Author: teng yan, former analyst at Delphi Digital; compile: 0xxz@比 作 作 作 作 作

This month, the cryptocurrency market has experienced a sharp decline.Many investors are panicked, and their risk of investment portfolio is reduced faster than you say “HODL”.The panic is rising, and his mood has fallen to the bottom.

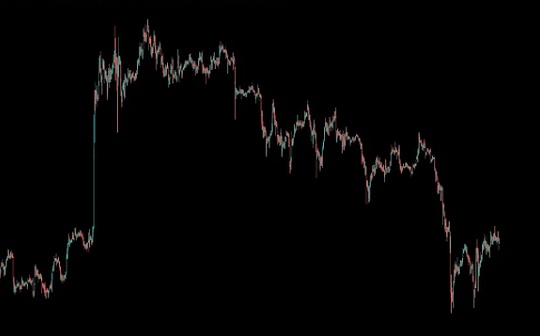

Last week, BTC fell below $ 54,000 and ETH fell below $ 2,850.

This is why it is the best time to firmly support seeing Du ETH.

Recent catalyst

-

It is expected that the spot ETH ETF will be launched around July 15th, less than a week.Given the large amount of sales we saw before, there are reason to expect the news to cause a rebound.No one said at the initial spot ETF traffic, but I believe they will exceed expectations within 12 months.

-

In my opinion, the most convincing capital inflow reason is that TRADFI investors that have been configured to BTC ETF will also be diversified by buying ETH.This enables them to occupy a wider part of the cryptocurrency market (digital gold + technology platform) while reducing the risk of single assets.”Diversity” is a word that many investors like.

-

Ethe’s outflow may be limited.At present, its transaction price is a net asset value, so investors who want to withdraw can exit without waiting for ETF to launch.In addition, GrayScale announced that it will distribute its new Ethereum Mini Trust Fund shares to the existing Ethe holders on July 18th, which has a lower cost of the fund.

German government BTC balance.They have been selling information on the market Source: Arkham

-

The cryptocurrency market, including ETH, is being dragged down by the German government selling BTC and MT. GOX compensation.Although some of these concerns are reasonable, because the actual capital outflows, this problem is very special and should be resolved as soon as possible.Especially in Germany, it has been fighting the market. At present, there are only less than 1 billion US dollars of BTCs for sale, which is 3 billion US dollars lower than last month.

Current market state

-

ETH Sustainable Futures Undenn Layout Contract (OI) has returned to the level before ETH.Although this may not be very important due to overall position changes, it indicates that there is generally lack of interest or attention, leaving more potential room for rising.

-

Although ETF is about to be launched, ETH’s emotions are at the lowest point.This gives people a sense of market state.

-

Many off -site investors and traders (such as Jason Choi/Tangent, Andrew Kang/Mechanism) have explained why we are at the turning point of a bear market.This may be true, but no one knows the exact answer.If the price starts to rise sharply, they will have to buy it again.

Mid -term outlook

Source: fedwatch

-

The improvement of the macro environment is coming.We are entering the interest rate cut cycle, and the market is expected to cut interest rates in September 73%.Citi analysts predict that by 2025, interest rates may be reduced by 200 basis points.We seem to be walking on the track of soft landing.

-

FTX creditors are expected to withdraw $ 14 billion to $ 16 billion in cash by the end of the year.These people are aboriginals of cryptocurrencies, so there are reason to think that they may use part of them to buy cryptocurrencies (H/T @Wintermute_T).

-

Trump is also very likely to win the election, which may mean that the supervision prospects of cryptocurrencies will be better.Gensler no longer serves as the chairman of SEC.

I am optimistic about ETH

There are sufficient reasons to be optimistic about ETH in the near future.

It’s not just that I have such an idea:

I have not even touched technology -let us assume that we all agree that Ethereum is a key factor in the success or failure of the encryption industry.The basic assumption is that ETH is the best technical bet in the tokenization world.

“If you want to invest in the development of tokenization, Ethereum is your best choice. It is the basis of all tokenization.” -Matt Hougan, chief information officer of Bitwise

One thing is certain: this will not be a straight road.

The market is still in a state of tension and needs to regain the confidence after the shock last week.As the summer vacation comes, big capital may not be ready until August.