Author: Pascal Hügli, Brick Towers, compiled by: Luccy, BlockBeats

Editor’s note:

With the maturity of the Bitcoin market and the emergence of various income products, people began to think about how to promote its financialization process while maintaining the local characteristics of Bitcoin.From Bitcoin’s local consensus, assets to earnings, this article discusses different categories of Bitcoin earnings products and emphasizes the importance of localized design in reducing trust dependence and counterparty risk.

While analyzing existing solutions, taking the Brick Towers project as an example, Pascal Hügli shows how to achieve a near-perfect Bitcoin fit by combining native Bitcoin consensus, assets and returns.This article emphasizes the importance of how to balance innovation and risk management in the process of digital currency financialization.Despite many challenges and unknown factors, Bitcoin, as an open and decentralized protocol, its localized design and basic characteristics will continue to lead the development direction of financial technology.

Bitcoin is undergoing a compelling evolution, with multiple perspectives on its nature.Some people think it is the currency of daily trading, some think it is modern gold for storing value, and others think it is a decentralized global platform for protecting and verifying off-chain transactions.While these views all make sense, Bitcoin is increasingly regarded as a digital base currency.

Bitcoin’s function is similar to physical gold. As a holding asset, inflation hedging tool, and provides currency parity similar to USD, Bitcoin is reshaping the concept of currency underlying assets.Its transparent algorithms and fixed supply of 21 million units ensure a non-discretionary monetary policy.In contrast, traditional fiat currencies such as the US dollar rely on central authorities to manage their supply, which raises questions about their predictability and effectiveness in the era of volatility, uncertainty, complexity and fuzzy (VUCA).

This contrast is particularly prominent in Nobel Prize winner Friedrich August von Hayek’s criticism of centralized monetary decision-making in his book The Prepense of Knowledge.Bitcoin’s transparent and predictable monetary policy contrasts sharply with the opaque and potentially unpredictable nature of traditional fiat currency management.

Do you want to use Bitcoin

For staunch Bitcoin supporters, the 21 million supply cap is sacred.Changing this cap will fundamentally change the nature of Bitcoin, making it completely different.Therefore, the Bitcoin community is generally skeptical about leveraging Bitcoin.Many people believe that any form of leverage is similar to fiat currency practices, undermining the core principles of Bitcoin.

This suspicion of leveraged Bitcoin is rooted in the difference between commodity credit and streaming communications outlined by Ludwig von Mises.Commodity credit is based on real savings, while streaming communications do not have such support, similar to unsecured IOUs.Bitcoin supporters believe that leverage operations create “paper bitcoin” economically risky and unstable.

Even some of the more detailed views in the community are cautious about leveraged Bitcoin, consistent with the positions of Caitlyn Long and others.Caitlin Long has been warning of the dangers of leveraging Bitcoin.The collapse of some leveraged Bitcoin lending companies such as Celsius and BlockFi in 2022 further reinforced Lang and others’ concerns about the risk of leveraging Bitcoin.

Celsius and other companies prove this

The crypto market experienced a major turmoil similar to the Lehman Brothers’ bankruptcy in 2022, triggering a widespread credit tightening that affected multiple players in the crypto lending space.Contrary to the assumption, most crypto lending activities are not peer-to-peer and have considerable counterparty risk, as customers lend funds directly to platforms, which then invest that funds into speculative strategies that are not adequately managed.

During the DeFi summer of 2020, the rise of major DeFi protocols provides promising revenue generation pathways.However, many of these protocols lack sustainable business models and token economics.They rely heavily on inflation of protocol tokens to maintain attractive returns, resulting in an unsustainable ecosystem that is separated from basic economic principles.

The crypto credit crunch in 2022 exposed various issues with centralized earnings tools, highlighting concerns about transparency, trust, and liquidity, market and counterparty risks.In addition, it highlights the shortcomings of centralization and off-chain risk management processes that mimic the shortcomings of traditional banks when applied to blockchain-based “banking services”.

Despite the optimism brought about by the bull market in 2020 and 2021, many institutions such as Voyager, Three Arrows Capital, Celsius, BlockFi and FTX have all gone bankrupt due to the lack of these necessary processes.The inability to implement necessary inspections and balances transparently and independently often lead to over-regulation and the ongoing failures and frauds, reflecting the historical challenges of the traditional banking system.However, lack of regulation is not a solution.

Bitcoin earnings are not an option

So how should we deal with it?Given this event in 2022, a growing number of Bitcoin supporters have raised the question: Should we accept Bitcoin earnings products, or do they pose too much risk, similar to fiat currency systems?While these concerns are justified, it is unrealistic to expect Bitcoin earnings to disappear completely.

This issue has become increasingly prominent as the emerging Bitcoin ecosystem develops.More and more projects are building or claiming to directly develop financial infrastructure and applications on Bitcoin.Will this once again raise the questions we have seen in the wider crypto space?

Most likely.Because this is the essence of the game.Since Bitcoin is a license-free protocol, anyone can build it on it, including those who want to build a Bitcoin-driven financial system.The financial system inevitably requires credit and leverage.

This is a historical fact: in any prosperous society, the demand for credit and income will naturally appear and become a catalyst for economic growth.Without credit, underdeveloped economies will find it difficult to escape their survival.Only by obtaining credit can a more complex and efficient economic structure be formed.

To achieve the Bitcoin-based economic vision, proponents recognize the need to develop credit and earning mechanisms on top of the Bitcoin protocol.While Bitcoin’s role as a currency is often praised, the reality is that in order to operate as a currency effectively, it needs a local economy to support it.

This highlights the importance of Bitcoin-based earning products in promoting Bitcoin-centric economic growth.Such an ecosystem will use Bitcoin as its digital base currency while leveraging revenue products to drive its adoption and use.

This is a trust range, anonymous

Bitcoin-driven financial systems will inevitably be built in layers.From a system perspective, this is not much different from the current financial system, and there is an internal level in currency-like assets.To correctly understand these inevitable tradeoffs, we need a high-level framework to distinguish Bitcoin implementations at different levels.

When providing Bitcoin earnings, it is necessary to understand that these options can be built along a triple trust range.The main concerns are:

consensus

assets

income

Evaluating Bitcoin assets and Bitcoin earning products based on the degree of Bitcoin’s native nature provides a valuable framework to evaluate their consistency with the spirit of Bitcoin.Assets and products that score higher on this spectrum usually minimize trust, reducing reliance on intermediaries and relying on transparent and resilient code.

This shift reduces opponent risk because dependencies move from off-chain intermediaries to code.The transparency of the code increases resilience compared to intermediaries that require trust.

This is a development direction worth exploring, and creating local income options for Bitcoin should be the gold standard and ultimate goal of the Bitcoin community.

Consensus angle

According to the consensus consistency of the Bitcoin blockchain, Bitcoin earning products can be divided into four categories.

No consensus: This category refers to infrastructure still being a centralized platform off-chain.For example, centralized platforms such as Celsius or BlockFi, which fully control users’ assets, exposing users to counterparty risks and dependence on intermediaries.Although these platforms use Bitcoin, their earnings strategies are mainly executed off-chain through traditional financial mechanisms.While these platforms are a step towards Bitcoin adoption, they are still highly centralized, similar to traditional financial institutions, but often lack regulation.

Independent consensus: In this category, infrastructure is decentralized and represented by public blockchains such as Ethereum, BNB Chain, Solana, and other blockchains.These blockchains have their own consensus mechanism independent of Bitcoin and are not clearly pegged to Bitcoin’s consensus.

Inheritance consensus: In this category, infrastructure is decentralized, represented by distributed consensus of Bitcoin sidechains or Layer-2 solutions.While these sidechains have their own consensus mechanism, they are designed to align more closely with the Bitcoin blockchain.Examples include federal sidechains such as Rootstock, Liquid Network, or Stacks.

Local consensus: This category relies on Bitcoin’s own consensus mechanism as the basis of security model.It does not use independent blockchains or sidechains, but uses encryption to link to the off-chain state channel of the Bitcoin blockchain.The Lightning Network is an important example of this approach, providing a high level of trust minimization through consensus that relies entirely on Bitcoin.

The closer the Bitcoin earnings products are to Bitcoin’s local consensus, the higher their compatibility with Bitcoin, and the higher the degree of trust that is usually considered to be minimized.However, in the two categories of independent consensus and inherited consensus, there are slight differences in the degree of decentralization and security of infrastructure.

Overall, the level of decentralization and trust minimization without consensus is the lowest, while local consensus is considered to provide the highest level of trust minimization, although considerations of consensus security and decentralization still require further analysis.

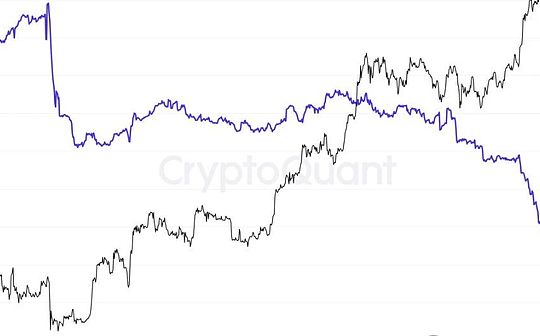

Source: Brick Towers

Asset angle

When considering the assets used by Bitcoin earning products, their fit with Bitcoin can be divided into three categories.

Non-BTC: This category includes solutions using assets other than BTC, resulting in a lower fit with Bitcoin.An example is Stack’s overlay option, where Stack’s native token, STX, is used to generate BTC’s earnings.

Tokenized BTC: Here, the assets used are tokenized versions of BTC, which improves the fit with Bitcoin compared to non-BTC assets.Tokenized BTC can be found on public blockchains such as Ethereum (WBTC, renBTC, tBTC), BNB Chain (wBTC), Solana (tBTC), etc.In addition, tokenized BTC is hosted on Bitcoin sidechains with inheritance consensus mechanisms, such as sBTC, XBTC, aBTC, L-BTC and RBTC.

Local BTC: This category of assets is on-chain Bitcoin (BTC), which does not involve any tokenized versions, providing the highest level of Bitcoin fit.Various CEX solutions and Babylon’s Bitcoin staking protocols directly utilize BTC.Babylon aims to expand Bitcoin’s security by staking the proof of stake mechanism for Bitcoin.In addition, projects like Stroom Network use the Lightning Network to achieve mobile stake, where users can earn Lightning Network revenue by depositing BTC and minting packaging tokens such as stBTC and bstBTC on EVM-based blockchains for a wider range of use.The DeFi ecosystem.

Source: Brick Towers

Revenue angle

When examining the income aspects of Bitcoin earning products, there is a question of fit with Bitcoin, resulting in similar categories as in assets: non-BTC, tokenized BTC and local BTC.

Non-BTC earnings: Babylon provides benefits through its Proof of Stake (PoS) blockchain’s local assets, enhancing the security of the blockchain through Babylon’s staking mechanism.

Tokenized BTC earnings: Stroom Network provides revenue in the form of lnBTC tokens.Sovryn, running on Rootstock, facilitates Bitcoin’s lending business by using tokenized BTC (RBTC) as a benefit.On Liquid Network, Blockstream Mining Note (BMN) provides BTC or L-BTC returns upon maturity, providing qualified investors with a way to obtain Bitcoin computing power through USDT security tokens that meet EU standards.

Local BTC Income: Stacks offers a variety of options, including tokenized BTC payments in certain earnings applications, leveraging sBTC.However, for Stacks’ overlay option, the benefits accumulate in native BTC.Similarly, some centralized revenue products provided by CEX distribute local BTC to users as revenue.

Source: Brick Towers

The gold standard of Bitcoin: full localization

Considering the ideal Bitcoin-based earnings product, the gold standard product will combine the following three features: local Bitcoin consensus, local Bitcoin assets and local Bitcoin earnings.Such a product will mimic a near-perfect Bitcoin fit.

At present, such a solution is just beginning to build.One project that is being actively developed is Brick Towers.Their idea of an ideal Bitcoin-based earnings product covers the achievement of near-perfect Bitcoin fit by integrating native Bitcoin consensus, assets and returns.Brick Towers focuses on using Bitcoin as a long-term savings solution, aiming to provide customers with minimal trust dependency and localization methods to leverage Bitcoin.

Their planned solutions revolve around generating soil benefits in Bitcoin, leveraging Brick Towers’ automation services to other nodes in the Lightning Network.By optimizing algorithms to solve economic benefits, capital is strategically allocated to meet the liquidity needs of other network participants, thereby optimizing capital efficiency while minimizing counterparty risks.

This approach not only promotes the growth of the Lightning Network, but also enhances the practicality of Bitcoin as an asset, while providing customers with a seamless and safe way to earn earning Bitcoin holdings.Importantly, Brick Towers’ solution avoids packaging coins, further reducing counterparty risk and strengthening their commitment to the Bitcoin native ecosystem.