Author: ARNDXT, encryption researcher; compiled by: 0xxz@bitchain vision

Now we should discuss the potential long-term impacts of Bitcoin ETFs and institutional adoption.

While the price movement is exciting, I worry that we may be overlooking some of the serious risks of Bitcoin’s basic value proposition.

Advantages: Adoption and price increase

Let’s start with the positive:

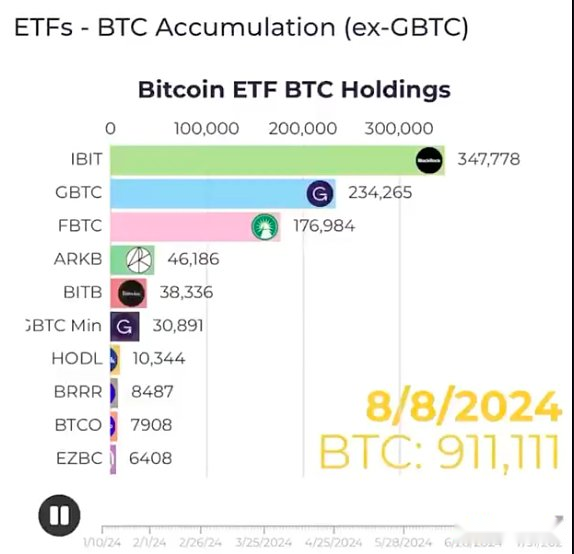

• The Bitcoin ETF was approved about 7 months ago, marking an important milestone in mainstream adoption.

• Since then, these ETFs have received about 4.3% of the total Bitcoin supply.

• The influx of institutional funds has indeed triggered a new bull market, pushing Bitcoin to record all-time highs.

On the surface, this looks great.In the eyes of traditional finance, the adoption rate is higher, the price is higher, and the legitimacy is higher.But as I dig deeper, I can’t get rid of this feeling: we are trading short-term gains for long-term risks.

Worrying: Centralized spread

Here are the reasons why I can’t sleep all night:

-

ETFs have swallowed up 4.3% of the Bitcoin supply in just 7 months.This proportion may be underestimated considering the number of lost Bitcoins.

-

MicroStrategy alone accounts for more than 1% of the supply.

-

The U.S. government also controls about 1%.

-

Other large entities are undoubtedly accumulating.

We see Bitcoin being rapidly concentrated in the hands of a few strong players.This trend directly goes against the core spirit of Bitcoin: decentralization.

Dilemma: Adoption and decentralization

This situation brings a typical dilemma:

-

We want Bitcoin to be widely adopted and recognized as a legal asset class.

-

But we also need it to remain decentralized to fulfill its commitment as a censorship-resistant, license-free monetary system.

The contradiction between these goals is getting bigger and bigger.The mechanisms that promote adoption (ETFs, institutional investments) themselves are also centralizing ownership.

Centralized risk

Why should we care about this centralization?Here are a few reasons:

-

Market manipulation: Large holders may affect price trends.

-

Regulatory Capture: Governments and institutions may implement regulation that benefits large holders and harm the interests of individual users.

-

Network Governance: Although the Bitcoin protocol is difficult to change, social consensus is crucial.Large holders can have a huge impact on the debate over escalation or forks.

-

Liquidity Problem: If a large supply is locked by long-term holders, it may affect the utility of Bitcoin as a medium of exchange.

Lack of blocking centralized mechanism

What is particularly worrying is that we have no mechanism to prevent this centralization.Bitcoin’s design prioritizes permissionlessness, which means we cannot stop anyone, whether individual or institution, from accumulating the wealth they want.

Personal thoughts

I’m glad to see Bitcoin gain mainstream recognition.But what is the price?Are we focusing too much on digital growth and ignoring the revolutionary potential of truly decentralized currencies?

I don’t pretend to know all the answers, but I believe this topic is crucial to the future of Bitcoin and cryptocurrencies as a whole.

original:The Double-Edged Sword of Bitcoin ETFs: Are We Sacrificing Decentralization for Adoption?