Author: cygaar Source: X, @0xCygaar Translation: Shan Oppa, Bitchain Vision

Currently, the relationship between Ethereum L1 and its L2 is quite unbalanced.

L2 benefits from Ethereum’s security, but its contribution to ETH is minimal.I think there are two ways to restore balance:

1) Increase the minimum blob fee

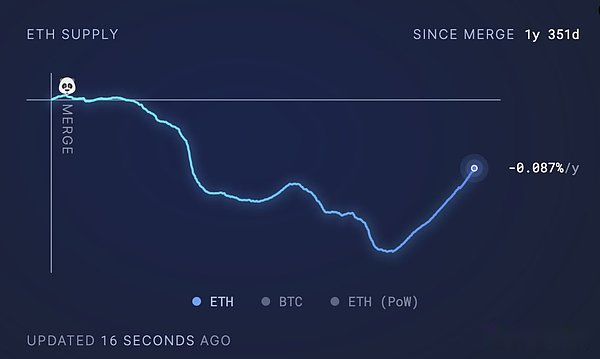

I’ve talked about this in the past, but now for rollups, the blob price is basically zero, which means Ethereum has little to accumulate value from the cost of L2 data availability.In the world before EIP-4844, rollups have been Ethereum’s largest natural gas consumer, exerting strong deflationary pressure on ETH.

However, since DA blobs are basically free, rollups no longer burn much ETH.Coupled with the reduction in execution activity on Ethereum L1, ETH becomes inflation again.

A potentially shorter-term solution is to increase the basic blob fee.L2 should pay a certain amount of fees to use Ethereum data availability.One might argue that increasing Ethereum data availability costs will lead to L2’s shift to other data availability solutions, but I think those chains that really want to inherit Ethereum security will still pay for those costs.

2) Add L2 to use

The current blob pricing curve is set in this way because researchers predict that L2 will have greater demand.However, except for a few major events (initial blob startup, blobscriptions, LZ airdrop), the cost of blobs does not deviate from the minimum cost too much.

If the demand and usage of L2 increases, we may reach a state where the blob pricing curve fully prices DA blobs, resulting in a healthy amount of ETH burning on L1.In addition to the considerable cost of data availability, the gas consumption for rollup clearing may also increase to a considerable amount (I need to calculate these numbers).

In the long run, this is the most beneficial approach to the Ethereum ecosystem, but it also requires an inherent need for the L2 block space.We need more interesting consumer-facing applications to attract users and drive more on-chain usage.In this world, blob fees will hardly stay at the lowest price, rollups will pay a considerable amount to inherit Ethereum’s security.