1. Project introduction

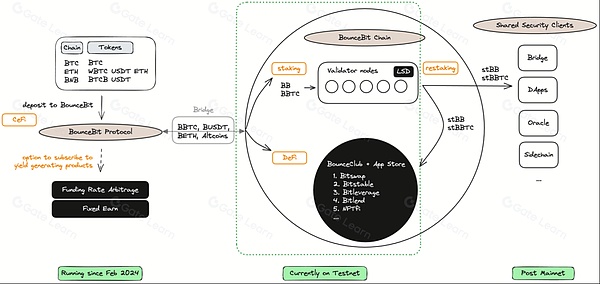

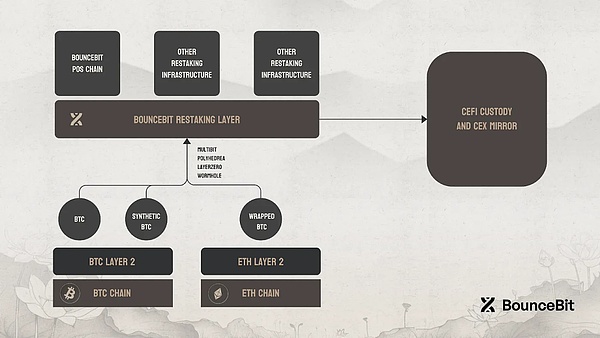

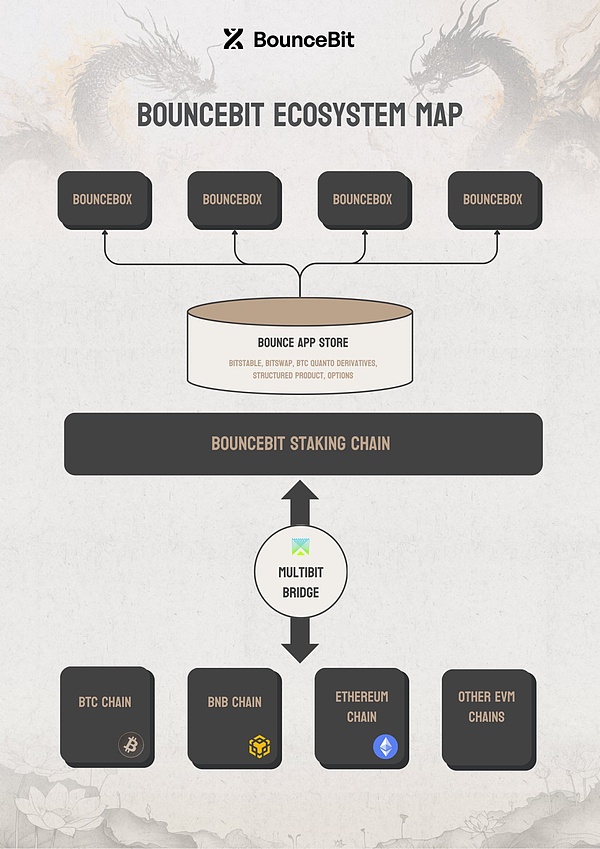

BoundceBit is a re -pledge project built in the Bitcoin ecosystem. The goal is to create a new ecosystem -Bouncebit Chain to allow BTC to generate organic pledge rewards.

>

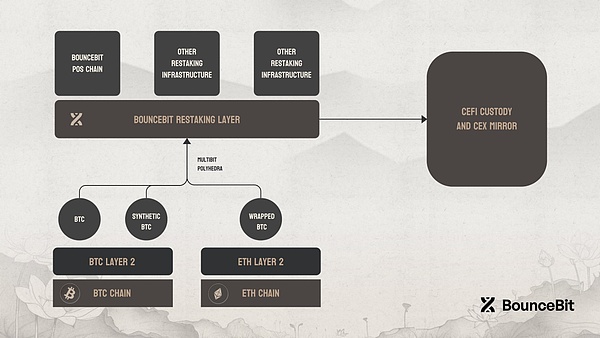

The core innovation of BoundceBit comes from the BTC re -pledge mechanism. This new concept is the key to promoting the project.Boundcebit will build a series of infrastructure to explore the use of re -pledged pledge on various Bitcoin types. These infrastructure can be side chains, prophecy machines, bridges, virtual machines, data availability layers and other forms.The goal is to support the entire framework by re -pledged and aggregated sharing security.

By integrating Bitcoin into a first -level network of storage (POS), Bouncebit redefines the role of Bitcoin in the blockchain ecosystem.BoundceBit not only extended the world’s first cryptocurrency’s practicality, but also created a token economy model promising scalability, security and inclusive.

2. Operation core mechanism

2.1Re -pledge mechanism

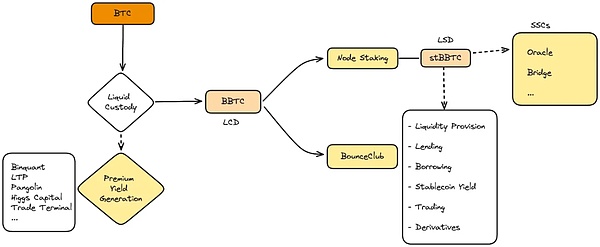

One of the core innovations of BounceBit is its BTC re -pledge mechanism.Users can convert their Bitcoin into BBTC, and then pledge on the Bouncebit platform to get rewards.This mechanism not only improves the liquidity of Bitcoin, but also increases its application in the DEFI ecosystem.

>

The following is a detailed introduction of the Bounterbit reconstruction mechanism:

2.1.1Basic concept

The re -pledge mechanism is based on the transformation of traditional cryptocurrencies such as Bitcoin into a new form that can be used on the Bouncebit platform, which is usually called BBTC.This conversion allows Bitcoin, which was originally not available in pledge function, can participate in the pledge and consensus process, so as to maintain its value while increasing additional benefits.

2.1.2Step and process

>

-

Convert to BBTC: Users first convert the bitcoin they hold to BBTC.This process is completed through BounceBit’s cross -chain bridge or directly on its platform.The conversion BBTC represents the value of Bitcoin on the original chain.

-

Package BBTC: Once Bitcoin is converted into BBTC, users can pledge it on the BoundceBit platform.By pledged BBTC, users participate in the security guarantee of the platform to help maintain the stability of the network and verify the transaction.

-

Reward: users participating in pledge can get rewards, which can be another native currency BB of BBTC or platform.These rewards are derived from online transactions, rewards for new blocks, or other economic activities.

-

Network governance: BB token holders can participate in the platform’s governance decision -making, including proposal and voting.This governance model allows community members to directly affect the development direction and key parameters of the platform and the adjustment of key parameters.

-

Pledge reward: BB tokens can be pledged in the network to support its operation, and pledges can get trading costs and other incentives as returns.

-

Security: By pledge BB tokens, users help maintain the security of the network and prevent dual payment and other types of attacks.

-

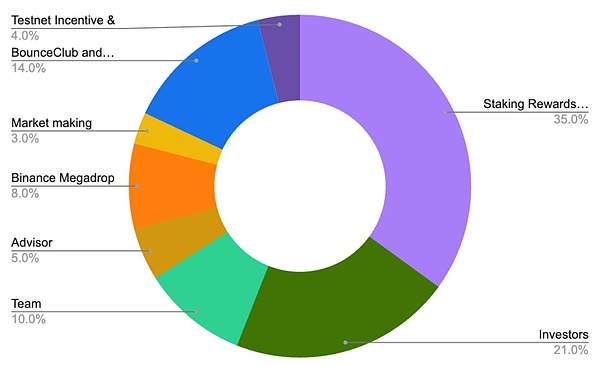

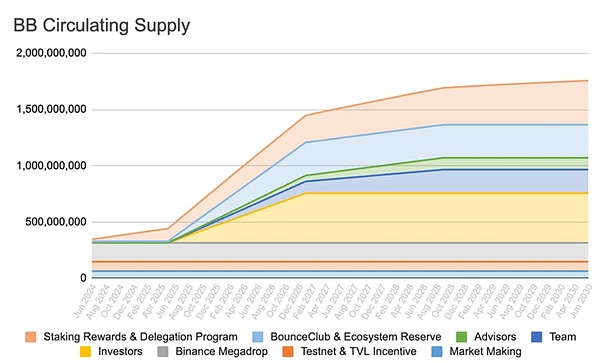

Pledge reward: 35%, used to reward users who provide pledge services to the BOUNCEBIT network.

-

market: 3%, used to motivate liquidity providers to provide liquidity for the Boundcebit transaction.

-

Binance megadrop: 8%, for public airdrop bb tokens through Binance Laundchpad.

-

Test network incentive: 4%, used to reward test network participants.

-

consultant: 5%, used to reward the consultant of the BoundceBit project.

-

team: 10%, team members who are used to reward the Boundcebit project.

-

Boundceclub and ecological reserves: 14%to support the development and growth of the Boundcebit ecosystem.

-

investor: 21%, used to reward early investors.

-

Increase the liquidity and usability of Bitcoin: Users can convert their Bitcoin to BBTC, and then use on the Bouncebit platform to participate in various pledge and investment opportunities, such as DEFI projects.

-

Cross -chain function: BBTC can be freely transferred between different blockchain, enabling Bitcoin to circulate and use in a wider range of blockchain ecosystems.

-

Participate in pledge and gain: By converting Bitcoin into BBTC, users not only maintain the value of Bitcoin, but also obtain additional benefits through pledge BBTC.

-

Verivers need to pledge BB or BBTC to participate in the consensus process of the network.

-

The design of this double -promoter enhance the security of the network because it requires participants to hold at least one of the two tokens, thereby increasing the economic cost of network attacks.

-

Double -generation currency mechanism and liquidity:

-

Cross -chain technology:

-

Double -generation currency pledge: Boundcebit allows users to use two types of tokens -BB and BBTC -to participate in pledge and network verification.This increases the diversity of participants and provides more pledge flexibility.

-

Elected verificationrs: In the POS system of BoundceBit, tokens can vote for nodes that can be voted as network verifications.This process promotes the decentralization of power and increases the degree of decentralization of the network.

-

Reward mechanism: Verivers participating in POS pledge can get transaction costs and new tokens generated as rewards.This reward mechanism inspires more users to join the pledge, which enhances the security of the network.

-

Security and stability: By requiring the verification to pledge a large number of tokens, the POS system of Bouncebit increases the cost of launching attacks, thereby increasing the security protection of the network.

-

Energy efficiency and efficiency: Compared to POW, the POS mechanism is more efficient in energy consumption.BoundceBit uses POS not only to reduce environmental impact, but also improves transaction processing speed and network expansion capabilities.

-

Verification transactions: Verifications are responsible for inspecting and confirming the transactions on the Internet to ensure their legality and correctness.

-

New blocks: Vermitters participate in generating new blocks. These blocks record all transactions that have occurred on the Internet since the previous block.

-

Maintenance of network security: Verivers can help prevent dual expenditure and other types of network attacks through continuous network participation and monitoring.

-

Transaction initiator: users can initiate and execute transactions, such as transfer, purchase, sales, etc.

-

Dapps utilizer: Users can use decentralized applications (DAPPS) deployed on the Bounterbit platform, such as borrowing platforms, exchanges, games, etc.

-

Prank participants: Users can participate in the security maintenance of the network by pledged BB or BBTC, and at the same time obtain possible benefits.

-

治理投票:持有BB代币的用户可以参与到网络的治理决策中,包括对协议更新、费用结构调整等关键决策的投票。

-

Pledge and income: BB holders can pledge its tokens in the network to support the security operation of the network and get pledge rewards.

-

社区建设:BB持有者通常更投资于平台的长期成功,他们可能会参与到社区建设和推广活动中,帮助增加BounceBit的知名度和吸引新用户。

-

Transaction verification and block generation: node operators are responsible for verifying transactions on the Internet and participating in new blocks.This is a key responsibility for maintaining the integrity and continuity of the blockchain.

-

Cyber Security Maintenance: By running the entire node, node operators help the Internet to resist potential attacks and faults.

-

技术支持和创新:节点运营商经常是技术上的先行者,他们可能会开发新的工具和功能,以提高网络的性能和用户体验。

-

Enhance liquidity:

-

Disposal risks:

-

Market adaptability:

-

DEFI Integration:

-

Financial management:

-

Maximize benefits:

-

Transaction fee: Boundcebit charges a certain percentage of fees by various transactions (such as tokens, pledge, etc.) on the platform.

-

Praising reward sharing: The platform may draw a part of the management fee from the award obtained by the user through the pledge.

-

Cooperation and integration: Cooperate with other DEFI and CEFI projects to obtain benefits through providing technical support or liquidity support.

-

Cryptocurrency investors: Hope to increase their asset returns through pledge and other methods.

-

Cross -chain users: Users who need to mobile assets between different blockchains need efficiency and security.

-

DEFI participants: seeking high -level financial instruments and users who have no financial services.

-

Lido Finance: Provides liquid pledge service, allowing holders of Ethereum and other assets to pledge assets without losing liquidity.The STETH provided by LIDO is a liquid duct derivative, similar to the LSD provided by BoundceBit.

-

Rocket Pool: Another DEFI project that provides Ethereum pledged services also supports pledges to maintain a certain liquidity.

-

ThorChain: Focus on providing cross -chain liquidity solutions, allowing assets on different blockchain to be freely traded and swapped, similar to the cross -chain function of Bouncebit.

2.2Dual -generation currency system

BoundceBit’s dual -generation currency system is a key design feature. Through this system, the platform can effectively enhance network security, provide flexible pledge mechanisms, and promote users to participate in its governance structure.This system includes two different functions: BB and BBTC.The following is about the detailed introduction of these two tokens and how they operate on the BoundceBit platform:

2.2.1BB token

BB is the native governance tokens of BoundceBit

2.2.1.1Main purpose

The design of the BB token is to motivate holders to actively participate in the maintenance and governance of the platform, thereby ensuring the healthy development and long -term success of the network.

2.2.1.2Token distribution

The total supply of Boundcebit tokens is 21 billion pieces, and the distribution is as follows:

>

2.2.1.3BoundceBit tokens release timetable

The BoundceBit tokens will be gradually unlocked within four years. The specific timetable is as follows:

>

>

2.2.2BBTC token

BBTC is a token linked to Bitcoin value, which is mainly used to achieve a wider range of Bitcoin on the Bouncebit platform.Its main features and uses include:

The design of BBTC is to solve the problems of lower liquidity and less application scenarios on the native chain on the native chain. Through BBTC, Bitcoin can participate more flexibly in various blockchain activities.

2.2.3Double -generation consensus mechanism

BoundceBit’s dual -profile system not only provides a variety of economic incentives, but also maintains the security and stability of the network through a unique dual -profile consensus mechanism.Under this mechanism:

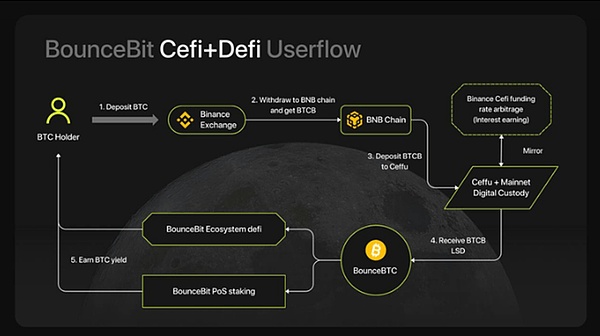

2.3DEFI & amp; CEFI integration

BoundceBit’s DEFI (decentralized finance) and CEFI (central finance) integration is one of the core features of the platform. It is committed to creating a bridge and seamlessly combining the traditional financial world with blockchain technology.This integration not only provides users with broader financial instruments and service options, but also enhances the liquidity and access of funds.

>

The following is a detailed introduction about how to implement DEFI and CEFI integration:

2.3.1DEFI integrated

1. Smart contract platform:

Boundcebit is built on the basis of compatible Ethereum virtual machines (EVM) to enable it to execute smart contracts.This characteristic allows developers to deploy and run various decentralized applications (DAPPS) on the BoundceBit platform, including loan platforms, automated markets as municipal merchants (AMMS) and other financial agreements.

2. Liquidity protocol:

By providing a built -in liquidity protocol, the BoundceBit users can pledge and borrow their crypto assets.These protocols are usually in the form of liquidity pools, and users can deposit their encrypted assets into the pool in exchange for transaction costs into or other forms of income.

3. 代币化资产:

Boundcebit supports token -based assets, such as BBTC, which allows traditional crypto assets such as Bitcoin to be more active in decentralized financial ecosystems. Users can use these assets to participate in a broader DEFI activity.

2.3.2CeFi集成

1. 受监管的合作伙伴:

BounceBit与受监管的金融机构合作,以提供中心化金融服务。这些服务包括资产托管、法币兑换和信用服务。通过这种方式,BounceBit确保了平台上的金融活动符合相关法规要求。

2. Asset liquidity and safety:

In terms of CEFI, BounceBit provides the liquidity management and guarantee measures of encrypted assets.The centralized institution of cooperation can provide faster transaction processing speed and higher transaction capacity, while providing insurance and other security measures for user assets.

3. User interface and experience:

Bounterbit strives to eliminate the boundaries between DEFI and CEFI in the user experience.By providing a unified interface, users can seamlessly switch between decentralized and centralized financial products, and enjoy the advantages of the two without having to change the platform or wallet frequently.

2.3.3Bridge DEFI and CEFI

BoundceBit’s dual -generation currency system (BB and BBTC) provides liquidity bridges for the integration of DEFI and CEFI.用户可以在DeFi协议中使用这些代币获取收益,或在CeFi平台上进行交易和兑换。

BoundceBit uses cross -chain technology to realize the free movement of assets between different blockchain, which enhances its ability to support different financial fields. Users can access multi -chain assets on one platform.

2.4Proof of Stake (POS)

BoundceBit uses a unique Proof of Stake (POS) consensus mechanism, which not only enhances the security of the network, but also improves its energy efficiency and scalability.In the POS system of Bounterbit, node operators need to pledge the consensus process and verification transactions of the network (such as BB or BBTC) to participate in the network.Here

2.4.1POS consensus mechanism basic principle

POS (proof storage) is a blockchain consensus mechanism. Compared with the workload proof (POW), it ensures the security and integrity of the network by holding the tokens.In POS, the chosen of the verifications is based on the number and currency time they hold, rather than the ability to solve the problem of complex computing problems.

2.4.2BoundceBit’s POS feature

2.4.3The role and responsibilities of the verification

In the POS system of Bounterbit, the verifications assume the responsibility of the key operation of the network, including:

2.5Liquidity and cross -chain operation

The liquidity and cross -chain operation of BounceBit are an important part of its platform function. It aims to improve the efficiency and access of encrypted assets, while connecting different blockchain networks.These functions are critical to establishing an open and interconnected blockchain ecosystem, so that assets can flow freely, while users can seamlessly conduct transactions and other financial activities on multiple platforms.The following introduces the functions and implementation of Boundcebit in these two aspects:

2.5.1Liquidity management

On the BoundceBit platform, liquidity management is realized through multiple mechanisms and tools to ensure that users can trade and use their assets efficiently and conveniently.

>

The main liquidity function includes

1. Liquidity pool:

BoundceBit uses liquidity pools to increase the liquidity of assets in the platform.These pools are usually provided by users. Conversely, they can get a part of the transaction fee.

The liquidity pool supports various transactions, including tokens exchange, loan operations, and other complex financial instruments.

2. Automated market as a market business (AMM):

Boundcebit can integrate AMM models, allowing decentralized transactions without traditional order books.Users can directly interact with intelligent contracts to buy and sell assets through the default algorithm, which improves the efficiency and predictability of transactions.

3. Pure and reward mechanism:

In order to further increase the liquidity of the platform, BoundceBit encourages users to pledge its bilateral currency (such as BB or BBTC) to support network operations and provide liquidity.In return, users can get pledge rewards, including part of the newly issued token or transaction costs.

2.5.2Cross -chain operation

Cross -chain technology enables BoundceBit to connect multiple different blockchain networks, allowing assets to move freely between different chains.This is a key technology to achieve extensive blockchain adoption and functional expansion.

>

Cross -chain function implementation method

1. Cross -chain bridge:

BoundceBit develops and maintains cross -chain bridge, which allows assets such as BBTC to transfer assets from one blockchain to another.This transfer guarantees security and transparency through smart contracts.

Bridge operations can be one -way or two -way, depending on the needs of specific assets and target chains.

2. Compatibility and interoperability:

BoundceBit ensures that its platform is compatible with other major blockchain protocols (such as Ethereum, Binance Smart Chain, etc.).This includes supporting standardized token protocols (such as ERC-20), so that these tokens can be issued and traded on different chains.

3. Decentralized authentication and security:

Cross -chain operation requires high security guarantee. BoundceBit ensures the security and anti -tampering of cross -chain transactions through multiple signatures, smart contract verification, and other encrypted technologies.

2.6Three -party ecosystem

BoundceBit’s three -party ecosystem is a key component of its platform structure. It is designed to promote interaction and cooperation between multiple participants, thereby promoting the healthy development and innovation of the entire network.This ecosystem includes three main roles: users (network participants), BB holders, and node operators.

>

The following three characters and their functions and functions in the Boundcebit ecosystem:

2.6.1User (Internet participant)

The user is the basis of the BounceBit ecosystem. They interact with the platform in various ways:

The activity of these participants directly affects the vitality and sustainable development of the network. Their trading behavior and pledge decision -making are also an important driving force for network demand and expansion.

2.6.2BB holder

BB holders have a critical governance role in the ecosystem of Boundcebit:

这一群体的决策对于平台的未来方向和发展至关重要,他们的参与确保了BounceBit能够按照持有者的共同利益前进。

2.6.3Node operator

Node operators are technical participants to maintain BoundceBit network security and efficient operation:

The stability and reliability of node operators directly affect the health of the entire network.They play the role of infrastructure providers throughout the ecosystem, and they are important bridges connecting users and holders.

2.7LSD (liquid Staking Derivative)

BounceBit的LSD(Liquid Staking Derivative)灵活质押机制是该平台的一个创新特性,它允许用户将加密货币进行质押而不牺牲资产的流动性。This mechanism is particularly suitable for users who want to obtain income from the encrypted assets it holds, and at the same time do not want to lock up assets.LSD solves the problem of insufficient asset liquidity in traditional pledge methods by creating a derivative representing pledge assets.The following is a detailed introduction to the flexible pledge of BounceBit:

2.7.1LSD’s working principle

1. Asset pledge:

Users first choose the assets they want to pledge, such as BB or BBTC.These assets are usually locked in a smart contract to support network security or participation in consensus mechanisms.

2. Release LSD:

Once the asset is locked, the user will obtain the corresponding liquidity pledge derivatives (LSD), such as STBB or STBBTC.These derivatives can be traded freely in the market, and users can use it for other investment or transactions without affecting the safety of original pledged assets.

3. Increase and reward:

Although the original assets are locked, users can still get pledge rewards by holding LSD.These rewards are usually related to network security, transaction costs, or new blocks.

2.7.2LSD advantage

The biggest advantage of LSD is to allow users to maintain the liquidity of assets.Even while participating in pledge, users can still use or trade their LSD tokens freely.

Users do not need to lock all assets in one activity or investment.Through LSD, they can participate in multiple pledge pools or DEFI projects at the same time, thereby dispersing risks.

LSD users can adjust their investment portfolio according to market conditions.For example, when the tokens fall, they may decide to sell some LSDs to reduce losses without the need to cancel the pledge itself.

2.7.3Use scene

LSD can be used in various DEFI protocols, such as loan platforms, liquidity pools, and automation markets as market merchants (AMM).Users can prove LSD as liquidity proof, participate in these agreements and get additional benefits.

Investors can use LSD for more complex financial planning, such as using LSD as a borrowing, or as part of the trading strategy.

By using pledge rewards and LSD market activities at the same time, users can maximize the overall income of their assets.

3. Team/partner/financing situation

3.1team

Most members of the Boundcebit team remain anonymous.The founder of the project is named Jack Lu.In 2020, Lu Jack became the co -founder of Boundce Finance and withdrew from the project.BoundceBit currently has 15 employees and plans to recruit more talents.

3.2Investor/partner

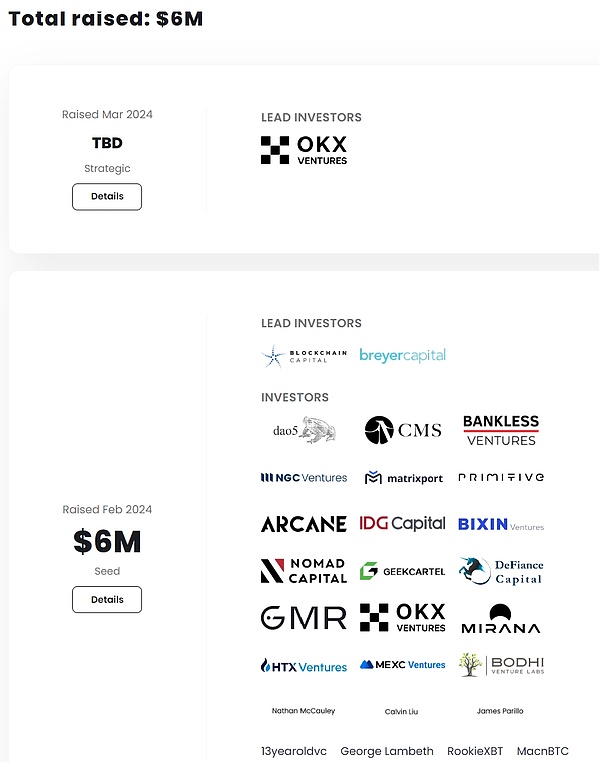

The latest investment in Binance Laboratory helped Bounterbit to gain high attention from the community.Although the amount of funds has not been made public, the Binance Lab stated that it will support the project’s expansion of Bitcoin’s function and traditional value storage.

At the end of February, Boundcebit successfully raised $ 6 million led by Blockchain Capital and Breyer Capital.

Some famous seedic investors include CMS Holdings, Bankless Ventures, NGC Ventures, Matrixport Ventures, Defiance Capital, OKX Ventures, and HTX Ventures.

>

The main angel investors of the project include Nathan McCauley, co -founder and CEO of Anchorage Digital, Calvin Li, and Brevan Howard’s investment portfolio director, Ashwin Ayappan.

4. Project evaluation

4.1Track analysis

The BoundceBit project belongs to multiple track fields, mainly DEFI (decentralized finance), cross -chain technology and pledge services.These tracks together constitute the core value proposal of BoundceBit: By using the re -pledge mechanism of Bitcoin and other assets in a multi -chain environment to enhance the liquidity and income potential of assets.

BoundceBit’s business model:

Service object:

Similar project

4.2Project advantage

The BoundceBit project has many advantages, which makes them stand out in the fiercely competitive cryptocurrency and blockchain market.The following is the main advantage analysis of BoundceBit:

1. Innovative pledge solution

BoundceBit introduces the concept of LSD (liquidity pledge derivatives), allowing users to maintain the liquidity of assets while participating in pledge and supporting network security.This model is a very attractive choice for users who want to obtain income from the encrypted assets they hold, and at the same time they are not willing to bear the liquidity risk brought by traditional pledge lock assets.

2. Cross -chain function

BounceBit’s cross -chain technology allows Bitcoin and other cryptocurrencies to flow freely between different blockchain platforms.This not only improves the efficiency and access of assets, but also enhances the interoperability and scalability of the entire encryption market.For users and developers, this means that we can access and use multiple blockchain network resources on a unified platform.

3. EVM compatibility

By compatible with the Ethereum virtual machine (EVM), Bounterbit can support extensive smart contracts and decentralized applications (DAPPS), which enables the platform to attract a large number of existing Ethereum developers and projects.This compatibility also means that BoundceBit can quickly integrate new functions and applications, thereby maintaining technological leading advantages.

4. Strengthen security and decentralization

BoundceBit uses a dual -generation currency system and the PROOF of Stake (POS) consensus mechanism, which not only improves the security of the network, but also enhances the network anti -review and decentralization characteristics through decentralization.The double -generation currency system also inspired users to actively participate in network governance and maintenance, which enhanced the sense of participation in the community and the stability of the platform.

5. Comprehensive DEFI and CEFI advantages

The platform’s platform combines the advantages of decentralized and centralized finance, providing an ecosystem covering a wide range of financial services.This integration allows users to experience fast and convenient CEFI services and flexible and transparent DEFI applications on the same platform to meet the needs of different users

4.3Project disadvantage

Although the BoundceBit project shows significant advantages in many aspects, like all technology and business innovation, it also faces some potential challenges and shortcomings.The following is the possible disadvantages and restrictions of the BoundceBit project:

1. complexity and user adaptability

BoundceBit has introduced a number of innovative concepts and technologies, such as LSD (liquidity pledge derivatives), cross -chain operations, and double -generation coin systems, which may be difficult to understand and adapt to ordinary users.This complexity may hinder the adoption of new users, especially for users who are unfamiliar with cryptocurrency operations.

2. Security risk

Although BounceBit has adopted advanced security measures, cross -chain technology and smart contracts themselves have brought new security challenges.Cross -chain bridges and smart contracts may become the goal of hacking, especially when there are vulnerabilities in the code.Security vulnerabilities may cause funds to be stolen or data tampering and damage user trust.

3. Supervision and compliance risk

Boundcebit may face regulatory challenges in different regions when trying to integrate DEFI and CEFI functions.In particular, cross -chain transfer involving cross -border transactions and assets may trigger complex compliance requirements.Failure to adapt to the changing regulatory environment of various countries may lead to legal risks and affect the sustainable development of the project.

4. Competitive pressure

Although Boundcebit provides innovative solutions in many fields, it still needs to maintain its leading position in a fierce competitive market.There are many mature competitors in the market, such as Lido and Thorchain, who have established a strong user base and brand cognition.Boundcebit needs to be continuously innovated and improved to stand out in such an environment.

5. Relying on technology and market changes

The success of BoundceBit depends on the progress of blockchain technology and the overall situation of the encryption market.The uncertainty of market fluctuations and technological development may affect the performance of the project and the return on investment.In addition, with the development of blockchain technology, new technologies may cause current solutions outdated.

5. Conclusion

BoundceBit and its token economics represent a major leap in the integration of traditional financial concepts and cutting -edge blockchain technology.By incorporating Bitcoin into its POS network and providing innovative pledge solutions, Bouncebit not only improves the practicality of BTC, but also formulates new standards for the token economy.With the continuous development of the platform, it is expected to become the cornerstone of the next -generation blockchain infrastructure, providing users, holders and verificationrs with stable, secure and scalable environments to increase their digital assets.