Author: Alana Levin, Variant Fund Investment Partner; Compilation: 0xjs@作 作 作 作 作 作

Every six months, I will write an internal reflection on the current status of cryptocurrencies and the future development direction.I think it is worth publishing one of my recent posts for public reading.

This article is divided into three parts: what ’s existing product (What’ s Working), other things that have already occurred (or are occurring), and new things I look forward to.

I tried to build most analysis on the basis of data, but it is undeniable that my views were revealed inadvertently.Hope this is an interesting article.If the response is positive or effective, I will consider sharing more internal reflection in the future.

Existing effective products

The good news is that many things are playing a role and progressing smoothly.The development of these things -Many of them are called “great ideas” because they can effectively change the status quo -they should create new opportunities, which is their successful subordinates.

For clearing, the term I used the term “What’ s Working “refers to the project or trend that shows the sustainable product market that is expanding the size of the encrypted market or both.

So, what factors seem to play a role or continue to grow?I list 10 items I think are the factors that are showing the signs of “existing results” (not in detail):

1. Stable currency

2. Bitcoin as an alternative asset

3. Farcaster, an early but growing social network

4. Asset creation

5. The AI model of community creation and training

6. Solana

7. Ethereum

8. Zora

9. Coinbase

10. Chain Exchange

11. BONUS: Blackbird

#1: Stable currency

The stable currency supply on the chain has achieved approximately $ 25 billion in net supply inflows so far this year.Overall, since November 2023, influence has been positive.The global US dollar use right that does not require permits will continue to enjoy a strong product market.

#2: Bitcoin as alternative assets

In January, less than 12 Bitcoin spot ETF was approved.As of early June, Bitcoin spot ETF was worth more than $ 80 billion.(I follow the tracker of Blockworks and The Block to obtain data).

Gold seems to be a powerful analogy of understanding the configuration of Bitcoin: Whether you think that the asset representative hedge inflation, it is a alternative to traditional stocks, and its value has a social consensus to a certain extent.Some people may say that Bitcoin is much better than gold -because it is easier to transfer, there is a well -known supply limit, and this asset is adopted on the balance sheet of some companies and countries -therefore, the market value of Bitcoin’s market valueOne day may exceed gold.

In the private market, the characteristic of the first quarter is that a large number of projects aimed at expanding Bitcoin utility have emerged.These projects include (many) Bitcoin smart contract layers, chain lending agreements, and exploring how to use Bitcoin’s economic security budget to help protect other chains.I guess any achievements of these development may be born in the second half of this year.

#3: Farcaster

Farcaster is a social network based on the open agreement track, and began to enjoy meaningful growth.

The turning point occurred at the end of January, when Frames was launched.Frames is a component similar to a small program, and people can share and interact directly in the social message stream of the Farcaster client.

#4: Asset creation

The number of newly created tokens continued to increase.One way to track this trend is to view the number of new token appearing on the DEX (decentralized exchange).The activity seems to be driven by assets on Base and Solana.

Especially on Solana, more than 10,000 new tokens have been created every day in the past few weeks.

Source: Solscan

Source: Solscan

Many of these new assets appear in the form of Memecoin.I will not describe myself as an active person in the field of Memecoin, but I do realize that a group of very real and active participation users show the enthusiasm of participation.

It is worth noting that the emergence of these new assets has brought some unexpected but effective by -products to a wider range of ecosystems.For example, we have seen more tests on new tools, such as Solana’s tokens.A tokens called $ Bern uses the new token expansion of Solana to innovate to Vibration Economics: if someone sells their tokens, 5% of the transaction will be destroyed (as a re -distribution mechanism for the remaining holdersTo.The popularity of $ Bern becomes a compulsory function for wallets to adopt the standard of tokens -these standards are effective because they can achieve complex payment splitting and confidential transfer.If there is no $ Bern, who knows how long it takes to use tokens.

In general, my main point is that asset creation seems to be a trend of smooth and smooth water.Regardless of your views on these assets, possessing rights and exchanges are still two excellent choices in value flow.

#5: AI model of community creation and training

Obviously, we are moving towards a world with a large number of LLM opportunities. Create a low cost and many choices.Where is the value in that world?

I think the value originated from scarce resources.Therefore, in a world with rich computing, rich content and rich tools, the problem becomes: What is scarce?One of the answers is taste and attention.The difficulty is that taste and attention are quite intangible resources.Even if we can measure them (such as “screen time” can be used as a measure of attention), it is difficult to measure these indicators with the US dollar.

We began to see that encryption played by closely combining finance with taste and attention activities.Specifically, the artificial intelligence model created and trained in the community has some productive output -such as a product or service that can be sold or authorized (such as art, movies, intellectual property rights, etc.) -This can reward participants.For models with subjective output, community participants act as manufacturers through their cultural preference training models.The motivation to choose a good taste is very strong: the more tasteful output, the higher the selling.

We began to see some of them appearing in real and effective ways.Botto is my favorite example.It is an independent artist who can help the training model every week every week.

Botto’s artistic works are high -quality, and they are getting better and better. The price of BOTTO works at the weekly auction is constantly rising.At the same time, the network of owner participants is also growing:

I think we will begin to see more artificial intelligence models created and trained by the community, especially with known and effective examples (such as BOTTO) become more and more prominent.

Some companies are challenging the attribution by litigation, data license agreement, or both.If we assume that the status quo represents less than 1%of the output based on the model five years, then there is obviously there is room for other attempts to solve the attribution problem and allocate contribution value.Encryption provides a unique and valuable solution.Crypto technology has strengthened economic and creative attribution.It is meaningful that it also allows anyone to participate anywhere.

Chris Dixon meditated in an old blog:

“There is a famous saying:‘ The future is here -but the distribution is unevenly. ’A obvious follow -up problem is: If the future has come, where can I find it?”

The model of community creation and training is an area of some of the projects that are small but are developing. These projects indicate the direction for a wider future.

#6: Solana

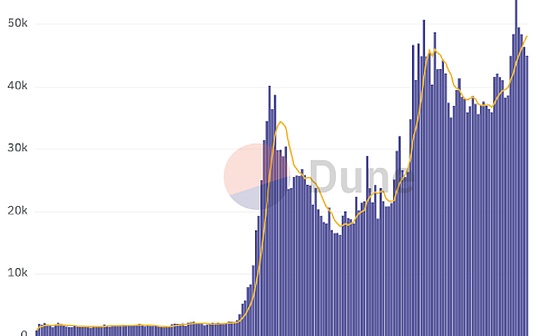

The daily active address that interacts with Solana is 2-3 times higher than the same period last year, which is roughly consistent with the highest activity period in the 2021 cycle.The number of active addresses per month increased by 3-4 times in the same time period, and in May 2024, a historical high:

The network also began to generate meaningful cost income, and began to prove that such a hypothesis: Solana’s low costs will be made up by larger user activities / quantities.

The network also began to generate meaningful cost income, and began to prove that such a hypothesis: Solana’s low costs will be made up by larger user activities / quantities.

Conclusion: The development trajectory of Solana shows that some things are playing a role, and they are playing in a meaningful way.Solana will continue.

#7: Ethereum

The Ethereum ecosystem has also made significant progress.There are two ways to describe this growth: pay attention to Ethereum itself, and look at the Ethereum chain system as a whole (that is, including Ethereum route map).

The number of monthly active addresses in Ethereum itself has also increased significantly.The average value of the past 30 days has increased by about 30%so far, only about 10%lower than the peak in 2021.

The Ethereum ecosystem also shows a significant sign of growth.In the figure below, I summarized the daily active address of the five major Ethereum blockchain (Ethereum, Arbitrum, Base, Optimism, and Polygon).The reason why these five blockchains are selected is partly because they have rich application ecosystems and developers.

The Ethereum ecosystem also shows a significant sign of growth.In the figure below, I summarized the daily active address of the five major Ethereum blockchain (Ethereum, Arbitrum, Base, Optimism, and Polygon).The reason why these five blockchains are selected is partly because they have rich application ecosystems and developers.

Key points: Ethereum has always been one of the most important ecosystems in the cryptocurrency field.

#8: Zora

Zora Chain has been online for nearly a year.During this period, the network has been looking for a foothold.The number of active users has increased by about 60%so far this year, and recently exceeded a new high of 250,000.The profit margin of the chain also reaches about 34%, which means that ZORA can retain about one -third of ETH spent on transaction fees.

Zora Chain helps verify such a point: applications with sufficient distribution can start vertically with other parts of the stack (such as block space) to release more attractive economic benefits.

Zora Chain helps verify such a point: applications with sufficient distribution can start vertically with other parts of the stack (such as block space) to release more attractive economic benefits.

#9: Coinbase

Coinbase has also performed strongly this year.It is listed as 8 custodians in 11 Bitcoin spot ETFs.The exchange business has continued to make progress -the transaction volume reached a high level of $ 157 billion, which is a number that has never been reached since November 2021.

The transaction fee still accounts for a large part of Coinbase’s income.In the first quarter, the platform’s transaction fee revenue exceeded $ 1 billion (about two -thirds of its quarterly revenue).

But it is also worth noting that Coinbase continues to diversify its source of income and no longer rely only on transaction costs.Blockchain revenue revenue and custody fees have doubled more than last year.The stable currency income is close to 200 million US dollars, and the growth of USDC circulation has offset (slightly) lower interest rates.Coinbase’s membership kit Coinbase One has more than 400,000 users.Coinbase’s 2 -layer protocol Base generates millions of chain costs per month.

Coinbase’s success proves (until recently) Many people think that the assumptions are real: the words of encryption can build many meaningful new business models.

# 10: Chain Exchange

On the main Ethereum chain, the number of independent users (traders) of Uniswap increased by about six months ago.

A definition of a successful agreement is that successful companies can be established on their basis.We have seen this in the chain exchange, such as the income growth brought by the interface of the Uniswap Labs interface:

A definition of a successful agreement is that successful companies can be established on their basis.We have seen this in the chain exchange, such as the income growth brought by the interface of the Uniswap Labs interface:

The 7 -day mobile average of the UNISWAP protocol has recently surpassed Coinbase:

It is important that we see that the growth of the exchange on the chain does not happen to the Ethereum.In Solana, the two leading DEX -ORCA and Raydium have also increased significantly:

The chain agreement contributes tens of billions of (even hundreds of billions) to the value exchange monthly, which is not a joke.The protocol and interface are very real revenue projects.In the case of a centralized institution (such as the interface business), I hope that we can see that some of these profits are re -invest in improving security, stability and user experience.

#11 (bonus): Blackbird

Blackbird is the loyalty and reward plan of the catering industry, which is built with encryption.When the user signed in a restaurant associated with Blackbird, the application will cast a NFT for them -this is the digital product they visited, and it is also a data point for the online Chinese restaurant to understand customer dining habits.Today, Blackbird is mainly in New York City.

The daily visual volume of Blackbird user base continues to increase.

Personally, Blackbird has changed my own dining habits: In the past, I usually let my friends choose where we should eat, and now I have more actively recommended a place for us (and mainly use the BlackBird application to guideWhere may be an interesting dining place).

Other things that have happened

Other noticeable trends in the past two quarters include the rise of social finance and the surge in the new chain (mainly L2 and L3 in the Ethereum ecosystem).Although I think it is too early to say whether they are indeed effective, it is worth noting that these trends are affecting the behavior of users on the chain and how developers develop their business models have a significant impact.

#1: The growth of SocialFi application

A large amount of financial social (“SocialFi”) has appeared.Several of them have been incurred by millions of expenses.Friendtech and FantasyTop are the two most popular applications I know.Obviously, some users find these applications very interesting and are willing to participate.It is a good thing to provide users with new things on the chain.

I have a doubt about the sustainability of some of the business models.It seems not enough to promote long -term success by speculation alone.But it doesn’t matter.Some of these applications may only be adjusted to achieve more sustainable business models.Attraction -even caused by speculation -providing a chance to monetize this interest through various ways.However, the key second step is of course the most difficult part.

#2: The surge in the new chain

We also see the launch of many new chains (especially L2 and L3).For these chains in the Ethereum ecosystem, the underlying technology does not seem to be a substantial difference.On the contrary, brands and communities are better than everything.The L2 Base launched by Coinbase may be a microcosm of a powerful brand.Even if there are no other chains to attract direct tokens to inspire talents, the chain also owns (rumored) developer ecosystems.

So far, we see that the chain attempts to achieve differentiation in three ways:

-

Under the technology.For example, integrated chain vs. modular chain, or optimistic Rollup vs. zero knowledge rollup.

-

Chain economics.As far as I know, Canto is the first chain that has tried the transaction fee to the developers in the ecosystem in recent years.Blast and BERACHAIN are currently trying various other types of benefits and economic allocation.It is unclear the sustainability of these measures -whether it is from the perspective of the overall economic consideration or from the perspective of providing long -term competitive advantages.

-

Brand and community.The culture and/or reputation of the chain can become a halo that attracts developers: it may enhance the developer’s views (from the community or other developers) when building in the ecosystem.It provides reputation in the eyes (“No one will cause trouble because choosing MacBook” or similar things), which may be consistent with the values advocated by/or chain communities may be consistent with the developer’s own ideology.

-

The company can send coupons directly to the wallet of the target customer (because each account has a related wallet).

-

The coupon may be mentioned based on the posts created by consumers, or the posts that users like.

-

Enterprises can operate with confidence, because data will always be open and accessible (that is, don’t worry about the API being closed or the price is raised), which allows enterprises to invest in the effectiveness of increasing the distribution channel.

-

It costs budget only when consumers are converted into sales (even with coupons).

-

Different forms of vouchers.The voucher (certificate, certificate, etc.) is a valuable resource on the chain: Putting the voucher on the public ledger is not only conducive to the labeling time, but also conducive to verifying the issuer.An example of such vouchers may be verification of the workplace -the receipt issued by the employer proves that someone has worked in a company for a while.In the encryption industry, I saw many proofs.I think the key here is to determine the voucher with real economic value -such as employment verification -and focus on these markets.

-

Price Differential Assets (PDA).These products have actual economic value, but there are great differences in the willingness of market participants.Restaurant booking is a good example.Recently, an article on the underground booking market in New York is spreading on the Internet: the popular booking is attacked by robots and resold at a price of thousands of dollars in the exclusive secondary market.In my opinion, if people think that this is inevitable, letting these “assets” be as transparent as possible and easy to acquisition seems good for diners and restaurants.The restaurant can easily view the history of reservation, while more potential consumers can participate.It can even achieve a certain programming price limit or share income with restaurants.This is just an example.There are more markets. Due to the opaque or limited channels entering the market, actual assets with basic economic value are wrong or inefficient pricing.

-

New forms of token distribution.There are many opportunities to promote existing behaviors through token awards as by -products that they can do.Blackbird is the first and most prominent example: eating out to eat is already a common activity, but the existence of BlackBird’s reward may have changed the location and frequency of some users to choose to eat.This can be used in areas where people have spent time and money but lack of consistency or loyalty in consumer activities.In particular, I will find a category that can benefit from a certain alliance or cooperation effect (as far as more data/insights of consumer behavior between merchants), and there is a great opportunity to improve customer loyalty (by promoting promotion).

Mature blockchain has these three elements.Take the two blockchains that I emphasize above as an example: Ethereum and Solana.Ethereum created EVM, realized the EIP-1559 (a mechanism for reorganizing part of the transaction fee as an ETH holder), and developed a strong developer community and spirit around its technology.Solana promoted integrated blockchain, the first blockchain to make low costs with commercial feasibility, and has a community to really forged in fire during the economic downturn in 2022-2023.

My assumption is that the next wave of blockchain differences will originate from external integration.Examples may include seamless access to other fund sources (such as Coinbase accounts), KYC such as KYC of wallets or verifying whether someone is human.This is a very broad design space, and I am glad to explore this field more deeply.

Look forward to the future

Looking back at the past six months, my main gain is that we are still talking about what talk about 6-12 months ago, but we are more mature in “existing results”.With these maturity, many platforms should be transformed into a platform for creating opportunities, which is its successful by -product.Growth will bring growth troubles, and these troubles create space for third parties to provide solutions.

The growth of these major platforms can also provide the foundation for us to think about future development direction.I am most concerned about the new distribution form and the new construction module.

New distribution and better building module

In terms of distribution, some of the growth vectors I feel excited include: larger Farcaster, Telegram applications with more powerful wallet functions, and interfaces such as World App to continue to attract more people (currently reaching 10 million)

There are also many exciting new construction blocks.Coinbase launched a smart wallet that allows users to pay directly from the Coinbase account.Reservoir’s Relay protocol helps eliminate the experience of bridging funds between users between chains and make the “one -click” checkout experience on the chain finally possible.The World ID continues to develop, which is expected to provide a method of authentication between people and intelligence.There are more.

This may sound a bit blurred.When I read some things that look more abstract rather than reality, I sometimes feel frustrated, so I will try to use a specific example to explain what these construction modules and new distribution channels can be achieved.Essence

Taking modern advertising as an example, this is a market worth billions of dollars, involving almost all businesses.I guess that although the attribution and positioning have been improved for decades, it is still inefficient.Now imagine what the “advertisement” on Farcaster will look like:

Overall, this seems to be a win -win situation for enterprises and consumers, and this is due to the open social maps, embedded payment channels, and verified digital identities.

Mature blockchain refers to the future

Another noticeable harvest of the “already effective” part is that there are now several reliable and continuous development ecosystems (Ethereum, Solana, Bitcoin).These three ecosystems compete in unique differentiated factors, and the advantages of each ecosystem have brought continuous improvement of production pressure to other ecosystems.For example, Solana’s success in low costs and high throughput has promoted Ethereum to continuously innovate on basic layers and L2.Similarly, Ethereum has multiple clients that may set a goal for Solana’s client diversity (for example, the upcoming Firedancer client).Bitcoin was the first to realize the real institution, but it has begun to try to implement new programmable elements (using Ordinals, Runes, and potential OP_CAT upgrades).In a broad sense, I summarize it as a constant attempt to achieve roughly the same functions as other ecosystems.Observe the current position of each ecosystem -and the positive relative characteristics displayed by its peers -as a guide for each ecosystem to try to implement improvement.

This feels very positive.I am a tennis fan, so I will use tennis to compare.If Federer, Nadal and Djokovic did not compete with each other, they may not reach the same level of exercise.Everyone promotes others to improve their level, and the result is that tennis is really great.I think what we see in different chains in the encryption field is the same.Everyone is making greater progress because of improvement of production pressure.As a result, the entire industry is expected to achieve net income.

Some new ideas

There are many ideal infrastructure and applications to be constructed.I am interested in some areas that have not been developed and have potential:

It is true whether these ideas have unique “effective results” are an unreasonable issue.Most of them left me a deep impression that these ideas have been existed for a while, but they have not been fully explored (it is worthy of further attempts).

in conclusion

This reflection represents many things I think have happened recently in the field of cryptocurrencies, but the important thing is not all.It does not involve the growth of permanent storage solutions (such as Arweave), the DEFI protocol is mature into a real financial platform (such as MORPHO), and Telegram’s impressive promotion of Ton.