Currently, Bitcoin price continues to consolidate not far below its historical peak, and long-term investors are also beginning to re-storage Bitcoin assets for the first time since December 2023.Meanwhile, with the first batch of Ethereum spot ETFs being approved for listing in the United States, Ethereum prices rose by 20% accordingly.

summary

Although the prices of Bitcoin and Ethereum have been consolidating sideways due to slight fluctuations since March, the markets of these two assets have still shown relatively strong after long-term consolidation after experiencing historical price peaks.

The U.S. Securities and Exchange Commission’s approval of the Ethereum spot ETF gave the market a surprise, causing ETH price to rise by more than 20%.

The net flow of Bitcoin spot ETFs in the United States turned positive again after four weeks of net outflow, indicating a rebound in demand from the traditional financial sector.

Selling pressure for long-term holders has dropped significantly, while investor behavior has returned to the pattern of asset accumulation, suggesting that the market needs higher volatility to drive the next wave.

Accumulate momentum to rebound

After experiencing the lowest point of Bitcoin price decline (-20.3%) since the FTX crash, Bitcoin price began to rebound again to its historical peak and reached $71,000 on May 20.Compared with previous situations, the price retracement pattern in the upward trend in 2023-24 seems to be very similar to the retracement in the bull market in 2015-17.

The upward trend in 2015-17 occurred in the infancy of Bitcoin, when there were no derivatives available for the asset class to analyze it.But now we can compare it with the current market structure, and the analysis shows that the upward trend in 2023-24 may be mainly from the free spot-driven market.The launch of US spot ETFs and capital inflows just prove this conclusion.

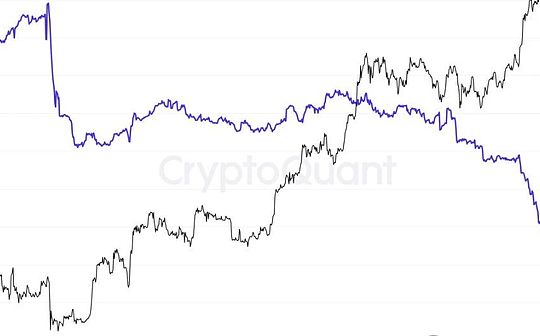

Figure 1: Bitcoin bull market adjustment and retracement

Since that low point arising from the FTX crash, Ethereum has adjusted significantly less compared to previous cycles.This market structure shows that between each continuous pullback, market resilience is increasing to a certain extent, while downward volatility is also decreasing.

However, it is worth stressing that Ethereum has recovered slowly compared to Bitcoin.In the past two years, ETH has performed significantly poorly compared with other leading crypto assets, mainly manifested in the relatively weaker ETH/BTC ratio.

Nevertheless, the approval of the U.S. Ethereum spot ETF is an unexpected progress in a broad sense and it may provide the necessary catalytic effect to stimulate the strengthening of the ETH/BTC ratio.

Figure 2: Ethereum bull market adjustment and retreat

“Diamond Hand” dominates the market

(Note: “Diamond Hand” refers to investors who hold high volatility financial assets and insist on holding them under extremely high selling pressure)

As prices rise due to new buyer pressure, so does seller pressure from long-term holders.Therefore, we can measure those reasons that are sufficient to stimulate their assets by evaluating unrealized profits from long-term holders and evaluate the actual situation of the seller through their realized profits.

First, the MVRV ratio of long-term holders reflects the multiplier of their average unrealized profits.Historically, long-term holders’ trading profits in the transition phase between bear and bull markets are above 1.5, but below 3.5, and this phase can last for one to two years.

If the market upward trend continues and eventually a new historical price peak is formed in the process, the unrealized profits held for a long time will expand.This will greatly increase their desire to sell and ultimately lead to a certain degree of seller pressure, thereby gradually exhausting demand that appears in the market.

Figure 8: MVRV<span yes’; mso-bidi- font-size:10.5000pt;mso-font-kerning:1.0000pt;”>

As a summary of this analysis, we will evaluate the spending rate of long-term holders through 30-day net position changes in supply from long-term holders.In the phase where Bitcoin moves toward a new historical peak in March, the market has experienced the first major asset allocation from long-term holders.

In the past two bull markets, the net distribution ratio of long-term holders has reached 836,000 to 971,000 bitcoins per month.Currently, net selling pressure from them peaked at 519,000 bitcoins/month at the end of March, with about 20% of them coming from holders of grayscale ETFs.

After this “squandering” state, the market ushered in a period of cooling-off, with the local accumulation of assets resulting in a monthly increase of about 12,000 bitcoins from long-term holders.

Figure 9: Changes in ETF positions for long-term holders and grayscale<span yes’; mso-bidi- font-size:10.5000pt;mso-font-kerning:1.0000pt;”>

Summarize

After Bitcoin’s price hit an all-time high of $73,000, seller pressure has been significantly reduced as a large number of long-term holders begin to redistribute their bitcoin assets.Subsequently, long-term holders began re-accumulating Bitcoin for the first time since December 2023.In addition, the market demand for spot Bitcoin ETFs has also rebounded significantly, which has led to positive capital inflows in the market and reflected huge buyer pressure.

Additionally, with the SEC approving U.S. spot ETFs, the competitive environment between Bitcoin and Ethereum has become evenly matched.This allows digital assets to further deepen their existence in the entire traditional financial system, and is also an important step forward for the industry.