S&P Global Ratings highlighted in a recent analysis,The U.S. may approve spot Ethereum (ETH) exchange-traded funds (ETFs), which include staking plans, may amplify centralized risks within the Ethereum network.

It is reported thatThe SEC may approve ETH ETF as early as May.However, as financial giants compete for stakes in this emerging field, the entry of ETFs could greatly impact the balance of power of Ethereum validators, bringing new challenges and opportunities.

The SEC must make a decision on VanEck’s application by May 23 and may decide on other ETH ETF applications by that deadline.

1. Concentration risk

The spot Ethereum ETF proposal proposed by Ark Invest and Franklin Templeton is intended to generate additional benefits by staking ETH.However, S&P Global analysts wrote that if these staking-enabled ETFs see high enough capital inflows, they could impact the participation rate of the Ethereum verification network.

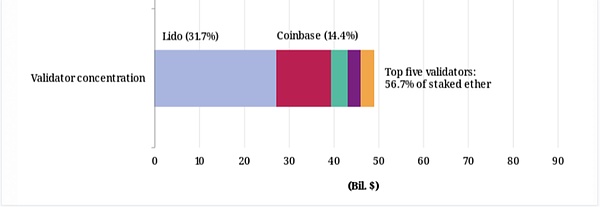

According to the report, Lido currently accounts for just under one third of the staked ETH, making it the largest Ethereum validator.However, the report doubts the possibility that these ETFs will choose decentralized staking agreements such as Lido.

Conversely, preferences for institutional cryptocurrency custodians seem more likely, suggesting that diversified strategies for validator concentrations vary based on issuers.

Verify ETH concentration by S&P Global

The report also highlights that Coinbase, as a custodian of certain fund, may also pose a concentrated risk if it receives new ETH on behalf of the U.S. ETF.

The exchange is currently responsible for about 15% of ETH staking, making it the second largest validator.It also serves as the custodian of three of the four largest non-U.S. staking Ethereum ETFs.

The report says these issues are critical because dependence on a single entity or software client can bring risks of validator disruption and attacks.It calls for enhanced monitoring of centralized risks and emphasizes its importance.

The emergence of new digital asset custodians could provide a way for ETF issuers to distribute their shares more widely, which could also mitigate concentrated risks.

2. JPMorgan Chase also expressed concerns

The S&P Global report echoes concerns raised by JPMorgan in a similar analysis of the spot of Ethereum ETFs.The lender’s report also concluded that Lido and Coinbase’s dominance poses a significant centralized risk to the ecosystem.

JPMorgan believes that the concentration of validators may become a single point of failure, jeopardizing the stability and security of the network.This centralization also provides lucrative targets for malicious attacks, from hacker attacks to coordinated disruptions in network operations.

Additionally, JPMorgan analysts warn that there may be collusion among the major validators.Validator oligopoly can manipulate the governance and operational parameters of the network to achieve its own advantages, but it will sacrifice Ethereum’s wider user base.

This can be manifested as censoring transactions, giving preferential treatment to certain operations, or preemptive transactions—which can weaken trust in Ethereum’s fairness and transparency.

Ensuring Ethereum remains a powerful, secure and decentralized platform that requires collective efforts to mitigate centralized risks and create an environment where no one validator or a group of validators can exercise disproportionate power.