization, censorship resistance and distributed ledgers.While Bitcoin is primarily focused on payments, its open source code base opens Pandora’s box for other technical experiments.These early experiments included dedicated blockchains such as Namecoin, Dogecoin and Litecoin.

Then Ethereum was born, a Turing-complete blockchain that allows developers to use a common global ledger to create any application they envision.This triggered a series of innovations—from stablecoins to decentralized finance, to games and intellectual property—that are developing at an exponential rate.However, Ethereum quickly began to be dragged down by its own success, with the influx of large amounts of activities leading to high costs and long wait times.

General blockchains need to be expanded.There are two forms of solutions.

The first solution is to extend Ethereum itself through a layer 2 solution (L2) or Rollup.L2 is designed to handle transactions outside the main blockchain while still exploiting its security by issuing concatenated proofs on the main blockchain.Even in L2, there are multiple methods; some methods (such as Arbitrum and Optimism) use optimistic proofs, while others (such as ZKSync and Starknet) use ZK proofs.In the process, Ethereum itself has officially adapted to the Rollup-centric roadmap.

The second solution is to completely deviate from Ethereum and build scalability from scratch.Teams such as Solana, Near and Cosmos embraced this vision, creating a new blockchain architecture with unique design choices and execution environments.Soon, other teams such as Sui and Aptos began to build their own stacks in a similar way.

Both Ethereum scaling solutions and alternative blockchains attract hundreds of millions of dollars in capital and trade billions of dollars on the open market.This wealth creation naturally attracts more builders, resulting in more blockchains.But these newer projects need to stand out in some way.

Some differentiate through technology (different variants proven by ZK or more advanced programming languages), while others differentiate through specific use cases (decentralized storage or games).

A new trend followed – distributed applications building their own chains.One of the early examples was Axie Infinity, the top Web3 game on Ethereum, which built Ronin—their own blockchain.Coinbase, one of the world’s largest exchanges, released Base, while Blur, the top Ethereum NFT marketplace, released Blast—both Ethereum L2.

This method is also adopted by major NFT projects such as Pudgy Penguins, meme coins such as Shiba Inu, and financial products such as Ribbon.Recently, we even saw the rise of L3—the chains that exist on L2.

Data: DefiLlama

These developments mean, there are at least 300 active blockchains (DefiLlama tracking) and more than 80 upcoming blockchains (L2 beat tracking) in cryptocurrencies today.Neither of these sources are comprehensive, so I suspect the actual numbers are much higher.

Nevertheless, we have seen the Cambrian outbreak of blockchain over the past two years, and there are multiple reasons to believe that this spread will not slow down any time soon.I’ve listed some of these below.

Financial incentives.

Fat Protocol theory believes that “the market value of a protocol always grows faster than the total value of the application built on it.” So far, this view is basically true – most of the value of cryptocurrencies has accumulated on blockchainlayer.This means that the investor and market value infrastructure layer is higher than the application layer.Therefore, the economic incentives for new and old application builders are created or migrated to separate chains.

sovereignty.

Universal chain requires that the application share the block space with other applications, and its users must pay gas fees in the blockchain’s native tokens.This can become a problem during high demand periods, as one application’s activity surges affect other applications.Additionally, if the application has its own token, its users must hold both the token and the native token to pay the gas fee, resulting in a worse user experience.

Migrating to a separate blockchain can achieve sovereignty over the block space and tokens.Pudgy Penguins, one of the few crypto brands recognized by the public (they have sold over a million toys), is building its own chain to “converge vertically from IP to base layer.”

distribution.

Successful businesses are built on moats, and few are more powerful than wide distributions.The project was initially launched on a common blockchain to take advantage of its existing distribution.Successful projects will build their own large user base.If this happens, they can make more value by transitioning to their own chains and allowing other projects to use their distributions.The success of Axie Infinity led to Sky Mavis launching Ronin, which has evolved into an independent gaming chain.

Infrastructure availability.

The need for builders who create chains leads to the commodification of the chain infrastructure itself.A few years ago, building a blockchain required a guide to the validator’s foundation or the technical skills to build L2.Since then, the barriers have been greatly reduced.

The combination of data availability solutions (such as Celestia), security solutions (such as EigenLayer), open source software development kits from Optimism, Arbitrum, and Polygon, and Rollup as a service platform (such as Gelato) makes creating blockchain relatively simple.

Updated experiment.

Innovation in basic blockchain is still in progress.The team continues to try new designs.Monad is creating an Ethereum-Solana hybrid.MegaEth is experimenting with “streaming transactions at lightning speed.”Additionally, chains like Solana and Bitcoin that traditionally do not support Rollup are now seen building Rollup on it.

In other words, all signs indicate that we will head to a world with thousands of blockchains.

Fragmentation

The multi-chain world, driven by financial, business and technology incentives, has fragmented the industry in many ways.

Liquidity fragmentation.

Liquidity is the core of a healthy financial market.The stronger the market liquidity, the easier it is to trade.Highly liquid DEX pairs can provide better prices (reduce slippage) when trading.A highly liquid lending pool helps to borrow safely and easily.

Mobility is a network effect game.High liquidity pools are more attractive to investors and increase the utility of the tokens that make up the pool, resulting in higher liquidity.This is why liquidity pools in protocols such as Uniswap and Aave follow a power law, where top pools are orders of magnitude larger than small pools.

When capital is spread across different chains, liquidity and its returns will also be fragmented.For example, the most efficient ETH-USDC swap pool may exist on Ethereum.However, if you want to do the same exchange on Base, you won’t be able to benefit from these lower prices.

Status and asset fragmentation

One of the reasons why smart contract blockchains such as Ethereum can become a game-changing technology is its composability.Developers can seamlessly combine and interact with different protocols, applications, and assets.This allows developers to build complex solutions without having to start from scratch.

I maintained two Google Chrome profiles – one for personal transactions and the other for work transactions.Many times, I would accidentally open YouTube in my work profile and see an unexpected set of recommendations, or I would look for a work bookmark in my profile, but then I found out that it didn’t exist.

Each configuration file retains its own history, extensions, saved passwords, connected accounts, and more.This is what state fragmentation looks like.

When operating within a single-strand range, the aggregator can browse multiple DEXs without permission and provide users with the best execution.Alternatively, lending agreements can provide users with loans of high-value NFTs.USDY (Ondo’s T-Bill-backed stablecoin) used to be just a revenue stablecoin that was idle in the wallet.

However, the asset is even more attractive to users when DeFi agreements such as Drift do not require permission to use it as collateral for perpetual contract transactions.

This composability will fail between blockchains.Users cannot buy NFTs on Ethereum using USDC on Base in a transaction.Developers cannot use assets on one chain to provide users with products on another chain.

User and social fragmentation

Cryptocurrencies are tribal in nature.Driven by financial incentives, the community unites to cheer for the project and make the project successful (and the value of the assets it holds increases).This also leads to a “we and them” mentality, or extremism.Bitcoin’s biggest user base doesn’t want to have anything to do with other blockchains.Solana’s largest user base is more likely to try Blinks on Solana than Time Dot Fun on Base.

The more chains there are, the more room for this maximism.This can lead to a split between users and culture.

These trends are a problem for developers.In fact, no chain does excel in all respects.Each chain has its shortcomings and advantages.So, how do they choose where to build it?Factors such as application cultural fit, programming language familiarity, financial subsidies and technical advantages all play a role.However, if you choose to build on only one chain, developers will miss the user base of other chains.On the other hand, no matter which chain it is on, users cannot experience the application that best suits their use case.

Poor user experience

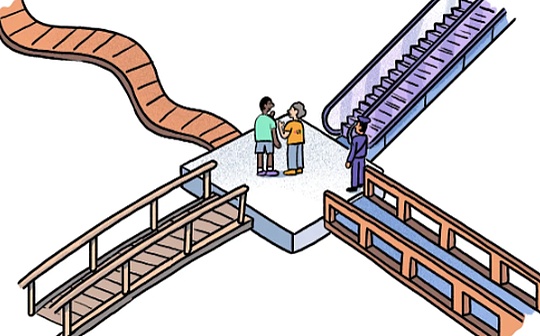

The split caused by blockchain silos is by no means a new problem, but an issue the industry has been working to solve for years.My colleague Saurabh likes to use a metaphor for treating these isolated blockchains as closed islands, each with its own citizens, culture and assets.To do anything between these islands, you need to connect them in some way.

The functionality of the encryption bridge is similar to the real world bridge, connecting different blockchains and allowing seamless movement of assets and data.When a user wants to transfer assets from chain A to chain B, the core of the bridge performs the following actions:

-

It allows users to deposit assets in chain A.

-

It asserts on chain B that the asset has been securely received in chain A.

-

It unlocks user assets in chain B.

Now, how the bridge completes these steps, especially the second step, may vary greatly depending on the mechanics of the bridge.There have been a lot of articles on bridge design (and its risks and security vulnerabilities) so I won’t discuss them here.Furthermore, they have nothing to do with the purpose of this article.

What we really need to know is that bridges exist, one of the most well-funded areas in the cryptocurrency space, has matured over time and is in a variety of forms.So, why do people have to fuss about this chain abstraction?Isn’t blockchain connected?Didn’t the bridge solve the fragmentation problem?In addition, don’t users have many choices?This should be a good thing, right?Well, not exactly.

Consider this situation: Martin is new to cryptocurrency, and his favorite artist has just released a new work in NFT on Optimism, selling for 0.1 ETH (approximately $300).Martin asks his cryptocurrency Aboriginal friend Joel to send him some money.However, Joel only has USDC on Base.Because Martin was in a hurry (this was a limited edition coin), he asked Joel to send him money and he would find a way to buy it.Martin may not be very familiar with cryptocurrencies yet, but he is tech-savvy.How difficult can this be?

As it turns out, this is actually very difficult.Here are the steps he must follow.

There are at least 10 steps and 28 individual clicks.I’m very forgiving here, assuming that Martin has set up a wallet that can use the same wallet to connect two chains and find the information he wants at once (how to pay gas, the correct bridge, the correct DEX).This does not include miscellaneous steps such as signature and transaction confirmation in the wallet.It would be a nightmare for a total beginner.Using funds from another chain to buy NFTs on this chain (one of the most basic user processes in cryptocurrencies) should not be Rocket Science.

We live in a world where we have rich choices but not focused enough.Consumers lack patience and cannot even wait for a few more seconds.Web2 developers know this well.They are determined to reduce user complexity by reducing clicks.Indicators such as conversion rate and session duration are scientifically accurately measured.

Amazon realized this more than 30 years ago and applied for a “one-click checkout” patent, a key breakthrough in its dominance in e-commerce.The best companies will pay designers millions of dollars to simplify their products.

Although this kind of thinking is basically not present in Web3 products today, it also reflects the nature of early technology.Ford’s Model T was the first production car, and it was slower than a running horse.Early computers occupied the entire building.For a long time, they were text-based and had no graphic display.The first “mobile” phone weighs 2 kg.As I mentioned before, the internet is also very slow and bulky at the beginning (loading line by line if there is an image).

In fact, if you think about it carefully, we have tens of millions of on-chain users who travel through these complex mazes to use crypto products, which is amazing.(This also shows how powerful financial incentives are if you need to explain it!)

But the trend is changing.After years of investment in infrastructure, we now have enough block space.Next, we will make cryptocurrencies more accessible, user-friendly, and more scalable.Projects, researchers, builders and investors are slowly but steadily coordinating to build a better, smoother, more web2-like experience in Web3.Such drastic changes won’t happen overnight.This is a gradual process with many moving parts.

What is the ultimate goal?It is to reduce the number of clicks required by Martin to cast NFTs to 1.To achieve this, we must first simplify the bridge.

Multi-chain crossing

The process of finding bridges, bridging assets, and redeeming required tokens on the target chain is one of the most common user processes in cryptocurrencies.But for beginners, it is also very complicated.

First, finding a bridge itself is not easy.There are a variety of options, including native and third-party bridging solutions.Martin might find that while certain bridges support Optimism, it does not support newer Base chains yet.Additionally, each bridge weighs in speed, safety and cost.For smaller transactions, users may optimize speed or fees.But if they were to transfer millions of dollars, they would prioritize security.

Once you bridge the asset, you also have to exchange it for the token you want.This also requires finding a DEX, paying the gas fee, and exchanging it.What makes users even more painful is that some bridges do not provide users with native tokens on the target chain (such as USDC), but instead provide unofficial copies of the original tokens (such as USDC.e).

Socket initially aggregates existing bridges and DEXs into a single meta-bridge.Its simple goal is to provide users with a range of options to move from asset X on chain A to asset Y on chain B based on their preferences for cost, latency and security.They achieve this using a combination of on-chain smart contracts and off-chain routing algorithms that can dynamically select the best bridge or route.

Socket splits this technology into two products.

The Socket API is suitable for developers who want to provide users with a cross-chain experience.It is used by platforms such as Zapper and Zerion, wallets such as Coinbase Wallet, Rabby, MetaMask and Rainbow, and DeFi applications such as Brahma.fi.

Polymarket is a predictive market consumer app that has soared popularity over the past year, and it also uses the Socket API.While the app is built on Polygon and accepts USDC deposits, users may have funds on other chains such as Ethereum.Instead of requiring users to bridge from Ethereum to Polygon alone, the Socket API helps seamlessly integrate these steps.

Bungee is the consumer version of Socket Metabridge.It allows users to bridge and exchange in a single interface without having to perform all the steps we discussed earlier alone.

For example, when Martin wants to redeem 300 USDC on Base to ETH on Optimism, he enters these parameters on Bungee.The protocol will help him find the optimal transaction bridge among the four options.Depending on his preference, he can complete the bridge and redemption on Bungee.

This is how he buys NFTs now.The number of clicks has been reduced by nearly half!It’s still too complex, but we’re making progress.

Bungee is also very flexible.If users were to transfer $1 million USDC from Base to Optimism, they probably wouldn’t trust a third-party bridge with such a large amount and might require stronger security.In this case, they can use the native CCTP bridge of Circle (USDC issuer).

Bungee Exchange and Socket APIs combine to provide over $12 billion in cross-chain exchange services to 16 (and growing) chains it supports.

Other teams that address cross-chain bridging and switching issues include Li.Fi and DeBridge.

Crypto native users who have gas tokens on another chain (such as ETH) may consider bridging their tokens.However, bridging can be expensive and slow, depending on the bridge used.

Socket provides an alternative through its service “Refuel”.Refuel uses indexers and liquidity pools to provide native tokens for gas on different chains.For example, users who own ETH on the main network need MATIC to pay for Polygon and deposit ETH into the Refuel contract.The centralized repeater confirms transactions and uses MATIC to fund users’ wallets.Refuel charges only the destination gas fee, making it a cheaper, faster (albeit centralized) alternative to gas bridge tokens.

But what should I do for cryptocurrency newbies who don’t understand gas fees?

The first abstraction: Account abstraction

Most popular crypto wallets such as MetaMask and Phantom are externally owned accounts (EOAs).Simply put, this means that the user’s account exists outside the blockchain state.EOA is not suitable for encrypted user experience for the following reasons:

-

Users must manage their own private keys.If their keys are lost or leaked, they have the potential to lose access to all funds.

-

Users must hold the native tokens of the blockchain to pay for their gas fees.

-

Users can only sign one transaction at a time.

These limitations are ultimately addressed by a common standard: ERC-4337, commonly known as account abstraction.We discussed account abstraction in detail in previous posts, so I will only talk about the sections related to this article.

Account abstraction relies on the concept of smart contract account (SCA).SCA is deployed as a smart contract on the account on the blockchain.This means that the user’s interaction with the wallet is part of the blockchain state.Instead of signing a transaction, the user signs a message called an “opcode” which is then processed by a dedicated participant called a “bundler”.

Among other things, account abstraction alleviates a major pain point in cryptocurrency user experience: gas fees.New cryptocurrency users like Martin will find the concept of gas fees strange.It’s like asking users to sign up with a credit card before starting Facebook – it’s unimaginable.However, each blockchain transaction does require a gas fee.If it is not a user, can we let others pay?

Account abstraction realizes sponsoring gas fees in the user’s name by introducing a new participant, a paymaster, into the transaction supply chain.The payer charges a fee, which can allow the application to sponsor gas fees in the user’s name, or allow the user to pay gas fees in the token of his or her choice.

For Martin, this means he can pay for the exchange gas with USDC without having to buy ETH separately on Base.Similarly, the NFT application can now sponsor gas fees on his behalf, and also let him pay with USDC on Optimism.

Now only 4 steps and 10 clicks!

Beyond the Chain

Both cross-chain exchange and account abstraction significantly improve the cryptocurrency user experience.However, we have not yet achieved the ultimate goal of one-click casting.

When bridging from one chain to another, even with an aggregator like Bungee, the user must select a source chain and a target chain among a number of options.If there are only a few main chains, like we encountered before, this is possible.However, if the number of chains reaches hundreds or thousands, the user experience starts to decline.Additionally, once users bridge funds, they still have to switch between different chains in their wallet to use those funds.

The root of these two problems is that users are forced to view their cryptographic experience as an experience across different chains.Their assets are on one or more chains, and the application they want to interact with is on another chain.This idea is inherently complicated.After all, blockchain is just the underlying ledger.When interacting with Web2 applications, users do not have to consider which servers or databases the developer chooses to build on.

From the perspective of bridge expansion, there are also problems in the world of increasing blockchains.Recall that the second step in bridge operation is to assert on chain B that the assets have been received on chain A.According to its design, the bridge does this by creating a messaging framework between chain A and chain B, deploying contracts so that each chain can understand the messages, and then using a repeater to pass messages from one chain to another.

There is a problem with this mechanism because these messaging systems must be deployed separately between each pair of chains.For example, if a bridge currently supports five chains and wishes to add another one, a message system must be deployed between the five chains and the new chain.In other words, the expansion speed of the bridge is quadratic—for n chains, there will be n square connections.Once a certain number of chains exceeds, cross-chain expansion becomes unfeasible.

Now, the solution is obvious: “chain abstraction”.Users should interact with blockchain applications, not the underlying chain where funds are located or the application is built.Martin should know about his NFT casting website, not Base, Optimism, or bridge or bridge aggregators from one site to another.

Now, the solution is obvious: “chain abstraction”.Users should interact with blockchain applications, not the underlying chain where funds are located or the application is built.Martin should know about his NFT casting website, not Base, Optimism, or bridge or bridge aggregators from one site to another.

From a developer’s point of view, they need a way to go beyond existing bridge solutions that cannot be scaled.They need the support of participants to help them transfer funds from Chain A to Chain B, regardless of whether there is a messaging system between them.

Chain abstraction is not a set of processes or products, but an ultimate goal, with multiple paths (each path has a set of tradeoffs) to achieve it.However, the common point between these implementations is the existence of “intention” and “solver network”.These have become buzzwords around the theme of chain abstraction.Let’s understand what they mean.

The user performs on-chain activities to transition from the current state to the desired final state.For example, Martin wants to switch from 300 USDC on Base to NFT on Arbitrum.In the current cryptocurrency state, we let users decide for themselves how to reach the final state.This takes the form of them interacting with specific smart contracts that meet their exact needs.

This situation is not always ideal for two reasons:

-

As we have seen repeatedly, even for simple use cases, the steps to reach the final state can become extremely complex.

-

Even if the user does find a path that can help them reach their final state, it may not always be optimal.

For example, suppose there is a user who wants to exchange $1 million USDC on one chain for USDT on another chain.They can use existing bridges directly and then exchange solutions, or they can interact with protocols like Bungee to help them with exchanges.However, it is also possible that there is an off-chain player (probably a market maker with a lot of liquidity on a centralized exchange) who are willing to provide them with exchange services at a fee below both solutions.

Users cannot benefit from it, resulting in inefficiency in the market.

Intents are a completely different way of thinking about crypto trading.The premise is the same – the user wants to reach a certain final state.However, by using intentions, a group of experienced participants will compete to help them reach their final state rather than figuring out how to reach that final state.Intent means that all Martin has to do is express his desire to cast NFTs on Optimism and will not cost more than USDC, and these participants (also known as solvers) will help him achieve this.

Here is an example that can help you understand intentions better.Joel wants to go to Manhattan from Brooklyn.Fifteen years ago, he had to go out to the streets to wave to passing taxis and let them stop.Some taxis are already full of passengers and will not stop.Maybe there was no taxi passing by, and Joel needed to walk to a busier street in the rain.Once he gets in the taxi, he may have to help the driver guide the way.This is what encryption technology looks like today—take dozens of steps in a lot of uncertainty to reach its final state.

Here is an example that can help you understand intentions better.Joel wants to go to Manhattan from Brooklyn.Fifteen years ago, he had to go out to the streets to wave to passing taxis and let them stop.Some taxis are already full of passengers and will not stop.Maybe there was no taxi passing by, and Joel needed to walk to a busier street in the rain.Once he gets in the taxi, he may have to help the driver guide the way.This is what encryption technology looks like today—take dozens of steps in a lot of uncertainty to reach its final state.

Intent is like using Uber.Joel can sit comfortably at home, tell his exact destination, browse different options to reach the destination, get price quotes and estimated time in advance, track the progress of the trip, get on the bus after arriving, and get there without any communication with the driver.His exact destination.

Uber has greatly improved the experience and convenience, far beyond the current situation.Intent to promise that on-chain transactions will achieve the same improvement.

So, how does intention work?Below is a general framework for simple cross-chain exchange.

- The user first expresses his intention to reach the final state.In this case, suppose you spend 300 USDC on Base to get at least 0.1ETH on Optimism.

-

The Intent Agreement then holds an auction called the Order Flow Auction (OFA), where the solvers compete to meet this intention.

-

According to the auction design (we will discuss this in detail soon), the protocol selects a solver and holds 300 USDC on Base as hosting.

-

The selected solver uses his liquidity to satisfy the user’s 0.1ETH order on Optimism by providing upfront capital.

-

Once completed, the solver shares a proof with the protocol.

-

The agreement releases escrow funds and settles with the solver.

Because this is a common framework for intent, implementations of each step of the process may vary by the team or protocol that built the solution.

For example, OFA can be designed in a number of ways according to the following options:

Where to share orders?Orders can be published in public memory pools that are visible to everyone, or in private memory pools powered by technologies such as TEE, or only partial intent details are displayed.

Who can be a solutionist?The list of solvers can be open to anyone, or limited to a specific selected set, or only one solver will be selected for a period of time, thus having exclusive access.

How to choose the winner?The winner of the auction can be determined based on different criteria, such as the fastest resolution time, the lowest user fee, or the largest inclusion guarantee.

You can read more about OFA auction design space here (https://frontier.tech/the-orderflow-auction-design-space).

Similarly, the verification process for intent protocol verification whether the solver has fulfilled the user order can also be implemented in different ways:

Optimistic verification.Once the solver claims to have completed the order, there will be a challenge period.If no one questioned the resolver’s claim during this period, they were free to claim the custodial funds.

Message delivery system.Once the solver deposits the funds, the message is passed from the target chain to the source chain.Existing messaging solutions provided by the cross-chain protocol can be used for supported chains.

Light client.Light Client is a simplified version of the full node, allowing users to verify transactions without downloading the full ledger.A light client of the target chain on the source chain can help verify the solver’s performance.

ZK Proof.Zero-knowledge proof (easy to verify and cannot be forged) is another way to prove order fulfillment.

Even the settlement process (i.e. releases locked funds to the settlement after verification), there may be different mechanisms.Some protocols only allow settlers to settle on the source chain, while others allow for greater flexibility.Some agreements settle individual transactions, while others settle in batches.

A range of protocols are tweaking these parameters to create their own intent solutions.These include Across, DLN, UniswapX and Anoma.We even offer dedicated solutions for specific layers of this stack.Everclear focuses only on making settlements as efficient as possible.Khalani Network helps solvers coordinate and collaborate to complete complex orders.

MOFA: Rethink OFA

The industry is excited about intentions and OFA, considering them to be solutions to cryptocurrency fragmentation and complex user experience issues, as this changes the role of users in the ecosystem.Users are no longer left to make their own way in the cryptocurrency wilderness, but are in a state where participants are motivated to help them achieve their goals.

Recall that developers building OFA need to deal with various design choices based on their specific use cases—auction design, verification and settlement mechanisms, allowed participants, and more.However, building OFA from scratch can be very inefficient and resource-intensive for a variety of reasons.

First, once developers decide on their solution design, they must deploy on-chain and off-chain code for them.Given that these networks will handle high-value transactions, they require high security assurance.Developing such a technology can be costly, time-consuming and risky.In addition, even small changes in the protocol design require a large amount of incremental resources.

Secondly, OFA operation depends on the solver, i.e., a special off-chain participant.The new protocol boots the solver library can be difficult and time-consuming.In the initial stage, the new protocol won’t have much activity, so it won’t be attractive for solvers without incentives (this is a typical cold start problem).Furthermore, since different intent networks will use different mechanisms, the solver must create solutions for each network separately, which further increases resistance.

Third, many applications may not require dedicated solvers’ services.Their needs can be met by the participation of existing participants in the transaction supply chain, such as validators, sorters, block builders and proposers, packers and payers.Furthermore, they may not want to introduce new message types in the form of intent, but use regular transactions or account abstract opcodes.

The Socket team has a first-hand observation of this evolution.As early participants in the cross-chain field, they witnessed the surge in chains and the emergence of intention and OFA in real time.They believe that we are still in the early stages of this paradigm (current solutions are limited to specific use cases such as exchange), intent-enabled user experiences will become a key component of massive adoption of cryptocurrencies, and there will be various intent networks toMeet different user needs.

Socket is no longer just a cross-chain aggregator, and is now building the first chain abstraction protocol.Their goal is to transform a world of 10,000 Rollups into an all-in-one experience for users.

The core of this protocol is MOFA (Modular Order Flow Auctions, abbreviation for modular order flow auctions).

MOFA provides developers with tools to create order stream auctions and implement their own design choices while remaining neutral.You can think of each design choice as a separate Lego brick, while MOFA is the solution that allows developers to mix and match bricks to build a network of intents of their choice.

By simplifying the creation of flexible intent solutions, MOFA significantly reduces the development and maintenance time and costs of new protocols.Furthermore, since all networks created with MOFA originate from the same building blocks, existing solvers can relatively easily build and serve newer intent networks.

By simplifying the creation of flexible intent solutions, MOFA significantly reduces the development and maintenance time and costs of new protocols.Furthermore, since all networks created with MOFA originate from the same building blocks, existing solvers can relatively easily build and serve newer intent networks.

Therefore, MOFA also helps protocols solve cold start problems by providing an open market for networks and solvers.(That can be considered similar to the role EigenLayer plays in blockchain security.)

MOFA also reconsidered the participant subjects that constituted the solver set.In most existing intent network designs, the solver is a dedicated off-chain participant whose functionality is separate from on-chain participants such as validators and sorters.MOFA expands the solver set to include validators and sorters, and calls participants of this set of extensions “transmitters”.

To understand the importance of this, we need to understand the concept of “restructuring risk.”My colleague Saurabh explained the reorganization in a previous post.

For blockchains like Bitcoin, many miners are racing to find new blocks.Sometimes more than one miner may succeed.Suppose two miners find the new block at a height of 1000 (#1000A and #1000B).Due to propagation delay, some nodes will see block #1000A, while others will see block #1000B.Now, if a new block is found above block #1000B, the chain where block #1000B is located will become the longest chain, and block #1000A will be discarded or reorganized by the network.

Note that the third block #1000C may be found at the same height (1000) by another miner, and the same miner or other miners built on this block have found two blocks (#1001 and #1002).In this case, both blocks #1000A and #1000B will be discarded, and #1000C will become part of the chain.Ethereum is also facing restructuring, but its depth is rarely more than one block.

Recall that the solver promises to advance funds to meet user intent and get settlement after verification delays.Consider a situation where the solver has just completed the order on the target chain, but has not received the user’s custody funds on the source chain.The risk here is that the source chain is reorganized at some point before the user escrowses the funds.

In this case, the user will eventually own funds on the source chain (where the reorganization returns funds) and the target chain (where the solver has already deposited funds), while the solver faces losses.

For the solvers, such restructuring is a huge risk.Reorganization, especially in newer and untested chains, is quite common.Degen Chain is one of the first famous L3s and has recently undergone reorganization of over 500,000 blocks!As the number of new chains increases, these risks will only intensify for solvers.

So how to eliminate (or at least reduce) the risk of restructuring?The solution for MOFA is to directly allow validators and sorters to become solvers.Verifiers and sorters are participants in charge of blockchain blockchain construction mechanisms.Because they have the greatest visibility of valid and invalid blocks and restructuring risks, they are best suited to take restructuring risks.Another benefit of having them serve as solvers is that they can directly include transactions in the block, thus speeding up intent parsing.

Like magic

In the purest sense, chain abstraction means that users have no idea of the existence of blockchain.Their funds may be spread across multiple chains, but only one balance is displayed.They should not pay for native gas tokens on different blockchains.Finally, any cross-chain transaction, such as Martin minting NFT, should be as simple as Web2 interaction—one-click, instant results.

Socket recently launched a framework called MagicSpend++ (inspired by Coinbase’s Magic Spend ), allowing developers to create a seamless user experience using MOFA and account abstractions.Here is how MagicSpend++ casts NFTs for Martin.

-

Martin uses a smart contract wallet, which shows him a single chain abstract balance.

-

Martin clicks on “Cast NFT.”

-

Payer Service Checks if Martin’s smart wallet (cross-chain) has enough balance for minting.Payers participate in auctions created using MOFA.

-

When creating userOP, the payer not only sponsors gas, but also provides funds for NFT purchases on the target chain.(The payer therefore acts as the solver.)

-

Once userOP is completed and NFT is delivered to Martin, the payer will be able to withdraw funds from the vault.

Martin can finally cast his NFT with one click!

Magic-Spend++ is essentially a “consumption first, deduct money” protocol designed to leverage the extensive account abstraction infrastructure that has been launched to achieve chain abstraction.This vision attracted teams like ZeroDev, which are already well-known account abstract service providers, to implement Magic-Spend++ in practice.

Magic-Spend++ represents a shift from a chain-centric to an account-centric perspective.This approach, i.e. wallet solution adaptation makes cryptocurrency user experience smoother, is also being implemented by other teams in the ecosystem, such as Near Protocol, Particle Network, and OneBalance.

Blockchain’s AWS Moment

So far, our focus on discussing chain abstraction is to solve the problem of encrypted user experience.However, this is just one side of the chain abstract coin.On the other hand, there is a way to completely change our perception of scaling blockchain applications.Let me explain.

Today, developers deploy smart contracts for their applications on a single blockchain.When Yuga Labs launched the Otherside series on the Ethereum mainnet, it caused severe congestion and gas prices.At that time (more than two years ago), the multi-chain ecosystem was still in its infancy.Even if they choose to deploy on other chains, they don’t have an easy way to get users to move NFTs back to the main network if they want.

However, In the world of chain abstraction, these restrictions no longer apply.Since there is no longer a difference between chains, there is no concept that users belong to one chain but not another.Every user will belong to every link.Furthermore, cross-chain transfer of assets (tokens and NFTs) has become easier due to existing cross-chain solutions and emerging intent solutions.

These developments mean developers no longer need to make clear choices about which chain to deploy.The application and the underlying chain are separated.In theory, an application can exist in multiple chains without the user knowing (because they don’t know the existence of the chain at all).

This is of great significance.Consider how developers interact with cloud service providers such as AWS, which provides developers with on-demand computing power that can scale or shrink horizontally according to their needs.When demand increases, AWS allocates more resources to the application, and when demand decreases, AWS reduces resources.As long as the developer’s needs are met, developers don’t care what CPU or memory AWS uses.

Chain abstraction now allows blockchain developers to get a similar extension experience.Free from the technical and cultural constraints of single-chain, they can now freely expand and shrink between different blockchains.Block space has changed from scarce resources to rich commodities.

To understand how this works in practice, consider an example of a common crypto event that often leads to chain congestion and fees–airdrops.Traditionally, application developers deploy airdrop contracts onto a single chain.Users interact with the chain through transactions to receive airdrops.As more and more users scramble to collect from a single contract on a single chain, the chain becomes congested.

In the world of chain abstraction, the load of the airdrop will be balanced between multiple chains.User wallet will sign a claim message (rather than a transaction) as intent.The sender (not the developer) will deploy the claim contract from a chain.As the initial chain becomes crowded and the user’s claim request is met, the sender will begin deploying claim contracts on other less crowded chains.

The max-claim-fees parameter set by the developer can trigger the decision to transfer to another chain.Once the fees on one chain exceed this limit, the sender can transfer to another chain.Thus, the sender acts as a natural load balancer between different available block spaces.If incentives allow, they can even deploy rollups on demand to meet user requirements.

From the user’s point of view, none of these matters.Once their claim is completed, they will only see the balance of the airdrop tokens without knowing which chain their tokens are located.

While this future vision remains ideal and may depend on years of basic work, its impact is enormous.As blockchain becomes commoditized, applications will no longer show “consistency” or cultural bias towards a chain or ecosystem, but will flow freely between multiple chains or ecosystems.If this happens, the fat protocol theory we discussed earlier will no longer hold.Instead, the application layer will start to accumulate more value, just like Web2 today.

This change requires re-planning many core aspects of the crypto industry, not just value accumulation.As the agreement’s generous premium drops, investors will begin allocating funds to the app.Most tribal communities currently around blockchain may begin to turn their loyalty to products.MEV is currently mainly owned by the validator; this equation may also change.

This change requires re-planning many core aspects of the crypto industry, not just value accumulation.As the agreement’s generous premium drops, investors will begin allocating funds to the app.Most tribal communities currently around blockchain may begin to turn their loyalty to products.MEV is currently mainly owned by the validator; this equation may also change.

Finally, contrary to the current thousand-chain pattern, we may see the final integration.Due to the low degree of differentiation and reduced financial incentives, many chains may die, leaving only a few chains that will benefit from power law and become the backbone of Web3 (like the few hyperscale providers that serve the network today and a long timeLike a professional provider).

Imagine the future world

August 1, 2028.

You wake up and find that your salary has been paid.Very good!You made a monthly DCA investment and paid off a small loan.Then you browse X to keep up with the latest election news.Of course, there is another twist.You quickly ponder what it means and readjust your election prediction bet.You’re ready to go to work.

On the way, you stop to have a cup of coffee and pay on your mobile phone.The barista tells you that you have accumulated enough points to get a snack for free.marvelous!When you leave the coffee shop, you see a billboard that says your favorite show is about to start a new season.You scan the QR code, cast another digital collection, and add it to your existing collection-it gives you a chance to meet the actors.

After get off work, you drink and watch football games with a few friends.As the conversation gets intense, you start betting on the results of the match and the goal scorers.After the game, your friend paid for you the bet and meal fee, and you gave him your share.

You took a taxi home after drinking a few glasses of wine.Once you get home, you start playing the game you have been addicted to for the past month.Someone bids to buy the sword you collected after the battle yesterday.It seems like a fair bid, and you have a stronger sword.You sold it.

After a while, you get tired of the game.You are also tired of the artwork in the digital photo frames on the wall.You want something new.You browse the art market and find something you like.You buy it and the artwork on the wall changes.

Finally, you complete the daily check-in with your AI therapist.After hanging up the phone, some points you purchased will be deducted.

When you look back on the day in bed, you realize how many financial transactions you have made.In fact, they all happen on the blockchain and there are many different transactions.However, you never noticed it.If you are not familiar with cryptocurrencies, you won’t even think of this now.Your thoughts go back to how complicated things were a few years ago.

You breathed a sigh of relief.

You silently thank the chain abstraction.