Author: Marcel Pechman, CoinTelegraph; Compiled by: Tao Zhu, Bitchain Vision

Eric Balchunas, senior Bloomberg analyst, raised the chance of approval of Ethereum Exchange-traded funds (ETFs) from 25% to 75% on May 20, after which Ethereum price surged by more than 20%..Balchunas noted that the SEC may face political pressure because their previous position indicated little contact with ETF applicants.

Source: Eric Balchunas

Balchunas further mentioned that the SEC is reportedly asking exchanges such as the New York Stock Exchange and Nasdaq to update their filings, although regulators have not formally confirmed it.Nate Geraci, co-founder of ETF Institute and president of ETF Store, saidRegistration requirements for the Individual Fund (S-1) are still subject to final decision.

Source: Nate Geraci

Geraci said the SEC can approve trading rules changes (19b-4s) independently of the Fund Registration (S-1), which could technically be delayed until the May 23 deadline for VanEck’s Ethereum Spot ETF request.Given the complexity and risks associated with the structure of cryptocurrencies involving Proof of Stake (PoS) , this gives regulators more time to review and approve these documents.

Analyze the impact of the upcoming $3 billion ETH options

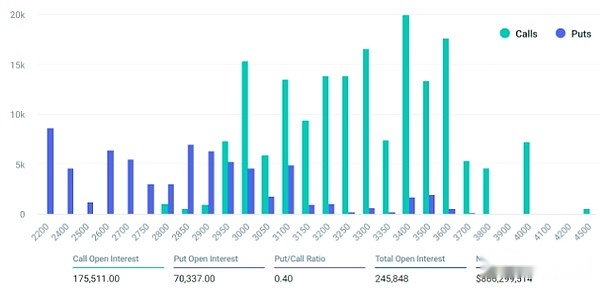

The upcoming decisions of Ethereum ETF spot have greatly increased interest in the expiration of weekly and monthly ETH options.On the leading derivatives exchange Deribit, the Ethereum option open contract record was $867 million on May 24, while on May 31, it reached an impressive $3.22 billion.By comparison, CME’s monthly ETH option open contracts are only $259 million and OKX is $229 million.

Deribit’s call-to-put ratio is very favorable for call (buy) options, which suggests that traders are more aggressive in buying them than put (sell) options.

Deribit May 24 ETH Options Open Contract, denominated in ETH.Source: Deribit

If Ethereum prices remain above $3,600 at 8:00 a.m. UST on May 24, only $440,000 bearish instruments will expire.Essentially, if ETH trades above these levels, the right to sell ETH at $3,400 or $3,500 becomes irrelevant.

Meanwhile, call option holders up to $3,600 will exercise their rights to secure the spread.If ETH remains above $3,600 at weekly expiration, this situation will result in a $397 million open interest favoring call options.

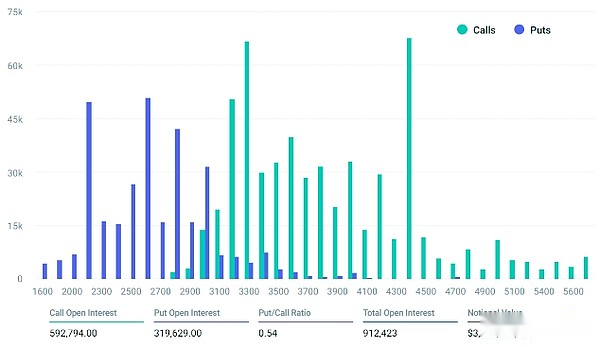

The risk is even higher when ETH expires monthly on May 31, as 97% of put options are priced at $3,600 or less, and if the price of ETH exceeds this threshold, they become worthless.

Bullish strategy greatly benefited from ETH gaining above $3,600

Deribit May 31 ETH Options Open Contract, denominated in ETH.Source: Deribit

While the end result may be far from the potential $3.22 billion open contract, it will significantly benefit call options.For example, if Ethereum price hits $4,550 on May 31, a net open interest would benefit call options of $1.92 billion.Even at $4,050, the difference is still favorable for call options $1.44 billion.

It should be emphasized that traders can sell put options to gain positive exposure when Ethereum exceeds a certain price.Similarly, when the ETH price drops, the seller of the call option will benefit and can use different expiration dates to implement more complex strategies.Unfortunately, this impact is probably not simple.

final,Ethereum unexpectedly rose 20%, surprised option traders and laid the foundation for the substantial gains for bullish strategies.These profits may be reinvested to maintain positive momentum, which bodes well for Ethereum prices after maturity.