Author: Charles, HUMBLE FARMER Army Research Translation: Shan Ouba, Bit Chain Vision

Although Pendle has been online for a long time, with the booming development of the LSD industry, PENDLE has been adopted as a “income transaction” platform in early 2023.By dividing the assets into the principal and yield part, Pendle allows the tokenization and transactions of yields.PENDLE allows users to purchase assets (similar to zero -interest bonds) at discounted prices to generate fixed income, and to speculate on the benefits of certain income (similar to interest rates) by their principal and income token.

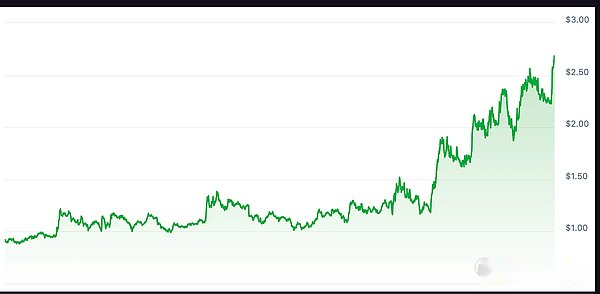

From then on, the surface area of the income tokens has expanded with the increase of returns. Recently, the liquid has been re-mortgaged to the tokens (LRT) -Pendle has continued to iterate and supports the revenue transactions of these primitives.The PENDLE LRT market is particularly successful because they essentially allow users to pre -sale or use long -term airdrop opportunities (including Eigenlayer).These markets have quickly become the largest market on Pendle, and are far ahead:

>

Driven by the hype of Eigenlayer, the success of this product brings positive price motivation to the $ Pendle token, until the end of the year:

>

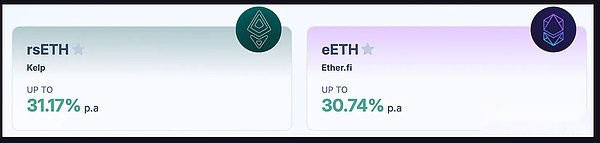

Through the custom integration of LRT, PENDLE allows the main currency to lock the basic pledge ETH yield, EIGENLAYER airdrop, and any airdrops related to the re -pledge protocol issued by LRT.This has created more than 30% of PT buyers for more than 30% of the annual rate of return:

>

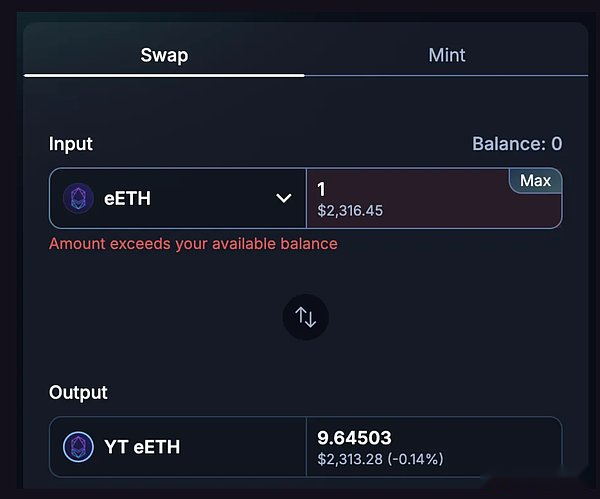

On the other hand, Yield Token allows a certain form of “leverage to farm”, which is also due to the way LRT integrates into Pendle.Through the exchange function in PENDLE, we can exchange 1eth to 9.6 YT EETH, which will accumulate EIGENLAYER and Ether.fi points, just like holding 9.6 EETH:

>

In fact, for EETH, YT buyers can also get 2 times the multiplication of Ether.Fi points. This is the real “leveraged airdrop mining”

In view of the approaching date, YT will tend to zero, and the value of YT buyers bet on Eigenlayer and Ether.fi (or KELP in RSETH) airdrops will be greater than the ETH spent to buy YT.

Considering the expected scale of Eigenlayer airdrops and high demand for farming, these light rail markets are not surprising to get the greatest attractiveness on Pendle.Locking airdrops and leveraged income agriculture in the form of ETH pricing are served very different market niche, but it seems that both have great demand.PENDLE may continue to dominate this segment, because they introduced additional LRTs, and may occur later this year that may surround AVS to be airdropped to LRT holders. In this sense, $ Pendle is LRT and EIGENLAYERThe success of the vertical field provides a good exponential exponential exposure!