Original title: All Markets Are Not Created Equal: 7 Factors To Consider When Evaluating Blockchain-Enabled Collectibles Marketplaces (BECMs)

Author: Vishal Kankani, Eli Qian; Investment Partner of Multicoin Capital; Translated by: 0xxz@Bitchain Vision

Collection is a big business.Today, more than one-third of Americans identify as collectors, and as of 2024, the market size of collectibles is now close to $500 billion.Collectibles are a booming industry—blockchain is moving towards it.

More and more collectors in the world are actually traders, whose sole purpose is to buy and sell billions of dollars in collectibles—from rare whiskeys to luxury watches to handbags—to make money by replacing the hand.While online markets usually range from digital classified ads to one-stop shops to vertical markets, they have not evolved to serve humanity in the most efficient way.

In order to maximize the efficiency of resale transactions, the collectibles market needs to have 1) instant settlement, 2) physical storage and 3) certification functions.Currently leading collectibles markets, such as Bring a Trailer, StockX, and Chrono24, offer these three services.Cash settlement is not an option; on the contrary, physical settlement is the default method – settlement time is usually in days or weeks.For larger collections, such as cars, physical storage quickly becomes a problem (where do you want to put them when you resell 20 cars?).For smaller collections, which are often traded through vertical markets such as Facebook groups, fraud is an ongoing challenge.All of these factors make trading collections extremely inefficient in today’s market.

We see a huge opportunity to create a brand new market design designed specifically for collectibles traders called the Blockchain-Enabled Collectibles Marketplaces (BECM).These markets provide instant transactions through cash settlement, use stablecoins to reduce settlement time from weeks to seconds, and use NFT as a digital representation of physical assets held by trusted custodians or certifiers.

BECM has the potential to reshape the multi-billion dollar collectibles markets because they can achieve the following goals: 1) unify the market and increase liquidity (relative to the current broken black market); 2) eliminate the need for personal physical storage, thereby encouragingMore transactions; 3) Increase trust by providing identity verification; 4) Financialize collection behavior by promoting previously unsubsidized borrowing.We believe that as more traders, liquidity, inventory and markets go online, the results of these efficiency will greatly expand the potential market (TAM) of the entire collectibles market.

However, while it is technically possible to build BECM for any collection category, not all BECMs are the same.The rest of this article will focus on what traits make BECM risk-investment value.We will break down seven key features along three design latitudes: financial axis, real-world axis, and emotional axis.

Financial Latitude

Lack of vertical trading venues

Today, most collections do not have a dedicated market or exchange to integrate liquidity and facilitate public price discovery; instead, they trade in many different venues—WhatsApp chat, Facebook groups, auction houses, etc.—that are scatteredand divide liquidity.This means there are ample opportunities to serve the underserved collectibles market; however, if the existing market structure is already efficient, BECM will be difficult to compete.These markets are not very attractive to venture investors.

According to our preliminary assessment of the collectibles market, the wine and spirits, handbags and watch markets have the greatest potential for improvement.Most of these collections are traded on the black market, and the lack of liquidity and price discovery makes the existing market easily disrupted.

Appropriate price point

To obtain venture capital in a collectible category, its collectibles must be priced at a low enough time for the collector to directly own the asset.For financial investments, it is OK to own a small part of the ownership of the asset, but for collectors, owning half of the luxury handbag is against the purpose of collecting.In addition, ultra-high-priced collectibles will reduce the overall number of buyers, making these collection categories less liquid.For example, no one would resell a million dollar Ferrari because demand would not be 24/7 coincidence.

On the other hand, collectibles need to be expensive enough that having them can bring a certain social status, give people a unique feeling, and bring emotional satisfaction.If something is too cheap and anyone can own it, it won’t attract emotional and status-driven buyers, thus reducing the liquidity of the market.Additionally, the price point should be high enough that it is worthwhile to allow potential market makers to spend time researching the collection category.If items are too cheap, they have to turn over more times to make the unit economic sense.However, cheap collectibles do not provide enough social status to attract collectors to form a mobile market.

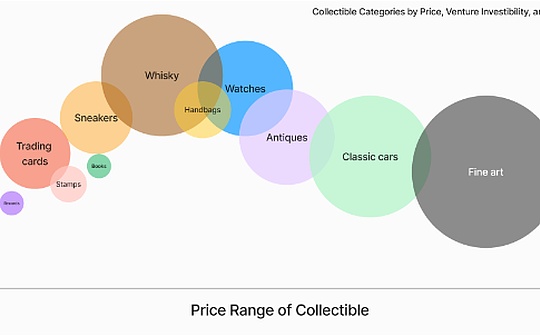

We believe that the price range of gold that can be invested in BECM is around $1,000 to $100,000.This will make collectibles like sneakers, watches, handbags and antiques ideal for BECM.Collections like art and cars are too expensive for most people.Collections like records and stamps may not be suitable for BECM because they are cheaper.Their niches coupled with low prices make it difficult for the market to generate enough trading volume.

Source:The feasibility of venture capital is our subjective assessment, and the size of the bubble corresponds to the market size.

Source:The feasibility of venture capital is our subjective assessment, and the size of the bubble corresponds to the market size.

Source: Records, exchange cards, stamps, rare books, sneakers, whiskey, handbags, watches, antiques, art, classic cars

Considered as a means of store of value

Collectors are buyers who pursue status.It can be said that they are the hands of diamonds.Their presence is crucial to the healthy price bottom line of the collectibles market.This shows that collectibles are not a temporary craze, but an item of lasting cultural significance.This is because when enough people believe that an item will have cultural significance for a long time to come, it has the opportunity to be regarded as a store of value.Collections with store of value are attractive across generations and are often unaffected by technological changes.

Art is a good example.Humans have enjoyed art for thousands of years, and it is safe to say that people will continue to enjoy art thousands of years later.Vinyl records are a more vague example.They have wide appeal to the older generation, but it remains to be seen whether the generation that grew up after the iPod era will continue to value them.

Real world latitude

Storage is difficult

Collections that take up a lot of physical space or are prone to deterioration in ordinary home environments are the main candidates for BECM and are therefore a good category worth investing in.It is difficult for ordinary people to store exquisite collections such as wine and art for a long time without taking environmental precautions (humidity, temperature, light, etc.).Even if you can magically solve these problems, you will soon encounter space constraints – in most people’s homes, storing over 50 paintings or 100 bottles of wine can be a hassle.Even if you can magically eliminate space restrictions, you will also have insurance problems.

If hosting a collection category is not difficult, then establishing a BECM may still be profitable, but the barrier to entry will be much lower, resulting in increased competition, diversification of liquidity and a decline in pricing power.NFTs are the best examples in this category: they are insensitive to the environment and do not take up any physical space, and the transparent source on the blockchain makes fraud nearly impossible, making it difficult to establish a defensible NFT marketplace.

source:TheBlock

We believe collectibles such as wine, whiskey and cars have the greatest challenges in storage, so collectors of these collections will benefit the most from BECM.Wine and whiskey are extremely environmentally sensitive and require special vaults to control temperature, humidity, light and other factors (our investment in Baxus is addressing this precise problem).Cars require large physical garages – it can be difficult for most people to store 3 or 4 cars at home.Trading cards, sneakers, watches and handbags are less difficult to store – collectors of these items can still benefit from outsourcing storage, but with less marginal improvement.

There is a trust issue

In addition to solving the problem of physical storage, BECM must also solve the problem of authenticity in order to attract investors.

Today, collectors face serious trust issues; buyers and sellers in group chats rely on community recommendations and anonymous moderators to review counterparties.As expected, almost all collections are fraudulent.It is difficult for market participants to believe in their purchases 100%.Creating market standards and trustworthy appraisers is crucial to attract liquidity to collectors, alternative asset investors and speculators.

There are two ways to authenticate:

-

Internal certification——This requires domain expertise and is more complex to operate.If the market erroneously identifies the item, it will assume the responsibility of indemnifying the collector.However, this may be a good moat, especially if the collection is difficult to identify.That being said, markets that are identifiable internally must manage potential conflicts of interest and require some oversight to maintain buyers’ trust.

-

Outsourcing——This method is relatively simple, but it reduces the profits that the market can obtain—so outsourcing makes more sense when the collection category is easier to identify.Another benefit is that outsourcing appraisal will naturally separate the market from the appraiser, thereby alleviating potential conflicts of interest.

If BECM can build trust and provide a money back guarantee, it can build a moat that gives it venture capital value.Collections such as watches, handbags and wine are filled with fakes.BECM has a great opportunity to increase trust and attract new collectors who are reluctant to collect because of fear of fraud.

Emotional Latitude

Time-based and brand-based source

In the context of a collectible, source refers to how an item obtains its value.For collectibles, the source is usually based on time or brand.

Time-based source means assets appreciate over time and historical context.Rare books are an example of such assets.Assets with time-based sources are traded only on the secondary market—no central issuer, and assets are usually one of them, or one of a few.This characteristic may limit secondary market activity because collectors do not need ongoing funds to buy newly issued assets, while diamond hand collectors will suppress the supply available for transactions.Constitution DAO is a good example – the copy of the constitution they bid for has not returned to the secondary market so far.Other time-dependent collections include antiques, art, cars and guns.

On the other hand, brand-based source means that the brand has established a reputation over time and the market is beginning to think its products are valuable.Watches are a typical example of brand source.Top luxury watch manufacturers—Rolex, Patek Philippe, Richard Miller and Audemars Piguet—can nearly half of the luxury watch market be brand collectibles because of their name value.Brand collectibles have a central issuing agency for profit-making and constantly issue new products.与基于时间的普罗旺斯收藏品不同,这类收藏品鼓励二级市场活动,因为收藏家需要资金来购买新供应并转向二级市场进行销售。

因此,基于品牌的 BECM 比基于时间的 BECM 更适合风险投资。

The fanatical collector group does exist

Venture capitalists want to see people have a strong emotion about collectibles; it is a prerequisite for having a diamond hand collector.Without them, it would be difficult to have organic liquidity.因此,社区薄弱的 BECM 将难以吸引大量资金并失去投资吸引力。

一个繁荣的社区最好的信号是充满激情,甚至到了争论的地步。We hope to see car collectors arguing about the best supercars The most highly regarded brand of handbag lovers ever A group of enthusiastic collectors will be active in every corner of the internet – sub-sections, forums and group chats.

Cambrian era in collection

未来不仅限于手表、手袋和葡萄酒的 BECM。There are hundreds of other investable categories.

BECM 的机会在于为各种收藏品开辟新市场,改善新一类另类投资的渠道。

我们长期以来一直对加密货币如何影响现实世界感兴趣,早在 2019 年,我们对Helium 的初始投资,率先推出了现在的 DePIN。We learned a lot from the early developments of DePIN and shared some of our thoughts on the DePIN market opportunities.

Like DePIN, BECM offers another such opportunity and will fundamentally redefine what owning and collecting means.