Author: Rui, HashKey Capital Source: X, @YeruiZhang

Let’s talk about the conclusion first. Babylon’s LST is difficult to be alpha, and it is difficult to replicate the grand occasion of Eigen LST in hype.

Let me first talk about why Eigen LST succeeds. In my opinion, there are several reasons:

1. Eigen itself gradually attracts TVL in the rising market cycle, and does not rush to issue coins in a rush, giving LST a soil for speculation.Eigen’s mining reward is ETH basic staking reward + LST coins + Eigen’s own coins, and various AVSs to expect.3-5% of ETH pledge is natural, and supporting LST can significantly alleviate the Yield reward given.

2. There is a strong Defi infrastructure on ETH, AAVE makes revolving loans possible, and Pendle’s launch of derivatives allows those who want hedging and double bets to get what they want.

3. Although there are ETH derivatives and Cap after February 10, Native Staking has given a window, which in my opinion is a means to support LRT flip LST.Correspondingly, because this money is real ETH, the exchange can position this group of big players.

4. Eigen successfully upgraded itself from the EigenDA narrative to the vision of AVS to replace the existing ETH infrastructure, becoming an indispensable part of ETH.

Let’s talk about why it is difficult for Babylon to replicate the grand occasion of Eigen.

1. There is not much time and space left for Babylon to absorb TVL, so there is no need for Babylon to pay for 5B+ TVL for more than half a year.The BTC ecosystem also has no basic interest rate to take advantage of.

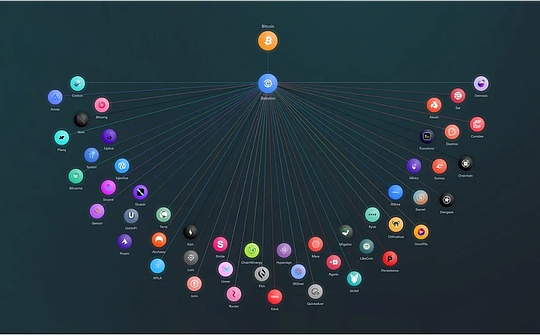

2. The BTC ecosystem has no Defi infrastructure, which leads to LRT doing everything itself, and the possibility of risk is greater.Also without Defi infrastructure pricing is difficult to reach a very high scale.

3. There is no need for Babylon to save all the money, it just needs independent users (if you want to support LST, then just package it out to the partner), which is why each number is only 0.02BTC.Since the market position in the BTC ecosystem has been determined, there is no need to pay too much for TVL (the previous TVL with Merlin 4B did not have a good effect, and it also covered most of the big players).Moreover, there are too many self-hosted TVLs in the BTC ecosystem, and blindly receiving them is risky.

4. From the first phase, LST has undertaken a lot of GAS. This part is to attract storage and display muscles to the exchange after Babylon is opened on a large scale, but if each phase in the following phase is 0.02BTC per number?

I don’t think Babylon itself is a bit disgusting, because it takes longer to get time and I think they will bring something different to the BTC ecosystem, but from the perspective of hype before it goes online, the success of Babylon LST is not low.