Main point of view

The encryption market will usher in reform growth in 2025, continuing its maturity and popularity.

The key themes of 2025 include macro -environment, blockchain meta games, transformation innovation and changes in user experience.

Execute summary

Looking forward to 2025, the cryptocurrency market is on the edge of reform.With the increasing maturity of asset categories, the adoption of institutions has continued to increase, and the use scenarios in various fields are also expanding.In the past year alone, the United States has approved the spot ETF. The tokenization of financial products has increased sharply, stable coins have ushered in a huge growth, and further integrated into the global payment framework.

It is not easy to achieve these achievements.However, although these achievements seem to be the pinnacle of years of hard work, more and more signs show that they may be just the starting point of greater change.

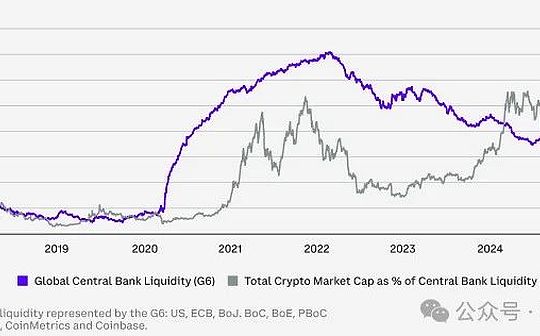

When we reviewed the past year, the encrypted market came out of the dilemma of interest rate hikes, regulatory strikes, and unknown prospects, showing amazing toughness.Despite these challenges, cryptocurrencies have been established as a reliable alternative asset class and showed lasting vitality.

From a market perspective, the rise in 2024 is significantly different from the previous bull market cycle.Some differences are on the surface: for example, the word “web3” is replaced by more appropriate “Onchain”.Others are more profound: the demand for the foundation has gradually replaced the investment strategy driven by narrative, which is due to the deepening of institutional participation.

In addition, not only the leading position of Bitcoin has risen, but the innovation of decentralized finance has also promoted the possibility of blockchain, laying a foundation for establishing a new financial ecosystem.The world’s major central banks and financial institutions are discussing how to use cryptocurrencies to improve the efficiency of asset issuance, transactions and record preservation.

Looking forward to the future, the current crypto market has shown many exciting development.At the forefront of change, decentralized point -to -point exchanges, decentralized forecasting markets, and artificial intelligence agents equipped with encrypted wallets are emerging.In the field of institutional fields, stable currency and payment (more closely combined with encrypted and fiat currency banking solutions), unsecured borrowing on the unsecured chain support on the chain credit scores, and capital formation on the compliance chain have shown huge potential.

Although cryptocurrencies are widely known, the innovation of its technical structure still makes it complicated and difficult for many people.However, technological innovation is also changing this situation, and more and more projects are committed to improving the user experience by simplifying the complexity of the blockchain and enhancing the smart contract function.This success may open the door to the encrypted world for new types of users.

At the same time, earlier in 2024, the United States laid the foundation in terms of regulatory clarity. This progress will be further accelerated in 2025, which may consolidate the position of digital assets in mainstream finance.

With the evolution of regulatory and technical environment, we expect that the encryption ecosystem will usher in a significant growth, and the wider popularity will promote the entire industry to get closer to its entire potential.2025 will be a decisive year, and its breakthroughs and progress may shape the long -term development trajectory of the crypto industry in the next decades.

>

Topic 1: Macro Roadmap in 2025

Federal demand and goals

Donald Trump’s victory in the US presidential election in 2024 became the most important catalyst of the encryption market in the fourth quarter of 2024, making the price of Bitcoin higher than the three-month average of 4-5 standard deviations.However, looking forward to the future, we believe that the influence of short -term fiscal policy reactions will be inferior to the importance of the long -term direction of monetary policy, especially in the context of the Fed’s upcoming moment.Nevertheless, it is not easy to distinguish between the two.We expect the Fed to continue to relax the policy by 2025, but the specific rhythm may depend on the intensity of the next round of expansion fiscal policy.This is because tax cuts and tariffs may push the level of inflation, and although the overall CPI has dropped to 2.7% year -on -year, the core CPI is still hovering around 3.3%, which is higher than the Fed’s goal.

>

The Fed hopes to achieve inflation from the current level, that is, the price needs to continue to rise, but the speed is slower to help achieve another task -the maximum employment rate.In other words, they want to control the rhythm of rising prices.On the other hand, after the high expenditure of the past two years, the family hopes to see a shrinking, that is, the price decline.However, although prices may be more popular in politics, it may trigger a vicious circle and eventually lead to economic recession.

Nevertheless, the current baseline situation is still soft landing, thanks to the lower long -term interest rate and the support of “American exceptionism 2.0”.The Fed’s interest rate cuts have basically become a formal problem, because credit conditions have been relaxed, which has created a favorable environment for the next 1-2 quarterly cryptocurrency performance.At the same time, if the expected deficit expenditure of the new government is realized, as more US dollars circulate in the economy, it may bring greater risk preferences (including the purchase of encrypted assets).

>

The most supported Congress in American history

Over the years, the United States has always faced politics in the field of encryption, but we believe that the next Legislative Council period may be the opportunity to establish supervision clarity for the United States for the encryption industry.This election passed a strong signal to Washington: the public was dissatisfied with the current financial system and eager to change.From a market perspective, the majority of supportable encryption in the House of Representatives and the Senate may make the US regulatory position from adversely to encryption to support encryption, which helps to support the performance of the encryption market in 2025.

The focus of a new discussion is the possibility of creating a strategic Bitcoin reserve.In July 2024, Senator CynThia Lummis (Waioming State) proposed the “Bitcoin Act” after the Bitcoin Nashville meeting, and the Pennsylvana Pennsylvania also introduced the “Pennsylvania Bitcoin Strategy Reserve”.If it is passed, the bill will allow the State Minister of Finance to invest 10% of Pennsylvania’s general fund in Bitcoin or other encrypted tools.At present, the Pension Fund in Michigan and Wisconsin has held encrypted assets or encrypted ETFs, and Florida is followed by.However, creating a strategic Bitcoin reserve may face some challenges, such as legal restrictions on assets on the Fed’s balance sheet.

At the same time, the United States is not the only judicial jurisdiction that has made progress in supervision.Global growth in encryption demand has also promoted more thorough regulatory competition internationally.Looking at overseas, the EU’s “Crypto Asset Market Act” (MICA) is being implemented in stages, providing a clear framework for the industry.Many G20 countries, as well as major financial centers such as the United Kingdom, the UAE, Hong Kong, and Singapore, are also actively developing rules to adapt to the development of digital assets, thereby creating a more favorable environment for innovation and growth.

>

Crypto ETF 2.0

The United States approved the spot Bitcoin and Ethereum Exchange Trading Products (ETP and ETFs) is an important milestone in the encrypted economy. Since its launch (about 11 months), net inflow funds have reached $ 30.7 billion.This number far exceeds the SPDR Gold Shares ETF (GLD) at $ 4.8 billion after inflation adjusted in the first year after its launch in October 2004.According to Bloomberg’s data, the performance of these ETFs has made it among the best 0.1%of the best performance in about 5,500 ETF listings in the past 30 years.

These ETFs have changed the market dynamics of BTC and ETH. By establishing new demand anchors, Bitcoin’s market proportion is pushed up from 52% at the beginning of the year to 62% in November 2024.According to the latest 13-F documents, almost all types of institutional investors already hold these products, including donation funds, pension funds, hedge funds, investment consultants and family offices.At the same time, in November 2024, the relevant options regulated by the United States may further enhance risk management capabilities and provide more cost -effective assets.

Looking forward to the future, the market’s attention is whether the distribution agency will expand the scope of exchanges trading products to cover other tokens, such as XRP, SOL, LTC, and HBAR.Although the potential approval may be beneficial to limited asset portfolios in the short term, it is more worthy of attention, if the US Securities and Exchange Commission (SEC) allows to include STAKING in ETF, or cancel its cash instead of physical ETF share creation and redemptionThe requirements of the return may bring the impact.

The introduction of physical creation and redemption mechanisms can not only improve the price consistency between ETF share price and actual net asset value (NAV), but also help reduce the spread of ETF share.This means that authorized participants (APS) do not need to quote at cash prices higher than Bitcoin’s transactions, thereby reducing costs and improving efficiency.The current cash -based models have also caused some problems, such as continuously buying and selling BTC and ETH price fluctuations, and triggering taxable results, and these are not applicable in physical transactions.

>

Stable currency: “killer application” in the encryption field

In 2024, the stabilized currency increased significantly. As of December 1, the total market value increased by 48%to $ 193 billion.Some market analysts predict that according to the current trend, the industry may grow to nearly $ 3 trillion in the next five years.Although this valuation seems to be huge, it is equivalent to the current scale of the entire encryption market, it only accounts for about 14%of the US $ 21 trillion M2 broader currency supply.

>

We believe that the next wave of actual use in the encryption field may come from the field of stabilization and payment, which also explains that the interest in this field has surged in the past 18 months.Compared with traditional methods, stablecoins can achieve faster and cheaper transactions, which has continuously increased its utilization rate in digital payment and cross -border remittances, and more payment companies are also expanding their stable currency infrastructure.In fact, we may get closer to this day: the primary application scenario of stable currency will no longer be trading, but global capital flow and business activities.In addition, the potential political significance of stable currency cannot be ignored, especially in solving the potential of US debt burden.

As of November 30, 2024, the stabilized currency market had completed nearly $ 27.1 trillion in transactions, which was nearly three times the same period in the same period of 2023.This includes a large number of point -to -point (P2P) transfer and cross -border enterprise payment for enterprises (B2B).Enterprises and individuals use more and more stablecoins such as USDC because they have good compliance and are widely integrated on payment platforms such as VISA and Stripe.For example, STRIPE acquired Bridge, a stable currency infrastructure company in October 2024 for $ 1.1 billion, which is the largest transaction in the encryption industry so far.

Tokenshuman revolution.

In 2024, the field of tokenization continued to make significant progress.According to RWA.XYZ data, the actual assets (RWA, excluding stable currency) of token (RWA) increased by more than 60% from $ 8.4 billion at the end of 2023, and reached $ 13.5 billion as of December 1, 2024.Analysts predict that the industry may grow to at least 2 trillion US dollars, or even as high as US $ 3 billion in the next five years, with potential growth of nearly 50 times.Asset management companies and traditional financial institutions, such as BLACKROCK and Franklin Templeton, are increasingly attached great importance to the licensing chain and public blockchain token government securities and other traditional assets, thereby achieving near -instant cross -border settlement and all -weather transactions.

Enterprises are trying to use such token assets as mortgages for other financial transactions (such as derivatives), which may optimize operations (such as margin recovery) and reduce risks.In addition, the trend of RWA is surpassing the US Treasury and Monetary Market Fund, and expands to private equity, commodity, corporate bonds, real estate and insurance fields.In the end, we believe that tokenization is expected to optimize process optimization by building a comprehensive chain of investment portfolio and the full chain of investment, but this vision may take years.

Of course, these efforts are also facing unique challenges, including decentralized and continuous regulatory obstacles across multiple chains.However, there have been significant progress in these two aspects.In the end, we expect tokens to be a gradual and continuous process; however, its advantages have been widely recognized.At present, it is the golden period of experiments and exploration to ensure that enterprises have a leading position in technological progress.

>

Decentralization Finance (DEFI) revival

DEFI is dead.Long live Defi.In the previous round of cycles, decentralized finance suffered a major blow, because certain applications were proved to provide unsustainable high returns through token incentives to guide liquidity.However, since then, a more sustainable financial system has gradually emerged, incorporating the scene of the real world and the transparent governance structure.

We believe that changes in the regulatory environment in the United States may inject new vitality into the prospects of DEFI.It may include the establishment of a stable coin regulatory framework, and to provide a path for traditional institutional investors to participate in DEFI, especially in the context of the increasing role in seeing the collaborative role between the capital market and the capital market on the chain.In fact, the transaction volume of the decentralized exchange (DEX) currently accounts for about 14% of the transaction volume of the centralized exchange (CEX), which is significantly increased from 8% in January 2023.More importantly, in a more friendly regulatory environment, the possibility of sharing the income of the agreement from the tokens is also increasing.

In addition, the role of encrypted technology in subverting financial services has also been recognized by key characters.In October 2024, the Federal Reserve director Christopher Waller pointed out in his speech that DEFI can largely supplement centralized finance (CEFI) to a large extent.He believes that distributed ledger technology (DLT) can speed up CEFI’s record preservation and improve its efficiency, while smart contracts can enhance CEFI capabilities.He also mentioned that stable currency may have potential benefits in paying and as “security assets” on the trading platform, but it is necessary to reduce the risk of risks of crowding and illegal financing through measures.

All these signs show that the influence of DEFI may soon surpass its foundation for encrypted users and begin to conduct more in -depth integration and interaction with traditional Finance (Tradfi).

Topic two: disruptive paradigm

Telegram trading robot: hidden profit center

After stabilizing currency and native L1 transaction fees, Telegram trading robots became one of the most profitable industries in the industry in 2024. Its net agreement revenue even surpassed the main DEFI protocol, such as AAVE and Makerdao (now renamed Sky).This profitability is largely due to the surge in transactions and MEMECOIN activities.In fact, in 2024, the MEME tokens used the growth of total market value as the measurement standard, becoming the most optimal cryptocurrency field.The trading activities of Memecoin on the Solana Decentralization Exchange (DEX) continued to soar in the fourth quarter of 2024.

Telegram trading robot is a chat -based token trading interface. Users can directly create hosting wallets in the chat window, and inject funds and manage funds for wallets through buttons and text commands.As of December 1, 2024, robotics users were mainly concentrated in Solana tokens (87%), followed by Ethereum (8%) and Base (4%).

Similar to most trading interfaces, the Telegram trading robot charges a certain percentage of fees by each transaction, up to 1%of the transaction value.However, due to the high volatility of the assets of user transactions, we believe that these high costs have little impact on the attractiveness of users.As of December 1, the accumulated year of PHOTON robots has reached US $ 210 million, close to Solana’s largest MEMECOIN launch platform PUMP.Other major robots, such as Trojan and Bonkbot, are also considerable, reaching $ 105 million and $ 99 million, respectively.In contrast, AAVE’s agreement income after deducting expenditure in 2024 was $ 74 million.

The attractiveness of these applications is mainly due to their convenience in DEX transactions, especially for tokens that have not yet launched on the exchange.Many robots also provide additional functions, such as the “snap -up” function and integrated price reminder when the tokens are online.Telegram’s transaction experience is quite attractive for users. Nearly 50% of Trojan users are reused for four days or longer (only 29% of users stop using it in a day), which also contributed to its up to $ 188The average income of each user.Although the increasingly fierce competition between Telegram trading robots may eventually reduce trading costs, we believe that Telegram robots (and other core interfaces discussed below) will continue to become a leading profit center in 2025.

>

Forecast market: basic ability

During the 2024 American election cycle, the forecast market became one of the biggest winners.Platforms such as Polymarket performed better than traditional poll data, and the latter predicts that the election results will be closer.This is a victory in the encrypted industry, because the prediction market of blockchain technology has shown a significant advantage compared to the traditional polls, and at the same time shows the unique application scenario of the technology.The predicting market not only shows the transparency, speed and global access capacity provided by the blockchain. Its blockchain foundation also makes decentralized dispute resolving and result -based automatic payment settlement. It is different from the non -blockchain version.

Although many people think that the correlation of such DAPP may decline after the election, we have seen that their applications have expanded to other fields such as sports and entertainment.In the financial field, these markets reflect the release of economic data (such as inflation and non -agricultural employment data), which is more accurate than traditional surveys, which may still have importance and use value after the election.

Game: Make entertainment the focus

The game has always been one of the core themes in the encrypted field, because the potential change of assets and markets on the chain.However, training loyal user bases for encryption games has always been a challenge.Compared with the popular player groups of traditional success games, many encrypted game users are more profitable, not pure entertainment.In addition, many encrypted games are distributed through web browsers and requires self -hosting wallet settings, which limits audiences to the scope of encrypted enthusiasts, rather than a broader player group.

However, compared with the previous cycle, games that integrate encryption technology have made significant progress.The core trend is to gradually get rid of the password punk concept of “full chain with games” in the early days, and turning to selectively upper the asset chain to unlock the new features without affecting the game experience.In fact, we believe that many well -known game developers now view the blockchain more as a supporting tool, not the core marketing characteristics.

“Off the grid” is a typical representative of this trend.When this first -person shooting battle game was launched, its core blockchain component (Avalanche subnet) was still in the test network stage, but it became the number one free game on the Epic Games platform.Its attractiveness mainly comes from unique gameplay, not the blockchain tokens or item trading market.It is worth noting that this game is paving the way for encrypted integrated games to expand distribution channels, and its distribution covers Xbox, PlayStation, and PC (through the EPIC Games store).

The mobile terminal has also become an important distribution channel for encrypted integrated games, whether it is native or embedded applications (such as Telegram mini -games).Many mobile games also selectively integrate blockchain components, while most activities actually run on centralized servers.These games usually play with external wallets, which reduces the entry threshold and enables players who are not familiar with encryption to easily get started.

We believe that the boundaries between encrypted games and traditional games may continue to blur.In the future, the main “encrypted game” may be an encrypted integrated type, not an encrypted as the central type, and pay more attention to the exquisite game experience and distribution channels, rather than earning a mechanism for earnings.However, although this may promote the widespread use of crypto technology, how it is directly transformed into the demand for liquidity tokens.The currency in the game may continue to be isolated in each game, instead of crypto players may not welcome external investors’ intervention in the economy in the game.

>

Decentralization real world

Decentralized physical infrastructure network (DEPIN) may change the distribution of real worlds by guiding the creation of the resource network.Theoretically, DEPIN can overcome the initial scale economic challenges that such projects usually face.The scope of the DEPIN project covers computing power, honeycomb communication tower, and energy, which provides a more tough and lower -cost resource aggregation method.

The most typical example is Helium, which is operated by personal distribution of tokens to the individual distribution of local honeycomb hotspots.By issuing tokens to hot providers, Helium can establish a coverage network in most urban areas in the United States, Europe and Asia without being responsible for the large number of early capital costs of construction and distribution of communication towers.Instead, early adopors obtained the early interests of the network through the tokens and were inspired.

Nevertheless, we believe that the long -term income and sustainability of these networks require specific analysis of specific conditions.DEPIN is not a Mangling medicine that solves the problem of resource allocation, because the pain points of different industries are huge.Decentralization strategies may not apply to certain industries, or can only solve some specific problems in the industry.We believe that there may be significant differences in the field of network adoption, token practicality and income, and these differences are more likely to depend on the target industry itself, not the underlying technology network used.

>

Artificial Intelligence: Create real value

Artificial Intelligence (AI) has continued to become the focus of investors’ attention in the traditional market and encryption market.However, we believe that the impact of AI in the field of encryption is many aspects, and its narrative direction often changes.In the early stages, blockchain technology was considered to solve AI -generating content and user’s trusted data problems (for example, verifying the authenticity of data).AI -driven intention -oriented architecture is considered a potential user experience improvement tool.Subsequently, the focus turned to decentralized AI model training and computing networks, as well as encrypted data generation and collection.Recently, the focus has turned to an independent AI agent that can control encryption wallets and communicate through social media.

We believe that the impact of AI on the encryption field has not been clear, which can be reflected in frequent changes in narrative.However, this uncertainty does not weaken the potential of changing the AI to the encryption field, because AI technology is constantly making breakthroughs.AI applications are also increasingly easy to use non -technical users, which may further accelerate the development of creative use cases.

We believe that the biggest suspense is how these changes create persistent value for liquidity tokens, not company equity.For example, many AI agents run on traditional technology tracks, and short -term “value embodiment” (such as market attention) flows more to Memecoin, not underlying infrastructure.Although liquidity tokens related to infrastructure layers have also experienced rising prices, their use growth usually lags behind price increases.We believe that the deviation of the price and network indicators, coupled with the market’s rotation of AI Memecoin, reflects that investors have reached a strong consensus on how to capture the growth of AI in the encryption field.

Topic 3: Blockchain Yuan Game

Multipartment in the future is there a zero -sum game?

After the last round of the bull market cycle, the popularity of replacing the Layer-1 (L1) network became an important theme again.Emerging networks compete in lower trading costs, redesigning environmental environment, and minimum delay.However, we believe that the expansion of the L1 space has reached the level of excess of general block space, even if high -value block space is still scarce.

In other words, the additional block space itself does not have an inherent high value.However, a dynamic protocol ecosystem, active community, and dynamic encrypted assets can still make certain blockchains have the ability to charge premium fees.For example, Ethereum is still the core of high -value DEFI activities even if the main network execution ability has not been improved since 2021.

Nevertheless, we believe that investors are still attracted by the differentiated ecosystems that these new networks may bred, although this differentiated threshold is continuously increasing.High -performance chains such as SUI, APTOS, and SEI are competing for market awareness with Solana, and Monad’s upcoming release is also regarded as a strong competitor that developers pay attention to.

In history, DEX transactions are the biggest driving force of the chain cost. It requires strong user guidance, wallet, interface, and capital support to form a cycle of activity and liquidity.The concentration of this activity often leads to the “winner” pattern on different chains.However, we believe that the future may still be multi -chain, because different blockchain architecture provides a unique advantage that meets diversified needs.Although AppChains and Layer-2 solutions can provide customized optimization and lower costs for specific use cases, and the multi-chain ecosystem allows specialization, while benefiting a wider network effect and innovation in the entire blockchain field.

>

The ability to improve layer-2

Although Layer-2 (L2) has index level expansion capabilities, the debate around the Rollup-CENTRIC roadmap around Ethereum continues.Criticism includes the influence of “plundering”, liquidity, and fragmented user experience on L2 activities, especially L2 is considered the reason for the decline in Ethereum network costs and the disintegration of “ultrasonic currency” narrative.New disputes around L2 also include decentralized trade -off, splitting of different virtual machine environments (such as potential fragmentation of EVM), and “Based” and “Native” Rollup.

Nevertheless, from the perspective of increasing block space and reducing costs, L2 has achieved great success.In March 2024, the average cost of L2 was reduced by more than 90% of L2’s average cost and promoted the 10 -fold increase in the Ethereum L2 activity.In addition, we believe that allowing multiple execution environments and architectures to perform experiments in the Ethereum environment is the long-term advantage of the Rollup-CENTRIC method.

This route map is also accompanied by short -term weighing.The interoperability of cross -rollup and the overall user experience have become more complicated, especially for new users who do not fully understand different L2 differences or cross -L2 bridge methods.Although the speed and cost of the bridge have improved, we believe that users need to interact with the bridge to reduce the overall chain experience.

Although this is currently a realistic problem, the community is solving the problem of this user experience through multiple methods, such as: (1) Superchain interoperability in the Optimism ecosystem, (2) real -time proof and super transaction for Zkrollups, and(3) Based on (Based) sorting, (4) resource lock, (5) sorter network, etc.However, most of these improvements are concentrated at the infrastructure and network levels, and it may take time to be reflected at the user interface level.

At the same time, the L2 ecosystem of Bitcoin is more difficult to navigate because the lack of uniform Rollup security and road map standards.In contrast, Solana’s “network expansion” is usually more appropriate, and may have less interference in the current user workflow.Overall, L2 is forming in most major encryption ecosystems, but its forms are different.

>

Everyone can have a chain

The convenient improvement of customized network deployment is promoting more and more applications and companies to build a chain that they can better control.The main DEFI protocols, such as AAVE and Sky, have clearly incorporated the construction chain into its long -term planning, and the Uniswap team also announced the launch of the L2 chain focusing on the DEFI.Even some traditional companies have participated in it, such as Sony announced the plan to launch a new chain called Soneium.

With the maturity of the blockchain infrastructure stack and increasingly commercialized, we believe that the attractiveness of block space is increasing, especially for the entity with regulatory requirements or the application of specific use cases.The technology stack that supports this trend is also changing.In the previous cycle, the centralized chain of the application mainly uses COSMOS or Polkadot Substrate SDK.And now, the growth of the Rollup-As-A-Service (RAAS) industry is promoting the launch of more projects of the L2 chain. The service platform represented by companies such as Caldera and Conduit has simplified the market’s market to simplify other services with other services.integrated.Similarly, Avalanche’s subnet may also usher in an upsurge in the development of Avacloud, which hosts the blockchain service, which greatly simplifies the startup process of custom subnets.

The growth of the modular chain may have a corresponding impact on the needs of the Ethereum Blab space and other data usability solutions (such as Celestia, EIGENDA, or Avail).Since the beginning of November, the BLOB usage of Ethereum has reached saturation (3 BLOB per block), an increase of more than 50% compared to mid -September.As the existing L2 such as Base continues to expand throughput and the new L2 is online on the main network, the demand does not seem to slow down.However, it is expected that the Pectra upgrade in the first quarter of 2025 may increase the number of target BLOB from 3 to 6, thereby alleviating some pressure.

Topic 4: User experience

User experience (UX) improvement

We believe that a simple user experience is one of the most important factor to promote large -scale adoption.Although the encrypted industry has historically focused on deep technology guidance due to the origin of its password punk, the focus is now rapidly turning to simplify the user experience.

In particular, the entire industry is trying to abstract the complexity of encryption technology into the background of the application.Some recent technological breakthroughs are transforming this possible, such as using account abstraction to simplify user guidance and use the session key to reduce signature friction.

The adoption of these technologies will make the security component of the encrypted wallet (such as notes and restoration keys) become visible for most end users -similar to the seamless security experience of the Internet today (such as HTTPS, OAUTH, and PasskeysTo.We expect that more PassKey guidance and application of wallet integration will be seen in 2025.For example, the Passkey guidance of Coinbase Smart Wallet and the integration login of Tiplink and Sui Wallet and Google is an early sign of this trend.

Nevertheless, we believe that the abstraction of cross -chain architecture may still be the biggest challenge facing encrypted user experience in the short term.Cross-chain abstraction is still the focus of network and infrastructure layers (such as ERC-7683) research communities, but in our opinion, this is still quite distance from the front-end application.To make progress in this area, the improvement of the smart contract application layer is required, and the improvement of the wallet layer is required.Protocol upgrades are necessary for unified liquidity, and the improvement of wallets requires users to provide users with a simpler experience.We believe that the latter has a greater impact on expanding the user base, although the current research and industry debate are mainly concentrated on the former.

Control interface

In our opinion, improving the user interface with “control” user relationship is one of the most important changes in encrypted user experience.This change will be realized in two ways: first to improve the experience of independent wallets, as mentioned earlier.The user guidance process has become more and more simplified to meet the needs of users.For example, the application function (such as exchange and borrowing) directly integrated in wallets allows users to stay in familiar ecosystems.

At the same time, the application is also abstracted to the background through the combination of integrated wallets to control the user relationship.This includes trading tools, games, chain social and member applications. These applications automatically configure their wallets for registered users through the familiar methods of users (such as Google or Apple).After the user completes the guidance, the transaction on the chain is provided by the paid service provider (Paymasters), and the cost is ultimately borne by the application owner.

This model brings unique dynamics, that is, the income of each user needs to match the cost of operation on the chain.Although these costs are declining with the expansion of the blockchain, the encrypted applications have also been forced to re -consider which data needs to be submitted to the chain.

Overall, the encryption industry will face fierce competition that attracts and retain users.As the aforementioned Telegram trading robot’s average income (ARPU) has proven, compared with traditional finance entities, many retail encrypted traders have relatively low sensitivity to prices.In the next year, we expect that the efforts of “controlling” user relations will surpass the field of trading and become greater attention to the agreement.

>

Decentralization

With the continuous improvement of regulatory definition and more assets to achieve gonalization under the chain, simplifying the understanding of customers (KYC) and anti -money laundering (AML) process has become increasingly important.For example, certain assets are limited to qualified investors in specific regions, which makes identity recognition and qualification certification a core pillar of long -term chain experience.

>

In our opinion, this involves two key components.The first is to create the identity on the chain itself.Ethereum Name Services (ENS) provides a standard to analyze the “. ETH” name that can read human beings as one or more wallets across the chain.The change of this technology has appeared on networks such as Basenames and Solana Name Service.The use of identity services on these core chains is accelerating, and the main traditional payment providers (such as PayPal and Venmo) are now supporting the ENS address analysis.

The second core component is to build attributes for the identity on the chain.This includes confirmation of KYC verification and data from the jurisdiction of judicial jurisdiction, and other agreements can then view these data to ensure compliance.The core of this technology is Ethereum Attestation Service, which provides a flexible service to the entity with certification attributes to other wallets.

These authentication attributes are not limited to KYC, but can be freely expanded to meet the needs of certifications.For example, Coinbase’s chain verification uses the service to confirm that the user associated with the user of the wallet and the coinbase trading account and is located in a specific jurisdiction.Some new actual asset licensed borrowing markets will limit the use permissions through these verifications on BASE.