Author: Daren Matsuoka, Robert Hackett, Eddy Lazzarin, A16z Crypto; Compilation: 0xjs@Bit Chain Vision Realm

Two years ago, when we released the first report of the current cryptocurrency status quo, the world at that time seemed very different from now.Cryptocurrencies are not important in the agenda of policy makers.Bitcoin and Ethereum Exchange Trading Products (ETP) have not been approved by the US Securities and Exchange Commission (SEC).Ethereum has not yet shifted to POS, which has minimized energy.The L2 network aims to increase capacity and reduce transaction costs is basically in an unrealistic state -the transaction costs on these networks are much higher than now.

As our latest release of the “2024 Crypto Status Report” reported in this article, the times have changed.Our report covers the rise of cryptocurrencies as the rise of popular policy topics, many latest technical improvements in blockchain networks, and the latest trends of cryptocurrency builders and users.

The report also also:

-

In -depth research on the emergence of key applications such as stablecoin -one of the “killer applications” of cryptocurrencies;

-

Explore the intersection of other key technical trends such as encryption and AI, social networks and games;

-

Share new data of cryptocurrencies in the US election before the US election.

The 2024 Crypto Currency Status Report also revealed the historical highest level of cryptocurrency activities.The report also analyzes how the blockchain infrastructure matures -especially after the recent expansion upgrade has greatly reduced the cost of transaction on the chain, and the rise of the Ethereum L2 and other high throughput blockchain.

In 2024, we also launched a new tool: A16z CryptoBuilder Energy instrument panelEssenceFor the first time in history, we shared the exclusive data of sharing with the unique insights of the cryptocurrency field, including the location where the “builder energy” is located.The instrument panel contains thousands of data points (summary and anonymous processing). These data points come from investment team research, our CSX startup accelerator plan and other industry scope.Through this tool, anyone can explore the views of cryptocurrency builders on their activities and interests -from what blockchain they are building, to which types of applications they are building, and which technologies they are using, and which technologies they use, and which technologies they use, and which technologies they use, and which technologies they use, they are buildingAnd where they are.We plan to update these data every year as part of our annual cryptocurrency status.

Now let’s take a look at the results of the investigation of the current situation of cryptocurrencies in 2024.

7 key points

-

Cryptocurrency activities and use set a record high

-

Cryptocurrencies have become a key political issue before the US election

-

Stablecoin has found a fit point for products and markets

-

The improvement of infrastructure has increased capacity and greatly reduced transaction costs

-

Defi is still popular and is still growing

-

Crypto technology can solve some of the most urgent challenges faced by AI

-

More scalability infrastructure has unlocked the new chain application

1. Cryptocurrency activity and usage hit a record high

The number of encrypted addresses per month has never been so much.In September, 220 million addresses have been interacting at least once with the blockchain. This number has doubled since the end of 2023.(As an indicator, active addresses are easier to be manipulated than other indicators.)

The surge in active addresses is mainly due to Solana, and its active address is about 100 million.Followed by NEAR (31 million active addresses), the popular L2 network Base (22 million), TRON (14 million), and Bitcoin (11 million).In the Ethereum virtual machine (EVM) chain, the second 2nd active chain second only to Base is the BNB chain (10 million) of the Binance, followed by Ethereum (6 million).(Note: EVM chain calculates the total number of 220 million through the public key.)

The surge in active addresses is mainly due to Solana, and its active address is about 100 million.Followed by NEAR (31 million active addresses), the popular L2 network Base (22 million), TRON (14 million), and Bitcoin (11 million).In the Ethereum virtual machine (EVM) chain, the second 2nd active chain second only to Base is the BNB chain (10 million) of the Binance, followed by Ethereum (6 million).(Note: EVM chain calculates the total number of 220 million through the public key.)

These trends are also reflected on our BUILEDER ENERGY dashboard.The most changing blockchain in the total shareholding of the builder is Solana.Specifically, tell us that they are or interested in the total share of the founders who are interested in SOLANA from 5.1% last year to 11.2% this year.The increase in Base ranked second, with a total share of 7.8% last year to 10.7%, followed by Bitcoin, and its total share rose from 2.6% last year to 4.2%.

From the perspective of absolute value, Ethereum is still the most interested in developers, accounting for 20.8%, followed by Solana and Base, and then Polygon (7.9%), Optimism (6.7%), Arbitrum (6.2%), Avalanchehe(4.2%), Bitcoin (4.2%), etc.

At the same time, in June 2024, the number of mobile wallet users per month reached a record high of 29 million.Although the United States accounts for 12%of the monthly mobile wallet users, in recent years, with the continuous growth of cryptocurrencies globally, and more and more projects have excluded the United States to seek supervision through geographical fences to seek supervision outsideIn compliance, the share of the United States in the entire mobile wallet user group has declined.

The footprint of cryptocurrencies continues to expand overseas.After the United States, the country with the largest proportion of mobile wallets includes Nigeria (the country has been trying to provide supervision transparency through supervision and incubation plans, and has achieved significant growth in consumers’ purposes such as bill payment and retail purchase), India (Population and mobile phones are growing) and Argentina (in the case of currency depreciation, many residents have poured to cryptocurrencies, especially stable currencies).

Although it is easy to measure the number of active addresses and the number of mobile wallet users monthly, it is much more difficult to measure the number of actual active encrypted users.However, by combining a variety of methods, we estimate that there are 30 million to 60 million active encrypted users in the world. This ratio only accounts for 5-70 million global cryptocurrency holders estimated by Crypto.com in June 2024.10%.

This difference highlights a huge opportunity to attract and re -attract passive cryptocurrency holders.With the major improvement of infrastructure, a new, eye -catching application and consumer experience have become possible, and more sleeping cryptocurrency holders may become active chain users.

2. Cryptocurrencies have become a key political issue before the US election

In this election cycle, cryptocurrencies have become the focus of discussion in the United States.

Therefore, we measured the relatively interested level of swing states for cryptocurrencies.The two states, Pennsylvania and Wisconsin, are expected to be the most intense battlefield in November. Since the last election of 2020, the increase in the interest of cryptocurrencies search is ranked fourth and fifth respectively. This is measured by Google Trends.Total search ratio.The increase in the interest in crypto currency search in Michigan is ranked eighth, while Georgia remains unchanged.At the same time, Arizona and Nevada have declined slightly since 2020.

This year, the listing of Bitcoin and Ethereum Exchange Exchange (ETP) may increase people’s interest in cryptocurrencies.As such ETP expands investors’ channels, the number of Americans holding cryptocurrencies may increase.Bitcoin and Ethereum ETP have added $ 65 billion in positions.(Note: Although these products are usually called ETFs, they actually use the SEC table S-1 to register as ETP, which indicates that their basic investment portfolio does not include securities.)

SEC approves ETP is an important milestone in the encryption policy.Regardless of the party to win the election in November, many politicians predict that with the passing of the two parties’ encryption legislation, the momentum will be enhanced.More and more policy makers and politicians are positive for encryption.

This year, the industry has also stimulated other major policies.At the federal level, the House of Representatives approved the “21st Century Financial Innovation and Technical Act” (FIT21) with the support of the two parties, of which 208 Republicans and 71 Democrats voted for votes.The bill is waiting for the examination and approval of the Senate, which may provide urgent need for supervision clarity for cryptocurrency entrepreneurs.

It is also meaningful that at the first level of the state, Wyoming has passed the “Decentralization Non -Corporate Non -profit Association (DUNA) Act”, which gives the law to decentralized autonomous organization (DAO) law and allows the blockchainThe network is legally operated without damage to decentralization.

The EU and Britain are the most active contact with the public on cryptocurrency policy and regulatory issues.Opinions issued by European institutions are much more called more than institutions such as the US Securities and Exchange Commission.At the same time, the EU’s “cryptocurrency market bill” (MICA) is the first policy and system that has become a comprehensive cryptocurrency -related policy system that has become the law, which is expected to take effect at the end of this year.

Stable coins have become one of the most popular encrypted products and one of the biggest topics in policy discussions. Congress has proposed a number of bills.At least in the United States, one of the favorable factor is that people realize that even if the US dollar’s global reserve currency status declines, stablecoins can consolidate the US dollar’s overseas status.Today, more than 99% of the stable coins are priced in the US dollar, far exceeding the second largest amount: the euro accounts for 0.20%.

Stable coins have become one of the most popular encrypted products and one of the biggest topics in policy discussions. Congress has proposed a number of bills.At least in the United States, one of the favorable factor is that people realize that even if the US dollar’s global reserve currency status declines, stablecoins can consolidate the US dollar’s overseas status.Today, more than 99% of the stable coins are priced in the US dollar, far exceeding the second largest amount: the euro accounts for 0.20%.

In addition to showing the strength of the US dollar to the world, stable coins may also strengthen the domestic financial foundation.Although it has only a ten -year history, the stable currency has jumped into the top 20 holders of US debt, making them lead in Germany and other countries.

In addition to showing the strength of the US dollar to the world, stable coins may also strengthen the domestic financial foundation.Although it has only a ten -year history, the stable currency has jumped into the top 20 holders of US debt, making them lead in Germany and other countries.

Although some countries are exploring the central bank’s digital currency (CBDC), the opportunity for stable currency in front of the United States has matured.Judging from the general views of these discussions and many well -known politicians now, we expect that more countries will start to seriously formulate their cryptocurrency policies and strategies.

3. Stable coins found the fitting point of the product and the market

By achieving fast and cheap global payment, stable coins have become one of the most obvious “killer applications” in cryptocurrencies.In fact, as the members of the MP, Dn.y.), in a column of “New York Daily News” in September, “the popularity of the US dollar stable coins -thanks to the smartphonePopularization and blockchain encryption -may become the greatest financial empowerment experiment in human history. “

The large -scale expansion upgrade has greatly reduced the cost of executing encrypted transactions (including transactions involving stable coins), and even reduced by more than 99% in some cases.On Ethereum, the average cost of sending US dollar hook stable currency USDC this month was $ 1, which was less than $ 12 in 2021.The average cost of sending a USDC on Coinbase’s L2 network base is less than one point.(Please note that these numbers may not include some money and exit costs.)

Compare these expenses with an average US $ 44 international electricity exchange cost.

Stable currency makes value transfer simple.As of June 30, in the second quarter of 2024, a total of 1.1 billion transactions were traded, and the transaction value reached 8.5 trillion US dollars.During the same period, the stable currency transaction value was more than twice that of VISA 3.9 trillion US dollars.Stable currency is heatedly debated as well -known and deep -rooted payment services such as VISA, Paypal, Ach, and Fedwire, which has been heatedly discussed, which fully proves its practicality.

Stabilizing currency is not just a momentary boom.If stable currency activities are compared with the fluctuation market cycle of cryptocurrencies, the two seem to be unrelated.In fact, even if spot cryptocurrency transaction volume decreases, the number of addresses sending stablecoins per month continues to increase.In other words, people seem to not only use stable currency for transactions.

All these activities are reflected in the use of statistics.Measured according to the daily active address share, stable coins accounted for nearly one -third of the daily cryptocurrency usage, 32%, second only to decentralized finance (DEFI), 34%.The remaining uses of cryptocurrencies are distributed in infrastructure (bridge, prophecy machine, maximum extraction value, account abstraction, etc.), token transfer and a few other fields, including emerging applications such as games, NFT and social networks.

4. Infrastructure improvement and increase the capacity, and significantly reduce transaction costs

One of the reasons for stable coins such a popular and easy to use is the progress of underlying infrastructure.First, the blockchain capacity is growing.Due to the rise of the Ethereum L2 network and other high throughput blockchain, the transaction volume of blockchain per second is more than 50 times that of four years ago.

What is even more shocking is that Ethereum’s biggest upgrade this year- “Dencun”, also known as “Protodanksharding” or EIP-4844-after the implementation of March 2024, the cost of L2 network was greatly reduced.Since then, although the value of ETH pricing on L2 has continued to rise, the cost of L2 Pay in Ethereum has decreased significantly.In other words, the blockchain network is becoming more and more popular, and the efficiency is getting higher and higher.

Zero Knowledge (ZK) proof is similar, which is another technology that is of great significance to blockchain expansion, privacy and interoperability.Although the amount used to verify that the amount proven by the Ethereum has declined monthly, the value of the ETH pricing on ZK Rollup has increased.In other words, the ZK proof is getting cheaper and cheaper, although they are more and more popular.(We use zero knowledge here as the general name of encryption technology, it can simply prove that the calculation of uninstaling to the Rollup network is correctly executed.)

ZK has a wide range of prospects because it has opened a new way for developers to calculate cheap and verified blockchain computing.However, there is still a long way to go to the performance of ZK -based virtual machines (ZKVM) to catch up with traditional computers -this is a notable phenomenon.

Through the improvement of all these infrastructure, it is easy to see why blockchain infrastructure is still one of the most popular categories of the builders, and why L2 has become one of the five most popular builders we have tracked.

5. DEFI is still popular, and it is still growing

The only category that attracts developers more than blockchain infrastructure is decentralized finance (DEFI), which is also the largest category of cryptocurrencies, accounting for 34%of the daily active address.Since the emergence of DEFI in the summer of 2020, the decentralized exchange (DEX) has grown to 10%of the spot cryptocurrency trading activities -and all these occurred on the centralized exchange four years ago.

At present, the funds locked in thousands of Defi agreements exceed $ 169 billion.Some top DEFI sub -categories involve pledge and lending.

Ethereum has completed the transition of equity for more than two years, which greatly reduces the energy consumption and environmental footprint of the network.Since then, the share of Ethereum pledged Ethereum has increased from 11% two years ago to 29%, which has greatly enhanced the security of the network.

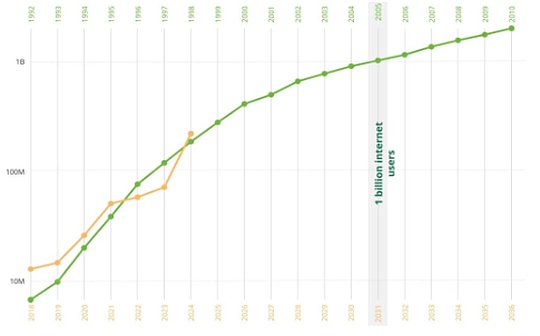

Although DEFI is still in the early stage, it provides a hopeful alternative for the centralization and power integration trend of the US financial system.Since 1990, the number of banks in the US financial system has been reduced by two -thirds, and the share of large banks in assets has become smaller and smaller.

6. Encryption technology can solve some of the most urgent challenges faced by AI

AI is one of the hottest trends this year, not only in the technical field, but also in the field of encryption.

AI is one of the most popular trends for cryptocurrency influencers on social media.Maybe even more surprising is that the visitors of ChatGPT.com and the visitors of top cryptocurrency websites have a lot of overlap, which shows that there is a close connection between cryptocurrencies and artificial intelligence users.

Cryptocurrency builders are also closely related to AI.According to our BUILDER ENERGY instrument board, about one -third of the cryptocurrency project (34%) indicates that they are using AI, no matter which category they are building, this ratio is higher than 27%a year ago.The most popular category of artificial intelligence technology is blockchain infrastructure projects.

Given that the cost of training cutting -edge AI models in the past 10 years has increased by 4 times each year, we believe that AI may tend to be centralized in Internet power.If it is not controlled, only the largest technology company has resources to train the latest AI model.

The centralized challenges of AI are almost the opposite of decentralization opportunities provided by the blockchain network.Today, the encrypted project is trying to solve some of the challenges, including Gensyn (calculated access by democratization AI), Story (to help compensate creators by tracking IP), NEAR (run AI and AI on an agreement owned by users) and users) and users) and users) and users) and users) and user ownership) and user ownership) and user ownership)Starling Labs (by helping to verify the authenticity and source of digital media), only a few cases are given.

In the next few years, the cross between Crypto X AI may be strengthened.

7. More scalability infrastructure unlocks the new chain application

With the decline in transaction costs and the increase in blockchain capacity, many other potential encrypted consumer applications are possible.

Take NFT as an example.A few years ago, when the price of cryptocurrency trading was much high, people traded NFT with billions of dollars in the secondary market.Since then, this kind of activity has faded and replaced by a new consumer behavior: cast low -cost NFT collections on social applications such as Zora and Rodeo.This represents a major change in the NFT market. Before the transaction cost is reduced significantly, this transformation is largely unimaginable.

Another example is social network.Although they currently only account for a small part of the daily chain activities, they have attracted strong builder activities: according to our Builder Energy instrument board, by 2024, 10.3% of the encryption projects are related to social.In fact, projects related to social networks (such as Farcaster -related projects) are one of the most popular categories of the most popular this year.

While developers and consumers explore more social experiences, chain games are pushing the blockchain to the limit.The Rollup used in the PROOF of Play’s Gonghai Adventure role -playing game “The Pirate State” has always been the most of all Ethereum Rollup.

As the November election approaches, the prediction market based on cryptocurrencies is ushered in development opportunities -although they are illegal in the United States -and predicting the overall development momentum of the market is increasing.So that Kalshi is a non -base cryptocurrency forecast market registered in the US Commodity Futures Commission. Last month, it won the federal lawsuit in the lower court on the listing contract.(As of now, the registered exchanges have been allowed to provide traditional futures contracts based on elections.)

New signs of consumer behavior began to appear.When the blockchain infrastructure is bulky and the transaction cost is high, all these emerging experiences are difficult to achieve.As the blockchain continues to improve along the traditional technical cost -effective curve, more such applications are expected to flourish.

New signs of consumer behavior began to appear.When the blockchain infrastructure is bulky and the transaction cost is high, all these emerging experiences are difficult to achieve.As the blockchain continues to improve along the traditional technical cost -effective curve, more such applications are expected to flourish.

What left us?In the past year, cryptocurrencies have made significant progress in policy, technology, and consumer adoption.These include the milestone of the policy, including the sudden approval and listing of Bitcoin and Ethereum ETP, as well as the passing of important two -party cryptocurrency legislation.The infrastructure has been greatly improved, from expansion to the rise of Ethereum L2 and other high throughput blockchain.There are also new applications being constructed and used, from the growth of pillars such as stablecoin to exploring emerging categories such as AI, social networks, and games.

Whether we have entered the fifth wave of the price innovation cycle (we understand the ups and downs of cryptocurrency’s market cycles), it remains to be observed.In any case, cryptocurrencies have made undisclosed progress in the past year as an industry.As proven by ChatGPT, only one breakthrough product can change the entire industry.