Author: Lao Bai, Partner of ABCDE Source: @Wuhuoqiu

Since Ordi detonated the BTC ecosystem, BTC actually quickly took the route of ETH – first, first, the asset on the chain (similar to ERC20), then the expansion plan (Rollup), and then to Staking/Restaking.However, since BTC does not have leaders like ETH Foundation and V God to guide the direction, the BTC ecosystem has shown a situation where “a hundred flowers bloom”, which can also be said to be that “a hundred flowers bloom together”(zao)”.

The explosion and rapid cooling of on-chain assets

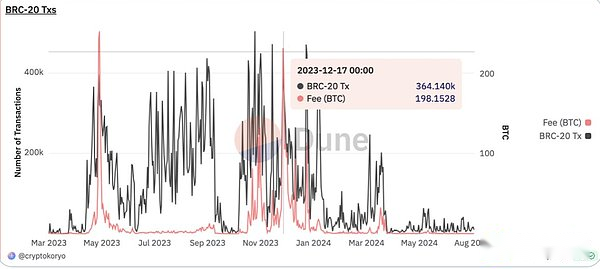

On the asset side, Ordinal was the first to cause the boom, and then various XX20 tokens such as Brc20, Arc20, Src20, Orc20, etc. emerged one after another.Last year, many people were optimistic that the security model problem of BTC was expected to be solved, especially when the block reward after the halving was reduced to a trivial level, on-chain transactions required enough handling fees to pay miners.However, although the inscription new product was issued at the end of last year, the handling fee once exceeded the block reward, and even reached a handling fee income of 300 BTC in one day, by August, the daily handling fee income dropped sharply to only 0.x BTC.Rune also became popular briefly in April and May, and then quickly shut down.

It can be said that BTC has completed the ICO boom of ETH in 2017 and is now entering the expansion plan stage represented by Merlin.Similar to Polygon (originally called Matic), some projects in the BTC ecosystem first use ETH’s EVM technology stack + a multi-signal side chain to run.

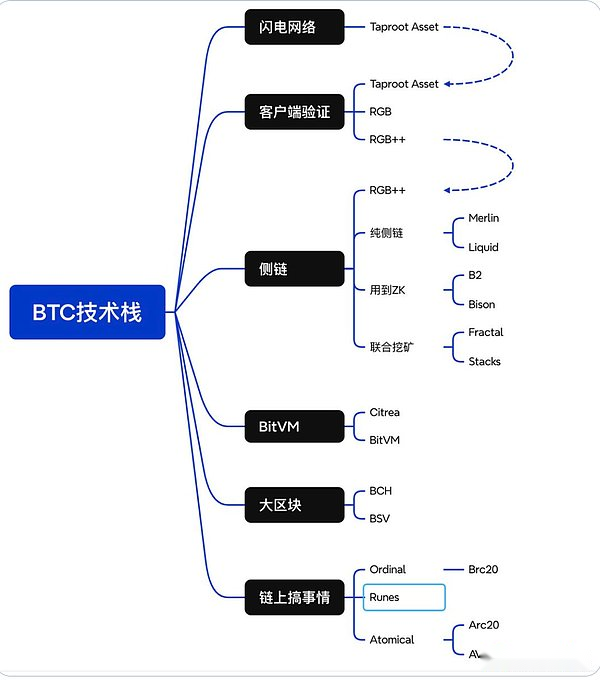

Unlike the Rollup solution officially promoted by ETH, BTC has a wide variety of expansion plans and more diverse technical routes. It is still difficult to predict who will win in the future.For the sake of easy understanding, a simple drawing was drawn, and the on-chain assets were also classified as part of the expansion technology.

At present, Taproot Asset only supports transfer functions, and the most “BTC-native” expansion solution is undoubtedly RGB (it is expected to be launched in September).RGB++ and UTXO Stack, as well as Unisat’s Fractal, have also received widespread attention recently.In addition, there is also a route missing in the figure, which is a contract virtual machine extension similar to layer 1.5. The representative project is undoubtedly Arch Network. The recently mentioned OP_NET is also included, but Arch uses ZKVM and OP_NET.WASM is used.

Since the technology stack of the expansion solution is extremely messy and more complicated than the situation of on-chain assets, it is hard to say who will win in the end.There is also a pessimistic argument that these directions may eventually be falsified. After all, the current main narrative of “electronic gold” does not need to be expanded, and the expansion is more about serving “on-chain assets”.If the on-chain assets route cannot rise, expansion will naturally lose its meaning.

Stage 3: The rise of staking/restaking

Compared with the first two directions, the Staking/Restaking route appears more solid because it does not conflict with the “electronic gold” narrative, and is even a perfect complement – releasing the liquidity of gold while turning gold into onePlant an interest-generating asset!

At this stage, the most important project is undoubtedly Babylon.Unlike ETH that naturally has POS benefits, BTC does not have a similar mechanism, and in the presence of Lido, EigenLayer’s Restaking narrative is more like a booster or icing on the cake for ETH.However, Babylon is a timely help for BTC. It re-polizes through the method of minimizing trust, generating returns, making BTC no longer an interest-free “gold”.

In addition, two projects worth mentioning are Solv and DLC.Link.The former provides interest and liquidity for BTC through Cefi+Defi, while the latter uses DLC technology to cast dlcBTC. In the context of WBTC’s trust crisis, it provides a decentralized and secure version that allows BTC to participate.Defi ecosystem on chains such as ETH, Solana.

Back to Babylon and Lorenzo

Babylon is undoubtedly targeting the EigenLayer niche, and the niche at the asset entrance is also crucial.In terms of EigenLayer, there are projects such as Etherfi, Renzo, and Puffer, while in Babylon, there are several competitions for Solv, Lombard and Lorenzo.

The differentiation between each company is more significant than EigenLayer’s LRT project.For example, Solv not only has profits on Babylon, but also has multiple cooperative benefits on Cefi and Defi.Lombard has an advantage in capital and resources. Its LBTC issuance uses CubeSigner (a professional unmanaged key management platform) and Consortium (a consortium-like chain network composed of industry leaders nodes) to achieve a balance between security and flexibility..Lorenzo integrates Pendle’s principal and interest separation function, provides two liquid staking tokens with stBTC and YAT, and provides users with a dual incentive system.Currently, Lorenzo’s total limit is 250BTC, and there are dozens of BTC capacity, which are expected to be full soon, first come first served.

Conclusion

Compared with the BTC chain assets and expansion directions, the interest generation/liquidity release of BTC is a more practical and promising direction.The clues can be seen from Binance’s layout in this direction, especially the investment in asset entrances.Among the projects mentioned above, Renzo, Puffer, Babylon, Solv and Lorenzo all have investments in Binance.Therefore, this track deserves our high attention!